AI Hype Cycle: What Previous Crashes Teach Us

A History of Bubbles

March 10, 2000 - The dot-com market began its descent from historic highs with billion dollar valuations dwindling down to nothing.

September 15, 2008 - Lehman Brothers, an institution that had been around for over 100 years filed for bankruptcy culminating in the subprime mortgage crisis.

February 20th, 2020 - a stock market crash began to the tune of billions… I’m sure you’re familiar with what followed.

When a bubble pops, people lose their jobs, their homes, basically people just lose across the board. This is caused by inflated valuation, siloed positioning, and increased leverage. But this isn’t a recent phenomenon, this is something that has been happening since at least the 1600s. The Dutch Tulip Bubble is one of the earliest accounts... but here’s what’s missing from the story. The tulip bubble popped yes, but tulips didn’t just go away. The Dot-com bubble crashed, but companies like Amazon survived and even thrived. With every collapse there’s a rise from the ashes.

Right now, it feels like a bubble is emerging with Artificial Intelligence. 76% of SaaS companies have AI on their roadmap. The hype is definitely there but at what point in the timeline are we? Are we still riding the hype upwards? Is everything about to come crashing down? By looking at historical examples, data, and speaking with an expert who has been through this several times over, we’re going to figure out what you can do to avoid the fallout when the bubble bursts.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

