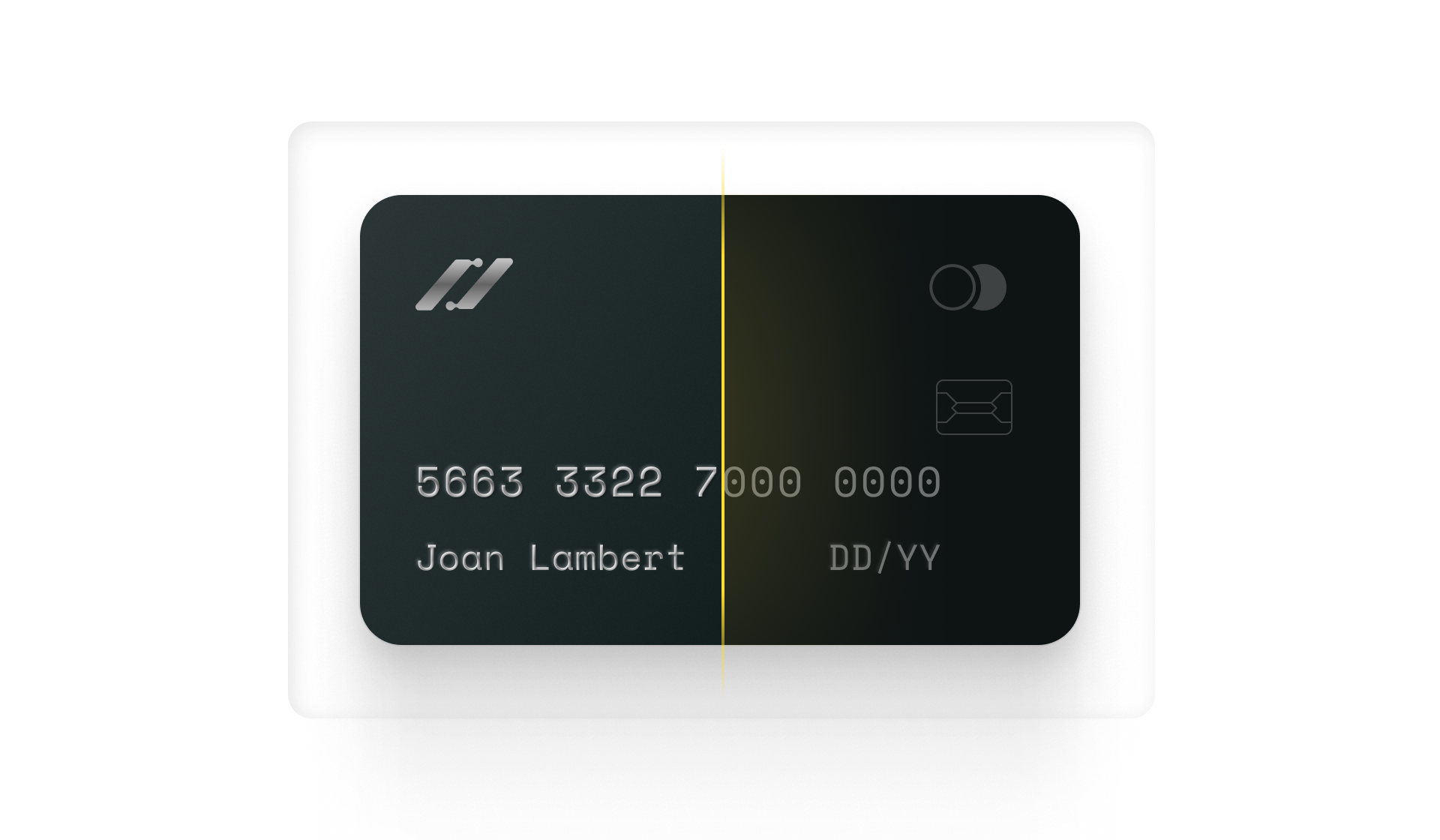

Reduce your risk with fraud prevention & protection

Billing actively combats card attacks and fraud to protect your revenue.

