Soylent's pricing strategy needs some nourishment

This episode might reference ProfitWell and ProfitWell Recur, which following the acquisition by Paddle is now Paddle Studios. Some information may be out of date.

Please message us at studios@paddle.com if you have any questions or comments!

Below are some valuable takeaways you can use for your own business.

- Understand how positioning changes the value of your product.

Tailor your positioning to your value proposition. Remember the right value proposition directly influences willingness to pay. Make sure you make the most of your data and understand what your customers value to properly align your positioning, packaging, and pricing for a smooth conversion. Mindset matters when priming your customers to make a purchasing decision. - Understand how usage changes willingness to pay.

We found that as usage increases, willingness to pay increases. Soylent is failing to take advantage of this. They should be reaching out to their longtime customers to offer different products. In half a year, these people have likely changed their habits and fully bought in, so it's time to hook them on more products. Over time, it'll be a natural upgrade process to increase those average order values and ultimately increase the lifetime value of a consumer. - Localization is key in a wide market with consumer products.

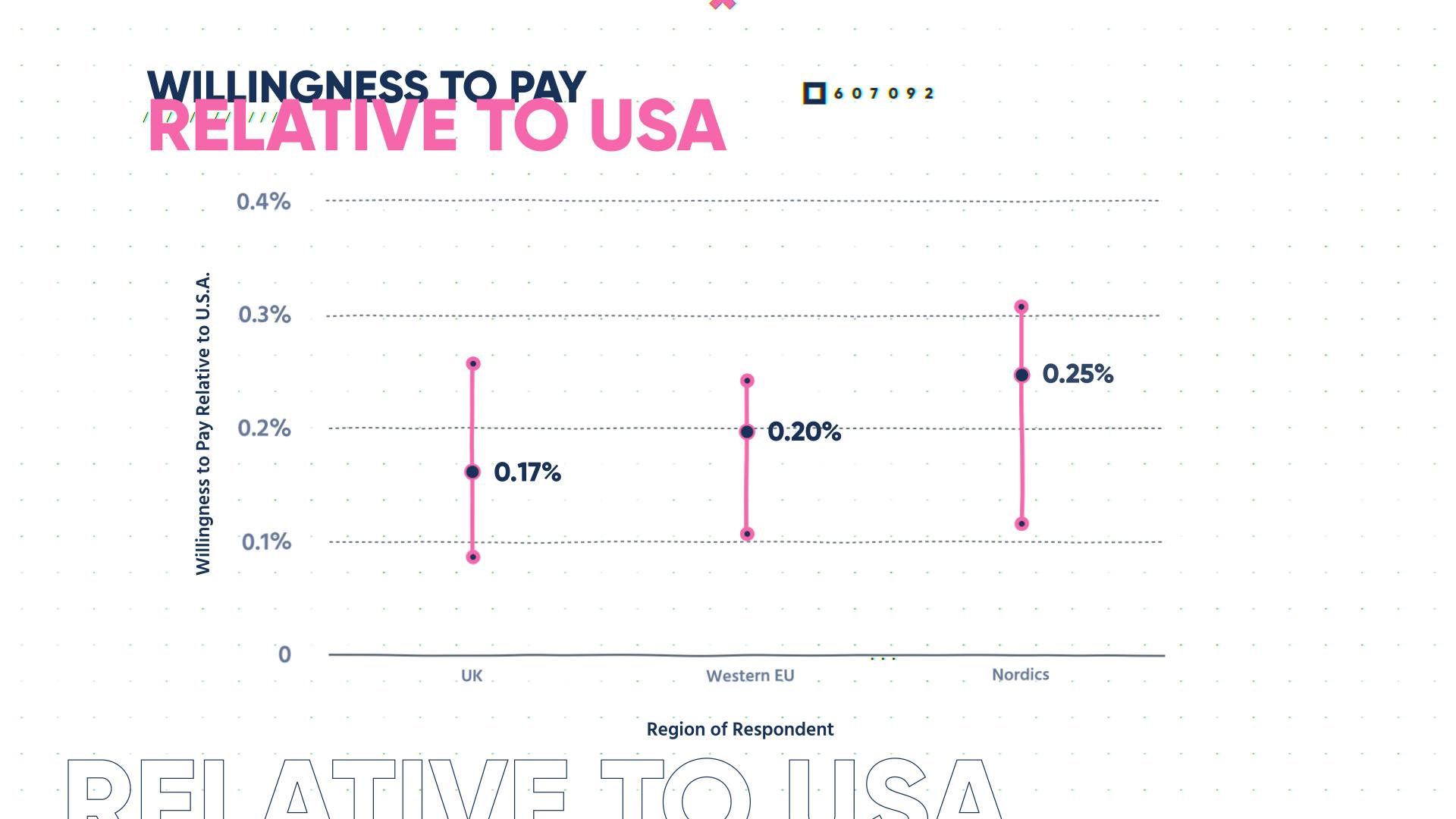

In a wide market of consumer products, you need a strong localization strategy. The data shows us consistently that the willingness to pay in the UK or Western Europe is 15 to 20% higher than in the U.S. And that's taking VAT (value added tax) and exchange rates into account. If you're operating at a high level, you need to develop an international presence that is tailored to the different consumer behaviors in the region.

Soylent

Why eat your meal when you can drink it? The meal replacement drink is one of the fastest-growing trends today. We’ve come a long way since the days when meal replacements drinks were primarily weight-loss supplements. And as consumers continue to adopt increasingly busy lifestyles, the meal replacement market has become a multi-billion dollar industry and is expected to see continued significant growth. But today, it’s about something bigger—complete nutrition shouldn’t be difficult or expensive.