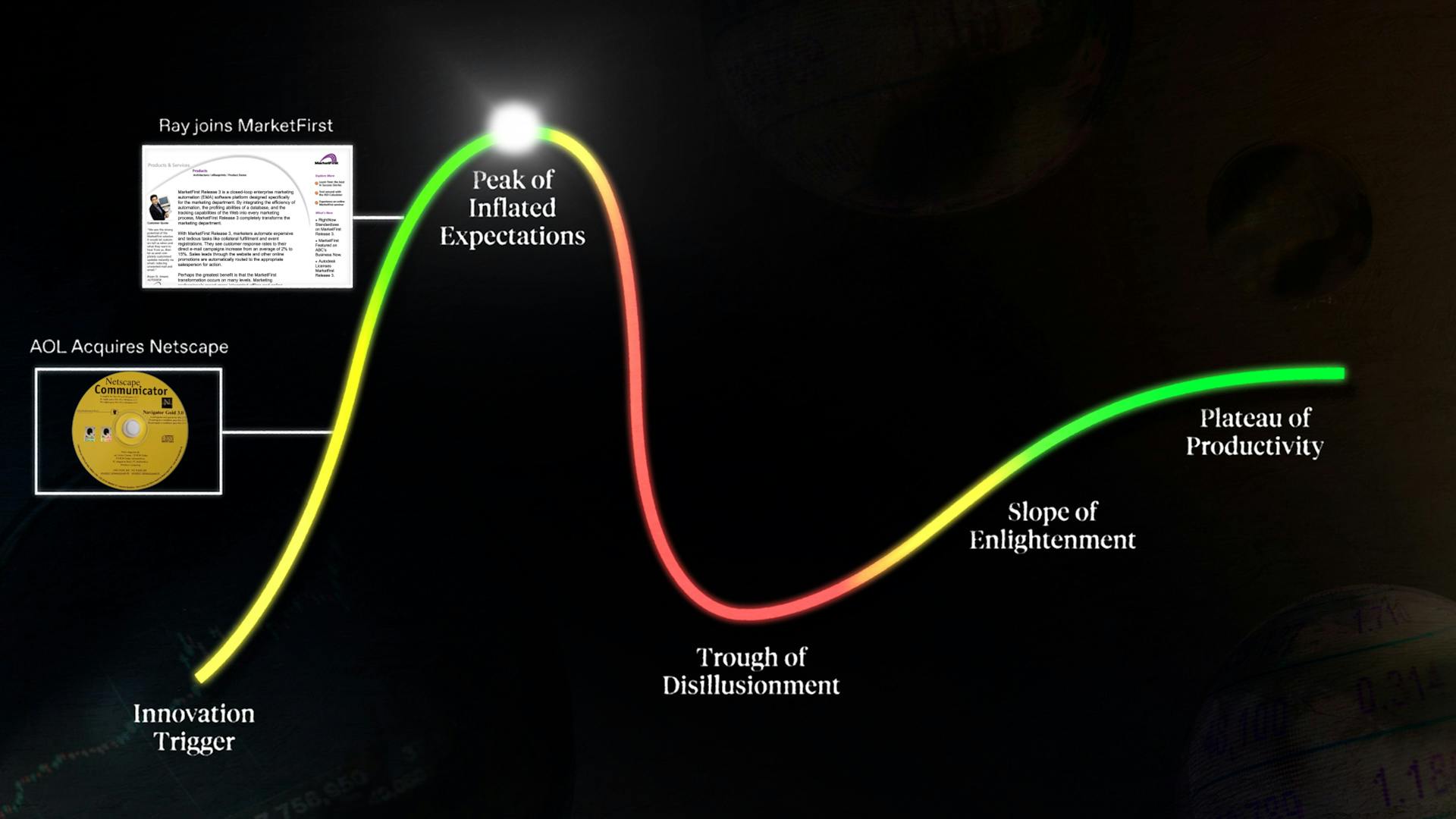

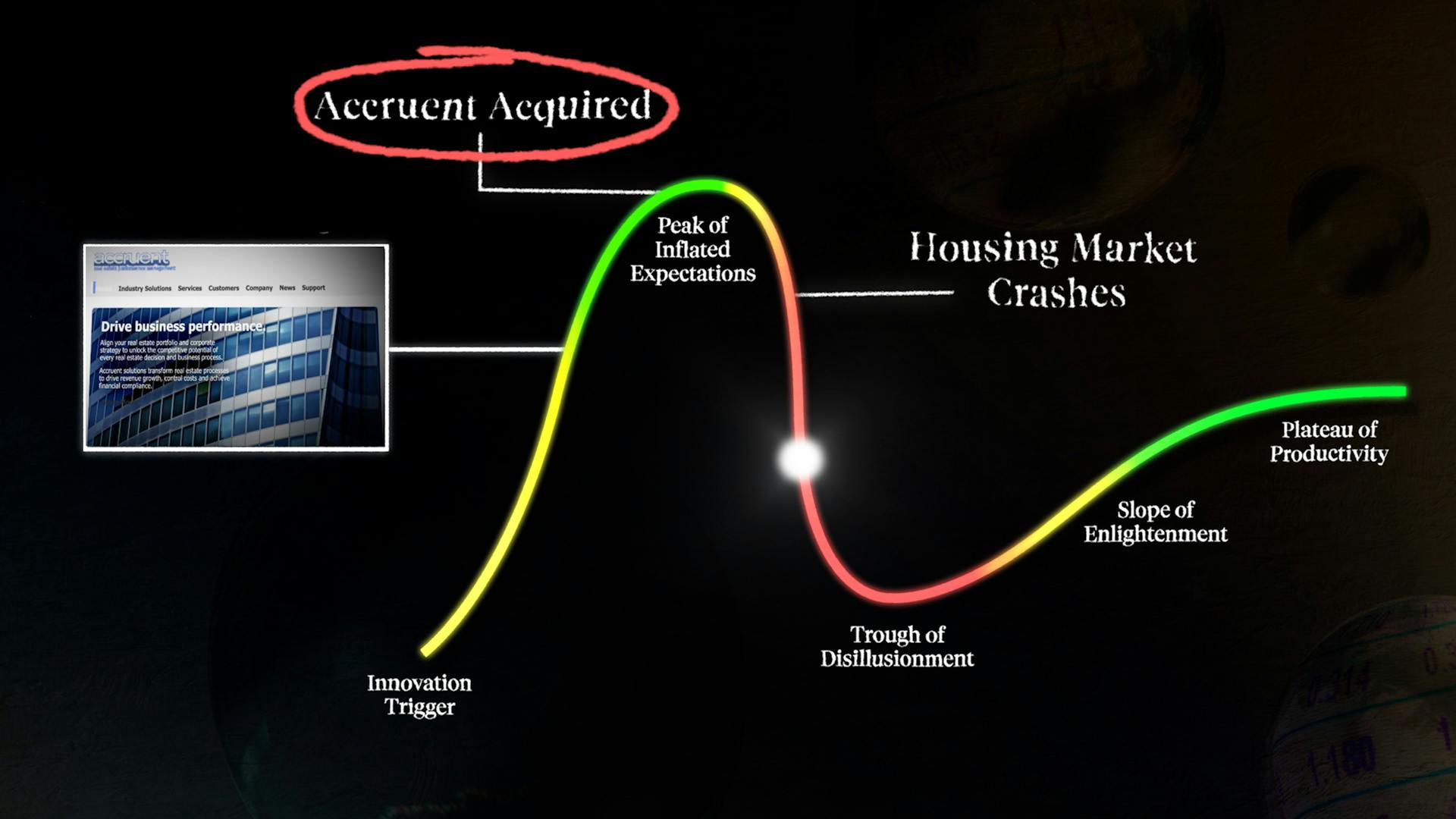

The Gartner Hype Cycle

There's a framework we can look at here that helps contextualize technology that often lies beneath these bubbles. The Gartner Hype Cycle. This outlines how technology matures over time to eventually reach a level of mainstream adoption. First, there’s a technology trigger, then a peak of inflated expectations, this is followed by a trough of disillusionment. But after that, there’s a slope of enlightenment as the true value is realized, and finally a plateau of productivity reaching mainstream adoption. There’s valid criticism that all technology doesn’t necessarily fit into this box. A bubble popping also doesn’t necessarily mean a major global financial crisis has happened… but for the AI cycle we’re focused on today, the puzzle pieces are falling into place.

It’s no secret that Artificial Intelligence has a lot of hype right now. Some warranted, some not so much. But where are we in the cycle? Are we just at the start or is inflated expectation peaking?

“We are in an AI Hype cycle for sure”

That was said by Ray Rike, the CEO of Benchmarkit. But before becoming a benchmarking expert, Ray experienced a few bubbles in real time.

The dot-com Bubble

For Ray, it all started in 1995 - the dawn of the dot-com wave. As networking technologies began rapidly expanding into homes all across the world, an entire category of web technology emerged in the market. Ray’s position at GE put him on the forefront of internet technology.

“At GE, which we were the world's largest provider of timesharing and our customers paid for it on a subscription plus usage basis. Sound familiar? It was SaaS before SaaS. We did a joint venture with Netscape in 1995 and then Netscape bought out GE so then we became the Netscape E-commerce business unit. We, Netscape, had been bought by AOL So I said, I'm going to go to a true start-up that doesn't have the two silver spoons of Netscape and GE feeding you right? So I was part of a company for marketing automation, late 1990s, it's called MarketFirst. We were one of the first platforms to create marketing automation for B2B companies. We went from 0 to $24 million in less than two years."

