Is commoditization in Klaviyo's pricing future?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Pricing Field Notes

The world of customer data and messaging living side-by-side has spawned rapid success for Klaviyo. And with more than 50,000 businesses of all sizes using Klaviyo, they've been balancing between the markets beautifully until now. But are their features enough for the hardcore user, or will they have to push their pricing towards commoditization?

Below are some valuable takeaways you can implement in your own business.

- Price from a cosmetic perspective

Klaviyo's fees are very linear. As you add more contacts, it very smoothly goes up and to the right. It's a nice smooth line. And it's really important that you keep this cosmetically appealing line in terms of pricing. It helps things make sense for your business and your clients, and it's not arbitrary. It's perfectly clear how your pricing is calculated and your customer base knows what to expect. - Price localization is key

Localization is the practice of adjusting prices to local markets. And Klaviyo has a huge opportunity to look at regional willingness to pay and optimize their pricing around those regions, especially as competition grows. This is a quick win for Klaviyo to implement, and it's the right time to do it. Market-based localization (measured willingness to pay in each region) results in double the growth rates of non-localized pricing. If 20% of your base is outside of your home region, these are factors you need to consider. - Know when not to differentiate

Understand where the feature and relative preference of your different features are, in order to understand what you can differentiate and not. Klaviyo doesn't differentiate their core features and shouldn't, as it works well with their all-inclusive pricing. But they will need to find add-ons and enterprise tiers to be properly optimized for their customer base, in order to increase their growth rates. Expansion revenue is key.

Ecommerce has made it so we can buy anything and everything online. From Pokemon cards of our youth to industrial manufacturing equipment for printing metal. We think it’s just shipping and logistics that brings that success, but in reality it’s the connectivity we all have with one another and the ability to reach any audience in any niche at any time. One of the core products arming the rebels who are reaching these niches is Boston-based Klaviyo.

Founded by Andrew Bialecki and Ed Hallen in 2012, Klaviyo is an email marketing product built from the ground up for ecommerce businesses. Andrew and Ed had worked together at Applied Predictive Technologies where they built big data-driven marketing solutions, but they realized these tools while great for the time, weren’t that smart for personalization and didn’t measure the most important thing in marketing—the revenue. All because they didn’t store any customer data.

Klaviyo set out to solve these problems by offering up an email marketing solution that monitors real-time customer data to automate personalized communication. Their platform enables “owned marketing,” which is a channel where you can control the entire experience by inputting whatever data you need into the Klaviyo product and having effective APIs and plugins to send whatever you need.

Klaviyo's success

This world of customer data and messaging living side by side has spawned rampant success, with tens of thousands of customers and whole percentage points of black friday sales attributed to companies using Klaviyo.

With success comes competition though—much of the risk Klaviyo faces comes from an extremely fragmented market. There are over 400 different email marketing providers and Klaviyo is on the high end from a pricing perspective. You’re even seeing companies like Shopify and Mailchimp add Klaviyo features to their stack. Other critics also point out that while there are millions of stores in the world of ecommerce, many of them aren’t going to need tools as sophisticated as Klaviyo’s and others are going to want more full stack solutions like Demandware’s.

Time will tell, but the question remains—how has Klaviyo been so successful and is the market valuing them enough to keep that success going? Will their pricing push towards commoditization, especially as email becomes ubiquitous throughout most of the products we use? Are their features enough for the hardcore users?

The mission metric

The mission metric is one of those things that more companies are going to need to use. We've talked about it a little bit with Shopify, but here's a quick recap. An effective mission metric means that you are focused—in terms of your efforts, product, pricing model, etc.—around your actual customer's mission. Sometimes, you can charge beautifully on that. You can actually charge, “pay for performance,” like our Retain product that lowers churn. Other times, you have to find a proxy for it—whether that's contacts, emails, or something else.

What Klaviyo does really well is center everything around the return on investment and the strength and efficiency of customer relationships. They don't even have to talk about it in all of their copy. It's clear not only on their homepage, but throughout their entire pricing strategy in which they consider, "What is the actual ROI of this email? How do we make sure you get higher lifetime value, repeat purchase rates, et cetera, out of these ecommerce interactions that you're having?" It's about more than just getting that next Facebook ad and getting that next individual to come through.

It's genius, because this small corner of the market was using email, just like everyone else. But Klaviyo identified their unique needs and catered to them in a way that no existing companies were.

There's a different sophistication as well. It perfectly targets these untapped audiences. SendGrid has been great for engineers, because they started more on transactional emails. MailChimp is super for small- and mid-sized business, but it's very generalized. Klaviyo came and said, "No, no, no, we're going to go after e-commerce specifically. These folks, they don't have any good tools."

External threats: Shopify and platform risk

One thing I fear for them is Shopify. Their email tool is starting to come out. I have to imagine that Shopify isn't all of Klaviyo's revenue, but it likely supplies a good portion. Even as Shopify evolves, however, they still fail to serve the mid to upper market—an audience that Klaviyo has been focused on.

That's a big enough market. There are frankly so many needs that, when people talk about platform risk derived from these programs building on top of one another, I don't feel quite as concerned. It's not that these fears are unfounded. It's just that Klaviyo has different types of platforms they can go after and the knowledge that they need to be the best in their niche. Their success depends on being the ecommerce market's best option, so if they're going to go after any other email provider, they need to make sure that they're always going to be better.

That awareness reduces platform risk. We see this with our analytics products. We approach the market with the resignation that no one is going to think about this problem as much as we are. People we integrate with will have their own analytics, but it will never go as deep as our thinking, which is the power of understanding what platform risk actually looks like.