This basic idea of easy and inexpensive nutrition, is what started Soylent in 2013, a brand of meal-replacement products. Founder Rob Rhinehart, and co-founders Matt Cauble, John Coogan, and David Renteln, understood the difficulties of eating healthy on the go and on a budget. As software engineers living in Silicon Valley, they started thinking not only about how to feed themselves, but also about feeding the growing population. Making “complete, sustainable nutrition accessible, appealing, and affordable to all,” became their core mission.

Soylent's success

Soylent’s growth can be attributed to two main factors:

First, Soylent understands that their most valuable asset is their highly engaged consumer base. They’ve been able to develop that consumer loyalty through their commitment to integrity-based products.

And the second component: Attaching itself to a meaningful cause. Soylent bills itself as a “purpose-driven company,” with its efforts to end hunger and food insecurity by donating to food banks and food rescue organizations.

So is it any good? Endless reviews attest to Soylent’s flavorful and nutritional value. Scientists carefully select each ingredient that goes into each of their products. Soy Protein Isolate is the core ingredient which is the most complete plant-based source of protein and contains all of the essential amino acids that are necessary for healthy, growing, and functioning bodies. Soylent consists of 39 essential nutrients, high in healthy fats, vegan and animal-free, lactose-free, and does not contain nuts. As a plant-based protein, Soylent says it produces less carbon dioxide than livestock and reduces waste because of its year-long shelf life. They also update the cardboard cases for all their Ready-to-Drink products to reduce their environmental footprint.

Soylent also offers a variety of flavors and consumption options—drinks, powders, and bars—so you’re ready whatever the situation.

Today, Soylent, valued now in the billions, is holding strong and continues perfecting their formula. And with the rapid and successful expansion into brick and mortar retail, Soylent’s available at nearly 20,000 retail locations, including Walmart, Target, and 7-eleven.

Soylent’s managed to channel the passion and enthusiasm of their consumer base to drive traffic in-store. And with growing five-star reviews, they’re showing no signs of slowing down.