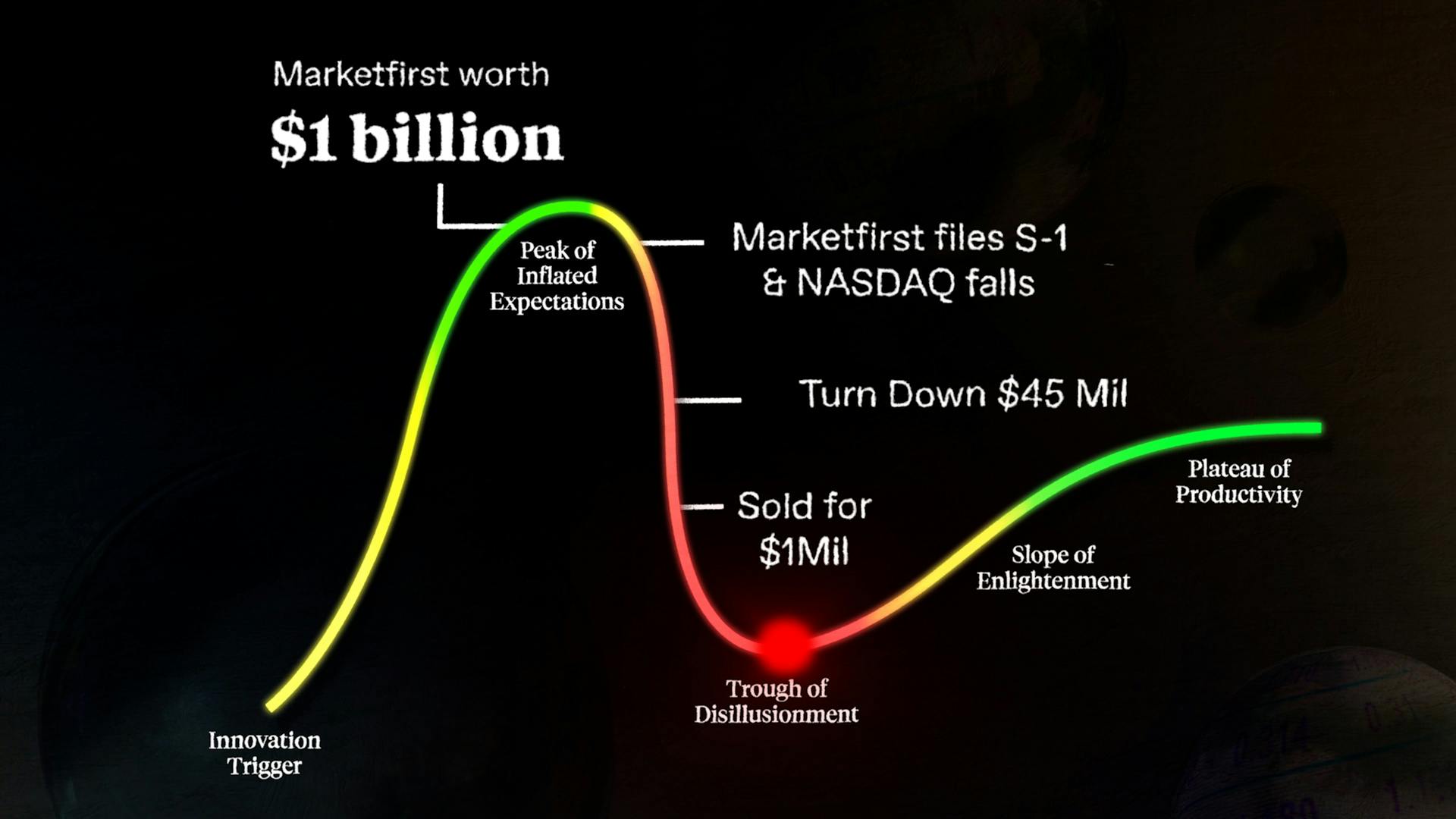

Basically, MarketFirst was HubSpot before HubSpot. As VCs rode the hype, it became easier to take a risk on emerging companies. Simply having a dot-com with a promising concept meant you could get a piece of the pie.

However, what happened after that fateful day in March of 2000 was that those companies that could not deliver on that promise collapsed like a house of cards. Pets.com pledged an ease in purchasing pet supplies yet failed to secure funding which lead to a 9 figure collapse. Webvan, a grocery delivery service, valued at $1.2 billion in November of 1999 lacked a large enough customer base to justify expansion. In the next two years, that valuation evaporated. When the market became oversaturated and the hype died down, the money valve was shut off. 5 trillion dollars were lost in funding.

Today, there’s a bit of a parallel hype with AI. Character.ai raised $150m with zero revenue, Humane Inc. even raised $230million without a product. It isn’t a given that they will go the way of Pets.com or Webvan but examples like this echo Ray’s dot-com experience.

“We would be worth $1,000,000,000 within 30 days after going public. Then we filed S-1 on April 14th of the year 2001. That was the same day, the exact same day that the Nasdaq had its first 10% negative correction. We turned down a $45 million offer... but we sold it for a million. That experience kind of taught me to be very careful of bubbles and a bird in the hand is worth two in the bush."

