Is Hims’ strategy preventative?

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Below are some valuable takeaways you can use for your own business.

- Design drives willingness to pay and retention

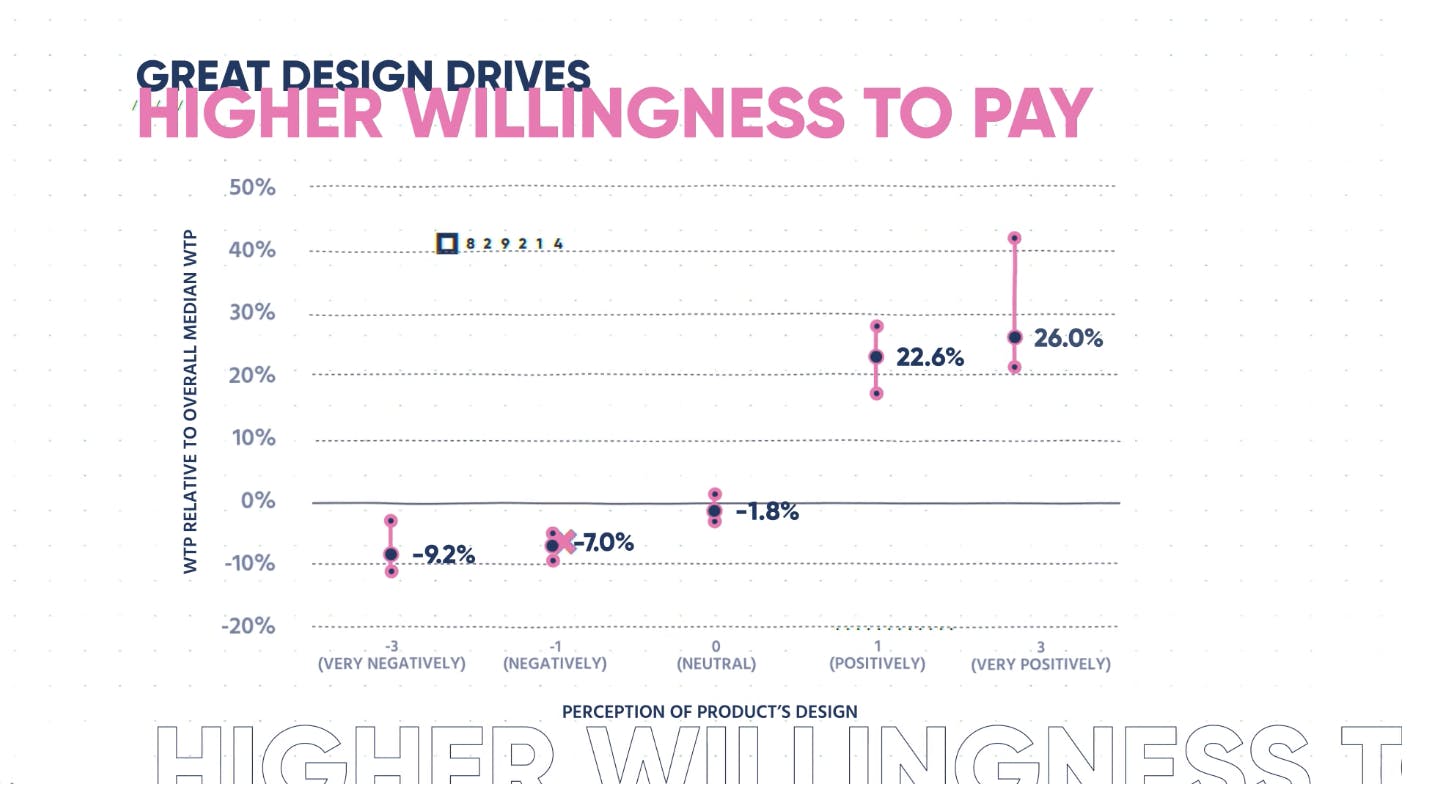

Great design is a value added feature or aspect of the experience. Not only does good design drive willingness to pay, but those with a positive perception of the company’s design also have a better net retention. You should be measuring the perception your customers or prospects have. Positive or very positive impressions have about a 20-30% boost in their willingness to pay. - Mass markets require segmentation

Segment willingness-to-pay data and your customer base to expose different opportunities for growth. Understanding your customer’s willingness to pay ensures that you're not over- or under-pricing. Each band of users will have different values, needs, and budgets. Hims is clearly targeting the younger crowd, which has a much higher willingness to pay than the older group.