Klaviyo's pricing page

ROI calculations

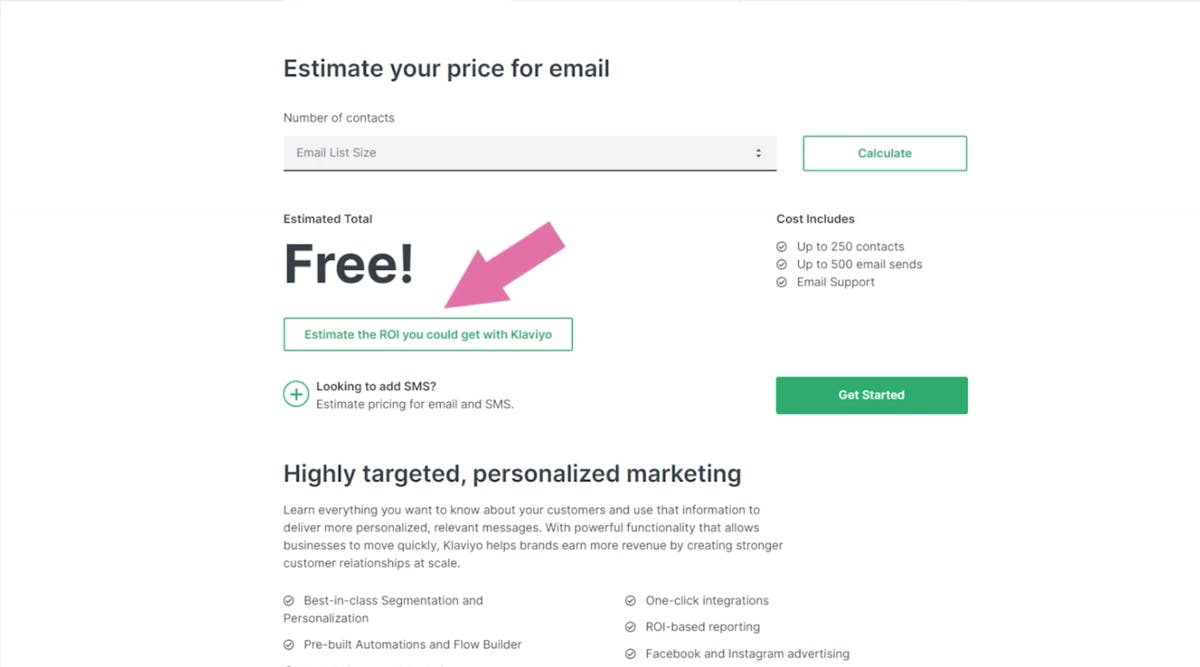

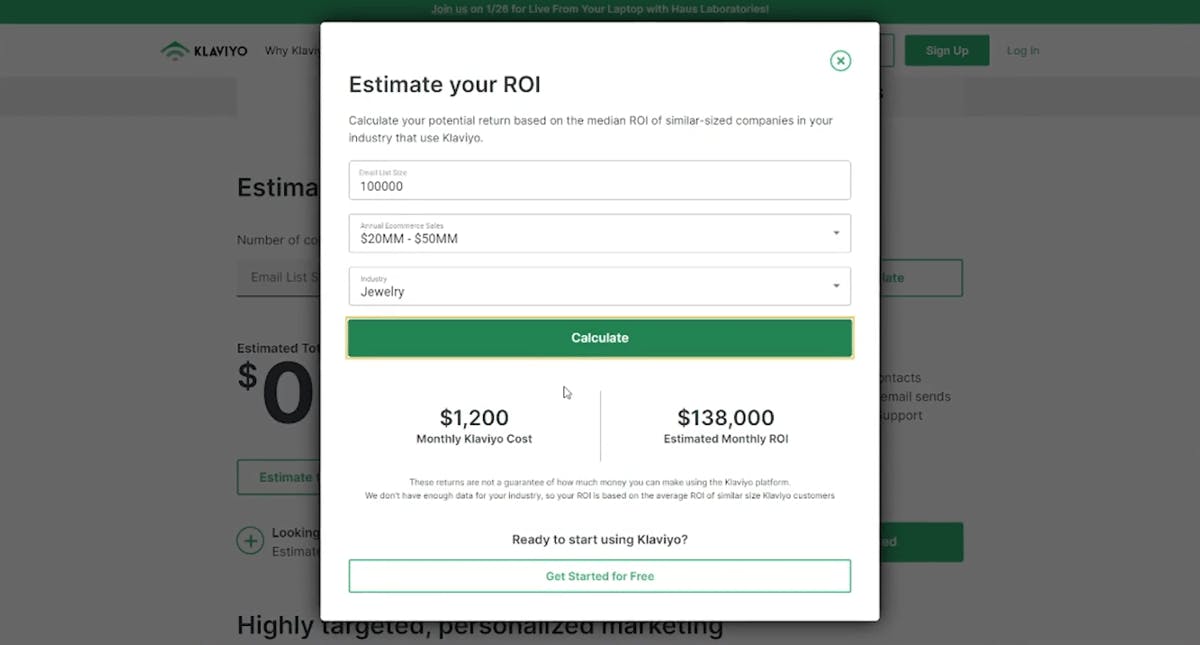

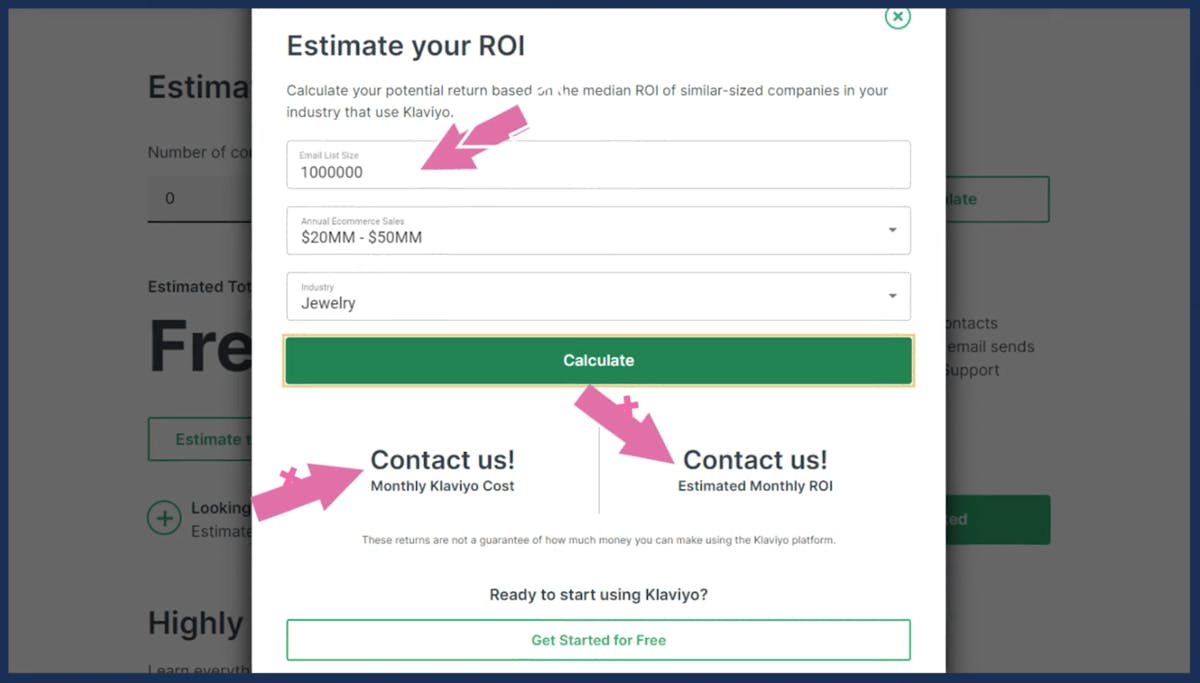

Two things jump out right away on the pricing page. One, it's incredibly simple. Everything's included, which can be good or bad, depending on how you look at it. An absolute positive for me, though, is that they estimate the ROI you could get with Klaviyo. As a visitor, you can input data like your list size or industry and see an estimated ROI output. It helps to contextualize things in a really strong way.

Of course, this won't work for everybody, because your customer has to at least somewhat believe what you're saying. If you put this in front of a very technical buyer, you might be met with some scoffing. Like, "Oh, there's no way you can tell that." Or, "I don't know if I believe these numbers." Still, someone a little bit lower in the market may look at this and think, "Oh, interesting." At the very least, it can start a conversation and serve as a client's first step in the experience.

In that way, it reminds me a lot of the HubSpot playbook with inbound marketing. At a certain level of sophistication, marketers will likely look at HubSpot copy and think, "I don't know about this." They might find it corny. Or, going back to our Klaviyo example, they'll need to know where that ROI calculator number is coming from. Still, some marketers will take one look at it and their eyes will light up. They'll be ready to get started.

Keep in mind, this is not the first page that people are going to. First they're going to get a little bit of product marketing, perhaps some email marketing before they arrive at the pricing page. But I think it works for what I presume to be, their target customer.

All-Inclusive Pricing

