In 2023, growth has been harder and slower across the board. In this post, we’ll dive into key areas you can address today to accelerate your growth, even in this “doom and gloom” environment.

The new north star metrics for SaaS growth focus on driving productivity and “doing more with less”. The proof is in the 2023 SaaS Benchmarks Report released this November by OpenView in partnership with Paddle.

The main takeaway? Growth is harder and slower across the board. For many SaaS companies, fundraising and scaling efforts are on hold, with the main focus placed on extending runway instead.

You can find the key takeaways of the report here.

In this post, we’ll dive into key areas you can address now to accelerate your growth, even in this “doom and gloom” environment.

Driving growth with a lean, productive team

We know from the Benchmarks report that the new north star metric is ARR per FTE (Annual Recurring Revenue per Full Time Employee), which measures the productivity of your team.

Key questions to ask yourself is your team enabled to efficiently drive all business operations, support customers, and focus on product development? If you have a complex stack of software holding your operations together, the answer is probably no.

Back office costs can often be your biggest recurring expense. Keeping these costs low in this environment will be key. Hint: Your billing infrastructure is low-hanging fruit.

Finance, tax, and compliance costs are often overlooked. 27% of surveyed companies in the Benchmarks report either don't know the cost or fail to track it. Instead we see teams building their billing and payments stack by bolting on software as they need it.

The result is a fragmented payments stack that often leads to hidden costs you might not consider:

- Paying multiple software subscriptions

- Tax and compliance fines

- Poor payment acceptance

- Missed payment methods

- Time to monetization

The key problem here: Responding to growth opportunities will be harder, slower or not possible at all if you don't have the operational structure to support it.

Be proactive. Address your billing infrastructure head-on, one way or another. One option would be to consolidate your stack into a single solution that handles all the complexities of selling internationally as well as your payments and billing needs.

Offloading those complexities to a merchant of record (MoR) will accelerate not only your team’s productivity but also your revenue growth.

An MoR makes sense if you're:

- Selling primarily via a product-led motion with a checkout

- Looking to deliver a local purchase experience to your global customers

- Wanting to expand to new regions

- Overwhelmed with the administrative burden of running a payments infrastructure that supports global transactions

- Experience poor payment acceptance and high churn

In this environment, it’s crucial to give your small team the space to focus on what they do best and not the mechanics of how you get paid. That means more time on product-market fit and less time on international sales tax, technology bandwidth or payment infrastructure. This is where an MoR could be crucial to your ARR per FTE, especially for hyper growth startups, operating on a lean team but driving rapidly-scaling revenue numbers.