Make sure to align your price points with the right people. - Upscaling commodities requires add-ons

Do your research and make sure you understand your consumers’ perception. Focus on the products that break a 20% or higher willingness-to-pay threshold. They'll justify the marketing, development, and acquisition dollars you put into them.

Hims

Did you know that 72% of men would rather do household chores than go see their doctor in person? And if they do make it to an appointment, they’re also more likely to withhold information. So it’s not hard to understand why men currently live about 5 years less than women.

So, why does self care pose to be so difficult for men? Interestingly enough, there are still a lot of cultural taboos, even societal shaming, that exist. And though we’ve made strides toward making self care in male culture normal, we’re still not quite there. Most men are still uncomfortable and embarrassed to talk about common personal care topics. However, men actually want to learn about treatment options, or even simply to gain knowledge on the topics.

And it was this quandary that motivated Andrew Dudum to found Hims in 2017, a telemedicine company that offers a modern-day approach to health and wellness for men. Dudum wanted to create a way for men to receive actual solutions for common matters without the embarrassment, by way of telemedicine—eliminating the middle-man.

Hims is opening up conversations and has created an open and empowered male culture that results in “more proactivity around health and preventative self-care.” This has resonated for men everywhere, as Hims was expected to reach $250 million in recurring revenue by the end of 2020. This projection was made excluding the COVID-19 pandemic, which Hims was very well positioned for.

Him's success

Hims’ explosive growth can be attributed to two factors:

First, Hims has built a massive cult following. A safe place where men can go to comfortably and openly discuss their personal wellness, which includes anti-aging, sexual wellness, hair loss, etc.—more than just how many reps they did at the gym. And by offering remote appointments, Hims completely eliminated the friction by removing the need for a doctor’s office visit, and other related inconveniences.

Hims’ brilliant combination of their marketing and branding with humor is another factor that quickly enraptured men everywhere. Hims redesigned the look of men’s products and packaging, and created a beautiful experience any man would be, as Dudum expressed, “proud to display on their bathroom counter.” The brand’s provocative humor has also caused quite a stir, in a positive way. Hims’ humorous messaging helps break the ice on topics men are self conscious about, and in turn, has created awareness and normalcy around those stigmatized topics.