In terms of the rest of their pricing page, there's one thing that I don't think I like. I get the simplicity of having all-inclusive pricing. I think it's great from an ease-of-use standpoint. It has to be nice for their sales team, and prospective customers likely appreciate the clarity. There's just not a ton of wiggle room on where people are going to land, because every plan kind of has everything. You're completely bypassing functionality, capability-driven differentiation, and not every customer can possibly have the exact same feature needs. With all-inclusive, they lose opportunities to monetize exclusive package components.

This is where an enterprise section could help. Within the mission metric focus, it's great to offer the "best of the best" to every client. Still, a unique enterprise plan could be great for higher contacts who need priority support and other gold-star features. If your email list goes to high, it's definitely a "contact us" situation. And I'm sure if I hopped on the phone with them, they'd tell me there was a more exclusive plan available, but there's no product marketing for it at all.

Adding an enterprise section would really help. Sometimes that "enterprise" terminology can scare away the SMB base, so language like "high volume" can be incredibly useful for stewarding large clients without alienating smaller ones. HubSpot did this very well, where they were more than willing to cater to some folks in the right way, to get the right information.

Let's look at the data.

Where does our data come from?

Here at Paddle, our Price Intelligently software combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers, having the ability to collect data from everyone, from a soccer mom or dad in the middle of Kansas, all the way to a fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value, which features and which segments are willing to pay more, all in the spirit of determining how a company can use monetization for growth.