Successfully monetizing your AI product

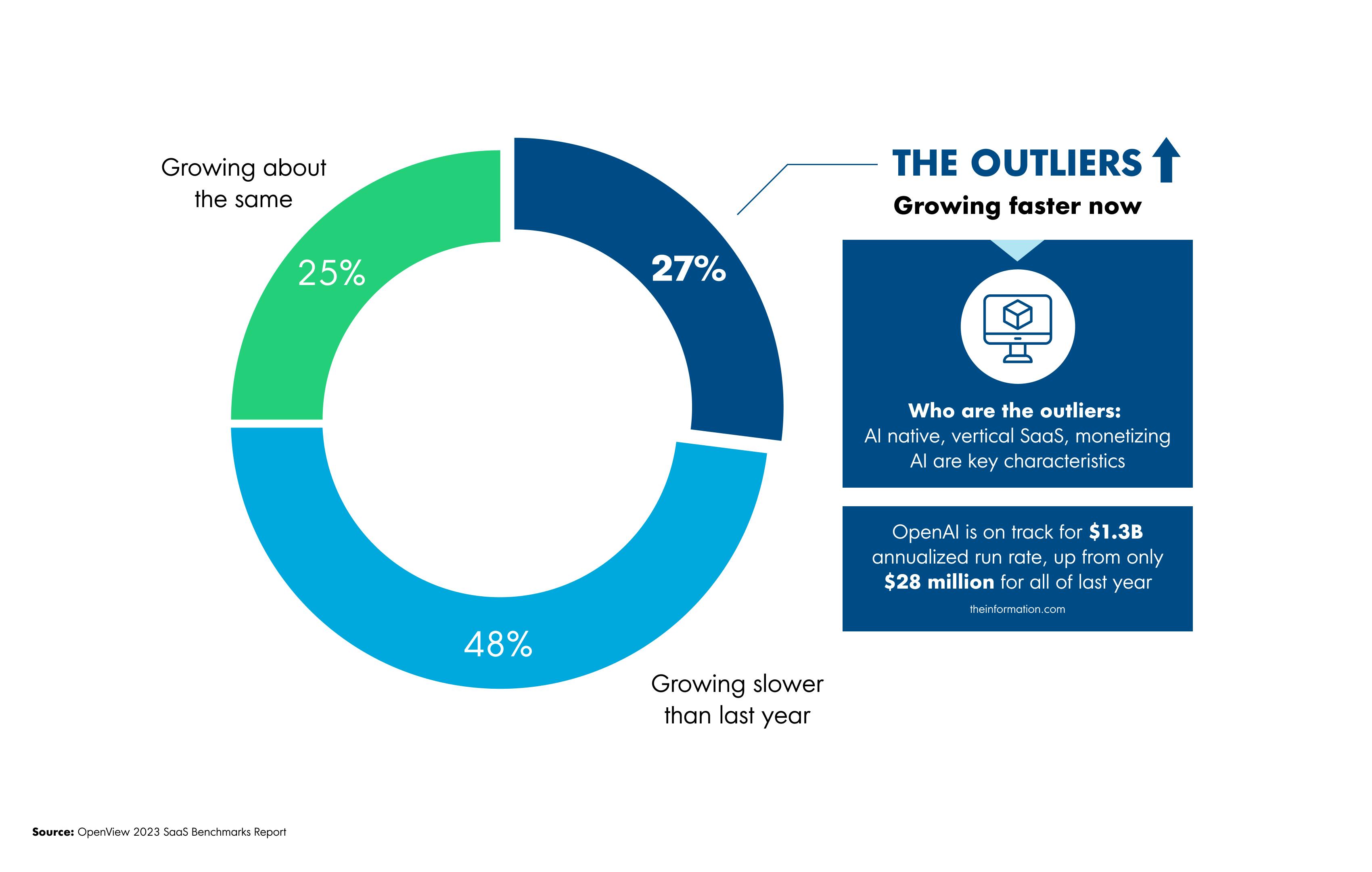

In the Benchmarks report, one of the pockets of resilience we are seeing amid all the bad news is monetized AI. SaaS companies that both launched and monetized AI products were 1.5x more likely to be outliers.

But only 15% of those who had either launched AI features or have AI on their product roadmap in 2023, have actually monetized their product.

That means the other 77% of SaaS businesses have room for growth. That’s if you know how to build a monetization strategy that moves the needle.

Based on data from the Price Intelligently team, companies connecting their product to user value when developing their pricing strategies will always outperform their peers.

For scaling SaaS companies in a growth-stricken environment, value-based pricing is where your real growth opportunity is, without losing margins or throwing more money at marketing. It shows that you are basing a product or service's price on how much the target consumer believes it is worth. It is especially critical for product-led and product-assisted companies.

You find out more about monetizing your AI product here. You’ll get access to data and insights on the pricing and packaging strategies dominating the SaaS industry today.

Doubling down on your existing revenue

We have known for some time that expansion revenue is the name of the game in this low-growth environment. But it’s getting harder to retain customers simply by growing their headcount or blindly increasing their usage. Median gross retention is dropping.

Some ways to address this might be to build a multi-product strategy with cross-sell as a source of revenue or creating add-on features. You should also be really specific about your ideal customer profile and build your entire go-to-market to support it. Doubling down on efforts here and driving improvements across the funnel will be important to build a more efficient product-led expansion program.

