Calculating Your Own SaaS Metrics? You're Probably Inaccurate

Patrick Campbell Sep 2 2015

SaaS founders are an awesome bunch. We're "Get Stuff Done" people used to hacking our way to success all on our own. Yet, because of this proactive default we can have massive blindspots.

We all saw this recently with Zirtual's collapse due to the fact that they didn't know their financial metrics precisely, resulting in too much burn and not enough revenue to cover costs, let alone grow. As Founder and CEO Kate Donovan put it, "[our] numbers were just completely f***ed."

We all may laugh or gossip about Zirtual's demise, but how confident are you in your own financial SaaS metric calculations? How about when I tell you that we found 2 out of 5 SaaS companies with greater than $10M ARR were incorrectly calculating something as seemingly simple as MRR?

To avoid burying the lead too much - your SaaS financial metrics require the precision of a specialist. The math gets too complicated, and the stakes for getting them right are too high. Let's explore this concept by illuminating how complicated your calculations can become, discuss the disastrous implications of getting these numbers wrong, before revealing how much time this truly takes to do right.

1. It's way more complex than you think

2. Do you understand how complicated calculating accurate metrics can be?

3. So what though? What happens if you get these wrong?

4. We haven't even mentioned how much of your valuable time you'll lose

5. Focus on your business and product, not calculating your metrics

It's way more complex than you think

Unless you're Chuck Norris, you're likely not performing your own heart surgery. You get a trained professional who went through a decade of training before they were even allowed to fly completely solo, let alone the years of continual education.

More technically, unless you're really into email server management (like really into email server management to the point you're probably a spammer), you probably don't manage your own email sending from a heat sunk closet. You outsource this to an email management company like Postmark, Sendgrid, or Mailchimp.

Yet, you're still putting your metric calculation and management on your backburner, reactively pulling these numbers when needed. This is a recipe for disastrously inaccurate metrics, because this is way more complex than you think.

Do you understand how complicated calculating accurate metrics can be?

There's a reason we've been cranking on ProfitWell for quite some time without seriously ramping up acquisition - accuracy is hard. This isn't a situation where you can be off by +/- 5%. Your metrics need to be accurate, and the task gets more and more complicated as you grow.

Let's explore this concept by looking at MRR churn rate as an example. It's seemingly easy to calculate:

MRR lost in period i / Total MRR at beginning of period i

Yet, when does someone officially churn?

Are cancellations churn?

Nope.

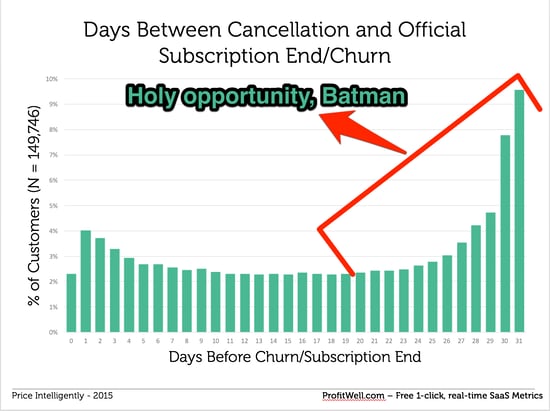

Cancellations are not churn. As soon as a customer indicates they're going to churn out may be a tempting time to mark them as dead. Yet, we've found that customers indicate they're going to cancel almost three weeks before they officially stop paying you. This is an amazing opportunity to recover that customer.

When do you include delinquent customers in churn?

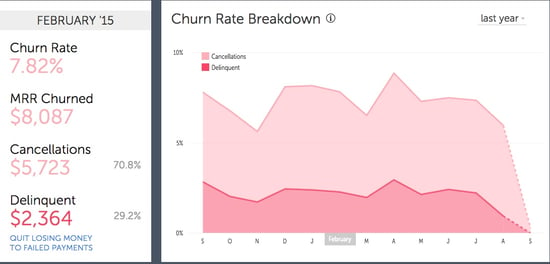

You'll find that not everyone pays you when they're supposed to because of failed credit cards or just not being a great, committed customer. Should you count these folks as immediately churned or give them a waiting period before they're officially churned to try and get them to pay up. In ProfitWell, we made the decision to give three attempts to recover the charge before officially putting them into the churn bucket. Even then, we make sure to break things down into separate buckets as a point of optimization.