Data and analysis

Pricing from a cosmetic perspective

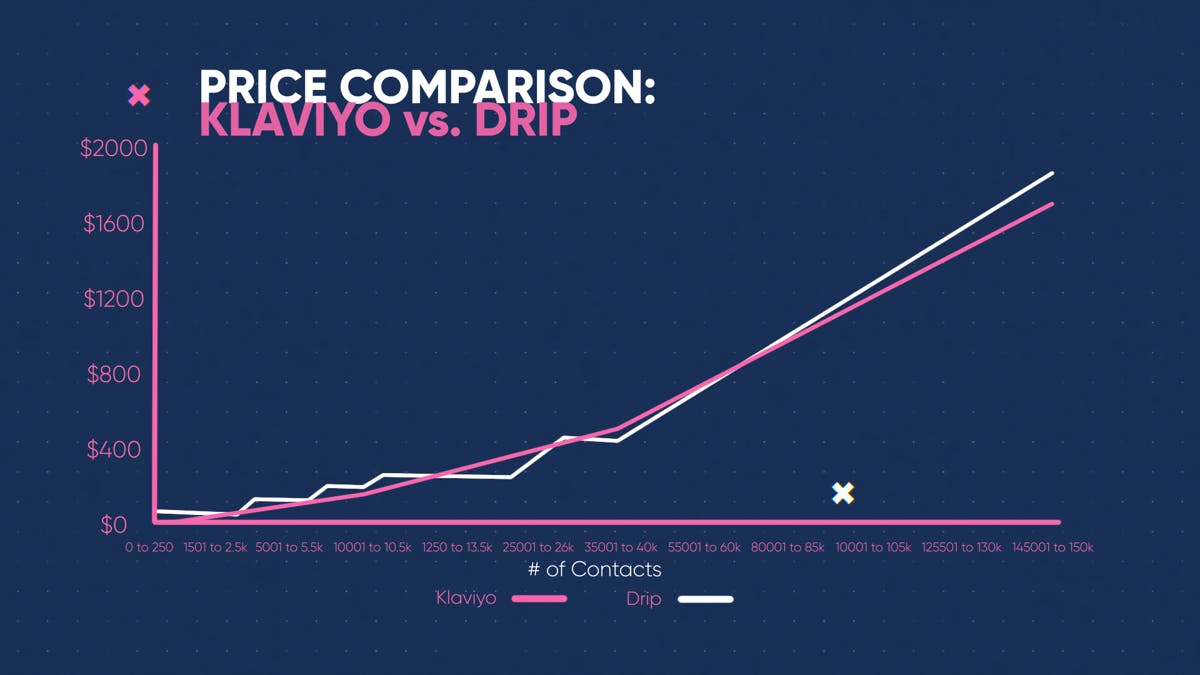

Make sure your price makes sense from a cosmetic perspective. We took a look at one of Klaviyo's competitors, Drip, based out of the Twin Cities. I mapped Drip's pricing against Klaviyo's pricing and, what you'll notice here, is that Klaviyo's fees are very linear. As you add more contacts, it very smoothly goes up and to the right. Every hundred or thousand contacts, they add a certain dollar amount. It creates this nice, smooth blue line.

Drip, on the other hand, has a tendency to jump in price very suddenly. This is problematic. If we're looking at purely competitive-based pricing, we see that Klaviyo is actually much more affordable on the lower end. At around 10,000 emails, Drip becomes less expensive. As the list of contacts grows, however, Drip jumps again and Klaviyo is once again the better option.

I don't know if Klaviyo did this on purpose. I don't know if Drip is their main competitor. But if you compare these two cosmetically, it's really hard to get on board with Drip. You look at this and you realize, "Okay, Drip. You're more expensive on the high end, and kind of more expensive on the low end, too?" It doesn't really make sense unless you're perfectly in the middle—and that's quite a small market to target.

I know most clients aren't comparing and contrasting to this extent. Still, I think it's really important that you keep this cosmetically appealing line in terms of pricing. It helps things make sense for your business and your clients, and it's not so arbitrary. With a linear relationship, it's perfectly clear how your pricing is calculated and your customer base knows what to expect.

Price localization for large, fragmented markets is key

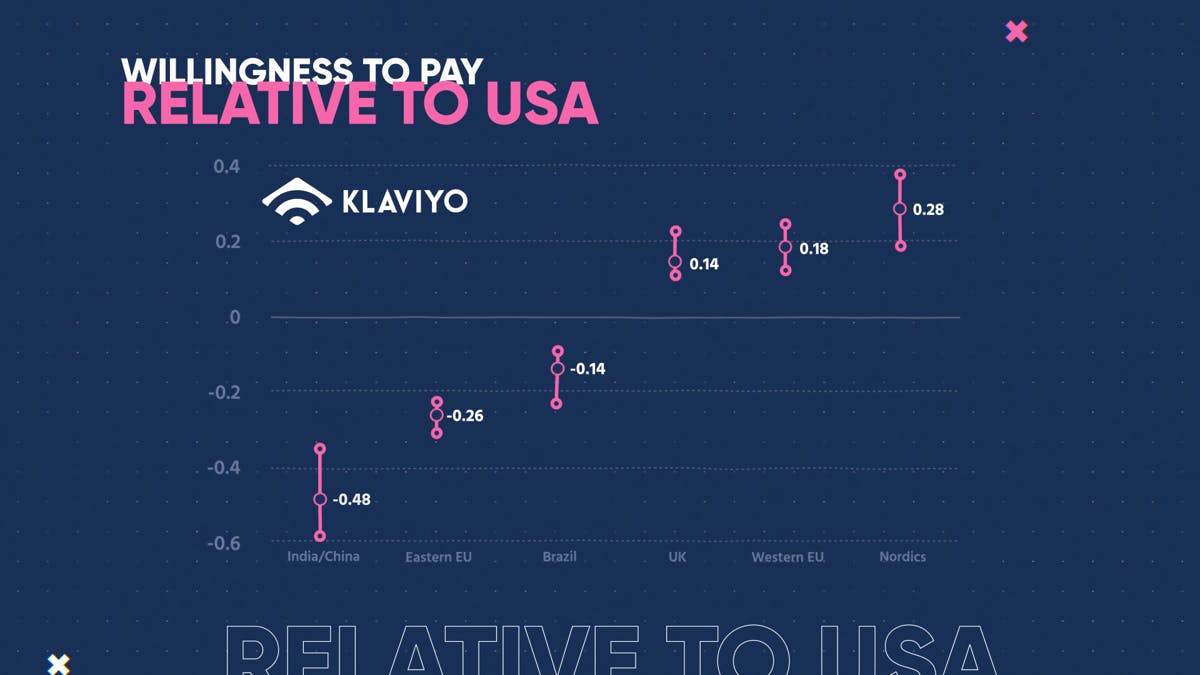

Price localization is when you change price points in different regions for the exact same product. It makes sense because there's a different willingness to pay across different regions. We can see that in our data, with some intuitive outcomes. On one end, we see India and China with lower willingness to pay. The other side of things frequently features the Nordics. They're willing to pay for their technology—they really like the good stuff.

This data is independent of those cultural assumptions and exchange rates, though. This is the actual, clean comparison of what's happening around the world relative to the United States. As things get more competitive for Klaviyo, it's essential that they realize people are willing to pay different prices in different regions. This is impacted by standard of living, margins, all types of things.

This is a quick win for Klaviyo to implement, and it's the right time to do it. If 20% of your base is outside of your home region, these are factors you need to consider. I can't imagine that Klaviyo isn't operating with at least 20% outside of the U.S., given the reach of Shopify, big commerce, Magento, etc.

For you and your business, it's time to look into localization if you've reached that 20% mark.