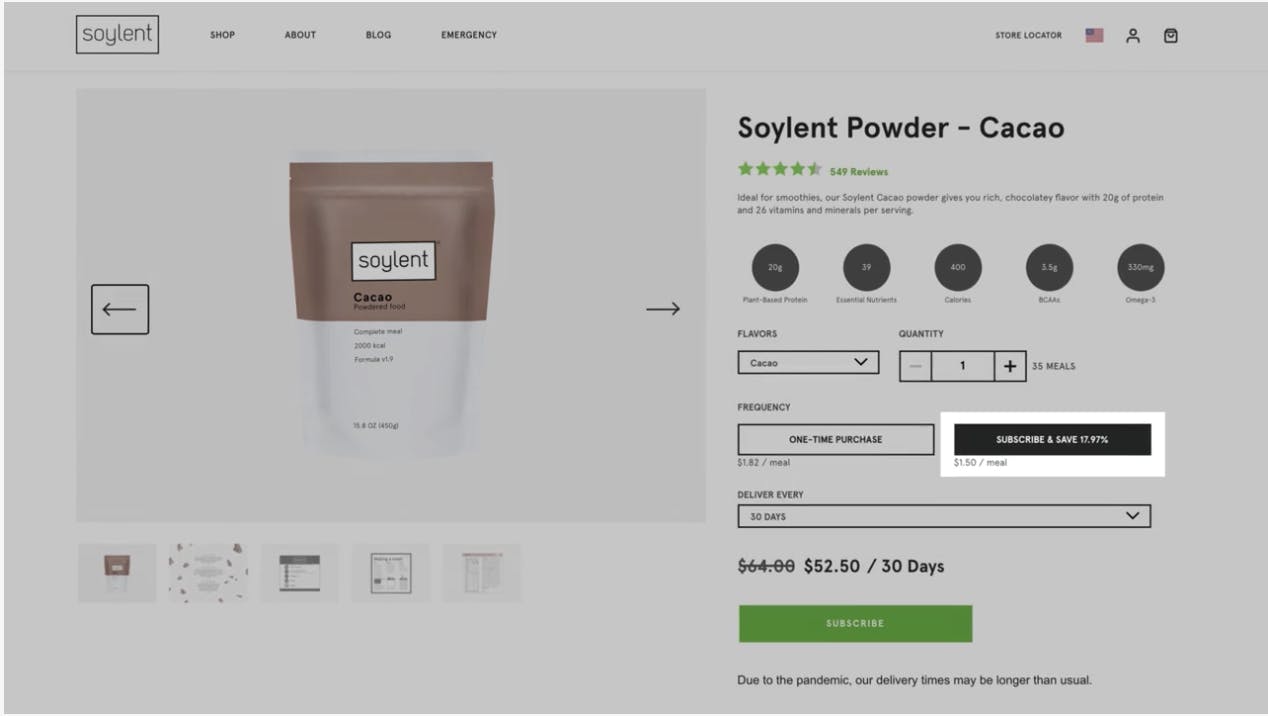

Let's start with the most obvious appeal of Soylent: the beautiful design. Their website complements the design of the bottles, their overall brand, and what seems to be their DNA since the very beginning. Their powders have changed since the first iterations of the product, but the design and marketing have been consistently strong.

Moving past those surface-level elements, I want to call out their pricing. I think they do a phenomenal job contextualizing the savings that come with a Soylent subscription. Take a look at their micro-copy. They don't hide how much it costs to just make a one-time purchase, and build up their prices according to frequency of buying. Suddenly, though, at $64 you have the opportunity to "subscribe and save." They show you the savings you're earning every 15 days with that 18% number.

This is crucial. Large e-commerce companies like Amazon are always quick to showcase unit price, and this is kind of their version. My only suggestion would be to change the percentage to a dollar amount. The data shows us, time and time again, that physical dollar amounts are a lot easier for consumers to contextualize. A dollar amount would also better showcase the increased savings as you commit to more and more months, while the percentile would stay the same.

There are other ways they could incentivize these bigger commitments. If they get me into a pattern of three or four months there's no offer for me to upgrade to a higher level. I would love to see them include some of their gateway products as add-ons. They could say, "Hey, if you sign for six months, we'll send you a sample of our meal bars!" We saw one of their competitors, Huel, use this strategy and it really worked for them. It gets you those upgrades and also might hook a consumer on another one of your offerings.

Another strong point of their pricing page is that it's very value-laden. We'll see this more as we look at the data perspective, but they do a great job of impact-reporting from their Soylent For Good campaign. They highlight that they've donated over three-million meals, and this is something that helps them stand out from the competition. It's a win-win: they're truly making the world a better place and they are also increasing consumers' willingness to pay. It'll even boost retention, as we saw with Who Gives A Crap (the actual company name of a subscription toilet paper).

Let's look at the data.

Where does our data come from?

