Learn the basics about churn and why it's the most important metric for SaaS leaders to measure and improve to build a thriving business

Customer churn is the silent killer of the subscription business. With rising customer acquisition costs (CAC) over the past five years and more market competition than ever, anything you can do to avoid lost customers is vital to your business' profitability.

So why aren’t more companies doubling down in their fight against churn? Because the solution isn’t intuitive. You have to understand the underlying issues that contribute to churn, predict how churn will impact your business, and find ways to combat it.

In this guide, we’ll walk through how you can identify, measure, and resolve churn so you’re able to retain more customers and keep your SaaS company healthy.

What is customer churn?

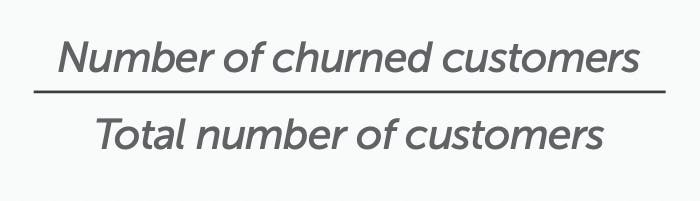

Customer churn (or customer attrition) refers to the loss of customers or subscribers for any reason at all. Businesses measure and track churn as a percentage of lost customers compared to total number of customers over a given time period. This metric is usually tracked monthly and reported at the end of the month. It's important to note that churn rates vary by industry and knowing your market is key to reducing churn with more precision.

Why is customer churn the most important SaaS metric?

Customer churn is the most important metric because revenue is tied directly to recurring relationships in the subscription model. Customer acquisition costs are especially high for subscription businesses, which I’ll get into momentarily. First, I’ll break down why SaaS businesses rely so heavily on recurring revenue and why customer success is so important.

SaaS businesses depend on recurring revenue

Monthly recurring revenue (MRR) is the lifeblood of the subscription business. Without predictable sources of revenue, it’s impossible to sustain your business over the long-term. On the flip side, it’s critical to track churned MRR to assess how customer attrition affects your revenue. If you’re losing customers too quickly, it can seriously hurt your ability to grow.

It's cheaper to retain customers than acquire new ones

CAC, or customer acquisition cost, is one of the most important SaaS metrics to track. CAC is the total costs of sales and marketing efforts that are needed to acquire a customer. It is one of the most defining factors in whether your company has a viable business model that can yield profits by keeping acquisition costs low as you scale.

A successful business model means your CAC is sufficiently lower than customer lifetime value (LTV). Low CAC and high LTV means your customer satisfaction is high and customers are staying for the long-term. Remember, it’s less costly to improve your customer journey to retain customers than acquiring new ones.

Improving customer engagement is an underrated revenue channel

Focusing on acquisition alone is a huge mistake because existing customers are likely to spend more money than new customers. You should still work to acquire new customers, but upgrading your existing customer base will unlock even more revenue.

Existing customers are with your product for a reason and have already developed brand loyalty from their onboarding process. It’s easier to sell to existing customers because they already have rapport with your company. If existing users find value in your product, then they are more likely to upgrade features if it means the experience will be enhanced. Convert more sales by focusing on upselling. Offer additional features or upgrades in an attempt to make a more profitable sale.

Why do customers churn (and what can I do about it)?