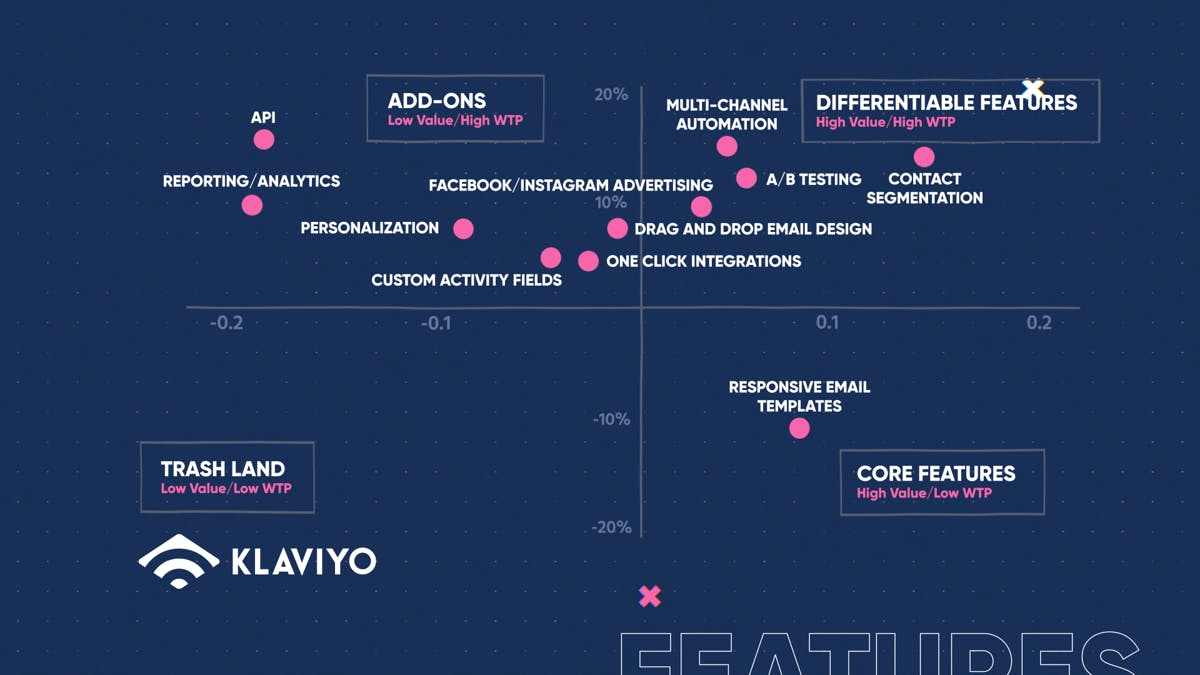

Value Matrix

You're about to see something called a value matrix. We collected data from the group comparing feature preferences and plotted those on the horizontal axis, more valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number-one feature preference on the y-axis. Analyzing data in this manner allows us to determine which features are differentiable add-ons, core, or commoditized for each segment.

Know when not to differentiate

This is me setting you up with your all-inclusive feature plan. Here's the thing with Klaviyo: it's more of a hub play, because there's no single feature that differentiates more than others.

In this case, what you'll notice is that none of the features—either differentiable or add-ons—break that +/- 20% mark. Normally when you see that, it's an indication that there's not one feature that you can pull out to build a premium tier. It also could be an indication that you forgot about some potential features. SMS marketing isn't on here, but would make a lot of sense. It's a different channel, and not every single ecommerce brand is doing that... although they likely will be soon.

It's one of those things you have to think about— there probably are enterprise features that they should be pulling out. We didn't test a lot of those here, but all of the features that they currently have are not in a place where they can differentiate.

This is good and bad, and leads to my biggest suggestion for Klaviyo here. First—great job not differentiating. You have a ton of different customers and prospects who likely appreciate the simplicity of your all-inclusive pricing. In order to maintain your growth rates, however, you have to start hunting for those add-ons, those key to an enterprise plan. Eventually, this current growth rate is going to begin slowing, and add-ons will be crucial to fill the gap. SMS is a great play for right now, but you'll need some other ideas on top of it to become the billion-dollar company you want to be.

At the end of the day, expansion revenue is key. When we look at this chart, the current simplicity is clear, with all of the features hovering around the median. There are lots of features that you can use to defend the core, but you're eventually going to need to find new ways to monetize. You've grabbed all of these users that presumably love you and are willing to buy from you. This doesn't go against the mission metric—it makes them higher retention, more loyal, and gives them a higher lifetime value.

Recap

- Make sure your price makes sense from a cosmetic perspective. We saw this by comparing Drip with Klaviyo. At the most basic level, there needs to be an understanding that as contacts go up, price goes up. Klaviyo's doing this perfectly fine; I don't think customers would take issue with it. They might have some trouble contextualizing how much is an actual contact, but that's a whole other thing to get into.

- Price localization is key. Klaviyo has a huge opportunity to look at regional willingness to pay and optimize their pricing around those regions. This is something they should do tomorrow.

- Know when not to differentiate. Understand where the feature and relative preference of your different features are, in order to understand what you can differentiate and not. Klaviyo's core features shouldn't be differentiated, and are well suited for their all-inclusive pricing. In order to get better growth rates, however, they are going to have to find add-ons and properly optimize those enterprise tiers for their customer base.

Need help with your SaaS pricing?

Price Intelligently by Paddle is revolutionizing how SaaS and subscription companies price and package their products. Founded in 2012, we believe in value-based pricing rooted in first-party research to inform your monetization strategies. We combine expertise and data to solve your unique pricing challenges and catapult growth.

(00:00):

Platform risk is one of the dumbest objections to most businesses because at this point, every business is a platform business.

(00:08):

Welcome to Pricing page teardown, where the profitwell Crew breaks down strategies and insights on how subscription companies from all corners of the market can win with monetization.

(00:23):

Welcome to Pricing page Chair down. I'm Patrick Campbell. I'm Rob Litterst. And this week we are talking about Boston's own Klaviyo, which is just taking the e-commerce market by storm, by storm, by providing e-commerce email and SMS products. And what's kind of amazing about it is that they have built themselves into this ecosystem in such a way where you can set up workflows both on SMS as well as an email. Throw a little social in there as well, and basically make sure that you are kind of making money when you sleep, even if you're an e-commerce business that oftentimes it's just so focused on like one time purchases. Totally. They took one thing, tracking revenue with email, one little thing, and they blew it up to build a rocket ship. Yeah, it's pretty amazing. And I know there's a lot of people who object around, Hey, is there platform risk here? Because they build on top of Shopify, big commerce, Punto, all of these other products, but they're doing some really, really brilliant things with their pricing in particular. And they're making a couple of mistakes that they can optimize a little bit further. We're gonna walk through all of these lessons and package 'em up into a nice little case study so that you can take these lessons and improve your own monetization strategy.