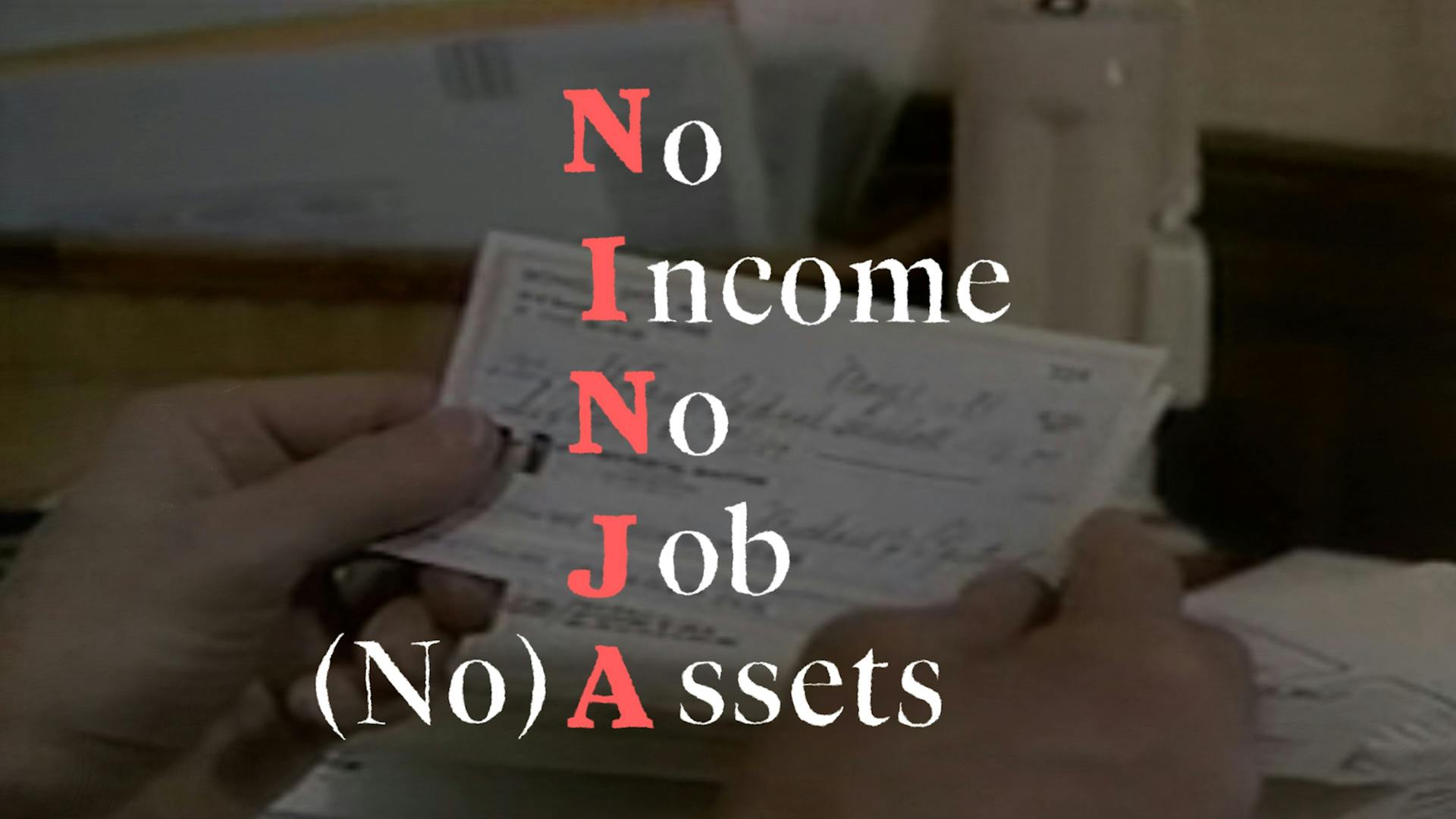

'08 Financial Crisis

Soon thereafter, Ray would be tested again as he found himself at the crest of another crisis. In the 2000’s, you could be practically broke and still find a provider to lend you money to purchase a home. Especially with the rise of NINJA loans: No Income, No Job, No Assets. Like the dot com bubble before, banks saw the speculation on hype as an opportunity to profit. This proved to be a situation ripe for disaster. Once reality set in and people couldn’t afford their mortgages, the bubble burst and the housing market completely collapsed.

Housing goes through a series of expansions and contractions over time, typically localized to certain regions but this time the effect was globally, with institutions like Lehman Brothers disappearing overnight. Fortunately for Ray, he had a bit of foresight to persevere through the turmoil.

"'05 I went to Accruent, a real estate performance management software. We had two years of unprecedented growth. These large multi-location retailers like Home Depot, Starbucks, CVS, they wanted to manage their store life cycle from 'Where do aI build a store?', to building it our quickly, to preventative maintenance, reactive maintenance, and then lease payments, because a lot of the times they leased the property, they didn't own it. They hype was all about retailers were adding stores, the economy was roaring back. Right? Remember? I started to see retailers pulling back on their expansion. So we made a strategic decision to try to be acquired by a private equity firm."

The Emerging A.I. Bubble

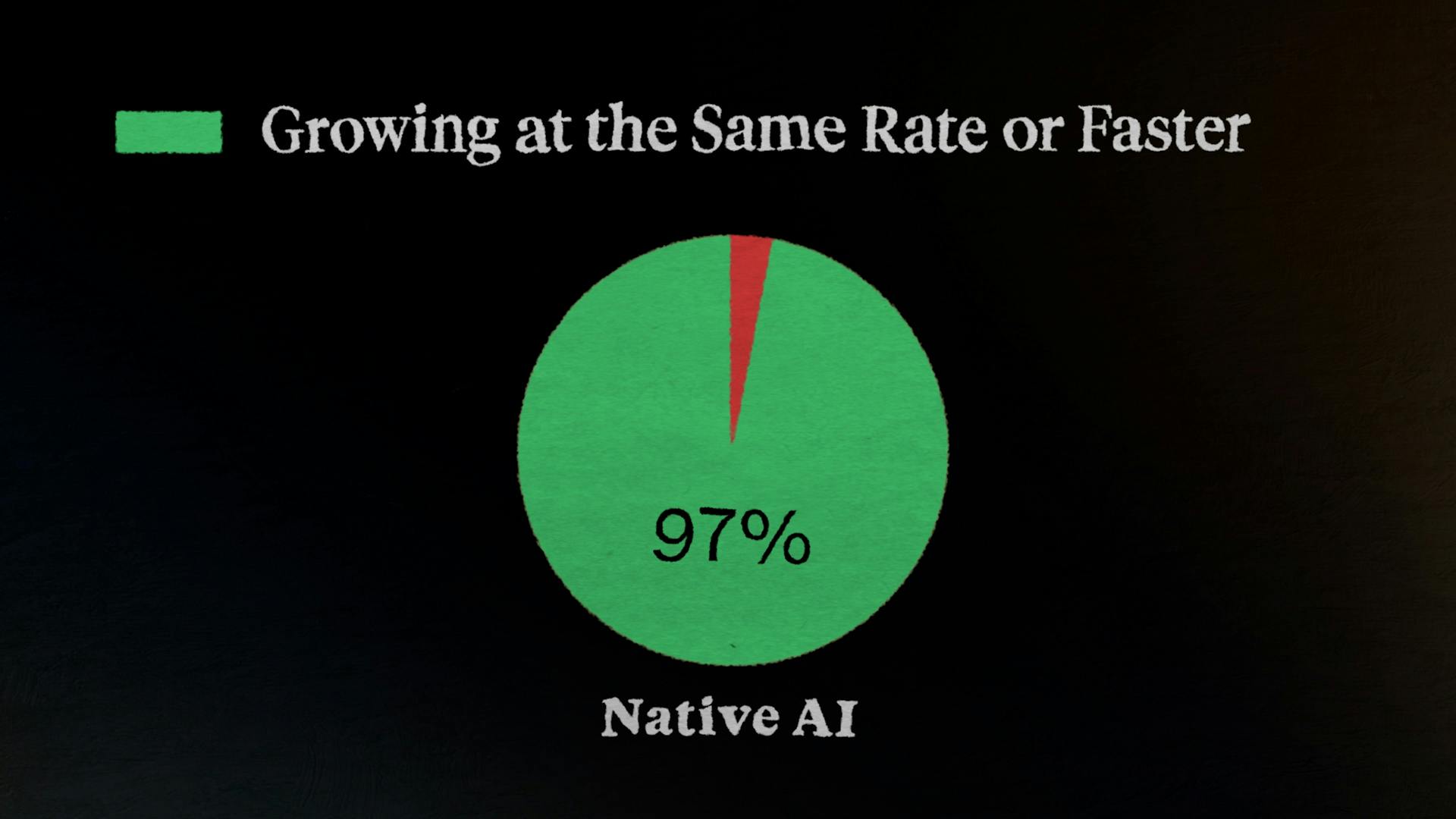

So how does this relate to AI? The AI market is projected to grow to over 1.75 trillion dollars in market share over the next 7 years. With this unprecedented rise, 35% of software companies are now incorporating AI into their businesses. Artificial intelligence has been discussed on 38% of S&P 500 quarterly conference calls. But, it’s not just talk. We found that 97% of native AI companies are growing at the same rate or faster than other companies. We are certainly past the early stages of the Gartner hype cycle but are we at the point of panic where you should consider changing your strategy to prepare for a crash?