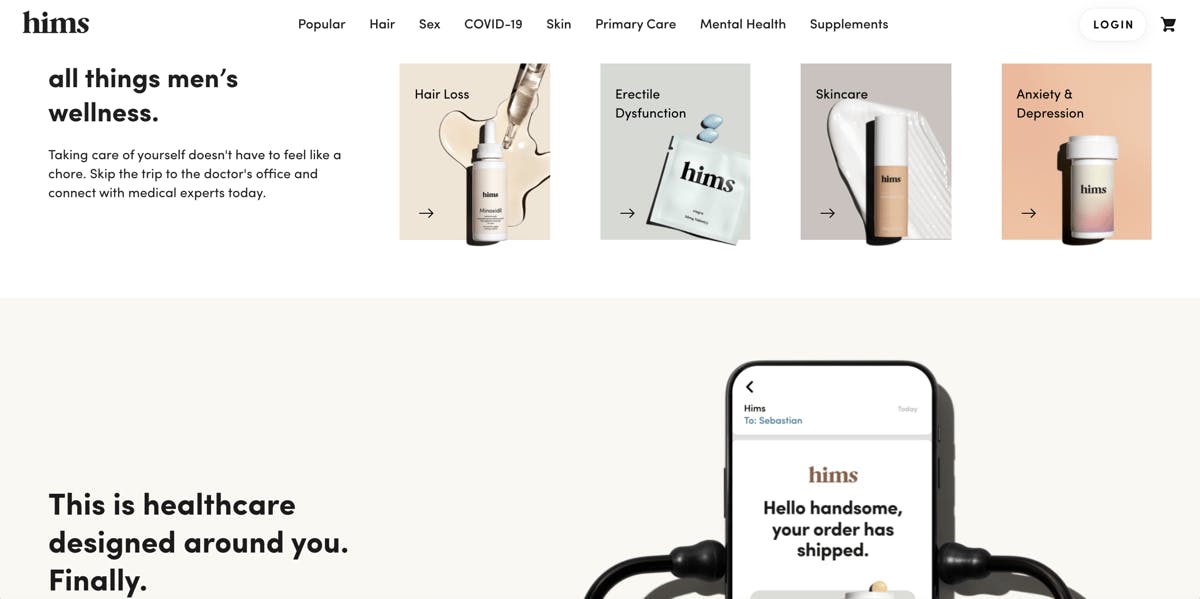

Hims currently addresses five different health care areas for men:

Hair loss, Sexual health, including erectile dysfunction and premature ejaculation, skin care, general health and well-being, and offers an at-home COVID-19 saliva test.

All of which can be attended to, diagnosed, prescribed, and paid for through the Hims app or website. The entire experience is online. And Hims’ doctors are all licensed to practice medicine in the U.S. and are Board-certified across many medical specialties.

With thousands of positive reviews, before and after pictures, and multi-millions in recurring revenue, it doesn’t look like they’re slowing down. In October of 2018, Hims added a women’s line named HERS. And in late March of 2020, the brand launched both lines at Target.

The Hims difference

Hims fascinates me for a number of reasons. From a business perspective, they have taken essential generic drugs and treatments that are normally talked about in secret. They've put beautiful branding around things like sexual health and loss of hair, and helped men get into the world of taking care of themselves. It helps people feel like they're not alone in their balding or other struggles.

Even topics like ED and premature ejaculation, which are extremely sensitive topics, have been made kind of mainstream. Historically, because men don't have certain things that absolutely need to be checked on a regular basis, we have a hard time getting into a cadence of self-care. Then, when we do need help, we're especially embarrassed about it and don't do anything. Hims has taken some of these hot button issues, brought them into the fold, and normalized them a bit. It empowers men to have these conversations with an actual doctor.

Now they're starting to not only put together things for mental health, but also other products and features like telemedicine for men. It's brilliant because all of a sudden men can think, "It's really easy for me to go to the doctor. I can get help and take care of myself."

Let's take a look at their pricing page.

Hims does really well by pushing you into a packaging flow right from the top of the page. You don't often see this in brands operating in DTC, B2B, or anywhere. Rather than having a traditional hero, you're essentially seeing, "These are all the big things we have!" There's probably even more here, but these are the top things people may start with. Things like hair loss, erectile dysfunction, skincare, and stage fright. It's all things, men's wellness, which is great.

As you're scrolling, that's when you actually get into the hero. When you're a brand that has multiple products and entry points, these features help have people bifurcate themselves into where they should be going. If they think, "These four things aren't really for me," they can keep scrolling and be captured in a new place. As you move deeper on the page, there are sections for hair, sex, skin, well-being, et cetera. It's really powerful.

A takeaway for your business here is that if you have a fairly fragmented market—or a target market with fragmented needs—it's okay to create a choose-your-own-adventure of sorts.

It's time for the data.

Where does our data come from?

Here at ProfitWell, our Price Intelligently software combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers, having the ability to collect data from everyone, from a soccer mom or dad in the middle of Kansas, all the way to a fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value, which features and which segments are willing to pay more, all in the spirit of determining how a company can use monetization for growth.

Design drives willingness to pay and retention

Design is huge. It drives willingness to pay and retention more than we think. You'd think that you just need a good brand and good design, because that's what high-quality companies love to focus on. These aspects are definitely important, as well, but there's an actual dollar amount associated with strong design elements.

