Sink or Swim: Net Dollar Retention Explained

Retention. We’ve talked about it for years... and years... and years. Retained customers are responsible for over half of average businesses revenue, yet companies still find themselves falling in love with the siren song that's sung by a brand new customer. As you acquire new customers, you begin filling up your ship and growing with each new customer who comes onboard. But there's a problem... Without a strong retention strategy many companies out there are taking on so much water that they are sinking. No ship is built perfectly, but it’s the most durable that weather the toughest storms.

So how do you get there? It starts with understanding your Net Dollar Retention. It’s a metric that you’ve seen time and time again, but it's far more important than you think. Let’s go over what NDR truly is, the benchmarks of companies similar to yours, and the tangible strategies to improve this metric. No company can have zero churn, but when we’re finished you’ll have the tools to make sure your ship doesn’t end up at the bottom of the ocean.

But first, if you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

What is Net Dollar Retention?

So what is Net Dollar Retention (also known as Net Revenue Retention)? Our expert analyst Stephen Ngo breaks it down:

“Net dollar retention, in SaaS and subscription companies, is basically a measure of how much recurring revenue over value of your existing customer base is growing or shrinking over time, and that's independent of net new sales, net new customer acquisition.”

Unlike Gross Revenue Retention, Net Revenue Retention factors in both churn and expansion revenue.

“ ...generally speaking, that's gonna be a function of two things: Number one is gonna be churn. How many customers are leaving? What's your success at providing value and getting customer satisfaction up? The second thing is expansion revenue (especially in B2B). And that's gonna be selling new products or selling more premium products to your existing customer base.”

Why is NDR important right now?

It's pretty simple. The more customers that are willing to stick around and upgrade the more durable your ship. But let's talk about that concept real quick. Durability. Although fast growth is still encouraging, it’s always prone to decline. Therefore, businesses and investors are focusing on long term durable growth now more than ever. Rapid acquisition is a great start, but can you keep it up? If you can’t, good luck staying afloat. Making sure you have the people and tools to help patch the leaks is important for any business that wants to maintain strong growth because a company with NDR above 100% is a company with growth built into their existing customer base.

For example, if the gold standard business for NDR, Snowflake, had suspended all customer acquisition activity a year before their IPO, they still would have grown by 58% that year. Snowflake, has very high expansion revenue opportunities. They’ve also figured out their product market fit. Now that’s a durable business!