Your pricing strategy is going to be key here. Pricing on your value metric with an expansion strategy built in will encourage usage and growth. Using market research that includes data on buyers who are not customers, in addition to your current customers, is the most objective and useful way to determine your value metric.

Top tip: Whether you gather this data yourself or work with an external pricing expert, your market research must have a big enough sample size, account for bias, and have methodical soundness to give you actionable insights.

International expansion through localization

One final growth area to zone in on: localization. Localization is more than a mere trend. It is the key to unlocking international growth.

SaaS companies today, particularly those with product-led revenue, are international by default. Additionally, CAC payback periods have worsened year-on-year, even as companies streamline operations. Attracting international customers in less saturated markets with an efficient localization strategy as one of the ways to address this.

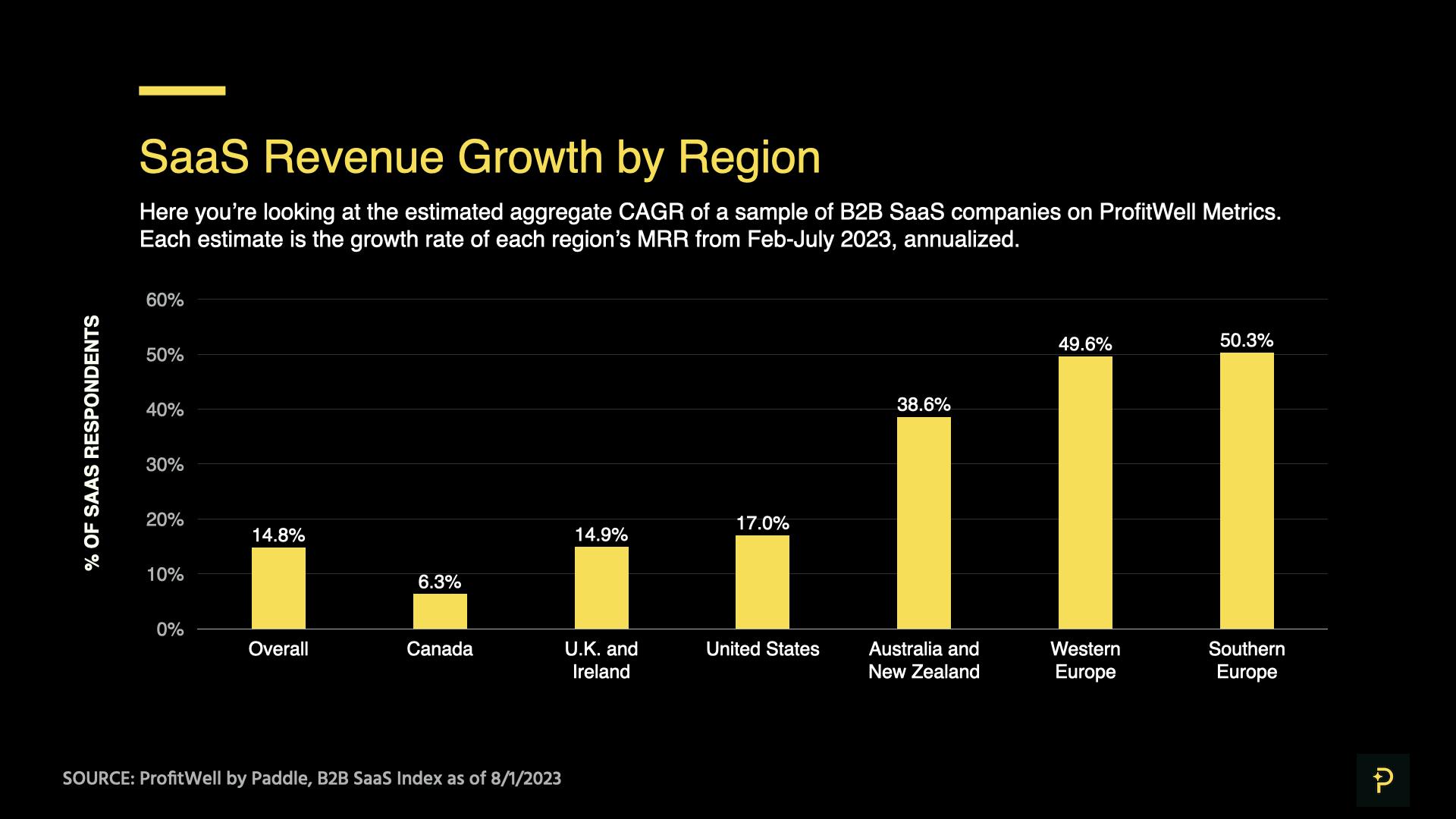

According to the latest SaaS market report from Paddle, most of the slowdown in SaaS growth comes from North America and the UK. Outside of these more concentrated markets, there are small but faster-growing clusters of SaaS companies in Continental Europe, India and even Australia.