When we look at Hims, you can tell that they recognize this value. There's little puns within the designs they use. There are metaphors for problems that they're solving. Ultimately, you have to realize that people who associate you with good design are typically willing to pay more. This is essential for when you're dealing with commoditized products that you could theoretically get for much cheaper in the generic prescription space. Hims needs to boost the overall value of their holistic approach, where they say, "Hey, we can help you with a lot of different things."

This is general data from a bunch of different brands, not just Hims. What we ended up doing is measuring people's affinity for designs of the products that we were recording willingness-to-pay data on. We had them rate their perception, with options like positive, negative, very negative, etc. What you'll notice here is that folks who have positive or very positive perceptions of the site, or product designs, have about a 20%-30% boost in their willingness to pay. Those who had a very negative, or negative perception, had about a 10% lower willingness to pay, which really isn't that much.

The takeaway here is that design is one of those things that won't tank consumers' willingness to pay if it's bad, but it can certainly help you if it's good. We're in the middle of a DTC revolution, where so many companies exist in traditionally boring spaces and have elevated themselves through exceptional design. Think Casper Mattresses and, of course, Hims—you take something that's totally clinical and make it look cool, hip, and super easy to use.

Hims also has very effective ad campaigns. One of their chief competitors, Roman, is known for their well-designed marketing, too. Their design focuses more on the doctor side of things, where Hims accentuates the outcome a bit better. Again, this is why perception is so important. Although, whether design is good or bad is fairly subjective, it's crucial to understand how consumers feel when they view your offerings.

Mass markets require micro-segmentation to ensure you're not over- or under-pricing