Here at ProfitWell, our Price Intelligently software combines proprietary algorithms and methodologies with a team of pricing experts who think about this stuff more than anyone else to help companies optimize their monetization strategy. We do this by going out into the market and collecting data from current and prospective customers, having the ability to collect data from everyone, from a soccer mom or dad in the middle of Kansas, all the way to a fortune 500 CIO in South Africa. We then take that data and run it through our algorithms and analyze it in every direction to determine a company's ideal customer profiles, as well as which segments value, which features and which segments are willing to pay more, all in the spirit of determining how a company can use monetization for growth.

Positioning changes the value of your product

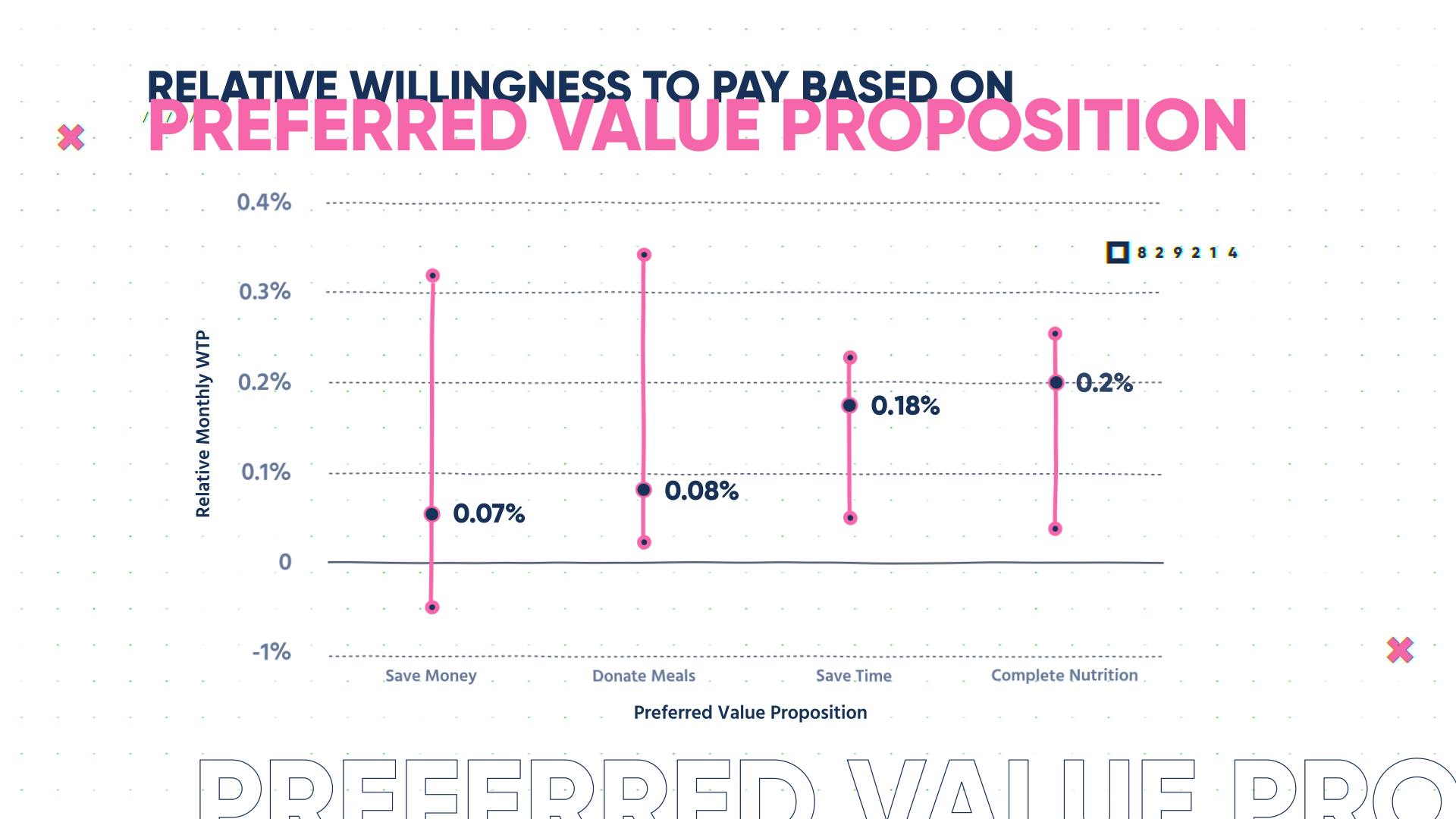

The first step in making the most of this data is understanding how positioning changes the value of your product. We started out by measuring the willingness to pay relative to the median. It allows you to clearly see how different positioning statements influenced willingness to pay.

