Lessons From 10,342 Blog Posts on Growth

Patrick Campbell Jan 6 2016

“Growth” is all we want to talk about as a software ecosystem. After all, the beauty of SaaS is that with very little COGS (cost of goods sold) we can scale a big, beautiful business. Yet, qualitatively when chatting with dozens of SaaS companies, we started to notice a trend that the only part of growth we care about is acquisition, even though folks like Brian Balfour continue to harp on the multi-dimensionality of growth.

In reality - growth is focused on optimizing the bottom line of cash-money in the bank no matter the channel through which that growth comes - acquisition, retention, or monetization.

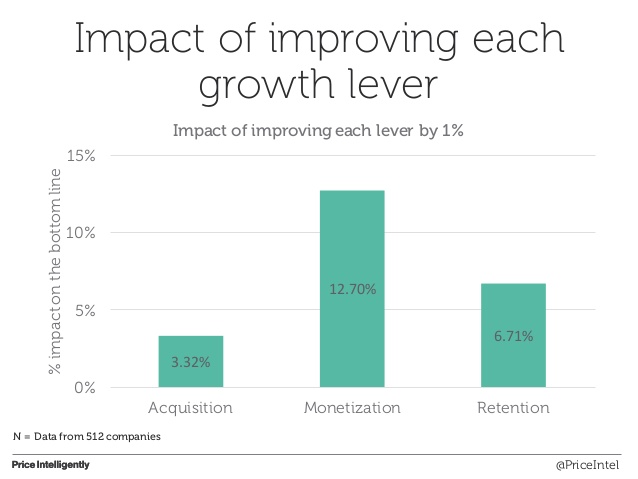

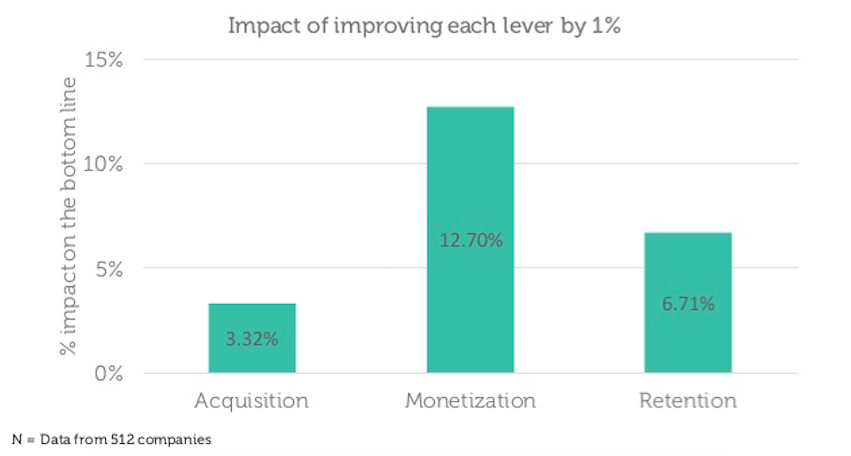

Making the distinction between growth and acquisition is important, because we’ve found that improving retention or monetization can actually impact growth 2-4x more effectively than improvements in acquisition.

To figure out if we’re the canary in the well or just preaching to the choir, we decided to go after the data, running an anthropological study on 10,342 blog posts. Let’s walk through the results before discussing some key implications for your business, as you (likely) continue to chase the wrong lever of growth.

"Improving retention or monetization has 2-4x the impact of acquisition on growth"

Quickly: Why blog posts?

While we could have run some sort of a survey of SaaS founder and leaders, we typically find that people lie to themselves about their abilities, as well as what they’re truly focusing on. We’ve all heard (when trying to sell to someone), “well, I/we can just do/build [your solution] ourselves” or “we have [this problem] handled already” when in reality the company won’t look at solving that problem for years, if ever, even though cash or time gets left on the table.

How should we collect clean data then? Well, through an anthropological study of our mindshare through blog posts. Blog posts are actually quite a perfect medium to study because we write: 1. what we know, and 2. what gets us traffic. If we know a lot about the tactics to setting up a Facebook acquisition campaign, then we’ll write about that. If we get mad clicks on a post we wrote about “the one simple trick that grew our leads by infinity percent”, then we’re going to write more of those posts.

Pragmatically we fired up some web scraping of Google News, Growthhackers, Y-combinator, and a few other sources to grab about twenty thousand posts. We then hired a hoard of mechanical turk workers to start classifying each article. Finally, we removed any articles not related to growing a business (all those articles on culture, transparency, etc.).

We then dove into the data and started pulling out some trends.