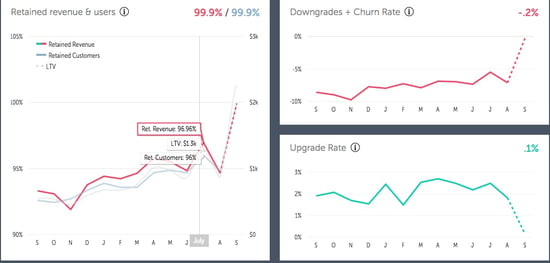

Are downgrades and upgrades included in MRR Churn?

Nope. The problem with doing this is you begin to mask the gross MRR that’s leaving your business and the momentum at which it’s leaving. This is why you should not include these aspects of MRR in this calculation, and instead look to your Retention MRR as the “God” metric for retention revenue. As a result, MRR churn then allows you to know exactly the amount and rate at which cash is actively leaving your business to optimize accordingly.

Those are three edge cases. Guess how many we've encountered in the past 18 months working on metric accuracy? 331 and counting. Everything from how discounts should be accounted in MRR to refunds to subscription length and currency shifts all need to be carefully considered in the context of what makes sense in a SaaS business.

So what though? What happens if you get these wrong?

When we helped a particular company with their pricing strategy before their IPO, we discovered a disastrous mistake - they had been mistakingly inflating their MRR numbers by just over 15% by not taking into account certain lifetime discounts. MRR isn't a GAAP metric, but it certainly is starting to be a huge factor when SaaS companies go on their IPO roadshow.

As our point of contact pointed out, "we knew we had potentially just wiped out up to $100M in our market cap for a boneheaded SaaS metric mistake."

"We just potentially wiped out $100M in our market cap because of a #SaaS metric mistake"

Thankfully they recovered nicely with some huge sales quarters before their roadshow, but even small mistakes can have catastrophic impacts:

Your financial planning and momentum will be defunct

Perhaps most pragmatically, your metrics help you plan and understand exactly how quickly you can grow, as well as who your best customers are (CAC and LTV). Having inaccurate metrics may mean you're going to waste an enormous amount of time on the wrong segment of your customers, or more scarily - not cutting or adding staff to grow or keep your business around (as was the case with Zirtual).

You're fraudulently reporting to your investors/advisors/partners

If you've raised money on inaccurate metrics, you're in trouble. Best case scenario you fix the mistake and they just think you're in need of some training. Worst case scenario you end up getting sued for fraud. Either way it's not a good look, and it becomes scarier as the stakes get higher and higher. Word travels quickly too, especially in a community as small as SaaS.

You're setting your team up for failure

Reporting that your sales team hit their goal, but finance corrects you when they close the books for the month/quarter because you were calculating MRR incorrectly is demoralizing beyond belief. This goes for any part of your team relying on a compass metric.

You're potentially hiding enormous problems in your business

Think about what inaccurate customer acquisition cost calculations could mean for your business, especially if you're relying on paid acquisition. Further, what if you're not segmenting your customer properly and don't focus enough time on high value customers. You'll end up losing time and potentially runway - both of which are precious.

We haven't even mentioned how much of your valuable time you'll lose

As a SaaS founder, your time is worth $1000/hour. It is incredibly valuable and you need to think about it as such. You definitely have better things to do with your time than calculating metrics, especially calculations that you're likely not specialized enough to calculate.

Sure, this may be easy with your first couple of customers to calculate. That's the trap though. It seems easy. Yet, then the metrics beast start to creep in, and you're spending or hiring someone to spend 10-20 hours per week calculating and updating reporting. In face, we've found most companies over $20M ARR have at least one full time employee working on non-specialized metrics. They aren't working on metrics used to explore a problem. They're working on just the basic metrics. The ones that should be reported weekly.

You calculating your metrics

20 hours * 52 weeks * $1000/hour = $1,040,000/yr

A Full Time Employee (FTE) calculating your metrics

$75k Base Salary + $15k Benefits + $10k in equipment, space, etc. = $100k/yr

The worst part is that every time one of these edge cases crops up you have to change your calculations and spend precious switching costs not focusing on building your business.

Focus on your business and product, not calculating your metrics

You should be concentrating on your own product, not on anything that could be outsourced to specialists who think about this more than anyone else out there. The risks are too high and the problem too complex and moving.

Whether it's heart surgery, managing your own email server, or calculating your SaaS Metrics accurately, it's ok not to be able to do everything.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.