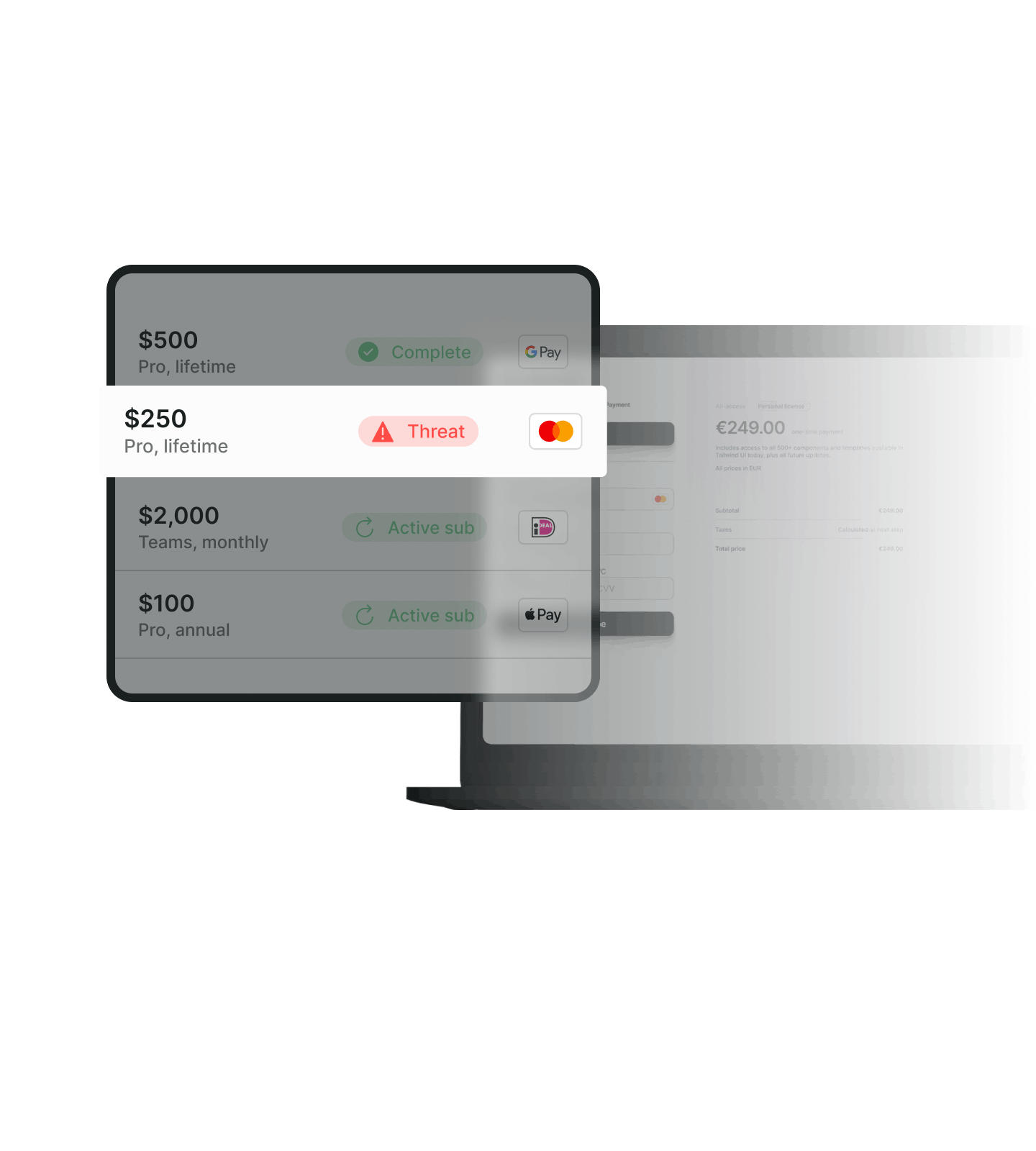

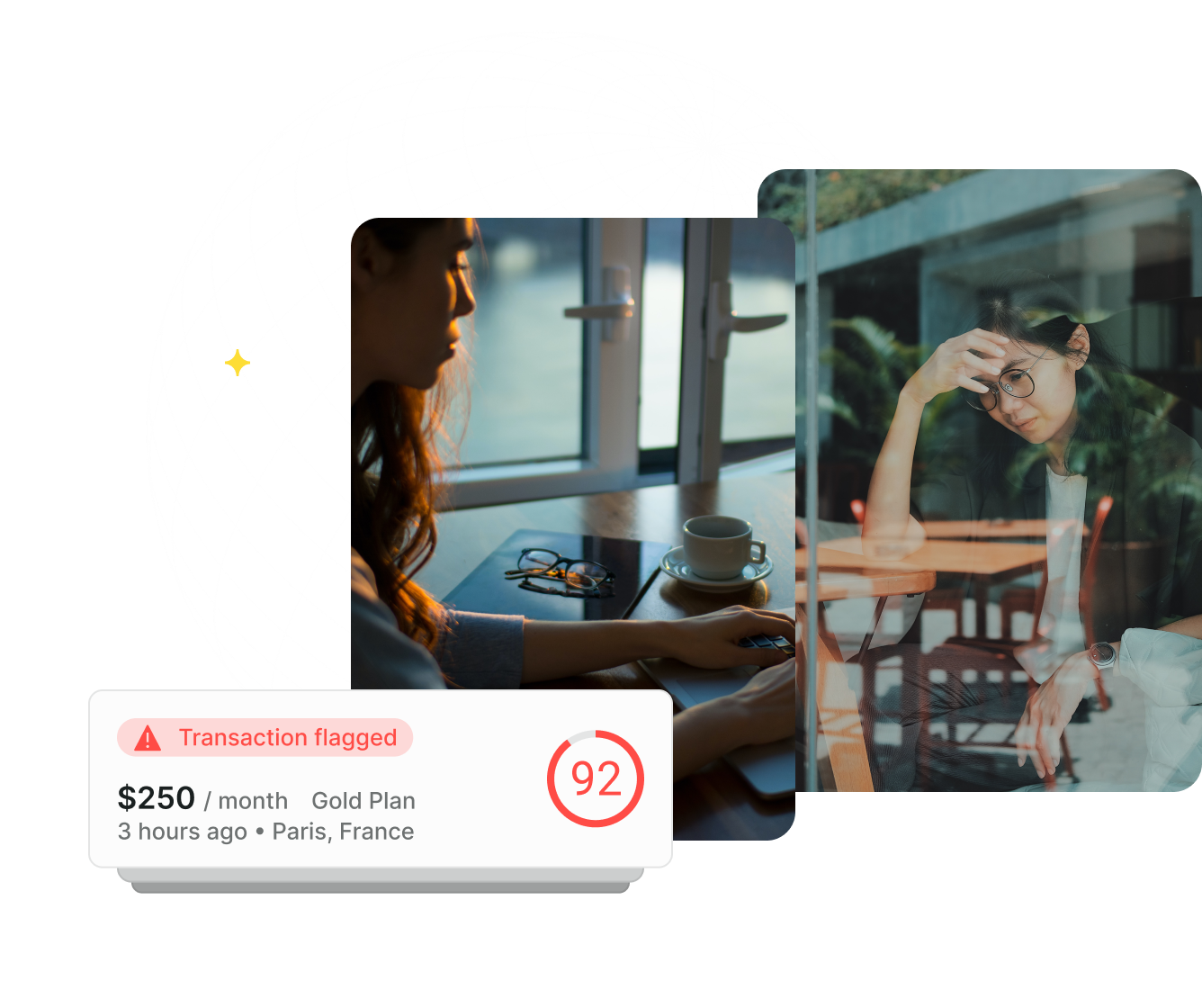

Every payment, fully protected

We analyze multiple variables on every transaction and optimize our system using insights from thousands of software sellers, so you’re always one step ahead.

Fight illegitimate chargebacks

Limiting exposure to illegitemate chargebacks is key to the health of your business. Paddle’s team can help you minimize chargeback risk.

- We fight chargebacks for you, ensuring you don’t lose out to false or fraudulent attempts to claim back revenue

- We offer support and advice to help you avoid chargebacks, guiding and educating you on best practices.

- We help you challenge a chargeback and can provide evidence to the card issuer on your behalf to prove valid transactions.

