3 Nefarious Tactics SaaS Companies are Using to Reduce Churn

Patrick Campbell Sep 23 2015

Churn is the most painful element of the SaaS game. All of that effort and investment put into getting that customer to sign up and start paying you for your product goes completely down the drain. Worse yet, tackling your churn problem can be a Sisyphean battle with no end in sight.

Since wrangling MRR Churn and User Churn takes so much effort and they both have such disastrous impacts on your bottom line, companies are often tempted to use nefarious efforts to curb churn. These tactics, although probably not technically illegal, create awful experiences and are simply putting off the inevitable ticking time bomb.

Let’s walk through three big nefarious tactics we’ve seen and catalog why these “solutions” are simply band-aids for a weak product.

1. Crappy Tactic #1: Not Sending Invoices Every Time a Credit Card is Charged

2. Crappy Tactic #2: Eliminating Your Cancellation Button

3. Crappy Tactic #3: Continuing to Charge Clearly Inactive Customers

4. Churn can’t be reduced with tactics; only process

Crappy Tactic #1: Not Sending Invoices Every Time a Credit Card is Charged

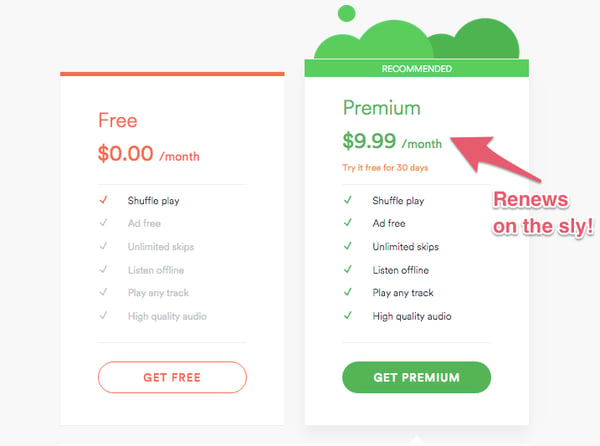

Culprits: Care.com, Spotify

One of the most powerful aspects of the SaaS game is the concept of auto-renewal, allowing you to automatically charge customers every single month or year without having to go through the sales process again. While some folks debate whether the auto-renew is nefarious in and of itself, most individuals understand the concept of a subscription. That being said, there’s a difference between auto-renewal and auto-renewing on the sly without sending a receipt. Care.com and Spotify appear to be using this tactic as to not remind customers of a charge and their subscription.

This very likely works practically, where some customers are none the wiser that they’re being charged because the dollar amounts are relatively small ($10 - $200). Yet, this short term gain results in some potentially powder keg bad PR. For instance, I found out about both these companies' tactics through word of mouth with friends complaining and vowing to never use the services again (here’s some forum posts about these companies, too)

Further, this tactic creates some pissed off customers looking for refunds after discovering the charge on their credit card. Sure, there’s a good amount that probably just take the charge and then cancel without contacting support, but that’s not a great branding experience. Do you really want the last experience a customer has with to be out of frustration or aggravatingly asking for a refund? Probably not. You also very likely don’t want your refund rate to continue to climb, as it kills the predictability in your growth.

A better solution: We’d say default to transparency in your pricing and billing strategy by sending out receipts every time a transaction occurs. If your product is worth what you’re charging and you’re targeting the right buyer personas, a reminder that a customer is paying shouldn’t cause people to run. After all, human beings *get* that stuff costs money more so than you’d think.

Tactically, you could offer an option for customers to opt out of receipts, which may actually be a better experience if you’re a higher transaction volume type business. Just be super careful you’re not putting a band-aid over the real problem of poor product marketing or not communicating your value properly.