“So using the Gartner hype cycle, probably it's coming off the very top of the hype and over time you get to the trough of disillusionment, right?”

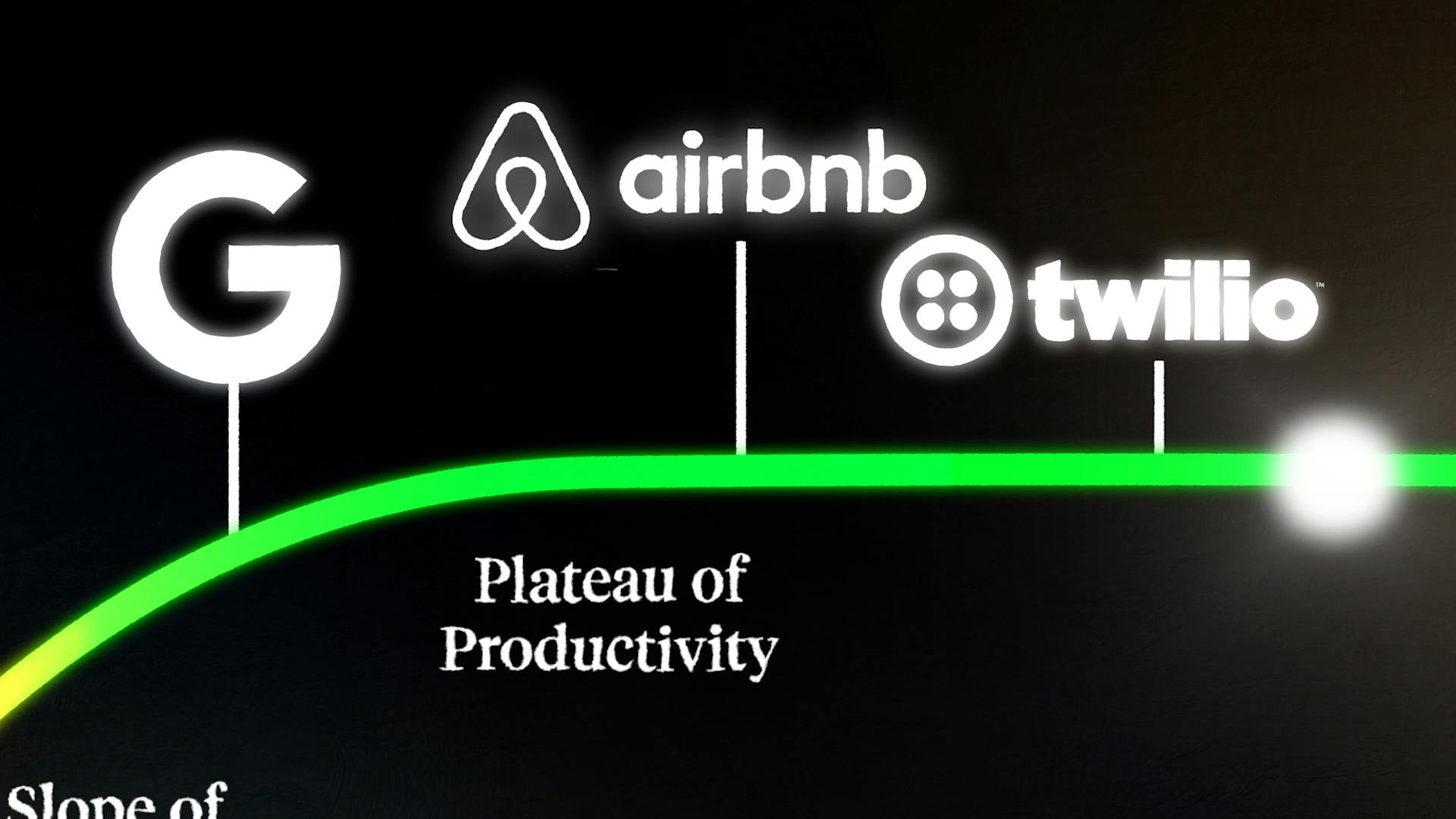

As the hype dies down and expectation meets reality, the money shuts off and we’ll plummet into failures, bankruptcy, and layoffs. However, it's not a permanent failure. Out of the ashes lies a period of steady growth, where the best of the best remain in the playing field. A plateau of productivity. If you’re a company with strong differentiation and have the retention numbers to last, you could end up becoming a big winner.

“The biggest companies in the world were created during crashes. Google basically came out of the late 99, 2001. Right? Airbnb, Twilio, came out of the '08-'09 economic recession. So you're going to see the same thing right now. And you're gonna see the rewards four, five, eight years later.”

A.I. Bubble Conditions and Time Frame

But it’s a bit early to suggest that a burst is imminent. First of all, there’s a conflation that happens. Generative AI and AI as a category. Generative AI, like ChatGPT and Dall-E, is a subcategory of Artificial Intelligence. Generative AI is driving this surge in the interest of AI as a whole category. And when we look at the broader economics of it all, Generative AI has yet to reach bubble territory.

Let's look back at the causes of a bubble, Valuation, Positioning, and Leverage. Today, there’s definitely companies that are garnering interest by simply being advertising as AI. But we have yet to see a blitz of profitless Generative AI companies going public like we did with the dot-coms in the late nineties.

The closest thing we have to monitor the health of AI valuation right now is the growth of chip providers. These chip providers like NVIDIA are not overinflated when we look at their price to earnings ratio as well as their revenue growth, a far cry from companies like Cisco were during the dot-com bubble when those numbers were far apart in realism.

As far as positioning goes, it hasn’t reached the point where capital is centrally focused in this specific region. There’s high growth in the sector, but the impact on GDP is relatively modest compared to the hype.

When it comes to investor leverage, we’re not at a breaking point by any means. According to the Federal Reserve, leverage at broker-dealers stayed near historically low levels in the past year. With the threat of a recession that has been looming in the states, preparations were made to stave off that possibility. Which begs the question: what’s next?

"I believe that AI will have the biggest impact on technology and the economy as a whole in the world. The question is what's the time frame? Around 2032, you're going to see the real benefits starting to accrue to the masses. Minimum basic income could have to become a reality because you're gonna have a lot of people making $80,000-$125,000 and you're gonna have to repurpose them."