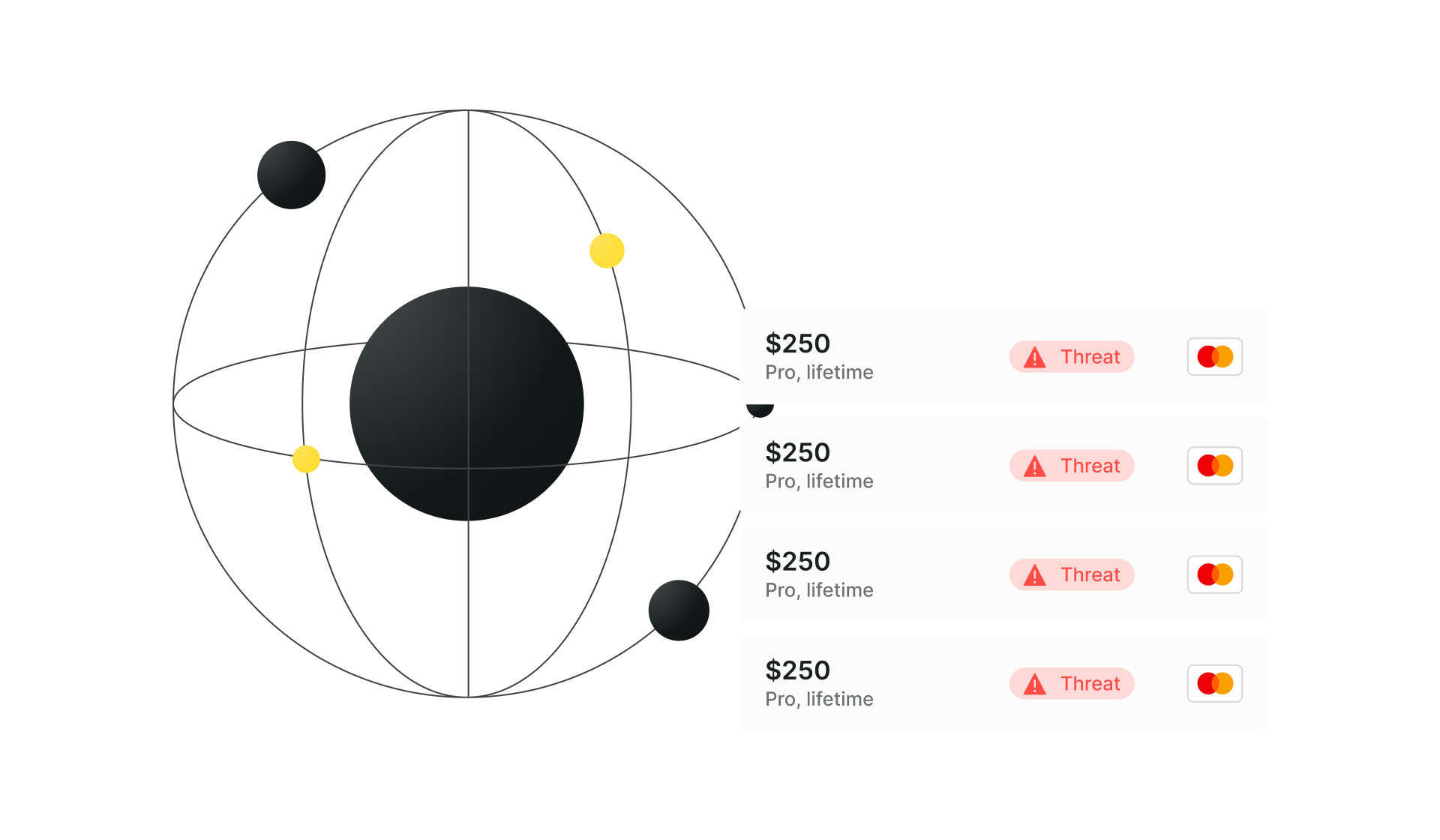

Avoid penalties & keep selling

Payment networks and providers can impose penalties and bans if you receive too many fraudulent payments. With Billing, you’re protected.