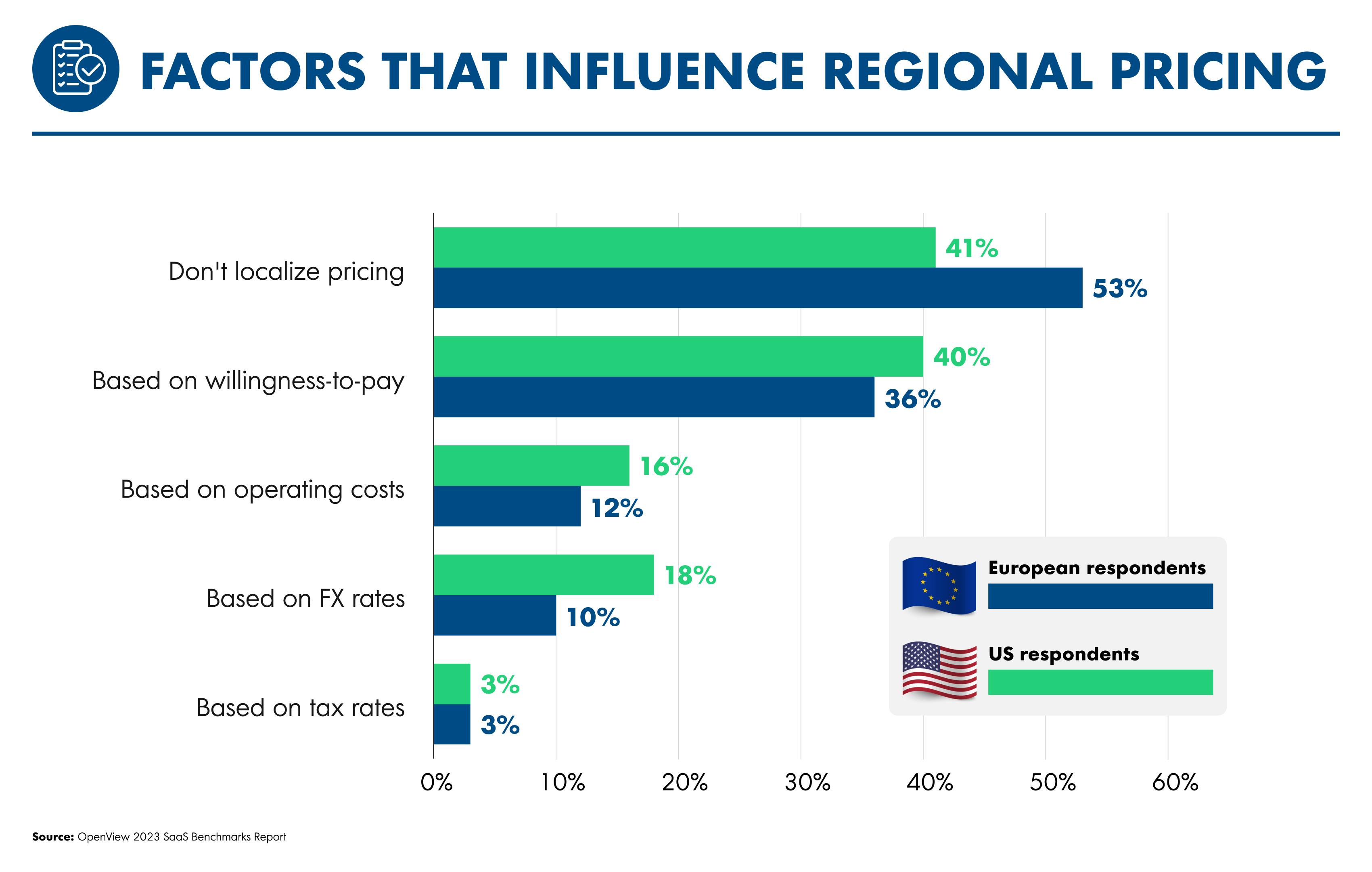

But, as we see in the Benchmarks report, there is a large portion of respondents who don't localize their pricing.

In this slow growth environment, you don't want to be leaking revenue or leaving money on the table. True localization helps you convert free users to paying customers by modifying pricing for customers in each market.