(01:32):

E-commerce has made it so we can buy anything and everything online from Pokemon cards of our youth to industrial manufacturing equipment for printing metal. We think it's just shipping and logistics that bring that success, but in reality it's the connectivity we all have with one another and the ability to reach any audience in any niche at any time. One of those core products, arming the Rebels who are reaching these niches is Boston-based. Klaviyo founded by Andrew Bai and Ed Halan in 2012. Klaviyo is an email marketing product built from the ground up for e-commerce businesses. Andrew and Ed had worked together at Adaptive Predictive Technologies where they built big data-driven marketing solutions, but they realized these tools well great for the time, weren't that smart for personalization and didn't measure the most important thing in marketing the revenue all because they didn't store any customer data.

(02:20):

Klaviyo set out to solve these problems by offering up an email marketing solution that monitors real-time customer data to automate personalized communication. Their platform enables owned marketing, which is a channel where you can control the entire experience by inputting whatever data you need into the Klaviyo product and having effective APIs and plugins to send whatever you need. This world of customer data and messaging living side by side has spawned rapid success with tens of thousands of customers and whole percentage points of Black Friday sales attributed to companies using Klaviyo. With success comes competition though much of the risk Klaviyo faces comes from an extremely fragmented market. There are over 400 different marketing providers and Klaviyo is on the high end from a pricing perspective. You are even seeing companies like Shopify and MailChimp add Klaviyo features to their stack. Other critics also point out that while there are millions of stores in the world of e-commerce, many of them aren't going to need tools as sophisticated as Klaviyo's and others are gonna want more full stack solutions like Demandwares. Time will tell, but the question remains, how has Klaviyo been so successful and is the market valuing them enough to keep that success going? Will their pricing push towards commoditization? Especially as email becomes ubiquitous throughout most of the products we use. Are there features enough for the hardcore users? Klaviyo's definitely balancing between the markets beautifully, but we're gonna answer these questions and more by collecting data from current and prospective Klaviyo customers. We'll reveal all the data and answers to these questions coming up in just a bit.

(03:49):

Mission metric is one of those things that mower companies are going to need to use and we talked about it a little bit with Shopify, but basically what mission metric means is that your focused at all of your efforts product, your pricing model, all of these different things around your actual customer's mission. Mm-hmm. <affirmative>, right? And sometimes you can charge beautifully on that. You can actually charge pay for performance like our retained product. Mm-hmm. <affirmative> the lowers churn. Other times you have to find a proxy for it, which might be contacts or emails or something like that. And I think what Klaviyo does really, really well is they center everything around, even if they don't talk about it in all of their copy around the ROI and the relationship with that customer. Exactly. And the efficiency of building that relationship. And you could see it not only in their homepage but also throughout their entire pricing strategy where they essentially focus on like, what is the actual ROI of this email?

(04:34):

Mm-hmm. <affirmative>, how do we make sure you get higher lifetime value, repeat purchase rates, et cetera, out of these e-commerce interactions that you're having rather than you relying on just getting that next Facebook ad and getting that next person to come through on Facebook. Totally. And it's genius because it was this kind of small corner of a market that would need email, right? Yeah. But they had slightly different needs than other companies that are using email. And there's a different sophistication as well, like SendGrid, I I imagine like engineers using that. Right? Right, right. Because they started more on transactional emails. Right. And MailChimp, it's super smb, but it's very, very generalized, right? Oh yeah. And Klaviyo's like, no, no, no, we're gonna go after e-commerce specifically cuz these folks, they don't have any good tools. Totally. Yeah. And one, one thing I fear with them is, you know, Shopify's email tool is, is starting to come out and I, I know, like I have to imagine that Shopify is not all of their revenue, but a really good portion of their revenue.

(05:25):

Oh yeah. But most of Shopify's tools, they don't really serve the mid to upper market. Right. And I think Klaviyo that that's kind of who they've been focused on. Right. And that's a big enough market where they have plenty. There's so many, right. Yeah. And that's why I think that like, there's a lot of like platform risk that people talk about with like building on top of other platforms and it's not untrue. Mm-hmm. <affirmative>, it's just not only does Klaviyo have different, you know, types of, of platforms they can go after, but in addition to that, Klaviyo knows that they need to be better than any other email product out there that serves the e-commerce market. Totally. And so if they're going to go after, you know, any other email provider, they need to make sure that they're always going to be better. Right. And that's like reduces platform risk.

(06:08):

We see this with our analytics products. It's like no one's going to think about this problem as much as we are. Right. Our people we integrate with. Yeah. They'll have analytics, but it will never go as deep as what we're thinking. Exactly. Which I think is the power of, of, of understanding what platform risk actually looks like. Totally. So let's take a look at the pricing page and then let's dig into the data on both their current and prospective customers. Absolutely. And what we're gonna do here is we're gonna take a look at what they're doing really, really well and what they're doing not so well. What could be optimized ultimately to figure out and package up all of those different lessons into its own case study so you can improve your own monetization strategy.

(06:44):

Two big things on this pricing page. One incredibly simple, everything's included. Um, which is, you know, maybe good, maybe bad depending on how you look at it. The one thing I really really like about those is this, they estimate the ROI you could get with Klaviyo. Um, so I put some inputs in here, like imagine we have a list size of a hundred thousand, we're doing 20 to 50 million, I think it's here per year. And then we're in the jewelry industry or we can kind of change that up and then they're basically giving us like a calculation. Um, it's one of those things that's kind of it, it it contextualizes things I think in a really good way. Yeah. Now this doesn't work for everybody because your customer has to at least somewhat believe what you're saying. Right? Right. And if you put this in front of two technical of a buyer, like someone who's way up market, like I would argue an enterprise, um, you know, enterprise e-commerce marketer might look at this and actually like scoff at it a little bit.