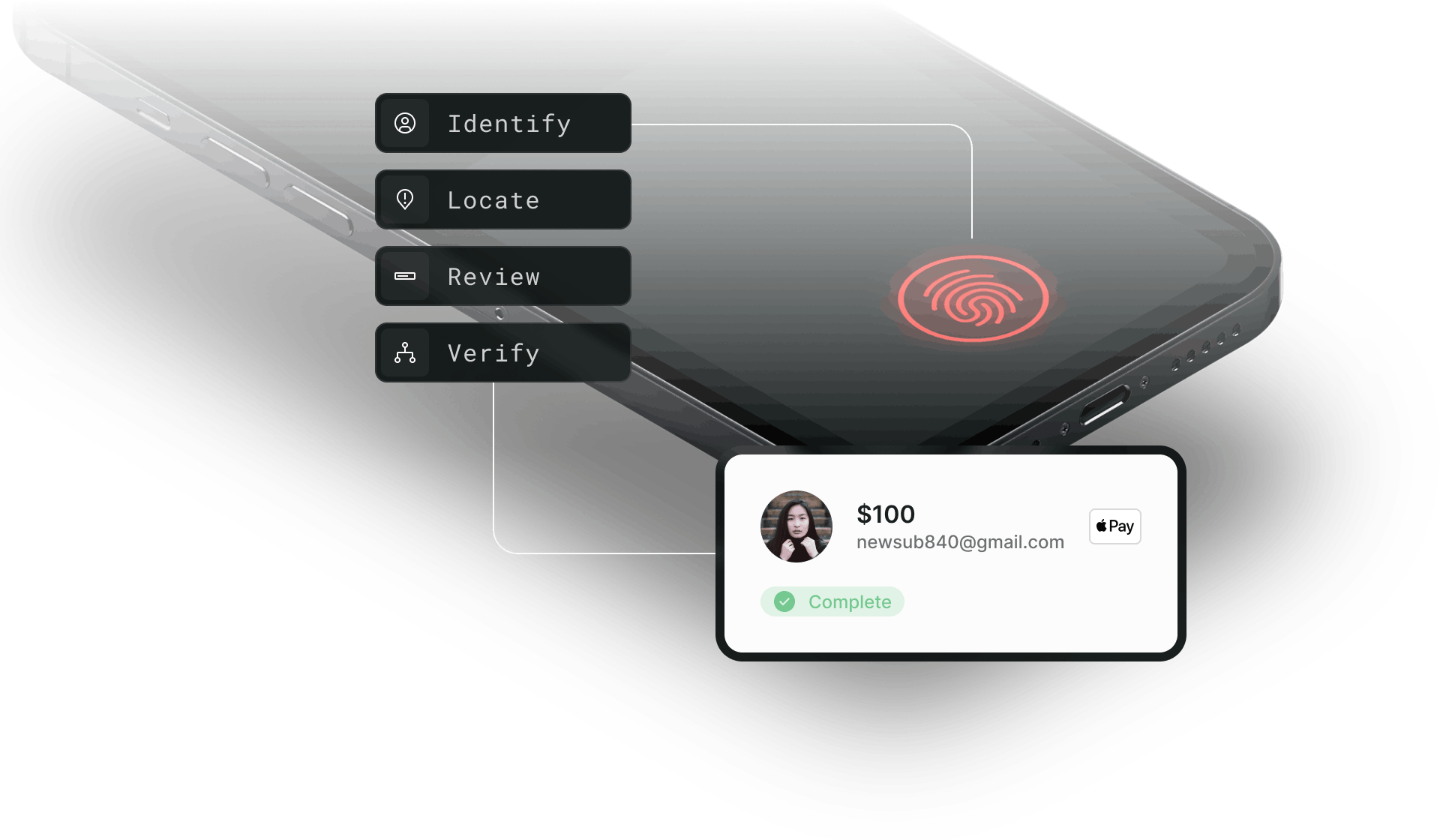

Your personal team of fraud experts

Paddle’s team continually reviews and optimizes the logic of our fraud protection to prevent the blocking of legitimate transactions or ‘false positives’ from reaching your account. We’ve built the team and the tools, so you can focus on selling, allow Paddle to handle your fraud management.

We don’t have to worry about any more issues with card verification attacks or local compliance legislation – even though we are accepting payments in an additional 10 currencies.