How to Prepare

So what do you need to do to survive a pop and reap the benefits? There has to be a path out of the trough and onto the plateau of productivity.

In a time when durability is key, no metric highlights your lasting power quite like Net Dollar Retention. It varies by cohort, but keep that number north of 100%. To do so, have an aligned understanding of what is most valuable to your customers. This makes it possible to keep customers around for the long haul. Focus on term optimization and improving support to start. But when a customer no longer realizes value, provide enough friction to learn from their cancellation without making it impossible to voluntarily churn. When acquiring new customers gets difficult, your existing customer base can be the lifeline you need to survive.

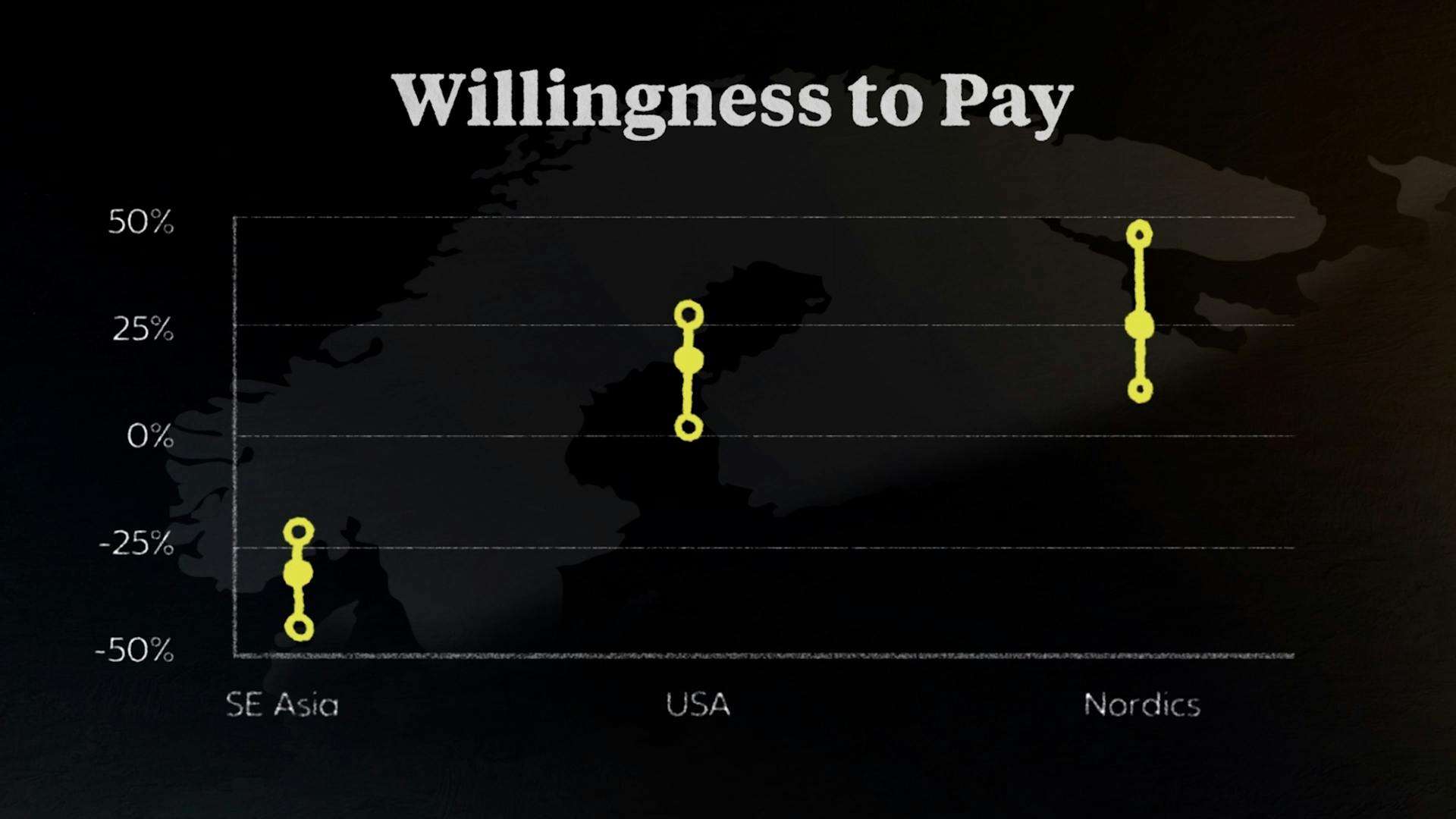

But in the most dire of economic situations, churn control is just the start. While a bubble like the 2008 housing crisis can have broad implications, remember that these can be regional in effect. Let’s say a pop happens localized to the US market. If that’s where all of your customers are then there’s only so much you can do to address retention. This is where the diversification of your customer base comes into play with a sound internationalization strategy. Customers in different regions are many times willing to pay you more for the exact same product. Even something as tangible as diversifying your payment methods can help build a bridge towards a global customer-base. With countries from all over the world preferring different methods of payment, it's shocking to find out that only 13% of companies offer PayPal, and 9% offer Apple Pay when various regions use them as their preferred payment.

But don’t stop with internationalization, ensure operational efficiency is up to snuff. The alignment of your product, sales, and marketing team is key, without which retention and acquisition will be for naught. With a product-led strategy, many companies, not just AI, see fruitful gains. Think about how much more likely you are to purchase a product if you can actually experience the product beforehand.

I can’t tell you when the AI bubble will pop, but I can tell you that the only thing that's going to stand the test of time are the innovations and products that provide long term value. Hopefully what I’ve told you isn’t a concern and you have a differentiable product that feeds the needs of a growing user base.

Make sure to check out our full talk with Ray Rike and subscribe to get in the know when we release new episodes.

00:00:00:10 - 00:00:03:11

Newscaster

On Wall Street today, a record close for Nasdaq.

00:00:03:15 - 00:00:20:11

Ben Hillman

March ten, 2000, The dot com market began its descent from a historic high with billion dollar valuations dwindling down to nothing that day for you. Another one. Yeah, I know. Too many in a row. September 15th, 28,

00:00:20:13 - 00:00:22:11

Newscaster

Lehman Brothers is going bankrupt.