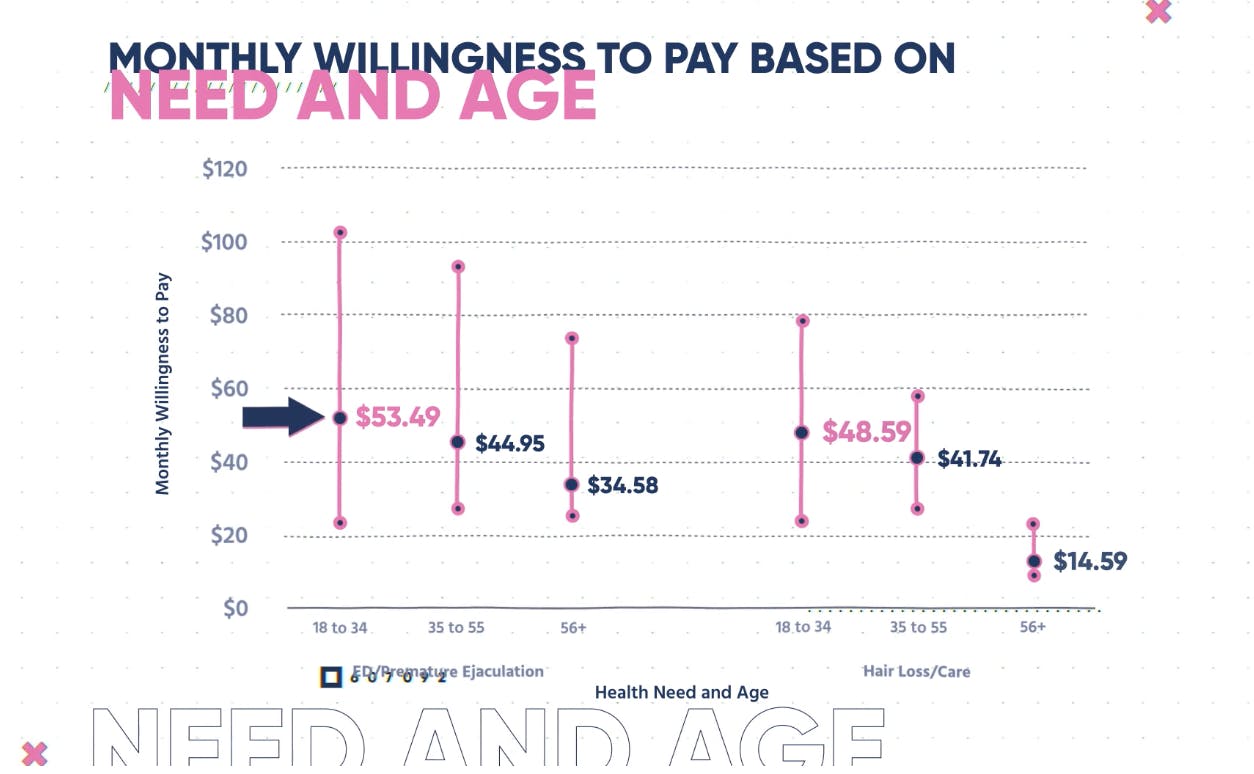

Next up: mass markets require micro-segmentation to ensure you're not over- or under-pricing. Hims is a multi-product offering, but it's important to dig into different segmentations within each of those products to understand the willingness to pay of each group. You can see here that causes like ED and premature ejaculation prompt a much higher willingness to pay among young people. You see the exact same trend with hair loss and hair care.

When you think about it, this makes sense. Older people who have already lost their hair don't really care to grow it back. My dad, at 60, is very bald and does not care. So when you think about Hims' target customer, they're targeting someone like me or even younger. They have to raise their prices to align with that willingness to pay from the younger group. The same goes for products addressing your sex life. It's obviously important all the time, but dysfunction is especially distressing when you're younger. You're willing to pay more to get out of that situation, but what Hims is currently charging does not reflect that higher price point.

The issue is, they seem to be charging based on pharmacy-type rates. I think that Hims should increase those prices and make sure that they're targeting their very specific, key publics, as opposed to averaging out their pricing for everyone else. For context, we're basing these conclusions on actual data we collected from current customers, as well as prospective customers of Hims who are in need of a particular solution.

Upscaling commodities requires add-ons

Finally, upscaling commodities requires add-ons and more add-ons. When you talk about the men's health market, the number of products that Hims could offer is pretty infinite. The options for packages are pretty infinite—skincare and mental health bundles, hair care and supplements... the list goes on. When you start to get into a large market, especially with commodities, you have to call your shots appropriately. That means understanding what appeals to different groups of people.