Factors like "saving money" are kind of table stakes at this point, but there's a really high variance, which is interesting. We saw this with Huel as well. There's a group of people who set $1.50 per meal as their goal. Others might aim for $3 a meal. "Donate meals" solicits a very high willingness to pay for some, but again has a huge variance. The overall median is not spectacular, but the high is really high.

What we see in general is that "saving time" and "complete nutrition" are their strongest value propositions. A lot of the people that are buying this are looking for convenience and a meal replacement. This aligns super well with the fact that Soylent breaks down their pricing into unit price economics based on the number of meals you're getting.

I do think they could do better about emphasizing the fact that they offer complete nutrition, however. Consumers don't understand how hard it is to create a product like this, which has all of these vitamins and nutrients. It's a lot more than just a protein shake, instead offering 20% of your daily nutrition. They highlight that a bit, but it's so, so important. If you drink five of these a day, you're getting your 2,000 calories and all of the different supplements you need. That's powerful.

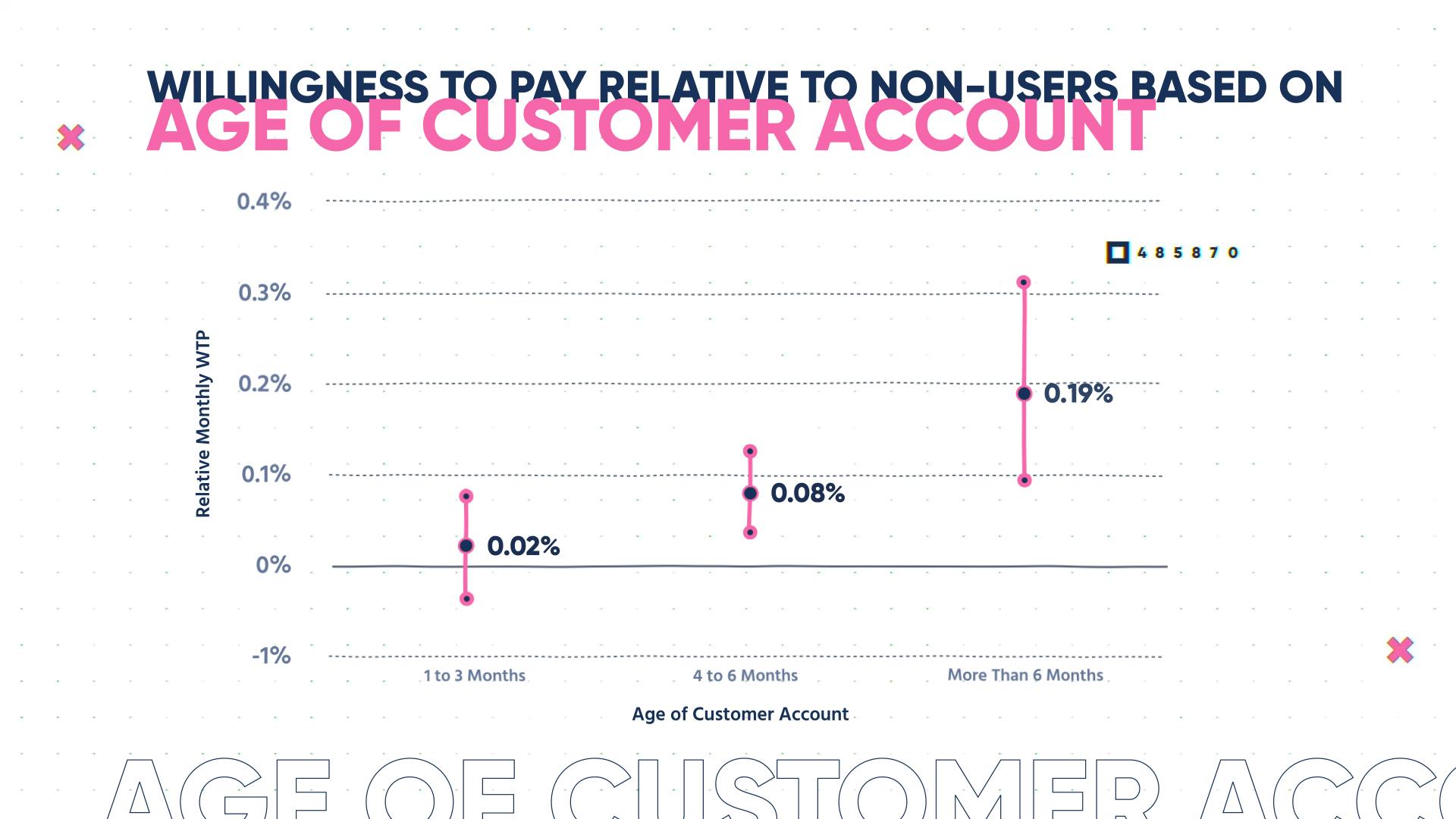

Understand how usage increases willingness to pay and then use this momentum

For this data, we looked at someone who has never used Soylent and measured their willingness to pay. Then we connected with people that have been using it for one to three months, four to six months, and over six months. What you'll notice is that as usage increases, the willingness to pay increases—pretty significantly, too, as you get to the higher level.

To take advantage of this, I think you want to be very intentional about continuing to offer additional products. This is something that Huel has mastered. Soylent has a number of different products, but we didn't see it as much in the checkout or the upgrade flow. They should be reaching out to those longtime customers and saying, "Hey, here's a free sample!" Get those folks on board with bars, protein power, and just keep ramping things up.

I know that "taking advantage" doesn't sound like a very friendly thing to do. However, you and your company need to maximize your brand equity. You worked hard to earn this customer and they obviously like you! They would likely enjoy buying more, you just need to be putting the right things in front of them. Over time, it'll be a natural upgrade process to increase those average order values and ultimately increase the lifetime value of a consumer.

Localization is key in a wide market with consumer products

