Subscription consumer software drops back into decline following promising growth.

B2B SaaS sees muted revenue growth with a further slowdown expected by the end of Q4.

This is the latest in our ongoing SaaS market reports, which track the movement of the ProfitWell B2B SaaS Index and the ProfitWell B2C Software Index, and their underlying growth and retention trends. Subscribe to the Paddle newsletter to get these updates in your inbox.

B2B SaaS MRR growth remains slow at 6.5% in November

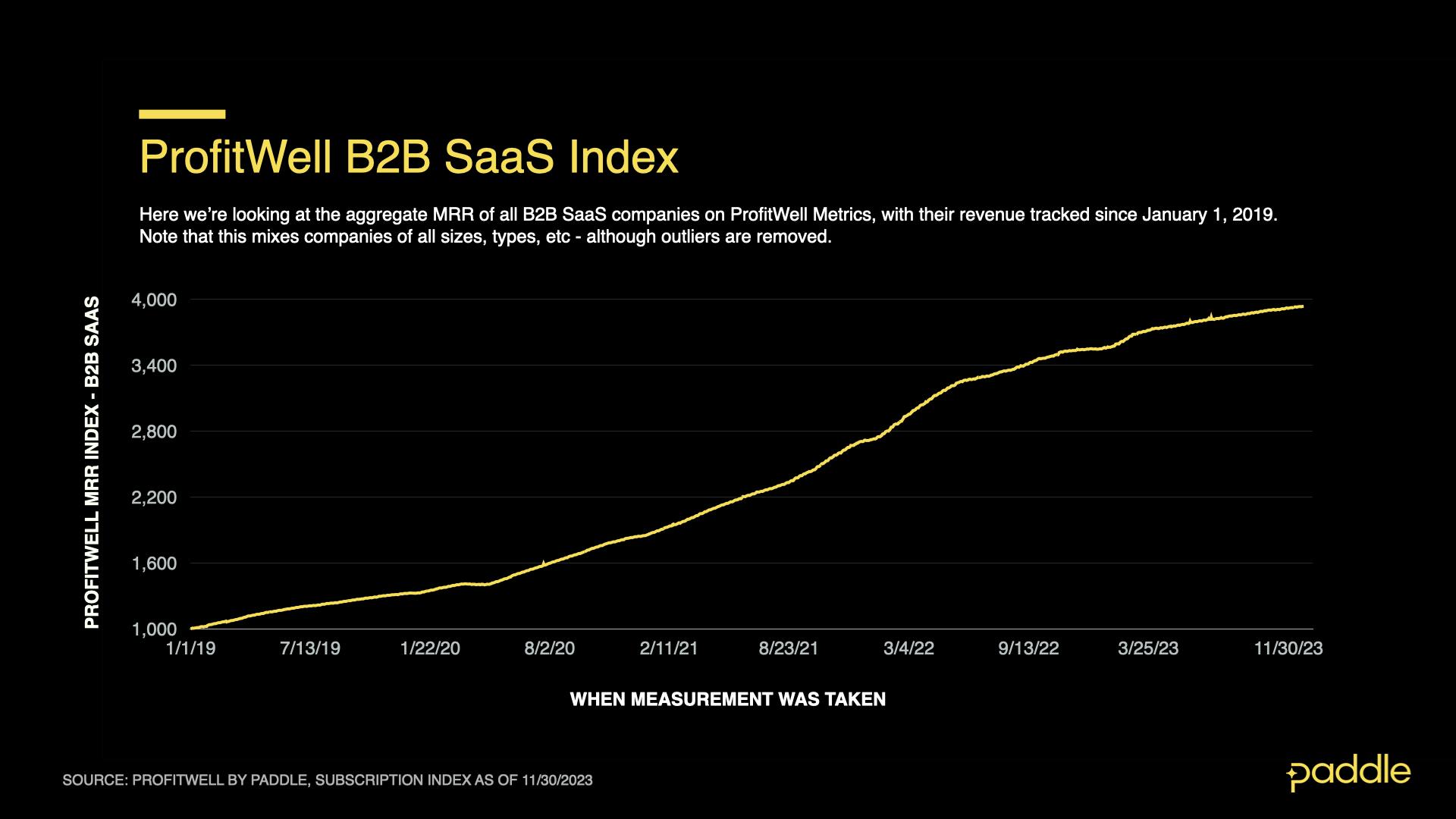

The ProfitWell B2B SaaS Index tracks the cumulative monthly recurring revenue (MRR) from a sample of the 34,000+ companies on ProfitWell Metrics. By measuring the revenue performance of this cross-section of companies over time, we can objectively observe how quickly the sector is growing (or not). The index does not adjust for inflation.

Explore the free demo of ProfitWell Metrics here.