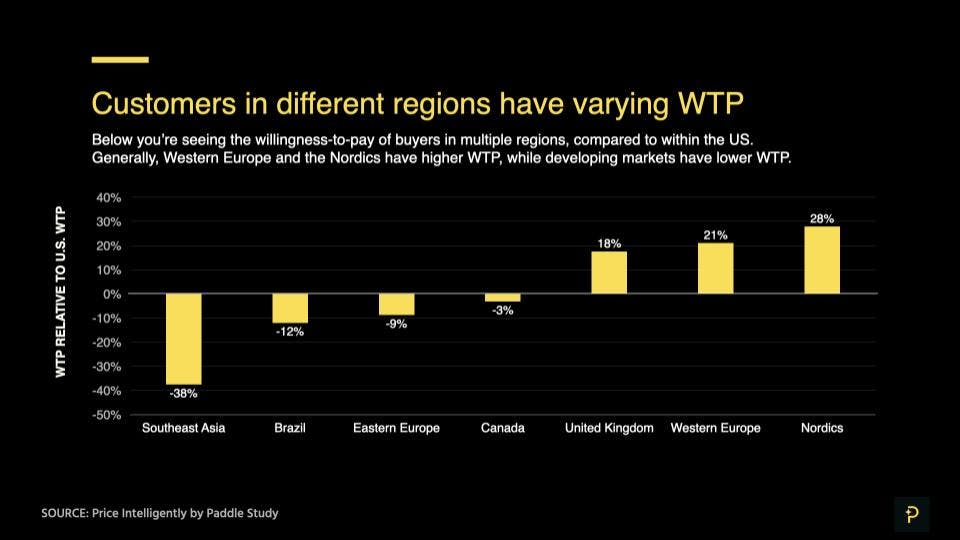

Central to pricing your products at that optimum rate is understanding your target market's willingness-to-pay. Knowing what your customers are willing to pay for your product or service is essential in building an effective and competitive pricing strategy. And as you can see in the chart below, this changes based on where you are.