Results: We’re Obsessed with Acquisition

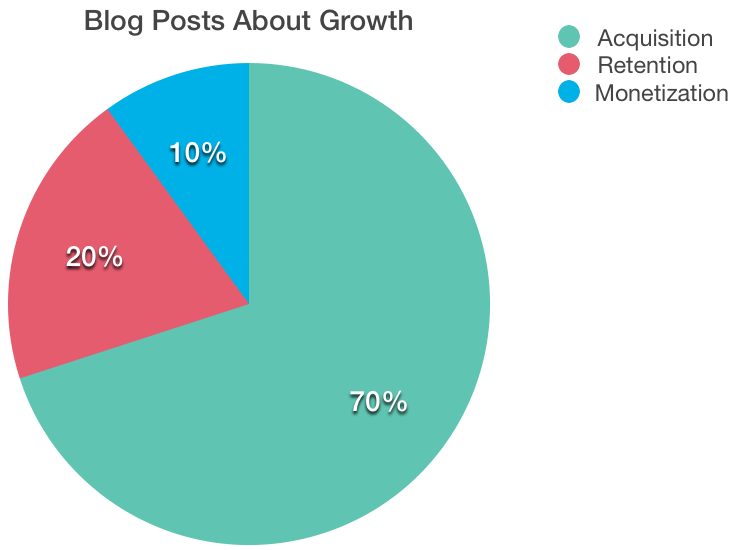

After culling through more “content marketing” than we think we ever wanted to, we found out we’re pretty obsessed with acquisition. More than 7 out of 10 of every post about growth is focused on acquisition; about 2 out of 10 are focused on retention; and less than 1 out of every 10 posts is written on monetization - most of which (for better or worse) being written by Price Intelligently.

When running a bit of a sentiment analysis on these posts, we also found that “tactics” and “quick changes” are running rampant. We’re not sure if content’s always been this way, but we’ve basically been overrun by “get rich quick” and “lose weight fast” marketing. The worst part is a number of posts rue the “tactic driven marketing” posts, but then give a bunch of tactics themselves.

"Growth" content has been overrun by "get rich quick" and "lose weight fast" marketing"

While there’s certainly much deeper sentiment analysis we could chat about from the results, let’s save those for some more content and walk through a couple of big implications. Chief among them: 1. we don’t understand growth as a community, and 2. we need to be more diligent on our teams about the efficiency of our efforts.

We (in the aggregate) don’t understand growth

While obsession with acquisition may seem intuitive - marketers writing about marketing - it indicates that we as modern marketers don’t understand the multidimensionality of marketing, nor that growth isn’t just a top of the funnel exercise.

Sure, a lot of older school marketing activities - pricing, retention, etc. - have been taken over by product and product marketing. Yet, somehow in all the role transitions and inventions of jargony “growth hacking” we lost product and marketing focus. We only spend 6 hours on average in the history of our business on our monetization strategy. We use feature development as the path of least resistance to retention. We don’t even know the definition of product marketing.

In short, we’re all about getting customers, but have no idea what to do once we get them. Our growth processes are that of brute force sledgehammers where we guess and check our way to throwing as much as we can against the wall and hope and pray that some of those customers stick.

"We're all about getting customers, but have no idea what to do once we get them"

Here’s the rub though - money runs out eventually. If you’re part of the less than 1% of companies that can keep the money-raising party going into perpetuity, then more power to you and keep on keepin' on. If you’re not, then don’t lie to yourself about unit economics and the fundamentals not mattering. The tide goes out eventually, and you don’t want to be the one caught without your swim trunks on.

We’re horribly inefficient with our resources

Even if you’re a money raising machine or a giant public company without money woes, there’s still a huge issue with such rampant focus on acquisition - it’s horribly inefficient. Remember, customer and user numbers in and of themselves are never the actual goal. You can’t support your team and business with paychecks that cash out user counts. Cash is what you’re after in terms of revenue and ultimately profit.

Put a more pragmatic way, ultimately you’re trying to make your ratio of lifetime value (LTV) to your customer acquisition cost (CAC) as high as possible. To maximize your LTV/CAC you need to focus on all three levers of SaaS - acquisition, retention, and monetization.

Yet, while acquisition is important, we alluded in the beginning of the post that the efficiency gains of acquisition relative to retention and monetization weren’t actually that great. With the data we have access through Price Intelligently and ProfitWell, we ran a modeling exercise to look at the relative impact of similar improvements in each lever and the resultant impact on the bottom line.

We found that relative 1% improvements in acquisition (increased customer volume), retention (length of time customers stick around), and monetization (increased price, better market alignment, etc.) had dramatically different results. In reality, retention and monetization impacts have 2-4 times the impact of acquisition with the same effort.

To state the obvious, we need to make sure our growth foci aren’t clouded by vanity metrics and ego boosting statistics. Growth doesn’t have to be flashy or sexy, especially when dealing with the cold, hard truth of building a business. Of course, if you grow effectively, you’ll have all the sizzle you need.

Growth 2.0

Growth remains multifaceted. As you continue to look for those pockets of growth and ways to improve your business, don’t forget to focus on what matters in terms of the bottom line. “Winner take all” markets are extremely rare, so make sure you’re getting your retention and monetization in check early on.

For more information on pricing strategy and price optimization, check out these articles:

-

-

-

Pricing Page Bootcamp

-

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.