NDR Benchmarks

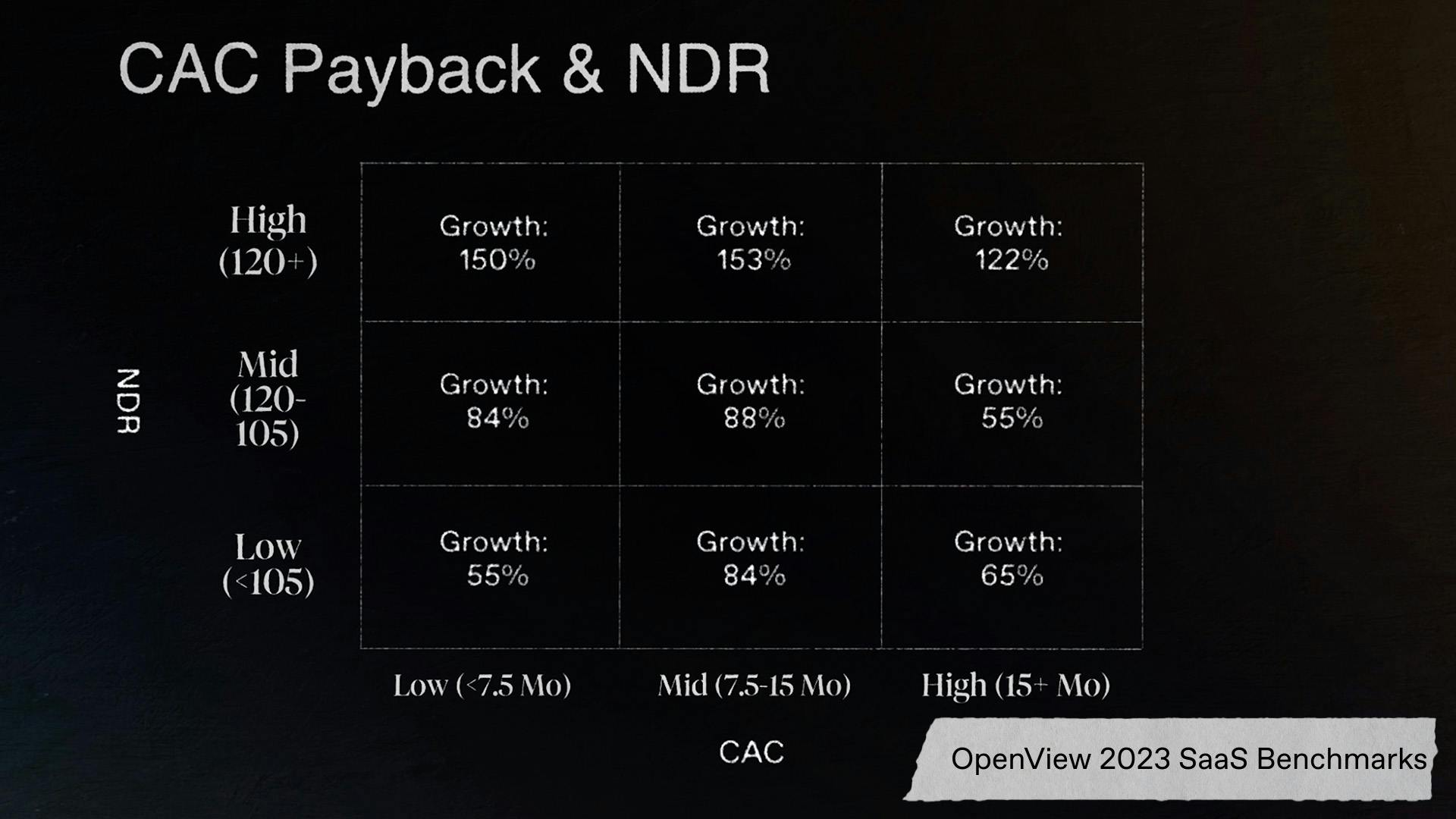

So how do you know if your retention and growth is in good standing? A great place to start is checking out our partner for this video, Openview. By looking at Openview’s Benchmark data, you can see where you stack up on this grid measuring NDR and CAC Payback.

On the upper left of the graph, we see companies with NDR above 120% and CAC payback below 7.5 months are doing amazing with growth of 150%. If we jump over to the right hand side of the graph, companies with NDR below 105% aren’t doing as well especially if their CAC payback is above 15. Growth here is only at 65%.. But a big takeaway is that performing poorly in either NDR or CAC Payback will, at most, leave you in the no man's land between great and not so great.

We have another video coming up on CAC Payback so be sure to check it out to learn a ton more. But the idea is simple, focusing on improving these 2 metrics can clearly lead to a higher median growth rate. Upper left means you’re doing great while bottom right means you’re taking on water. Seeing where you stack up is crucial. There’s a ton more on NDR and more in the Openview Benchmark report. Sign up to get it and you’ll be an outlier when the world is facing economic strife.

Improving NDR

So, we know what qualifies as a good NDR, but how do you actually patch up your leaks? Let’s run through 3 tips.

First, focus on delivering lasting value to your customers to improve retention. Focus on term optimization, cancellation flow improvements, improve support - do whatever you can to provide value to your customers. Keeping your customers happy can even turn them into ambassadors for your product further down the line.

Next, leverage your data to help create goals and form insights. Sure, a naturally great NDR means you’re doing some things right but you should be building that up and targeting a specific goal.

Finally, create more expansion revenue opportunities. Reducing cancellations by improving your cancellation flows with salvage offers and winback campaigns is a great way to boost NDR.

Stephen Ngo Continues:

“we often recommend to a lot of our customers that you try to cross sell or sell within the companies you're selling into. So if you imagine, for example, Salesforce, when it first started out, they might land at one sales team, within a larger company, and then sell within that company to other sales teams, and that's a very common model we see for getting that positive net dollar retention.”

You can also incorporate payments and retention tools like the ones we have at Paddle to do the hard part for you and decrease your churn rate automatically.

NDR is a simple metric to track but it has huge implications. By knowing where you stand with your NDR benchmarks, shoring up churn, and improving your retention strategy, you can create a durable and long standing business with growth built right into your existing customer base. Nobody likes losing money, so make sure you build a ship that lasts. Reach out if you have any questions, and make sure to check out the OpenView benchmark report. I’ll see you in the next one!

If you like this kind of content and want to learn more, subscribe to get in the know when we release new episodes.

00:00:00:00 - 00:00:03:10

Ben

How durable is your business? We've talked about it for years.

00:00:03:11 - 00:00:06:18

Patrick

Churn is one of the most annoying pieces of your business.

00:00:06:18 - 00:00:07:19

Ben

And years.

00:00:07:19 - 00:00:09:07

Patrick

churn, churn, churn, churn.

00:00:09:08 - 00:00:10:02

Ben

And years.

00:00:10:05 - 00:00:11:15

Patrick

Churn, Churn, Churn

00:00:11:19 - 00:00:21:16

Ben

Retained customers are responsible for over half of average business revenue, yet companies still find themselves falling in love with the siren song that's sung by a brand new customer.

00:00:21:22 - 00:00:41:00

Ben

As you acquire new customers, you begin filling up your ship and growing with each new customer who comes on board. But there's a problem with that a strong retention strategy. Many companies out there are taking on so much water that they're sinking. No ship is built perfectly, but is the most durable that weather the toughest storms. So how do you get there?