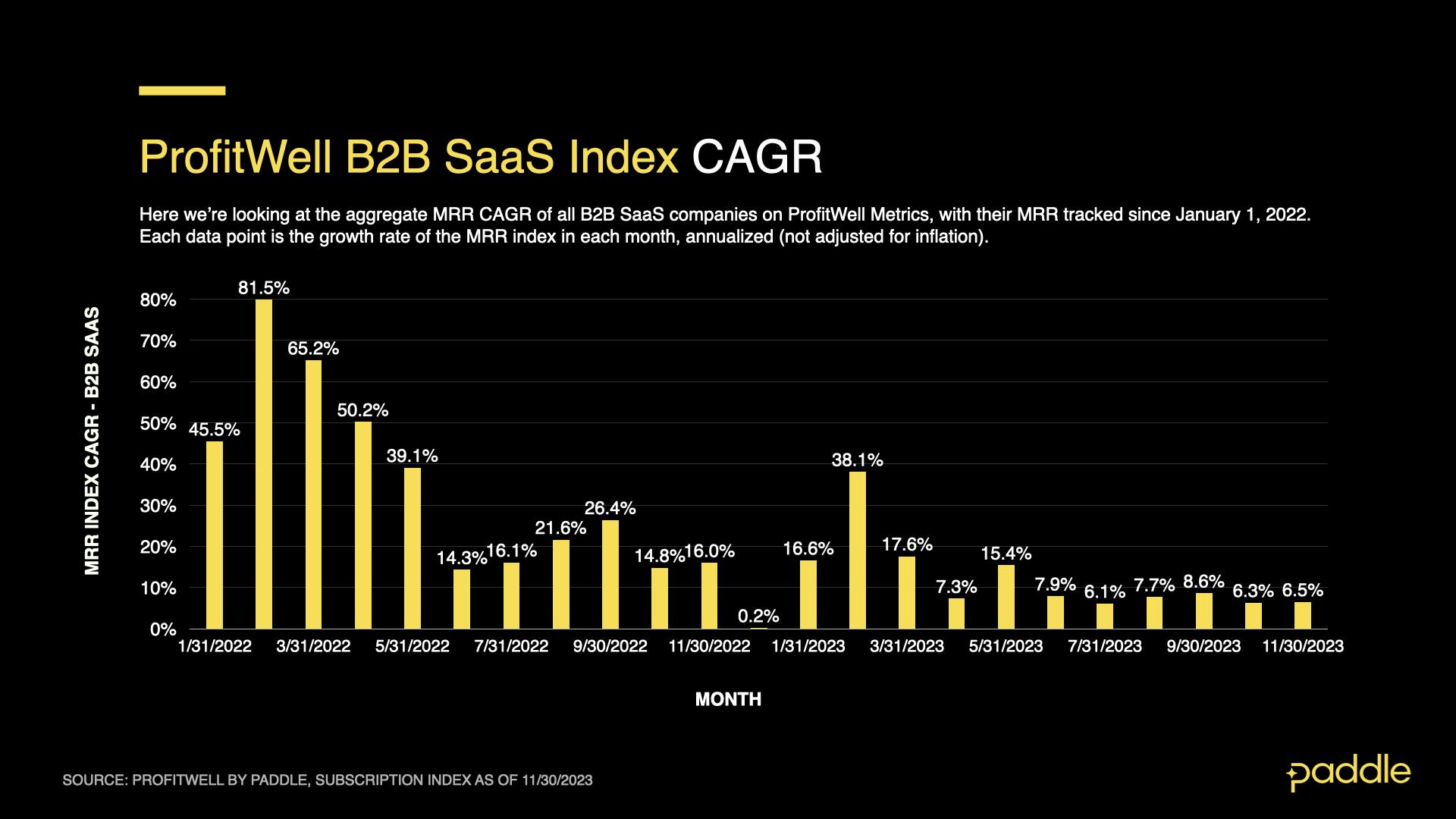

The ProfitWell B2B SaaS Software Index increased at a compound annual growth rate (CAGR) of 6.5% in November. While this is slightly up on October’s 6.3% growth, it could be little more than noise in a continued downward trajectory.

November 2022 saw 16% growth in comparison followed by 0.2% growth in December 2022 indicating that there could be a possible decline in revenue next month if this trend continues in 2023.