Crappy Tactic #2: Eliminating Your Cancellation Button

Culprits: Handy, Comcast

As we mentioned, auto-renewal is awesome for the subscription economy. That’s what gives us amazing growth. Yet, if someone wants to cancel their subscription, you shouldn’t put exorbitant amounts of effort between them and their cancellation. Collect reasons why or try to save the sale, sure, but know when the writing is on the wall. Handy and Comcast are notoriously awful at this, to the point where I just keep rescheduling my Handy appointment because it’s easier than canceling the service.

Similar to not sending receipts, this works practically. You’re putting enough friction between the customer and canceling that inevitably the decision gets put off or your customer retention team is able to keep that customer around. The problem though is in most instances you’re essentially holding your customer hostage which violates the original intent of your auto-renew agreement. This results in horrible PR, such as Handy’s yelp reviews that mention the inability to cancel many times or Comcast’s nightmare recording from Ryan Block that went viral.

A better solution: You need a streamlined cancellation process that: 1. collects information on why that customer is leaving, and 2. tries to win them back if they’re winnable. Collecting information allows you to gain enough information to start categorizing why customers are leaving, which therein allows you to properly build systems to keep those customers around. Maybe you just need to add a feature or remind them of the value.

Further, with this information you may be able to win these customers back quite easily. For instance, if they say the price is too expensive for the product, you can offer a targeted, expiring discount to try and keep them around for a bit longer to get hooked. Alternatively, you may have found that they just couldn’t find a feature or answer to a question that you can easily answer and keep them around.

The point is that the cancellation process should be an opportunity, not something to try and bury and hide from your customers. If you’ve done all you can and they still want to leave, you have to let them go, so you might as well make that last experience with you as positive as possible.

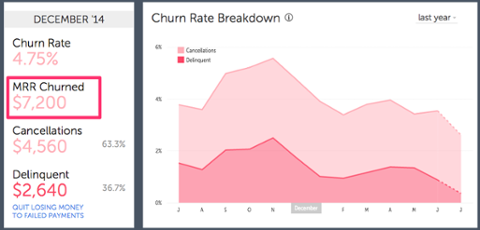

Crappy Tactic #3: Continuing to Charge Clearly Inactive Customers

Culprit: Most enterprise companies

While the first two tactics are a bit more straightforward, continuing to charge customers who are clearly inactive is a bit grayer. These “zombie” accounts are clearly not getting value from your product, but the customer technically hasn’t cancelled the account and presumably is still getting a receipt that they’re paying for an account. Should you feel bad about charging them?

From our perspective, continuing to charge for these inactive licenses flies in the face of everything we believe with value based pricing. These users and customers are clearly not getting value from the product. The problem is that in a lot of large companies, zombie customers can accounts for millions of dollars in MRR. The MRR churn rate of these individuals is typically much higher as people discover the credit card charges and call in to cancel (normally frustrated, because they forgot they were getting charged). Yet, these accounts represent a ticking time bomb of potential issues both from a financial perspective and from a security perspective as clearly these customers aren’t the most diligent folks within your product.

A better solution: This isn’t the easiest solution, but convert to a value metric based pricing strategy where you’re charging for an actual volume of usage in some manner (seats, page views, etc.). This allows you to avoid the problem of dead accounts, but you’ll also find that expanded usage reaps huge dividends with actually charging on value. You’ll no longer charge that Fortune 500 company the same price of that startup, which will raise overall ARPU substantially.

Another step down this path follows the lead of companies like Slack who only charge for active users. This puts the onus for creating value on the side of the product team who have to work to create as much active usage as humanly possible. By aligning the value in the product with their pricing and expanded usage you also get the benefits of a value metric and team alignment around one compass metric.

Churn can’t be reduced with tactics; only process

Overall, tactics will work for reducing your churn, but they’re inevitably just putting a band-aid over a problem that will need to be addressed eventually. Sure, you can run away from the churn problem with enough funding and customer acquisition, but the buck will stop somewhere. You might as well bake it into your churn process good product. Inevitably, the dividends will pay off in multiple ways with better churn reduction, knowing your customer better than you ever have before, and a quicker growth rate.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.