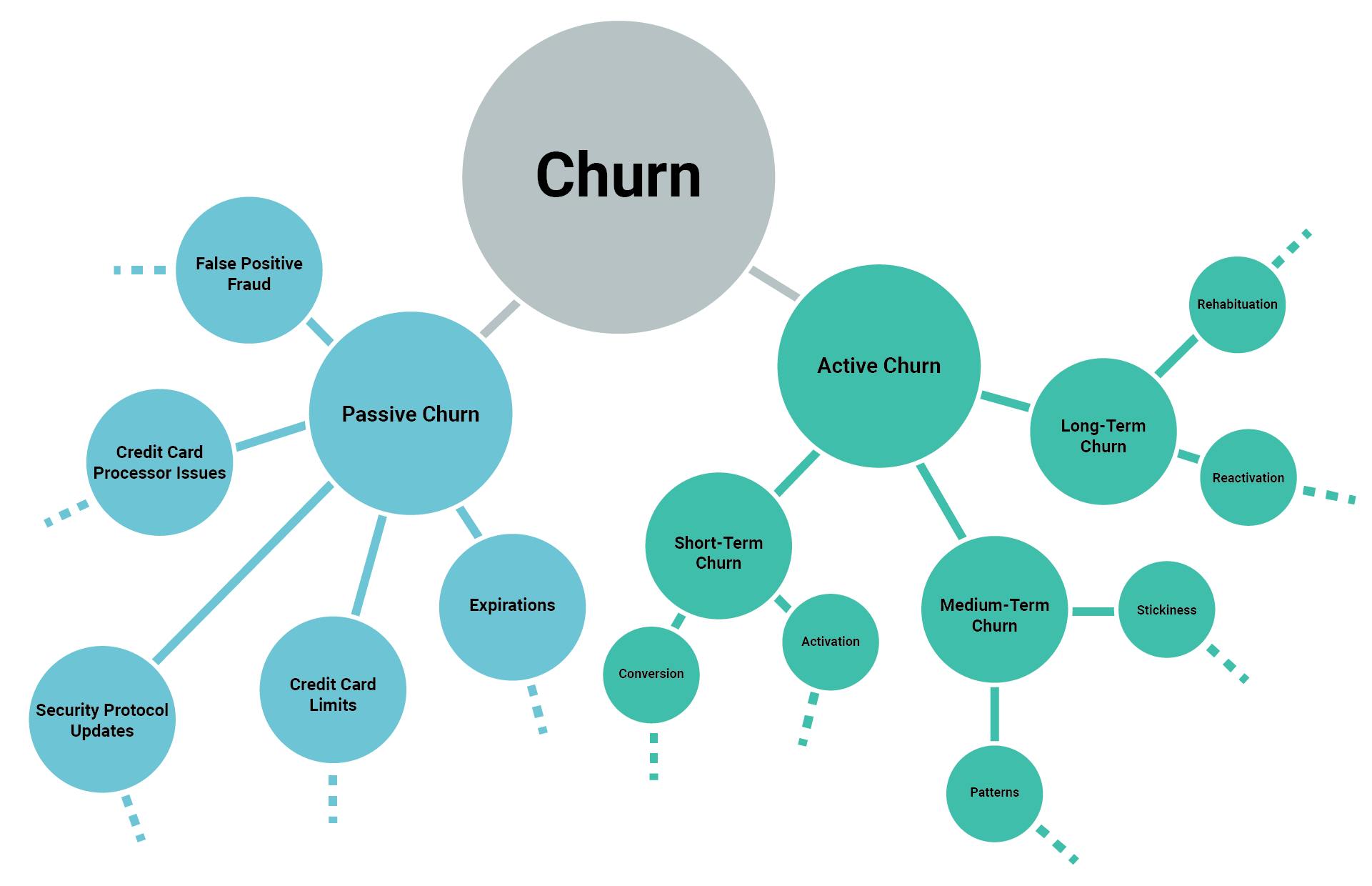

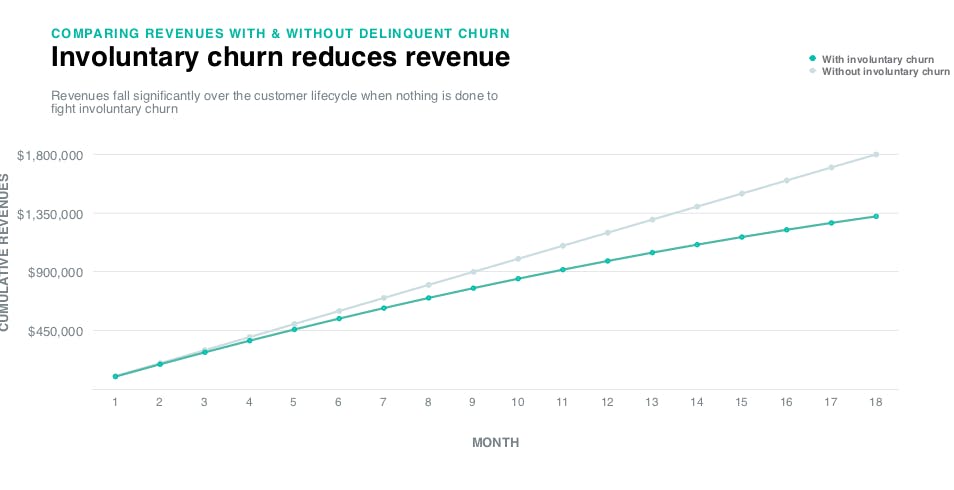

Customers churn for a number of different reasons. Businesses tend to focus on voluntary churn (where customers actively choose to leave your service) but involuntary churn (where they leave due to a failure that is outside of their control) Is the most common type, and the most easily addressed (if you can fix it proactively, before the failure).

Voluntary (active) churn

Voluntary churn happens when your customer chooses to leave the service on their own, whether it’s due to a poor experience or a better competing offer. Combating this type of churn starts with understanding how to continuously improve customer satisfaction.

Involuntary (passive) churn

Involuntary, or delinquent, churn is what happens when customers leave your service without actively choosing to do so. It’s the most common type of churn in SaaS, but it’s much more easily avoided than voluntary churn. As a mostly mechanical failure of your tools, delinquent churn is easy to fix by using the right tools.

How to model customer churn?

Calculating the basic formula for churn is simple: you take the number of customers you lost over a specific period and divide it by your total customer count.

This formula, however, doesn’t give you the whole picture. To truly understand how churn impacts your business, you must create a model for it.

There are a number of different ways to calculate churn, from formulas to more in-depth statistical analysis. By looking at these results together, you’re able to build a comprehensive picture of both your historical churn and a prediction of the impact churn may have in the future. Deciding on which results to use for your subscription business depends on the size of your company, your customer sample size, and your goals.

Predictive churn modeling

Once you’ve done a basic churn calculation, it’s a good idea to build a predictive churn model as well. It will help you anticipate customers leaving your service, so you can put a plan in place to stop them from leaving. This model also helps you predict future revenue by accounting for MRR that will likely be lost to churn.

How to manage and reduce customer churn

Combating customer churn is only possible when you have a solid retention process in place. Also helpful is implementing a way to keep track of customer satisfaction using a net promoter score. Building this plan starts with recognizing what drives churn for your subscription business, as we covered earlier in this guide. Once you understand these reasons, you’re able to find tactics that directly address those issues.

Prevent it from happening in the first place

For most types of churn, there are strategies you can put in place to identify at-risk customers and prevent them from churning by addressing their concerns. Prevention tactics are especially effective for decreasing involuntary churn, which is more solvable than voluntary churn. This is the foundation of customer retention.

Treat B2B and B2C churn differently

Churn impacts B2B and B2C companies in different ways. For B2C companies, the biggest issues are competition and the potential for individual credit card failures. For B2B companies, it’s a reliance on employee output and a high-touch customer service experience. Resolving these issues requires different types of strategies.