Slower B2B sales and increased churn led to a gloomy November

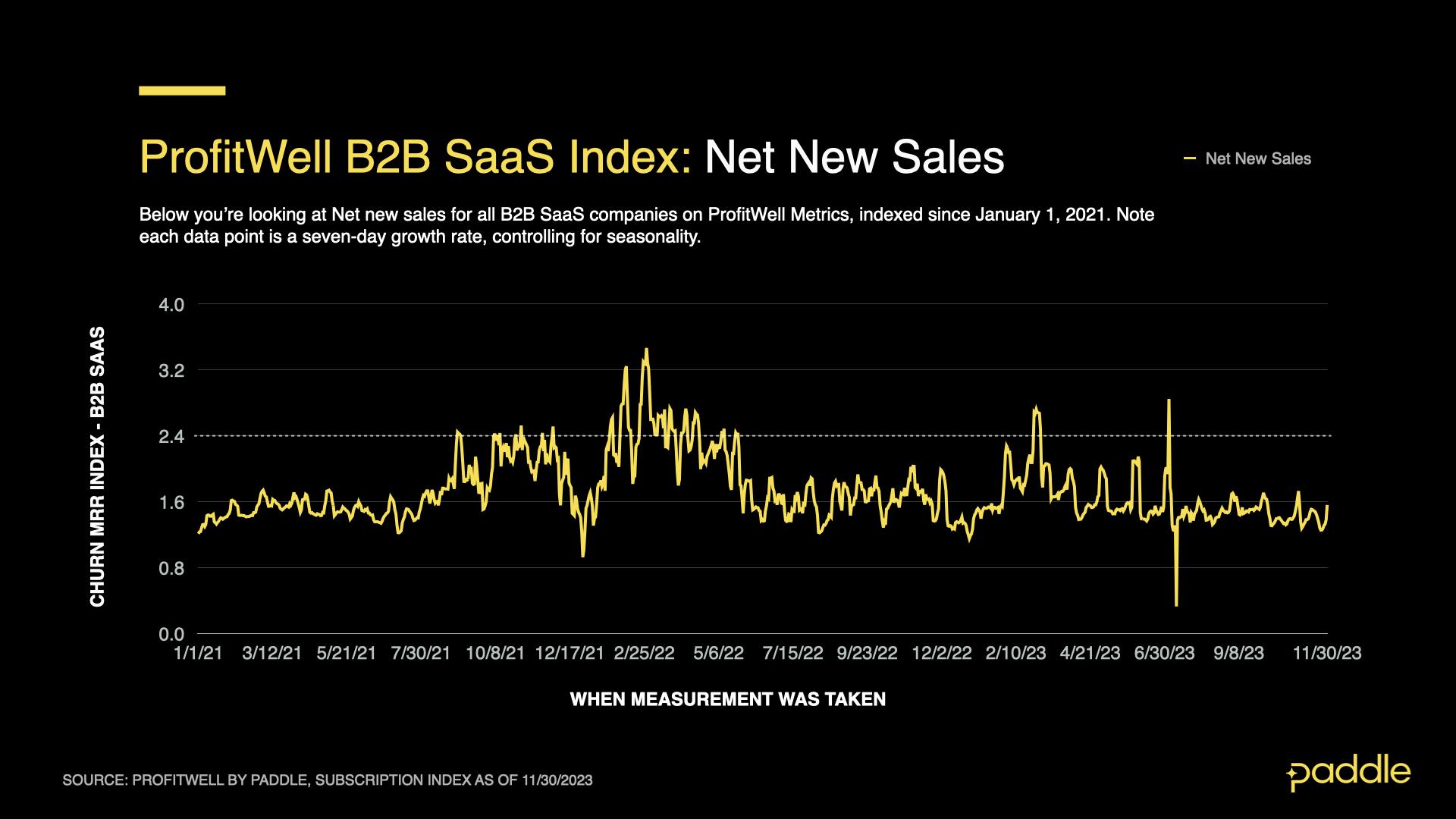

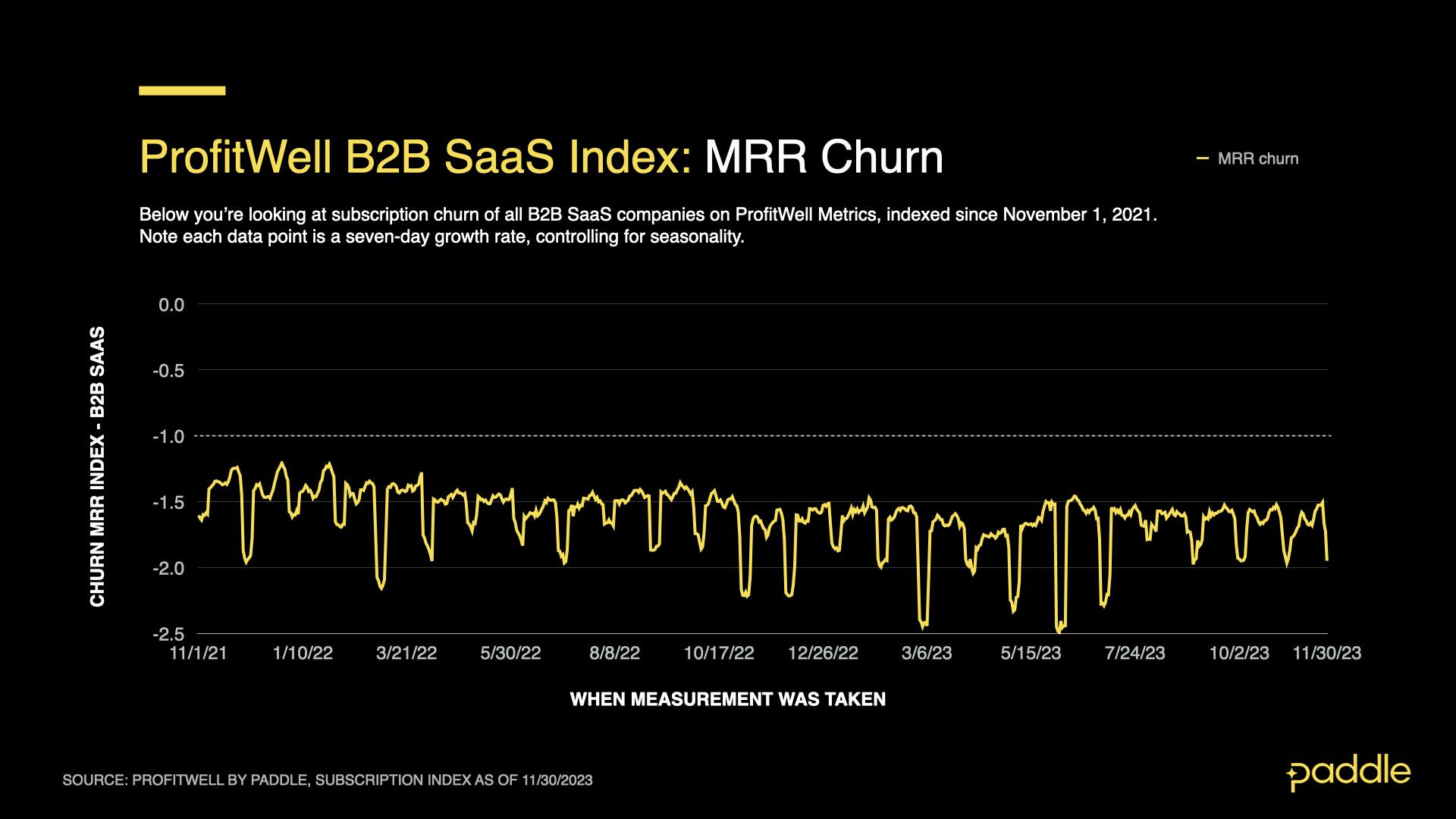

The ProfitWell B2B SaaS Sales Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019, while a 1.10 reading would be 10% higher sales (the ProfitWell B2B SaaS Churn Index is calculated similarly, but will be negative, with -1.00 being an “average” 2019 figure).

Because these indices are seven-day averages, they should be read as directional indicators and not direct inputs into the main SaaS index.

The ProfitWell B2B SaaS Sales Index also averaged 1.42 in November, a marginal 0.59% decrease from October. This was a 16.1% drop in sales compared to the same month last year, despite covering the Black Friday/Cyber Monday weekend. This indicates that B2B SaaS was less impacted by sale periods.

B2B customer retention continues its gradual decline

November’s MRR churn was similar to October’s performance, with the churn index increasing slightly from -1.68 to -1.7, a 1.36% increase.

In last month’s update, we expected churn to increase by at least 10% in November and December, based on 2022’s performance. Instead, the marginal increase we saw in churn could indicate that companies are being more rigorous about assessing the need for additional SaaS products before even purchasing them.

Before we draw more definitive conclusions, let’s see what December’s churn figures look like.