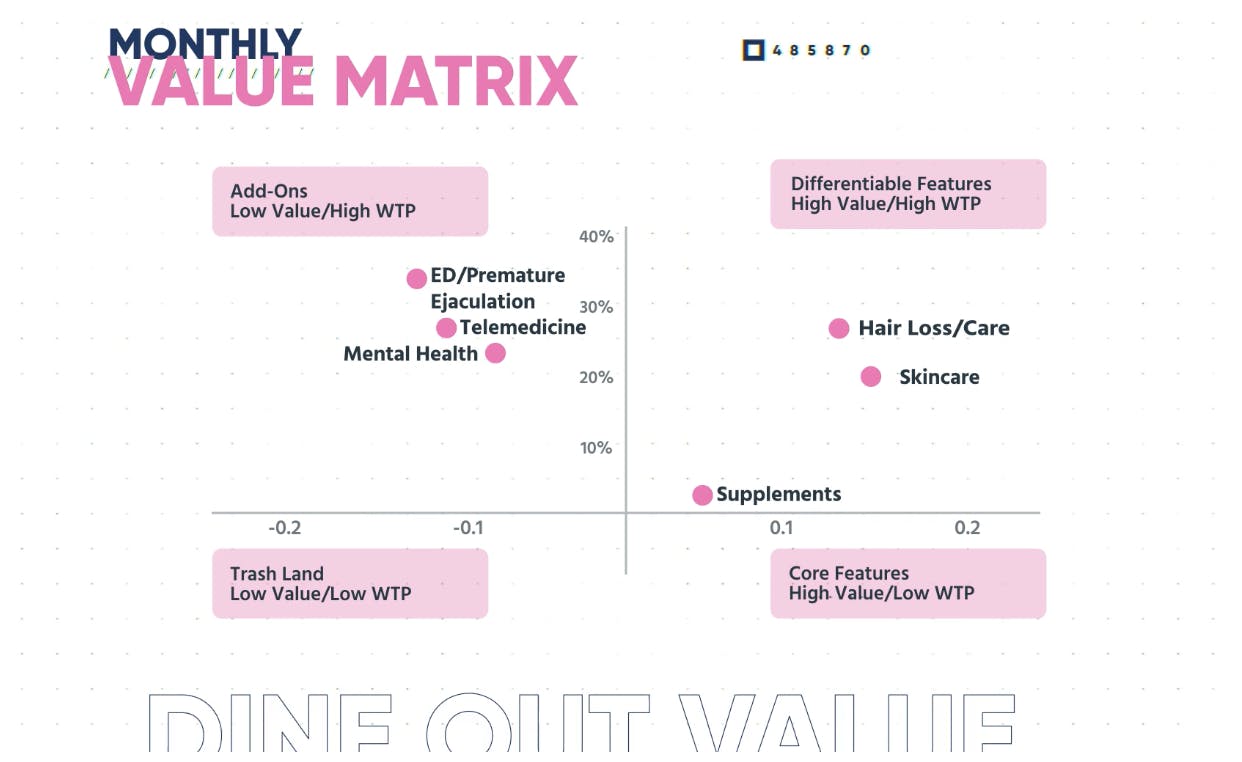

What are those things that are going to make the most sense to go all-in on? We collected data on what's called a value matrix. This is where we collect relative preference data on certain segments (in this case, current and prospective customers of Hims). We're looking at, how much do you care about feature A versus feature B, C, D, and E. We score what the most preferred and least preferred features are, and see how those with strong opinions' willingness to pay is affected.

Value Matrix

You're about to see something called a value matrix. Here, we collected data from the group comparing feature preferences and plotted those on the horizontal axis. More valued features on the right, less valued on the left. We then collected willingness to pay for the overall product and plotted that based on their number one feature preference on the Y axis. Analyzing data in this manner, allows us to determine which features are differentiable. Ad-ons, core, or commoditized for each segment.

What you'll notice here, which is pretty fascinating, is that the horizontal x-axis isn't as interesting as the y-axis. Hair care, skincare... these are things that are very mass market. Every guy out there cares on some level about their hair and their skin. Then things like ED, mental health, telemedicine, and supplements are a bit more niche.

Again, though, it doesn't really matter with those things. Every single one of these features gets out of the 20% barrier, meaning that they could make for a good add-on. I think Hims, in this particular case, is really picking their shots almost perfectly well. Now, their next wave of products could use a bit more research. It gets harder and harder as you get out of the more obvious offerings, but I think they're off to an amazing start.

What does all of this mean for your brand? It's really hard to build a business without being multi-product. You can build a nice lifestyle business, but if you're trying to build a hundred-million or billion-dollar company, you have to go multi-product early and often. You just need to take the time to determine what products are worth your time and desired by your targeted base.

- Design drives willingness to pay and retention. Design is important for your business. You probably already knew this on a surface level, but you should be measuring the perception that your customers or prospects have. Positive or very positive impressions are your moneymakers.

- Mass markets require micro-segmentation. This ensures that you're not over- or under-pricing. We talked about this a lot with these guys. They're clearly targeting the younger crowd, which has a much higher willingness to pay than the older group. Align your price points with the right people.

- Upscaling commodities requires add-ons. Do your research and make sure you're looking into exactly what's going on with consumer perception. Fight for the products that break a 20% or higher willingness to pay threshold. They'll justify the marketing, development, and acquisition dollars you'll pour into them.

Who's up next?

Next week, we have a product that, at the very least, appeals to me from a design perspective. I'm a sucker for black and green designs, as you can probably see from our website. We're talking about a brand that has taken a great market and paired it with incredible spokespeople. This brand is called the Art of Sport—you won't want to miss this.