The final thing that we can learn from Soylent is the importance of localization. In such a wide market with consumer products, you need to have a strong localization strategy. We've seen this over and over and over in DTC. Right now, it looks like Soylent is going through Amazon. I don't even know if they fulfill orders to a site. They've obviously had success, but once you reach $5-10 million in annual revenue, it's crucial that you're localizing in different markets. The data shows us consistently that the willingness to pay in the UK or Western Europe is 15 to 20% higher than in the U.S. That's taking VAT and exchange rates into account. The Nordics are even more generous—ready to pay 25 to 30% more.

Long story short, it's vital that Soylent considers a localization strategy. It's a huge thing for most brands and, yeah, it can be a big pain. Shipping's hard, logistics are complicated, and there are plenty of other great excuses to not do it. Still, it'll be hard to build a really fast, sustainable company if you're ignoring the habits of these massive markets.

Pricing Recap

- Understand how positioning changes the value of your product. We've seen a few different value propositions from Soylent that really resonate. There's some crazy variants on a couple of them, but we determined that "saving time" and "complete meal" is something they should be drilling into.

Take advantage of these positioning keywords. Use your research to inform what goes into your H1 headings, the email copy you should send to people who abandon their carts, et cetera. Know what draws them. - Understand how usage changes willingness to pay. Use this momentum. Soylent is failing to take advantage of the folks who have been with them for about six months. In half a year, these people have changed their habits and fully bought in, so it's time to hook them on more products.

- Localization is key in a wide market with consumer products. I could've missed some of Soylent's efforts in this area, so I don't want to make any harsh conclusions on them. But for your business, if you're operating at a high level, you need to develop an international presence that is tailored to the different consumer behaviors in the region.

Who's up next?

Next week we have a brand that I'm super, super pumped about. It's a brand that has figured out how to combine sports and deodorant. It's the Art of Sport, and they're going to teach us some really great lessons on using spokespeople. They also will show how you can leverage many different parts of your brand to boost willingness to pay and ultimately boost that overall lifetime value. There are some things that they need to get better at, however.