(07:36):

Yeah. Which is like, oh, there's no way you can tell that. Or you know, I don't know if I believe these numbers or you know, X, Y, Z, but someone who is like more mid-market a little bit in the lower market, I think they look at this and they go, oh, interesting. And at least like starts the conversation or actually starts me, you know, going into, into, you know, this actual experience. There's Yeah. Their eyes like probably light up. I mean I think it, it reminds me a lot of, um, the HubSpot playbook with Yeah. Inbound marketing. It's like at a certain level of sophistication of marketer, you're probably looking at some of the HubSpot copy and just being like, uh, I don't know about this. Yeah. Thinking, thinking it's a little bit corny with this. It's like I, I need to know where that ROI calculator number's coming from.

(08:15):

Sure. But there're probably some marketers that look at it and their eyes light up and, and they're so excited and they're like, cool, let me get started. Let me check this out. Or why, and keep in mind like, this is not the first page that people are going to. Right. They're gonna get a little bit of product marketing, a little bit of email marketing probably before they get here. Totally. Uh, but I think it, I think it works for what I presume to be their target customer looking at the rest of their pricing page. There's one thing that I just don't know if I, like, I, I get the simplicity of having all inclusive pricing. I think it's great from an ease of use standpoint for prospective customers that are coming to the site. It's gotta be nice for their sales team. Like there's just not a ton of like wiggle room on like where people are gonna land.

(08:52):

Sure. Cuz every plan kind of has everything, but you're completely bypassing functionality and kind of capability driven differentiation and Yeah. Not every customer can possibly have the exact same feature needs. Right. They, there have to be opportunities for them to monetize for, I think, to me, and I think we'll have some data on this in a second mm-hmm. <affirmative>, I, I don't mind this, especially with the mission metric focus. I think that they absolutely, if they don't have it already need some sort of enterprise plan. Yes. That's very, very different. And maybe that has like priority support, phone support, these types of things. If I go too high in terms of contacts and things like that, it definitely is a contact us situation. And I'm sure, or I, I can only imagine that when I get on the phone with them all of a sudden it's like, oh, we actually have these enterprise packages and things like that.

(09:35):

I would like some product marketing around that though. Right. And maybe we're just missing it. Um, yeah, but I don't see it in the FAQs and I don't see it on their website. Adding like a little bit of an enterprise section I think could really help here. And you, you can call it something like high volume or something like that. Cuz sometimes enterprise can scare away like an SMB base, but I think you saw this with HubSpot where they were more than willing to kind of like cater to some of these folks in the right way to get, you know, the right information. Absolutely. You wanna take a look at the data? Let's look at the data. Let's do it. So

(10:04):

Where does our data come from? Here at ProfitWell, our Price intelligently product combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers. Having the ability to collect data from everyone from a soccer mom or dad in the middle of Kansas all the way to a Fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles as well as which segments value which features and which segments are willing to pay more. All in the spirit of determining how a company can use monetization for growth.

(10:54):

First up, make sure your price makes sense from a cosmetic perspective. What do you mean by that? Well, what I mean is, and this is, this is what's really interesting is that I took one of their competitors' Drip. Okay. Um, out of the Twin Cities, I believe outta Minnesota and, and I, I basically mapped drips pricing as well as Klaviyo's pricing. Wow. And what you'll notice here is that Klaviyo's pricing, just very much like as you add more context, a very smoothly goes up into the right mm-hmm. <affirmative>, I think that there's like, I can't remember the exact dollar amount, but they add a certain dollar amount every like a hundred contacts or a thousand contacts at some point. And that's why you have this nice smooth blue line. Yeah. Wow. Now Drip on the other hand, basically as it goes up, all of a sudden you're seeing a situation where, you know, all of a sudden the price will jump at a certain point.

(11:36):

Mm-hmm. <affirmative>. Now the reason this is problematic is look what's happening, like if we're looking at purely competitive based pricing, which we never really should, all of a sudden on the low end Klaviyo is actually much more affordable. And then right around, I believe it's the 10,000 of emails, all of a sudden you're looking at like Drip is actually less expensive. Right. Which all of a sudden I might be thinking, oh, it's too cheap. Or that's a really small market to really go after. I don't know if Klaviyo did this on purpose. I don't really know if Drip is their like main competitor at all. But if I was comparing these two, I would say cosmetically, um, it's really, really hard for me to get on board with Drip. Yeah. Because I'm looking at this and I'm like, oh, you're more expensive on the high end and kind of more expensive on the low end and it just doesn't, unless it doesn't really make sense perfectly in the middle on that one.

(12:18):

Totally stretch. And it's, I don't think a lot of people are comparing and contrasting as, I mean they are, but they're not doing it as much. I just think that it's really important that cosmetically that like as things go up now, if you have a price point that is really, really based on the amount of input, the number of email contacts, um, or even the number of like messages that are being sent, then it's one of those things where like, you can get away with this because basically Klaviyo's offering up some sort of calculator mm-hmm. <affirmative>, if you don't show this, then it just becomes a little bit more complicated to understand like how the pricing shifts. So I think this a really big point and for your business, just make sure it makes sense, right? Like, and it's not so arbitrary. I think what Klaviyo does really, really well here is like they're just adding a certain amount for every number of contacts and it's kind of the same amount.

(13:02):

It creates this nice smooth upswing, right? Whereas Drip, they basically kind of have this arbitrary waited until it went up in price, et cetera, which customers will notice. And I don't think enough, we don't appreciate enough how customers will look at that and be like, if it doesn't make sense, then they're not necessarily gonna, you know, buy or they're gonna have some extra dissonance that you're gonna have to get over. Right. Next up, price localization when it comes to large fragmented markets is absolutely key. And you can see here, so again, price localization, it's when you change price points in different regions for the exact same product, but it makes sense because there's different willingness to pay across these different regions. And we saw that shake out here in the data with some intuitive, um, outcomes. Here you see on, on one end we have India and China with lower willingness to pay.