00:00:22:14 - 00:00:27:21

Newscaster

Caught up in the housing bubble. The result was more than $60 billion in losses.

00:00:27:23 - 00:00:30:00

Ben Hillman

February 20th, 2020.

00:00:30:02 - 00:00:33:08

Newscaster

This is the fastest 12% loss in history.

00:00:33:09 - 00:00:35:01

Ben Hillman

I'm sure you're familiar with the reasons why.

00:00:35:07 - 00:00:40:13

Newscaster

Now told to stay at home. Stay at home. Stay and stay at home orders. Home is also saving a life.

00:00:40:15 - 00:00:50:22

Ben Hillman

When a bubble pops, people lose their jobs, their homes. People basically just lose across the board. This is caused by inflated valuations, siloed positioning and increased leverage.

00:00:51:00 - 00:01:17:00

Ben Hillman

But this isn't a recent phenomenon. This is something that's been happening since at least the 1600s. The Dutch tulip bubble is one of the earliest accounts of one. But here's what's missing from the story. The tulip bubble popped, but to a just go away. The dot com bubble crashed, but companies like Amazon survived and even thrived. With every collapse, there seems to be a rise from the ashes.

00:01:17:02 - 00:01:38:13

Ben Hillman

Right now, it seems like there's a bubble emerging with artificial intelligence. 76% of SaaS companies have a high on their roadmap. The hype is definitely there. But at what point in the timeline are we? Are we riding the hype upwards, or is everything about to come crashing down? By looking at historical examples, data, and speaking with an expert who has been through this several times over.

00:01:38:15 - 00:01:42:19

Ben Hillman

We're going to figure out what you can do to avoid the fallout when the bubble bursts.

00:01:42:21 - 00:01:50:22

Newscaster

But like every bubble, the bubble ended.

00:01:51:00 - 00:02:13:15

Ben Hillman

So there's a framework that we can look at that helps contextualize technology that often lies beneath these bubbles. The Gartner Hype Cycle. This outlines how technology matures over time to eventually reach a level of mainstream adoption. First, there's a technology trigger, then a peak of inflated expectations. This is followed by a trough of disillusionment. But here's where it gets special.

00:02:13:16 - 00:02:36:10

Ben Hillman

There's a slope of enlightenment as the true value is realized. And finally, a plateau of productivity reaching mainstream adoption. There's valid criticism that all technology doesn't necessarily fit into this single box. A bubble popping also doesn't necessarily mean that a major global financial crisis has happened but for the A.I. cycle that we're focused on today. The puzzle pieces are already falling into place.

00:02:36:15 - 00:02:48:18

Ben Hillman

It's no secret that artificial intelligence has a lot of hype right now, some warranted and some maybe not so much. But where are we in the cycle? Are we just at the start or is an inflated expectation peaking?

00:02:48:20 - 00:02:51:16

Ray Rike

We are in an AI hype cycle for sure.

00:02:51:21 - 00:03:16:19

Ben Hillman

That's Ray Rike, the CEO of Benchmarkit. But before becoming a benchmarking expert, Ray experienced a few bubbles in real time. For him, it all started in 1995, the dawn of the dotcom wave, as networking technologies began rapidly expanding into homes all across the world. An entire category of web technology emerged in the market. Ray's position at G.E. put him on the forefront of Internet technology.

00:03:16:21 - 00:03:43:06

Ray Rike

G.E. Which we were the world's largest provider of timesharing, and our customers paid for it on a subscription plus usage basis. Sound familiar? It was SaaS before SaaS. We did a joint venture with Netscape in 1995 and Netscape bought out G.E.. So then we became the Netscape E-commerce business unit. We Netscape had been bought by AOL. So I said, I'm going to go to a true start up to nuts and have the two silver spoons of Netscape and GE feeding you, right?

00:03:43:07 - 00:03:56:18

Ray Rike

So I was part of a company for marketing automation late 1990. It's called Market First. We were one of the first platforms to create marketing automation for B2B companies. We went from 0 to 24 million in less than two years.

00:03:56:19 - 00:03:58:17

Ben Hillman

You were sitting on HubSpot before HubSpot?

00:03:58:23 - 00:03:59:09

Ray Rike

Yes.

00:03:59:15 - 00:04:18:01

Ben Hillman

As VCs grows the hype, it became easier to take a risk on emerging companies simply having a dot com with a promising concept meant you could get a piece of the pie. However, what happened after that fateful day in March of 2000 was that those companies that could not deliver on that promise collapsed like a house of cards.

00:04:18:03 - 00:04:42:19

Ben Hillman

Companies like Pets.com pledged an ease in purchasing pet supplies, yet failed to secure funding, which led to a nine figure collapse. Webvan, a grocery delivery service ahead of its time valued at $1.2 billion in November of 1999, lacked a large enough customer base to justify an expansion in the next two years. That valuation evaporated when the market became oversaturated and the hype died down.

00:04:42:23 - 00:05:04:19

Ben Hillman

The money valve was shut off. $5 trillion were lost in funding. Today, there's a bit of parallel hype with A.I. character. I raised $150 million with zero revenue. Humane ink even raised $230 million without a product. It isn't a given that they will go the way of Pets.com or Webvan. But examples like this echo raised dot com experience.

00:05:04:19 - 00:05:26:10

Ray Rike

We would be worth $1,000,000,000 within 30 days after going public. We filed our S-1 the exact same day that the Nasdaq had its first 10% negative correction. We turned down a $45 million offer, but we sold it for a million. That experience kind of taught me, be very careful, bubbles, and bird in the hands worth two in a bush.

00:05:26:12 - 00:05:47:06

Ben Hillman

Soon thereafter, we would be tested again as he found himself on the crest of another crisis in the 2000. You could be practically broke and still find a provider to lend you money to purchase a home. Especially with the rise of ninja loans. No income, no job, no assets. Like the dot com bubble before banks saw the speculation on hype as an opportunity to profit.

00:05:47:12 - 00:06:13:21

Ben Hillman

This proved to be a situation ripe for disaster And once reality set in and people couldn't afford their mortgages. The bubble burst and the housing market completely collapsed. Housing goes through a series of expansions and contractions over time, typically localized to certain regions. But this time the effect was felt globally, with institutions like Lehman Brothers disappearing overnight. Fortunately for Ray, he had a bit of foresight to persevere because the turmoil.