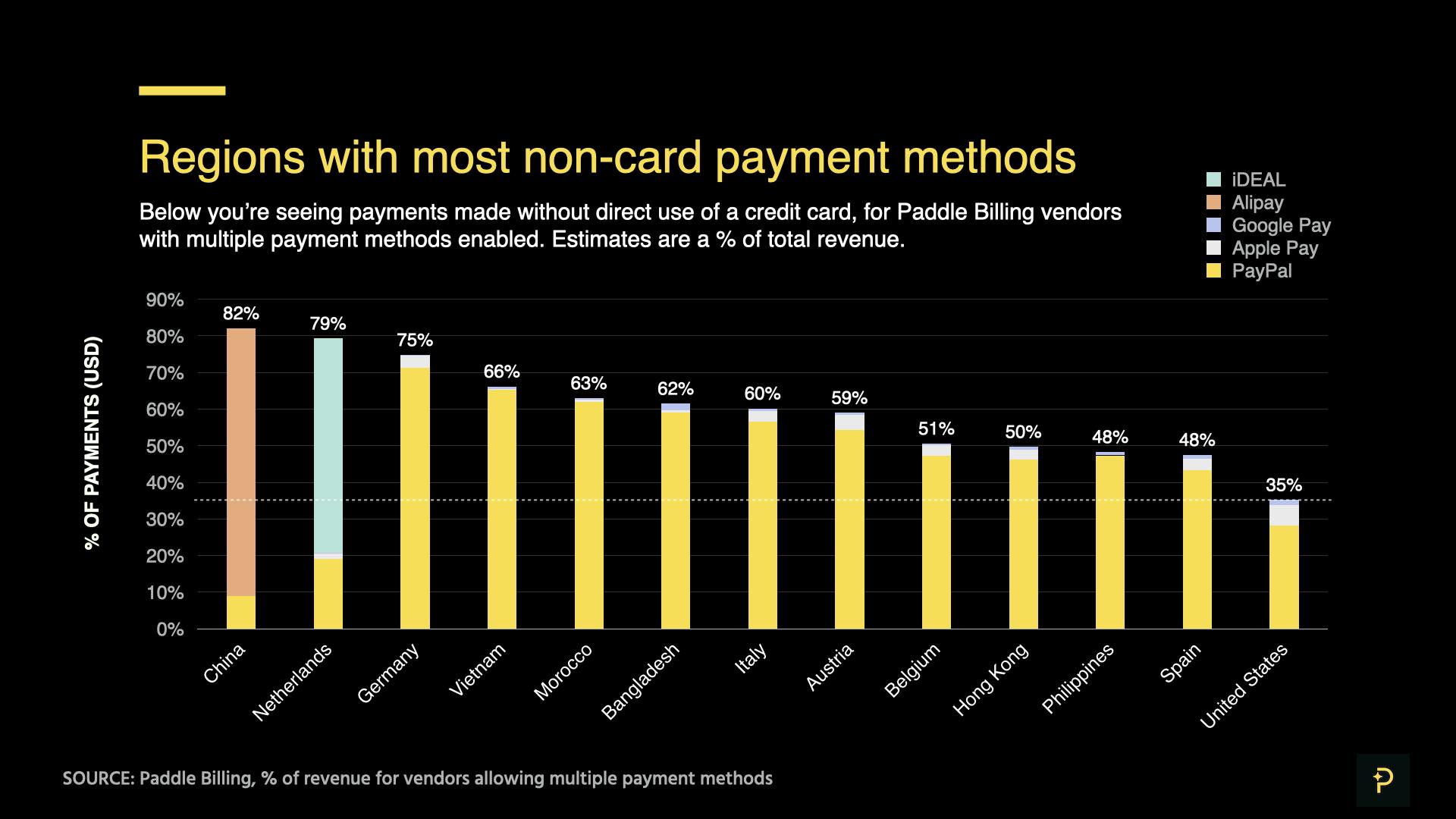

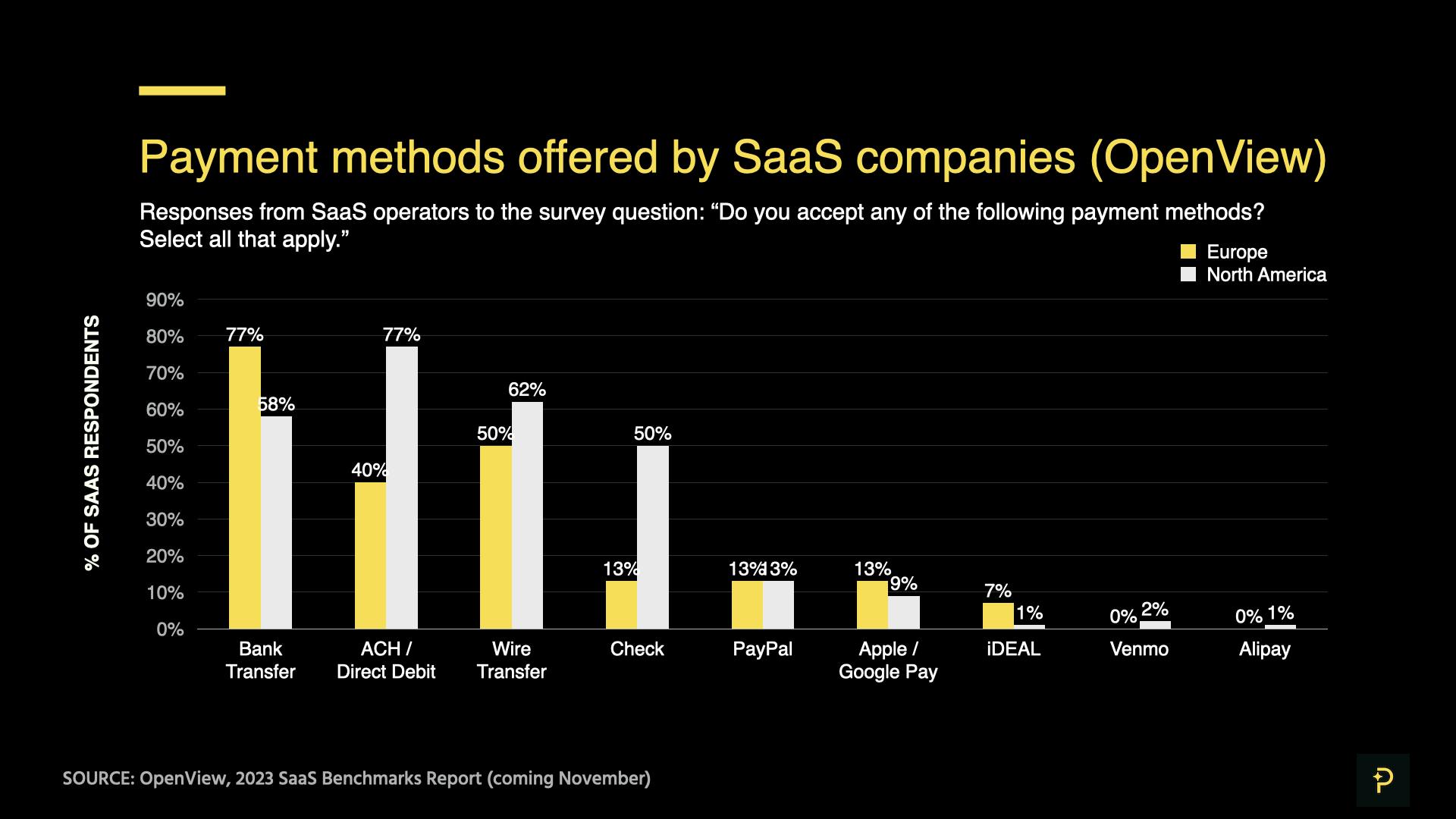

Next, payment methods. Not every region will favor the same local payment methods as you can see in the chart from Paddle below.

If you are only offering direct debit and bank transfers, you are missing out on new revenue. Full stop.

Building a localization strategy for your pricing should be high on your agenda. Having a billing platform that can be easily updated across different regions will enable you to test, land and expand in new territories in a much more efficient and cost effective way.

Still looking for more areas of growth to focus on? Catch up with OpenView’s Kyle Poyar, and Paddle’s Andrew Davies on this on-demand webinar. They delve into more of the survey data and discuss the most interesting findings, providing practical insights for SaaS leaders.