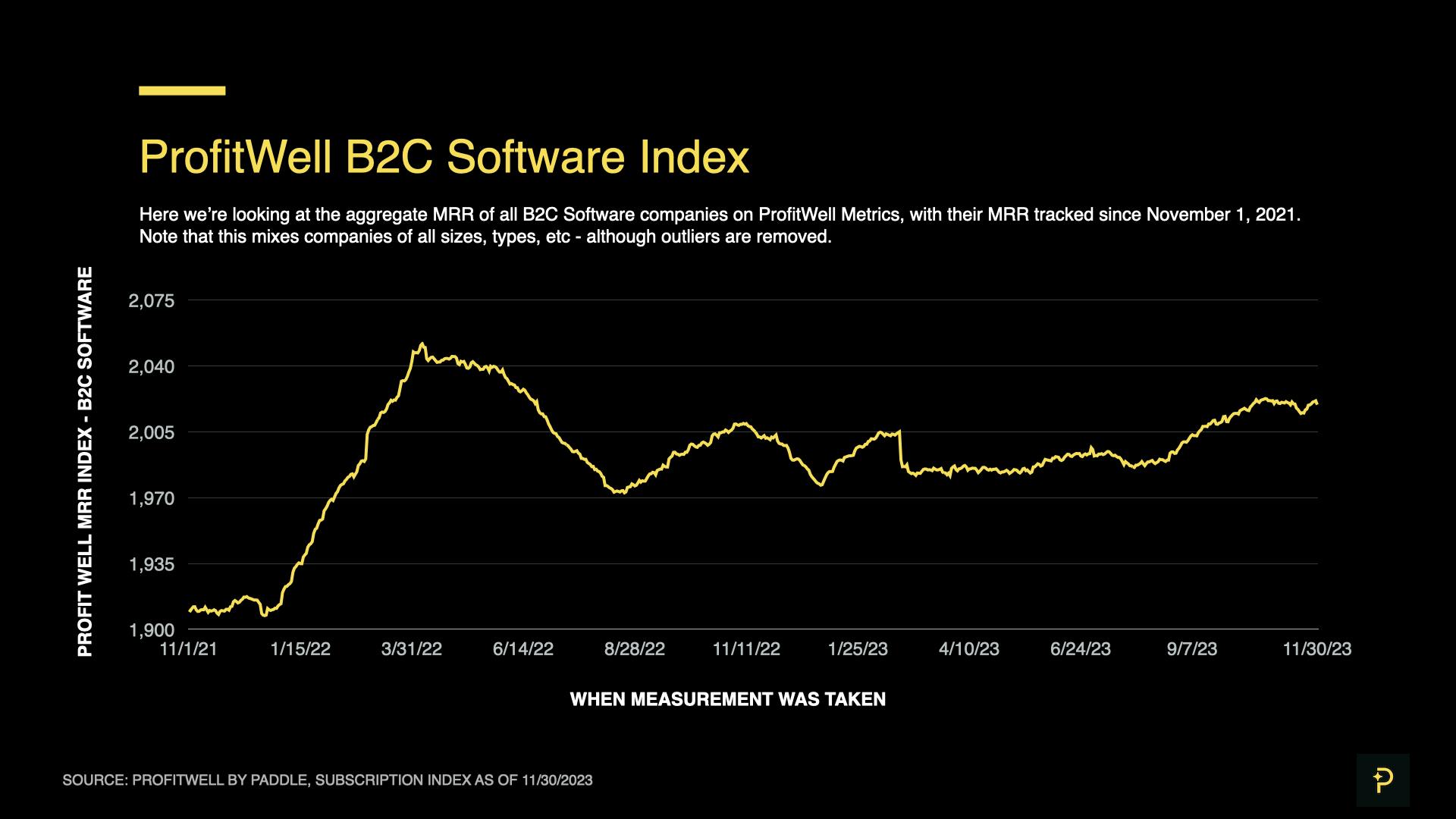

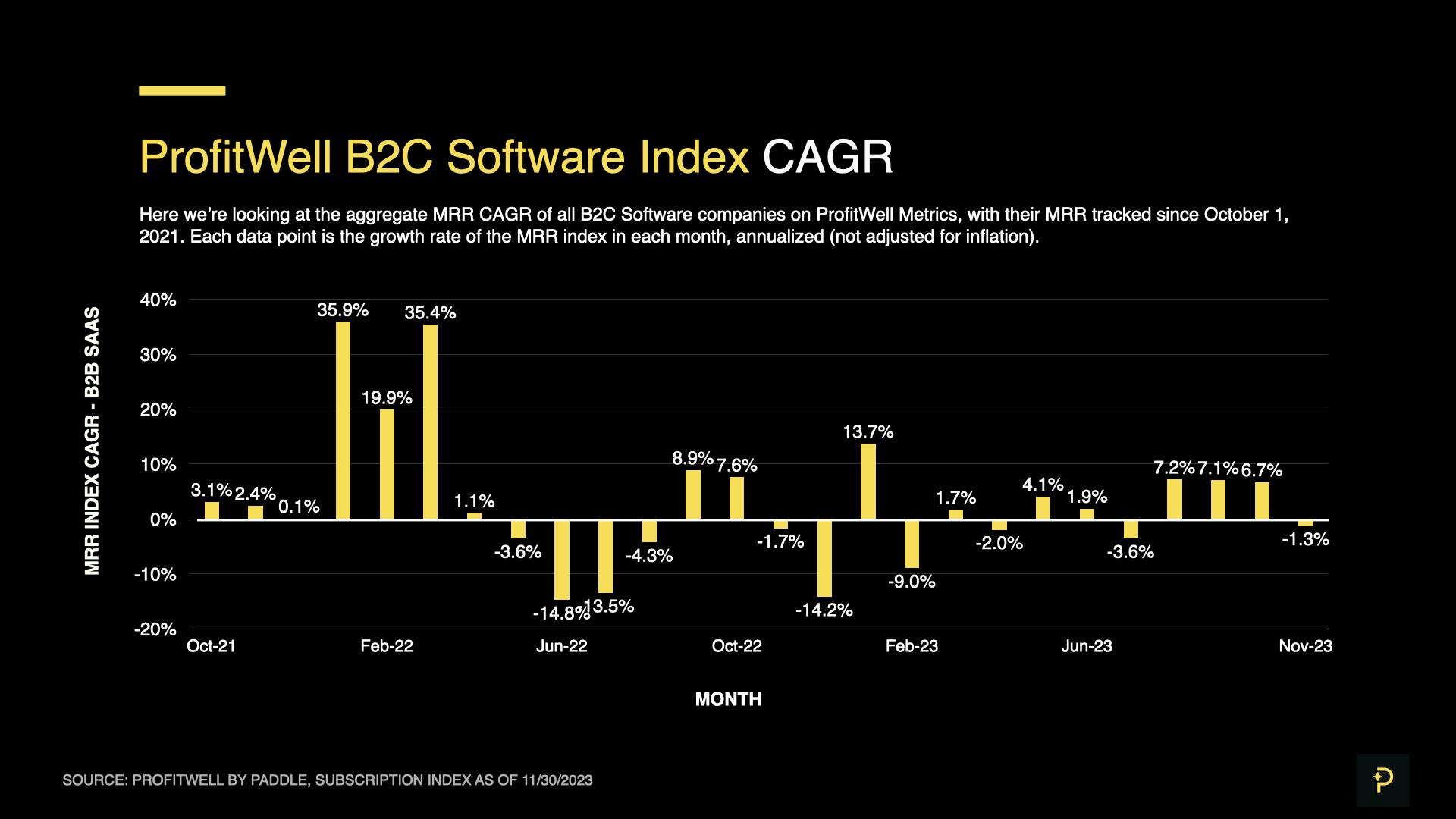

B2C Software MRR declined at a 1.3% rate in November

After three consecutive months of growth in August, September, and October respectively, the ProfitWell B2C Software Index declined at a CAGR of 1.3% in November.