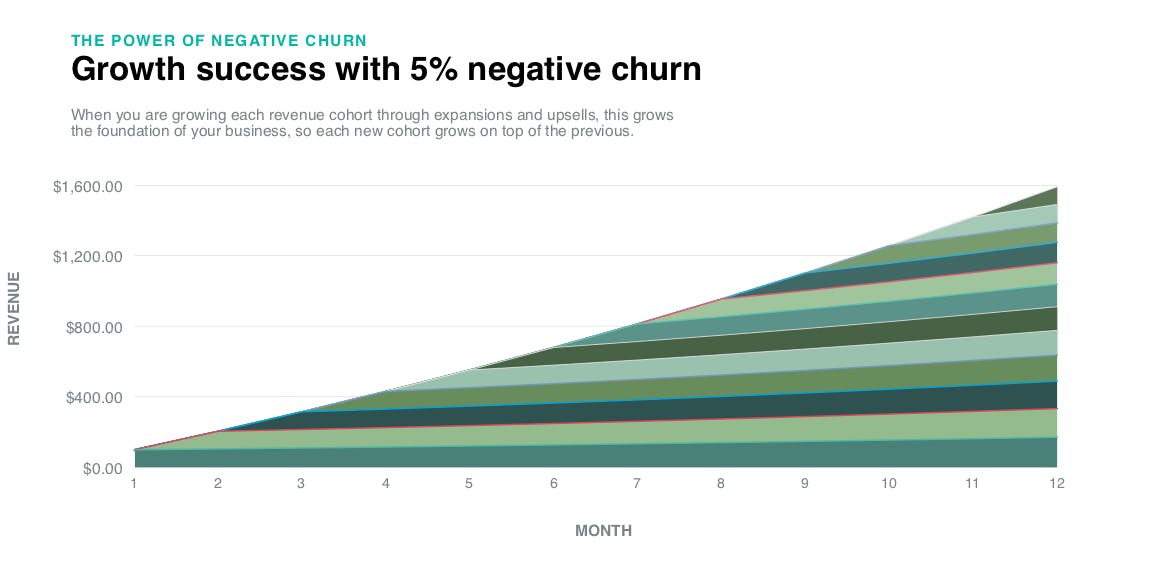

Aim for a net negative churn rate

Negative churn refers to your MRR being greater than the revenue lost to churn. In other words, you’re earning more than you’re losing. Maintaining a negative churn rate skyrockets company growth. Our research shows that businesses with a 5% negative churn are able to grow more efficiently than those battling positive churn rates.

Understand the churn rate benchmarks

The average churn rate for subscription companies is between 2% and 8%, which is a fairly wide range. A “good” churn rate is relative to the size and maturity of your business, but of course, lower is always better for your bottom line.

How to automatically reduce churn with Retain

Don’t let churn be the silent killer of your subscription company. When you understand the drivers of churn for your business and have a retention process in place to combat those issues, you can drastically decrease your churn rate over time.

Learn more about how churn impacts your business and what you can do to stop it with Paddle Retain, Paddle's churn prevention software.

Paddle is sitting on data from roughly 20% of the subscription-based economy, giving us an exclusive view into billions of transactions and the metadata surrounding payment methods within those transactions. When it comes to retention, we know what works and we know what doesn’t.

Our research shows that up to 40% of your churn is caused by failed credit payments. Most customers weren’t planning on cancelling and may not even realize their card is outdated. That’s where Retain comes in. We stop churn before it happens.

Retain strings together all the necessary outreach to recover failed payments—white-labeled, constantly tested, and optimized emails, in-app notifications, and smart retries. The best part is that with Retain, you only pay for performance. We don’t charge until we beat your current recovery rate.

Customer churn FAQ

Why is churn important to know?

Customer churn is a key metric that impacts revenue growth for SaaS business. It costs most to acquire a new customer versus retaining an existing customer. Therefore, keeping customer churn low maximizes your business’ growth potential.

How to reduce customer churn?

To reduce customer churn, a business has to have a good pulse on existing customer relationships. By having a reliable feedback loop, a business can identify customers who are at risk of churning before it happens and improve their product or customer experience based on feedback. By improving known issues, a business can tackle trends that cause churn and proactively reduce customer churn.

What is an acceptable churn rate?

Generally speaking a 5% monthly churn rate is considered average, while a monthly churn rate of 3% or less is considered good. Ultimately, an acceptable churn rate depends on you market and it is best to take industry benchmarks into account.

What tools can I use to keep track of customer churn?

There are many tools that help businesses keep track of and reduce customer churn. For example, Profitwell Retain targets customer churn due to credit card failure by automating personalized responses to reduce payment churn in real-time.