00:00:41:02 - 00:01:03:17

Ben

Well, it starts with understanding your net dollar retention or NDR. It's a metric that you've seen time and time again, but it's far more important than you might think. Let's go over what many are truly is the benchmark of companies similar to yours and the tangible strategies to improve this metric. No company can have zero churn, but when we're finished, you'll have the tools and make sure that your ship doesn't end up at the bottom of the ocean.

00:01:03:19 - 00:01:10:17

Ben

So what is net dollar retention also known as net revenue retention? Well, paddles expert analyst Steven now is going to break it down for you.

00:01:10:19 - 00:01:25:23

Stephen

Net dollar retention, in SaaS subscription companies is basically a measure of how much recurring revenue or the value of your existing customer base is growing or shrinking over time. And that's independence of net new sales, net new customer acquisition.

00:01:26:00 - 00:01:31:06

Ben

Unlike gross revenue retention, net dollar retention factors in both churn and expansion revenue.

00:01:31:08 - 00:01:48:13

Stephen

Generally speaking, that's going to be a function of two things. Number one is going to be churn. How many customers are leaving? What's your success at providing value? The second things is expansion revenue, especially in B2B, and that's going to be selling new products or selling more premium products.

00:01:48:15 - 00:02:11:09

Ben

It's pretty simple. The more customers that are willing to stick around and upgrade it, the more durable your ship. But let's talk about that concept real quick. Durability, although fast growth is still encouraging, it can always be prone to decline. Therefore, businesses and investors are focusing on long term durable growth now more than ever. Rapid acquisition is a great start, but can you keep it up if you can't?

00:02:11:10 - 00:02:33:06

Ben

Good luck staying afloat. So making sure you have the people and tools that help patch the leaks is important for any business that wants to maintain strong growth because a company with MDR above 100% is a company with growth built into their existing customer base. For example, at the Gold standard business for MDR, Snowflake had suspended all customer acquisition activity a year before their IPO.

00:02:33:06 - 00:02:54:00

Ben

They still would have grown by 50% that year. Snowflake has very high expansion revenue opportunities and they've also figured out their product market fit. That's a pretty durable business. So how do you know if your retention and growth is in good standing? Well, a great place to start is by checking out our partner for this video. OpenView. By looking at OpenView is benchmark data.

00:02:54:00 - 00:03:17:11

Ben

You can see where you stack up on this grid, measuring NDR and payback. On the upper left of this graph, we see companies with MDR above 120% and can pay back below seven and a half months are doing amazing with growth of 150%. If we jump over to the right hand side of the graph, companies with MDR below 105% aren't doing as well, especially if the payback is above 15.

00:03:17:13 - 00:03:37:09

Ben

Growth here is only at 65%. But a big takeaway is that performing poorly in either NDR or CAAC, payback will at most leave you in no man's land between great and not so great. If you have any questions, we have another video coming up on payback, so be sure to check it out to learn a ton more. But the idea is simple.

00:03:37:14 - 00:03:57:04

Ben

Focusing on improving these two metrics can clearly lead to a higher median growth rate. Upper left means you're doing great, while bottom right means you're taking on water. Seeing where you stack up is crucial. There's a ton more on NDR in the Open View benchmark report. Sign up to get it and you'll be an outlier when the world is facing economic strife.

00:03:57:06 - 00:04:23:04

Ben

So we know what qualifies as good. NDR But how do you actually patch up your leaks? Let's run through three tips. First, focus on delivering lasting value to your customers to improve retention. Focus on term optimization. Cancellation flow improvements. Improve support. Do it ever you can to provide value to your customers. Keeping your customers happy can even turn them into ambassadors for your product further down the line.

00:04:23:06 - 00:04:46:07

Ben

Next, leverage your data to help create goals and form insights. Sure, a naturally great NDR means you're doing some things right, but you should be building that up and targeting a specific goal. Finally, create more expansion revenue opportunities, reducing cancellations by improving your cancellation flow with salvage offers and win back campaigns is a great way to boost NDR.

00:04:46:09 - 00:05:04:22

Stephen

Try to cross-sell or upsell within the companies you're selling into. So if you imagine, for example, Salesforce when it first started out, they might land at one sales team within a larger company and then sell within that company to other sales teams. And that's a very common model we see for getting that positive net dollar retention.

00:05:05:01 - 00:05:22:17

Ben

You can also incorporate payments and retention tools just like the ones that we have here at PADDLE. We'll do the hard part for you so you can focus on growing your business. NDR is a simple metric to track, but it has huge implications by knowing where you stand with your NDR benchmarks showing up churn and improving your retention strategy.

00:05:22:19 - 00:05:37:10

Ben

You can create a durable and long standing business with growth built right into your existing customer base. Nobody likes losing money, so make sure you build a ship that lasts. Reach out if you have any questions and make sure to check out the Open View Benchmark report. I'll see you in the next one.