This decline signals that it still won’t be an easy road ahead for B2C as companies head into the holiday season. As we’ll explore below, churn was up this month despite higher sales so customer retention, not just customer acquisition, will need to be a key focus to drive growth and deliver greater lifetime value.

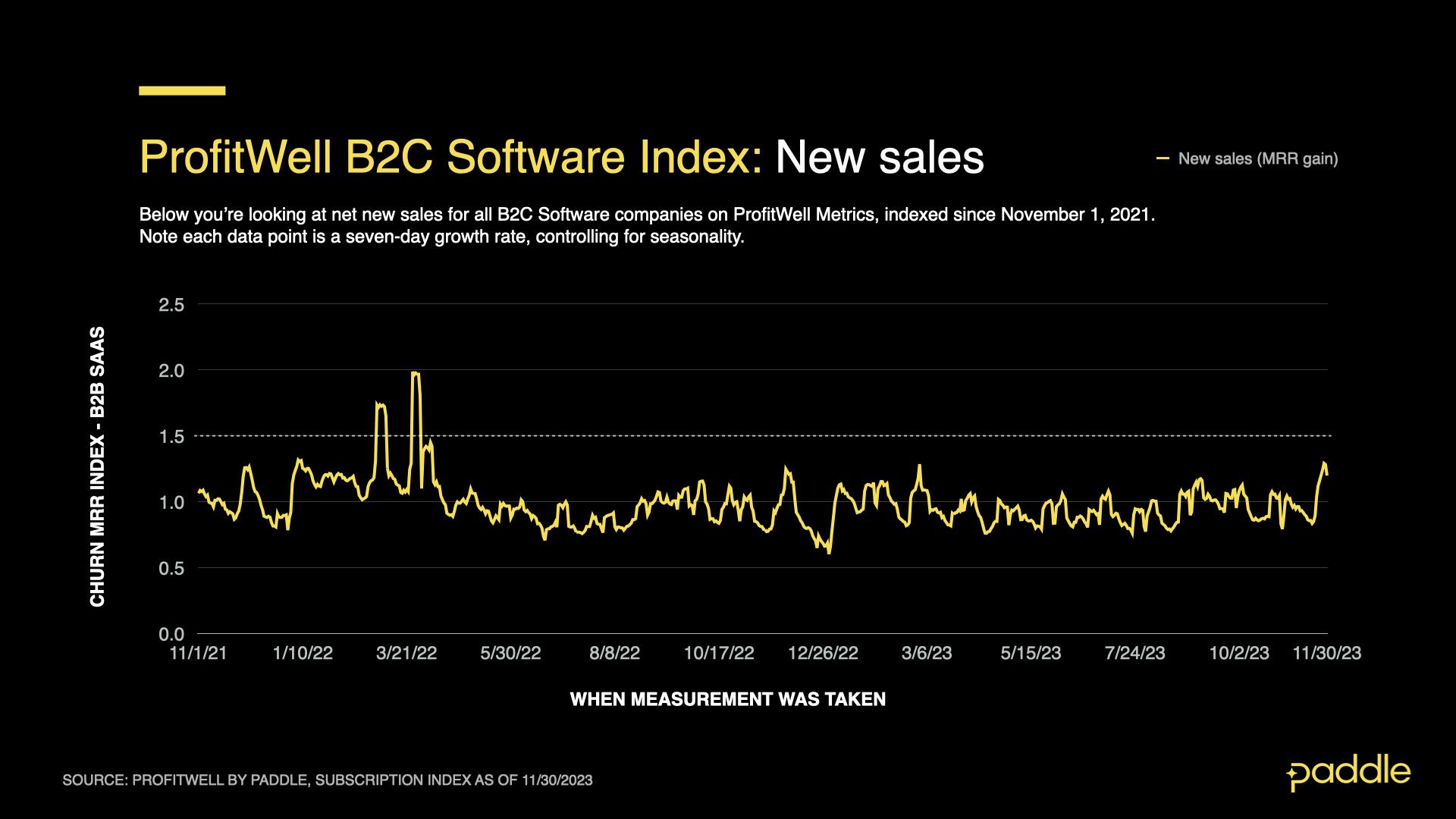

B2C sales were up on the back of Black Friday activity

The ProfitWell B2C Software Sales Index is a seven-day rolling average of MRR from net new sales, expressed as a multiple of typical daily sales in 2019. A 1.00 index reading represents sales on an “average” day in 2019.

The ProfitWell B2C Software Sales Index averaged 0.88 in November. This was an 8.8% increase from October, and 6.6% higher than November last year.