(13:45):

Um, on the other side of things, as we as we sometimes see the Nordics, those Nordics, they're always willing to pay more. They're willing to pay for their technology. Man, they, they really like good stuff and yeah. And this is independent of that as well as exchange rates. We sometimes get some pushback on there. Yeah. This is the actual clean comparison, um, of basically what's happening relative to the United States here. And I think this is something, at least when I was looking at the vpn, I couldn't find different price points for different regions. And I think it's one of those things where Klaviyo, as the things get a little bit more competitive, you have to realize that people are willing to pay different prices in different regions Totally. Based on standard of living margins, all types of things. This is like a pretty quick win that I think Klaviyo could actually implement.

(14:27):

Oh yeah. Um, even if in in the right time to do this is like if 20% of your base is outside of your home region. And I can't imagine Klaviyo doesn't have 20% of their base outside of the United States, right? I'm just given the reach of Shopify, big commerce, magenta, et cetera. And so for you in your business, I would just make sure you're doing localization. If you have 20% of your base outside of your home region, it's critical. Finally know when not to differentiate. And this is was me kind of setting you up with your all-inclusive feature plans. Yeah. So that's, that's what you have to thank me for. Here's the thing with Klaviyo, it's, it's more of a hub play because there's no single feature that differentiates more than others.

(15:06):

You're about to see something called a value matrix here we collected data from the group comparing feature preferences and plotted those on the horizontal axis, more valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that base on their number one feature preference on the Y axis. Analyzing data in this manner allows us to determine which features are differential add-ons, pour or commoditize for each segment.

(15:36):

When you're looking at the value matrix data here, what you'll notice is that none of the features for either differential features or add-ons really break plus or minus 20%. And normally when you see that it's an indication that there's not like one feature that you can really pull out to build a premium tier or to make as an add-on overall. Yeah, I think SMS marketing, which I don't believe is on here makes a lot of sense cuz it's like a different channel and not every single e-commerce brand is doing that, although they will be very, very soon if they aren't. But I think it's one of those things you have to think about is that there are probably enterprise features that they should pull out. And we didn't really test a lot of those here, but all of the features that they currently had, or at least the main ones that we tested, they're not really in a place where they can differentiate or it would be too much given their market base to basically figure out where to go.

(16:25):

Right. So my biggest suggestion to Klaviyo here is great job not differentiating, but in order for you to sustain yourself into the future and maintain those growth rates, you obviously have a ton of different customers to go after and different prospects, but you gotta start hunting for those add-ons. You gotta start hunting for what that enterprise plan is because eventually the logo add growth rate is starts and you're not gonna decline, but it's gonna start to get a little bit slower. So the revenue growth rate with different add-ons and things like that, it's gonna be needed to find those add-ons. And I think they found that with sms it's a very obvious play to go into, but they're gonna need to do some other things on top of this to, you know, become the billion dollar plus company that they want to be. Totally. That expansionary revenue is key.

(17:06):

And I mean, looking at this chart right now, like all of these features are just hovering around the median. So I totally get your point around just keeping it simple. But um, yeah, to your point, I think they're, they're gonna need to find some add-ons other than SMS going forward at some point in their life cycle. Yeah. They may find based on their acquisition like growth rates right now mm-hmm. <affirmative>, but like, I think the big thing for everyone else who's watching out there is just make sure that you realize that there's a lot of features that you can use to defend the core, but you're eventually gonna need to use some features in order to monetize in addition to your core pricing, right? You've grabbed all these users, the users presumably love you, they presumably are okay buying from you, but it doesn't hurt to not only go after that mission metric but also add on different things that they're more than willing to pay for. That both makes them higher retention because they're more ingrained within your product. Right. But also obviously higher lifetime value from both retention as well as from the higher actual revenue that they're paying you. Exactly.

(18:03):

Let's recap. First up, make sure your price makes sense from a cosmetic perspective. Um, we saw this mainly in the context of comparing Drip as well as Klaviyo, but I think the big thing that you know, these guys need to do is just keep on going with, hey, every time there's more contacts, the price definitely goes up. Totally. They're doing this pretty much perfectly fine. I don't think any customers will have a problem with it. They might have some trouble contextualizing like how much is an actual contact, which is a whole nother thing to get into, right? But I think cosmetically they're doing really, really well. Absolutely. Second point is price localization when it comes to large fragmented markets is key. Um, we've seen this in so many examples, but these guys have a huge opportunity to look at some of the regional willingness to pay that we found here and really optimize their pricing around those regions.

(18:44):

Especially this is something they should do tomorrow totally. Especially if 20% of their base is outside their home region. And then finally know when not to differentiate. I think you have to understand where the feature and relative preference of your different features are in order to understand what you can differentiate and not in the terms of Klaviyo at least their chorus or their core features. None of those should be differentiated and continuing their kind of all inclusive pricing. But in order to get their better growth rates, they are gonna have to find add-ons at some point. And those enterprise tiers to be properly optimized for their customer base, totally love what they're doing with, with SMS already. And the bundle option is really cool too, but more add-ons are just gonna lead to more expansion.

(19:21):

Well, that's all for this week's episode of pricing page. Teardown, if you got some joy from this, if you got some learning from this, make sure to share it on our social media channel of your choice. We want to get these learnings in the hands of as many operators as possible. And of course if you want help with your own pricing, you want similar data for your own business, feel free to reach out to me@patrickprovo.com or out to rob@provo.com and we'll hook you up with the right team to use our software and get the data you need to get your pricing strategy in check. So who's up for next week? Next week we have this small, tiny little company called Amazon. Ooh. Um, and we're gonna be talking about actually an entrant potentially into the e-commerce market at some point. Wow. But we're gonna be talking about Amazon particularly in the context of Amazon Prime.

(20:00):

Okay. And I think Amazon Prime is basically the number one subscription membership in the world. Um, and it's one of those things where I think it's something crazy, like 75% of all US households have an Amazon, uh, prime membership, and then the other 25% inherently has access to one. Yeah. But it's one of those things where it's a really, really good case study to understand how a membership product and how a subscription can do really, really well within a business, especially if you're not necessarily a subscription SaaS company. Totally. All right, we'll see you next week. See you next week.