For SaaS companies, customer attrition is one of the worst things that can happen to the health of your company. Granted, some attrition is inevitable, but minimizing this key factor will undoubtedly mean the difference between a successful business and a failed one. So, what exactly is customer attrition and how do you minimize it? In this post, we'll take a close look at this metric and how to manage it so your SaaS company's growth chart is moving in the right direction.

What is customer attrition?

Customer attrition is defined as the loss of customers by a business for whatever reason. Customer attrition is a normal part of the customer life cycle. As customers will not remain active indefinitely, customer attrition is a key indicator of business health over time. In SaaS, customer attrition is commonly referred to as customer churn and is expressed as a rate that indicates the number of customers lost over a given period of time. This is an important indicator of business health, especially in SaaS.

What causes customer attrition?

There are a lot of factors that can cause customer attrition, some of the most common ones including:

- Bad targeting and customer fit

- Inadequate onboarding procedures

- Less-than-competent customer support

- Undefined USP

- Product glitches

- Misaligned pricing strategy

- Payment failures

A good analytics tool can help you identify those issues so you can take the proper steps to keep your client attrition rate as low as possible. By actively tracking your customer attrition, you can take a proactive approach to determine the reason why a customer is leaving and win them back. This insight is also very useful to understand demand trends in the market and ensure that active customers are happy and less likely to churn.

The negative impact of high customer attrition

Everyone instinctively knows that losing customers is bad. Because customer attrition is inevitable, however, some SaaS companies simply accept it as a normal part of doing business. This is an unhealthy attitude.

It may be inevitable that customers will churn, but it is a metric that can be managed with a little effort on your part. More importantly, taking the time to control the customer turnover rate can result in a more solid product that will actually attract more users over time.

So taking proactive steps to reduce churn will not only save you money, but will act as an effective strategy for new customer acquisition on top of that. Let's look at some ways that customer attrition hurts your business.

Less revenue

We'll start with the obvious. If customers leave, so does the revenue. In SaaS, monthly recurring revenue (MRR) is not only the lifeblood of a company, it's also an indicator of long-term viability. Customer attrition directly decreases revenue, so it is vital to keep it at bay. When a customer churns, you've also lost any ability to further monetize that customer.

Fewer customers

Imagine you have a product that you've convinced a single person to spend a million dollars a month on. If you do that, you're riding high for a while, but if you lose that one customer, you've also lost that million dollars. This is an extreme example, but it shows you the value of having as many customers as possible. It isn't just the revenue that having a large customer base provides, it's also the buffer it yields to help when attrition does happen. The more customers you have, the less losing one will hurt you. It goes without saying that in order to have a lot of customers, you need to minimize attrition.

Poor CAC: LTV ratio

Customer acquisition cost (CAC) is the amount of money that you have to spend in order to acquire a new customer. Your customer lifetime value represents the total amount of money you can expect from each of your customers throughout their time with your company. The goal, to maximize profits, is to have the lifetime value of the customer be significantly higher than the cost of acquiring that customer.

If you're spending to acquire customers and they churn before you make back those costs, then you're running a tough deficit. Churn increases your average CAC.

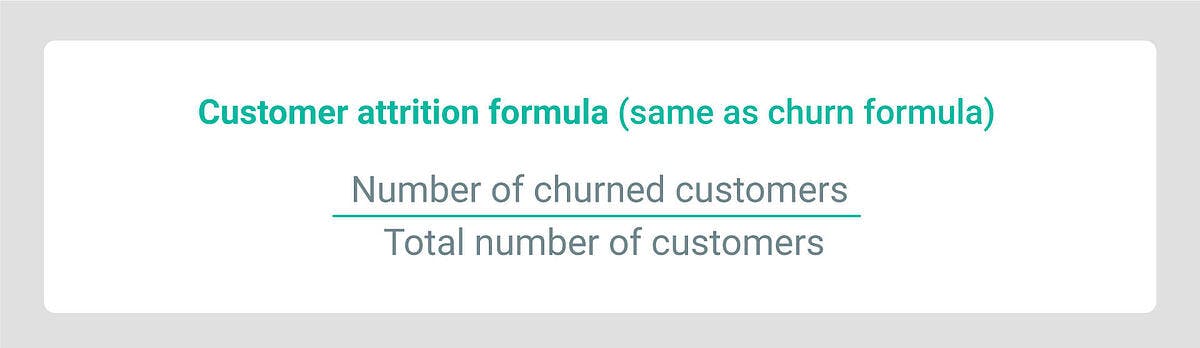

How to calculate your customer attrition rate

You can't stop customer attrition if you don't know how or where it's coming from. Let's take a look at how to calculate customer attrition rate, also known as churn rate. The first thing you'll have to do is to decide on the length of time that you want to measure. Most SaaS companies will measure by the month, but use whatever suits your data needs.

Where the number of churned customers is how many people have left your service over the period out of the total number of customers you had during the period. For example, if you start the month of January with 500 customers and 5 of them leave during the month, your churn rate would be 5 divided by 500, or 1%.

Any good analytics tool, especially one designed specifically for SaaS like ProfitWell Retain, will be able to calculate your churn rate for you. These tools will make it easier to monitor the trends over time and ensure that you are moving in the right direction.

Customer retention vs customer attrition

What’s the difference between customer attrition and retention? Customer retention rate is the percentage of customers retained over time. The customer attrition rate is the percentage of churned customers who have not been replaced by new customers. In a sense, customer retention is the opposite of customer attrition. By putting a sound customer retention strategy into place, you'll be able to minimize customer attrition and keep your company on the path to growth.

To summarize:

- Customer Retention — This is good. Retention keeps customers on board, gives you the chance to increase their customer LTV, keeps the revenue flowing, and gives you the opportunity for expansion revenue, so your company can focus on growing r.

- Customer Attrition — This is bad. By losing customers, you're losing revenue, plain and simple. Attrition is to be avoided at all costs.

What is a good customer attrition rate?

There is no universal answer. Naturally, you want to strive for the lowest customer attrition rate possible, but that is not a specific number. The safest bet is to look at the industry average and aim to stay above it.

Furthermore, it is crucial for all businesses to understand that a good customer attrition rate comes from a good customer experience. Regardless of the industry, the aim should be to retain as many customers as possible and stay focused on acquisition to fuel the company growth.

How to reduce customer attrition

In order to reduce customer attrition, you have to have a retention strategy that nurtures customer relationships. This starts with using tools like ProfitWell Metrics to closely monitor your attrition rate over time with the goal of consistently reducing it.

Sometimes, this won't happen. In fact, a spike in attrition may be your first clue that something is wrong in the customer journey. Are there new bugs that you're not aware of? Is some new feature proving difficult for users to figure out? There can be many reasons for attrition, but noticing that spike is an indicator that you need to start looking for something that is causing that change in customer satisfaction.

The best way to stop attrition is to track customer data on a regular basis and respond to feedback. This means making sure that you provide thorough onboarding that builds customer engagement from the start. Set customers up for success by prioritizing their product adoption with an accessible help center and bug-free product.

In addition, you can use powerful tools like ProfitWell Retain, to identify churn risk and stop customer turnover before it happens. Retain's algorithms are constantly evolving to push your recovery rates up. With accurate retention reporting for customer success, you can create a data-driven data-driven retention strategy that saves at-risk customers can and builds customer loyalty in the long run.

Customer attrition may be a part of doing business, but you should not simply settle and let eat your bottom line. Take control of your customer attrition rate today and check out how ProfitWell Retain can automate this for your business.