November marks the beginning of the holiday season for consumer retail and Black Friday/Cyber Monday had a significant impact on this (more on that below). However, the stronger sales performance wasn’t enough to drive a fourth consecutive month of revenue growth thanks to higher churn.

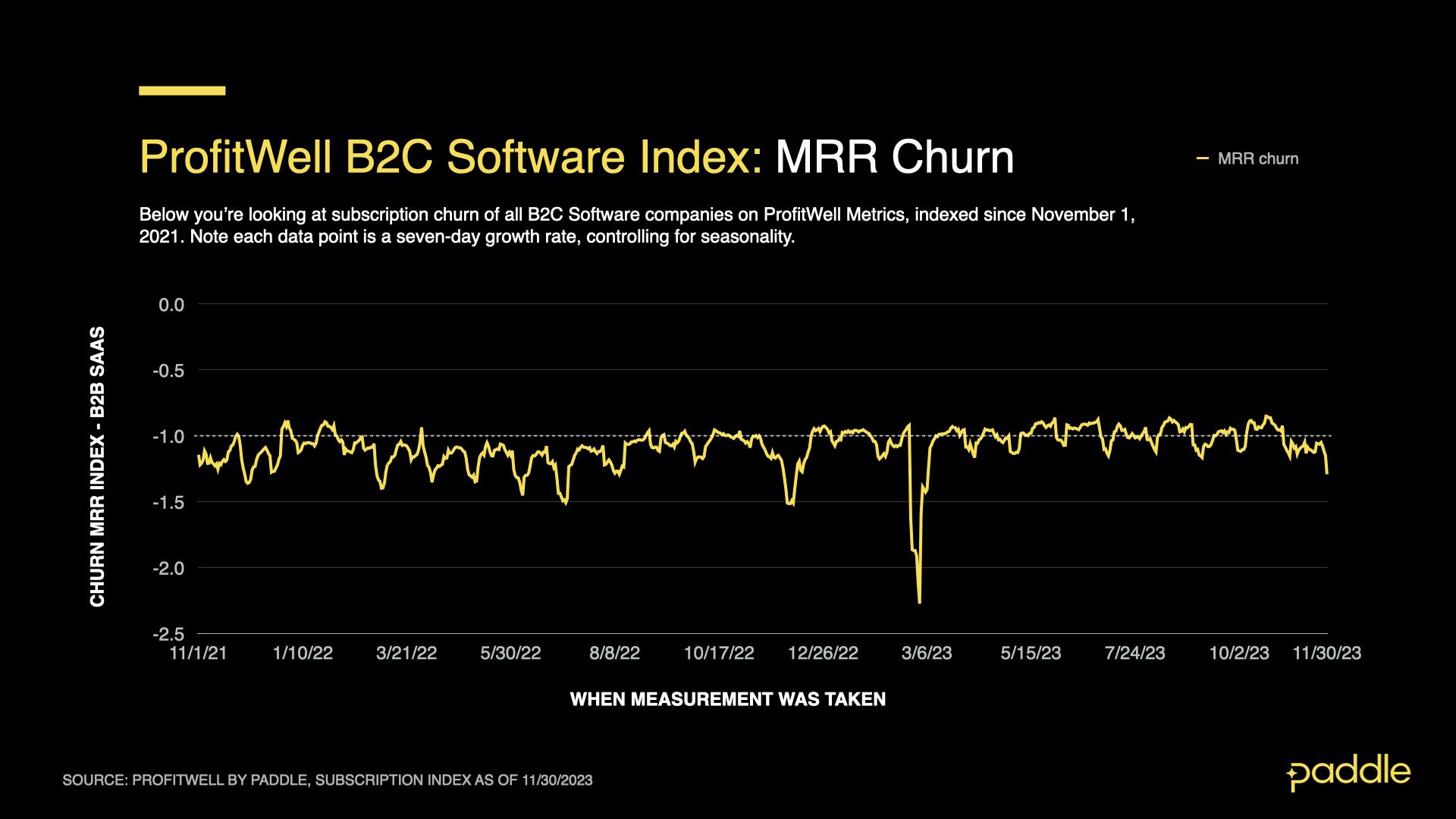

High B2C churn was the main driver for November’s revenue decline

The ProfitWell B2C Software Churn Index slumped to about -1.1 in November, a 14.7% increase in churn from October.

From Q2 onwards, much of 2023 had seen lower consumer churn, however, this month’s figures offset a rise in sales and were the major contributor to the overall revenue decline.

One possible reason is that customers who bought subscriptions over the sales period last year now churned when it came time to renew for the full price.

This is a timely reminder that those companies who can strike a balance between short-term and long-term goals (balancing customer acquisition numbers with customer lifetime value targets) will be the ones who benefit the most from sales periods

Learn more about discounting strategies from our pricing experts here.

How did Black Friday/Cyber Monday impact sales this month?