00:06:13:23 - 00:06:40:10

Ray Rike

five went to your current write real estate performance management software. We had two years of unprecedented growth. These large multi-location retailers like Home Depot, Starbucks, CVS, they wanted to manage their store lifecycle from where do I build a store to building out quickly? To preventive maintenance, reactive maintenance and then lease payments. Because a lot of times they leased the property, they didn't own it.

00:06:40:16 - 00:06:59:21

Ray Rike

The hype was all about retailers were adding stores. The economy was roaring back. Right. Remember? I started to see retailers pulling back on their expansion. So we made a strategic decision to try to be acquired by a private equity firm.

00:06:59:23 - 00:07:27:16

Ben Hillman

So how does this all relate to A.I.? Well, the A.I. market is projected to grow over $1.75 trillion in market share over the next seven years. With this unprecedented rise, 35% of software companies are now incorporating A.I. into their businesses. Artificial intelligence has been discussed on 38% of S&P 500 quarterly conference calls. But it's not just talk. We found that 97% of native A.I. companies are growing at the same rate or faster than other companies.

00:07:27:18 - 00:07:34:17

Ben Hillman

We're certainly past the early stages of the Gartner hype cycle, but are we at the point of panic where you should consider changing your strategy to prepare for a crash?

00:07:34:19 - 00:07:43:18

Ray Rike

Easy to Gartner Hype cycle. The probably coming off the very top of the hype and over time you get to the trough of disillusion when right as.

00:07:43:18 - 00:08:07:16

Ben Hillman

The hype dies down and expectation meets reality. The money's going to shut off and will eventually plummet into failures, bankruptcy and layoffs. However, it's not a permanent failure. Out of the Ashes lies a period of steady growth where the best of the best remain in the playing field a plateau of productivity. If you're a company with strong differentiation and have the retention numbers to last, you could end up becoming a big winner.

00:08:07:19 - 00:08:28:00

Ray Rike

Biggest companies in the world were created during crashes. Google basically came out of the late 99 2001. Right. Airbnb. Twilio came out of the 0809 economic recession. So you're going to see the same thing right now and you're going to see the rewards four or five, eight years later.

00:08:28:02 - 00:08:51:21

Ben Hillman

But it's a bit early to suggest that a burst is imminent. First of all, there's a conflation that happens. Generative AI and I as a category generative AI like chatbot and Dali is a subcategory of artificial intelligence. Generative A.I. is driving the surge in the interest of AI as a whole category. And when we look at the broader economics of it all, generative A.I. has yet to reach bubble territory.

00:08:51:23 - 00:09:15:18

Ben Hillman

Let's look back at the causes of a bubble valuation, positioning and leverage. Today, there's definitely companies that are garnering interest by simply being advertised as A.I., but we have yet to see a blitz of profitless generative AI companies going public like we did with the dot coms of the late nineties. The closest thing we have to monitor the health of air valuation right now is the growth of companies like chip providers.

00:09:15:20 - 00:09:35:13

Ben Hillman

These chip providers, like NVIDIA are not overinflated when we look at their price to earnings ratio as well as their revenue growth. A far cry from companies like Cisco were during the dot com bubble when those numbers were a bit far apart in realism. As far as positioning goes, hasn't rise to a point where capital is centrally focused in one specific region.

00:09:35:15 - 00:09:53:11

Ben Hillman

There's high growth in the sector, but the impact on GDP is relatively modest compared to the hype. When it comes to investor leverage, we're not at a breaking point by any means. According to the Federal Reserve, leverage on broker dealers stayed near historically low levels in the past year, with the threat of a recession that has been looming in the States.

00:09:53:13 - 00:09:59:09

Ben Hillman

Preparations have been made to stave off that possibility. Which begs the question, what's next?

00:09:59:11 - 00:10:23:22

Ray Rike

I believe that AI will have the biggest impact on technology and the economy as a whole, the world. The question is what's the time frame around 2032? You're going to see the real benefits starting to accrue to the masses. Minimum basic income could be have to become a reality because you're going to have to take a lot of people making 80 to $120,000 a year and you're going to have to repurpose them.

00:10:24:03 - 00:10:47:00

Ben Hillman

So what do you need to do to reap the benefits and survive a pop? There has to be a path out of the trough onto the plateau. Productivity in a time when durability is key, no metric highlights your lasting power quite like net dollar retention. It's going to vary by cohort, but keep that number north of 100%. To do so, having aligned understanding of what is most valuable to your customers.

00:10:47:01 - 00:11:10:17

Ben Hillman

This makes it possible to keep customers around for the long haul. Focus on term optimization and improving support to start. But when a customer no longer realizes value, provide enough friction to learn from their cancellation without making it impossible to voluntarily churn when acquiring new customers gets difficult. Your existing customer base can be a lifeline. You need to survive, but in the most dire of economic situations.

00:11:10:18 - 00:11:33:21

Ben Hillman

Churn control is just the start. While a bubble like the 2008 housing crisis can have broad implications, remember that these can be regional in effect. Let's say a pop happens localize to the US market if that's where all of your customers are. And there's only so much you can do to address retention. This is where the diversification of your customer base comes into play with a sound internationalization strategy.

00:11:33:23 - 00:11:57:04

Ben Hillman

Customers in different regions are many times willing to pay you more for the exact same product. Even something as tangible as diversifying your payment methods can help build a bridge towards a global customer base with countries from all over the world, preferring different methods of payment. It's shocking to find out that only 13% of companies offer PayPal and 9% offer Apple Pay when various regions use them as their preferred payment.

00:11:57:10 - 00:12:19:09

Ben Hillman

But don't stop at internationalization, and sheer operational efficiency is up to snuff. The alignment of your product sales and marketing teams is key, without which retention and acquisition will be for or not with a product led strategy. Many companies, not just I see fruitful gains. I mean, think about how much more likely you are to purchase a product if you can actually experience the product beforehand.

00:12:19:11 - 00:12:35:08

Ben Hillman

I don't know when the air bubble is going to pop, but I think that we've seen with these examples that the things that stand the test of time are the innovations and products that provide long term value. Hopefully, what I've told you isn't concern at all, and you already have a differentiable product that feeds the needs of a growing user base.

00:12:35:09 - 00:12:42:12

Ben Hillman

Thanks so much for watching. Check out more from Ray on the screen If you want to dive deeper and subscribe to Paddle Studios if you want to build better SaaS.