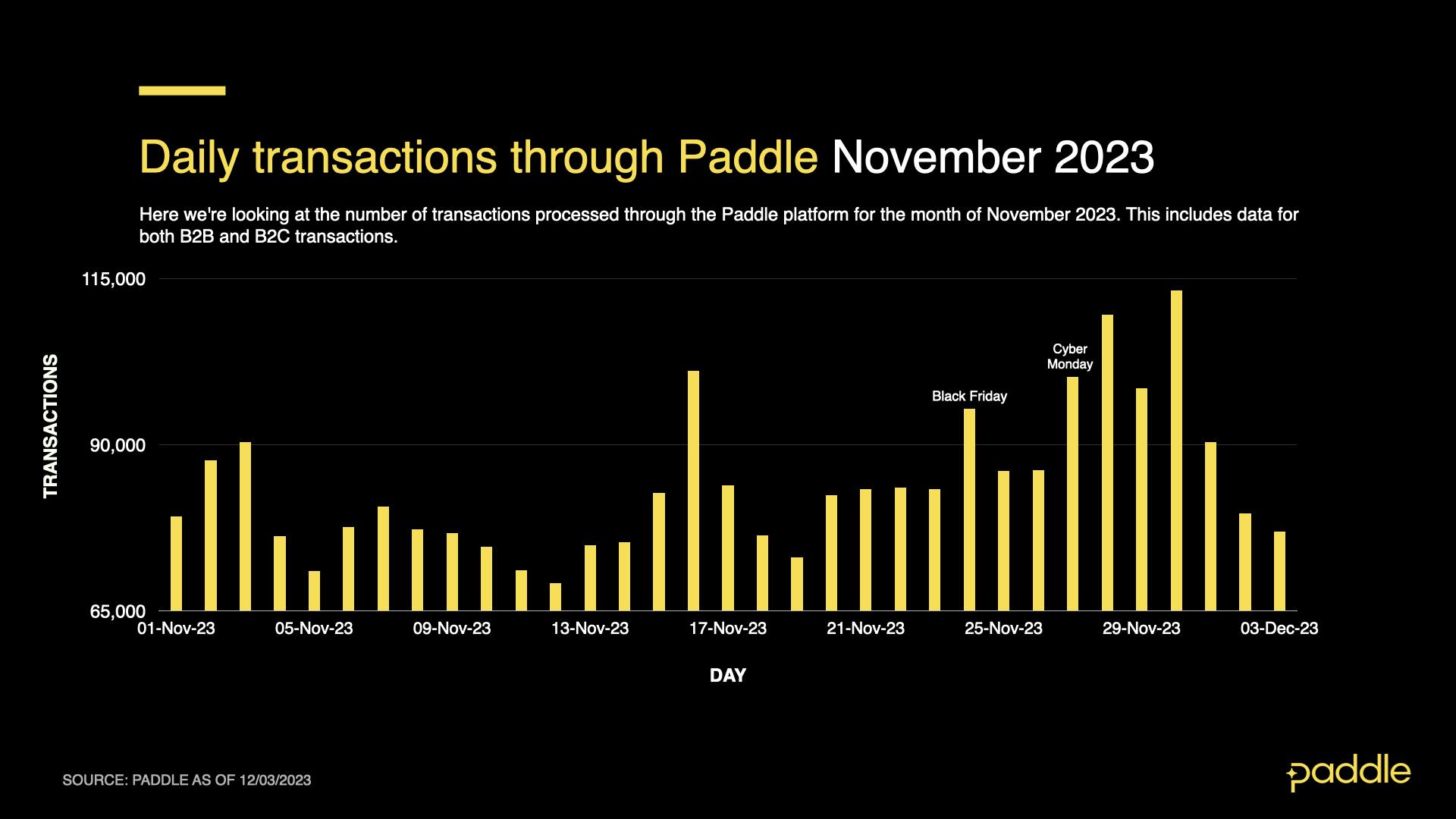

Paddle’s transaction data over the Black Friday weekend showed a significant spike in activity across both B2B and B2C, with the majority of this driven by B2C.

Compared to the Black Friday/Cyber Monday performance in 2022, the dollar amount of transactions was up 14% as well as a 5.6% increase in volume.

Interestingly, transactions peaked on November 30, which is typical for the end of the month, however, this was buoyed by increased transactions across Black Friday weekend. Transactions for Cyber Monday, Tuesday, and Wednesday all outperformed Black Friday signaling that the period is now considered a multi-day event by both sellers and consumers.

Keep an eye on new tax regulations if you sell into the EU

Another development of note set to impact both B2B and B2C companies selling digital products and subscriptions is the upcoming introduction of new EU VAT regulations.

Beginning January 2024, companies from outside the EU making more than 25 sales per quarter in Europe will be reported to CESOP (the Central Electronic System of Payment Information), meaning you will be expected to calculate, file, and remit the correct sales tax.

If you are selling software in Europe using a payment service provider (PSP), such as Stripe or Paypal, and you aren’t calculating, filing, and remitting the right sales tax, you are much more likely to get a letter from the authorities.

We publish monthly reports on the ProfitWell Subscription Index to show you where the market’s headed — and help you form strategies to respond. All backed by data from the 34,000+ companies on ProfitWell Metrics.

Missed our previous market reports from October 2023? Read them here and here.

Subscribe and be the first to receive the next SaaS market report.