How Does Churn Differ Across Subscription Markets?

Neel Desai Oct 2 2019

This week, Gal Thompson, Regional Manager at Secured Signing, has something on her mind: How is churn different across different types of subscription companies?

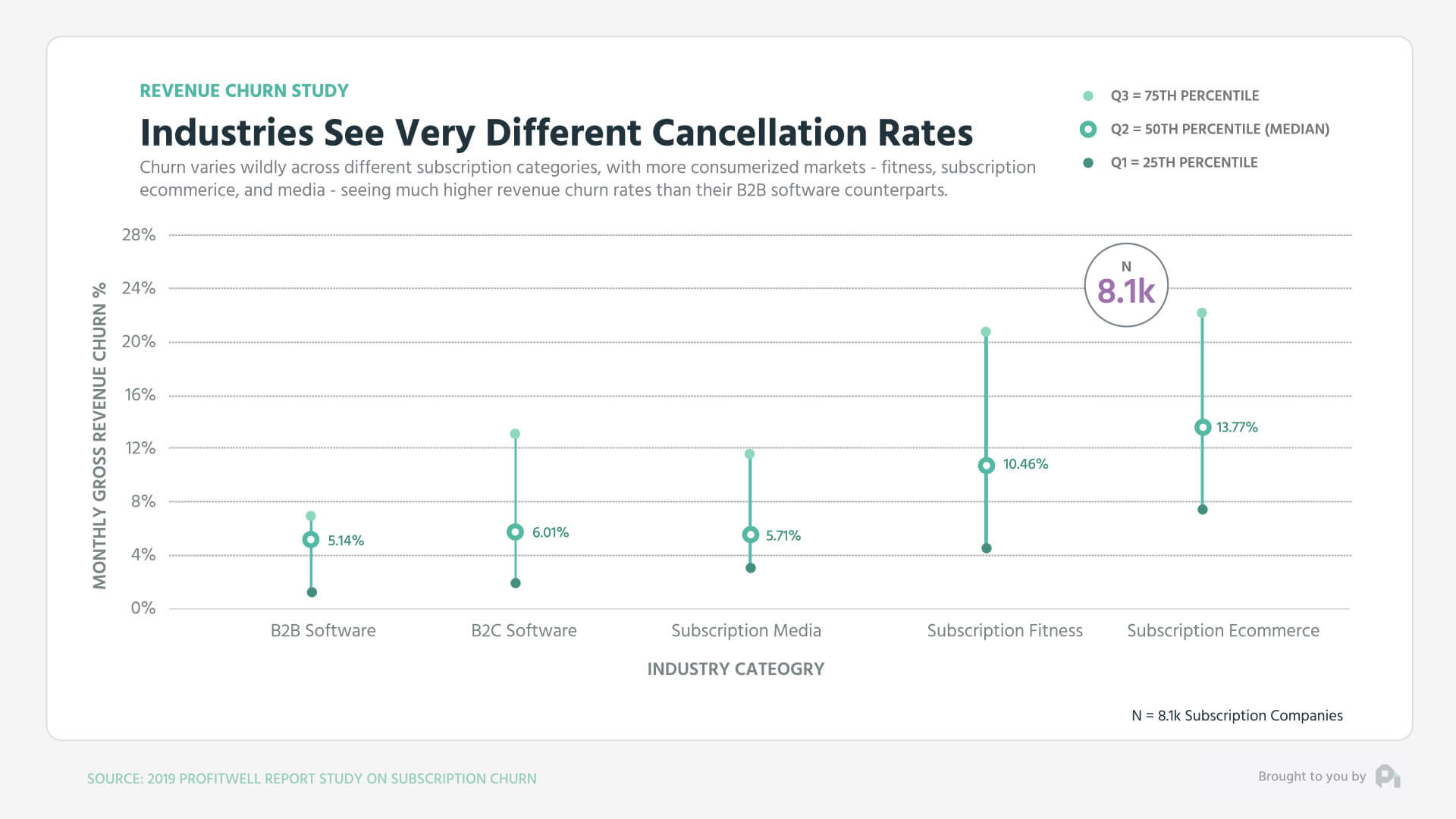

To shed some light on these differences, we looked at churn data from more than 8,000 different subscription companies across five different industries and found some interesting results. Let’s jump in.

Don't miss out on more insights. Subscribe to get on the ProfitWell Report's list now.

Churn is the cost that we must bear for the opportunity to take advantage of the subscription model–and it's a beautiful model. For the first time in history, the relationship between a company and the customer is baked right into how we make money. And if a customer no longer sees value in what we're providing, they can easily cancel when the term comes up for renewal. With that, there is a level of churn that’s just to be expected.

Subscriptions are everywhere at this point. We have classic B2B enterprise products, we have subscription box of the month clubs, and we even have subscription entertainment but the thing is, churn varies widely across these industries.

Notice how the software industry actually has much lower churn comparatively with a median churn rate of roughly 5% for B2B software and 6% for B2C software. Subscription media follows closely with an interquartile churn range from roughly 3% to 11%. Churn rates jump considerably when you start looking at subscription fitness and subscription e-commerce with churn rates ranging roughly from 5% to almost 20%.

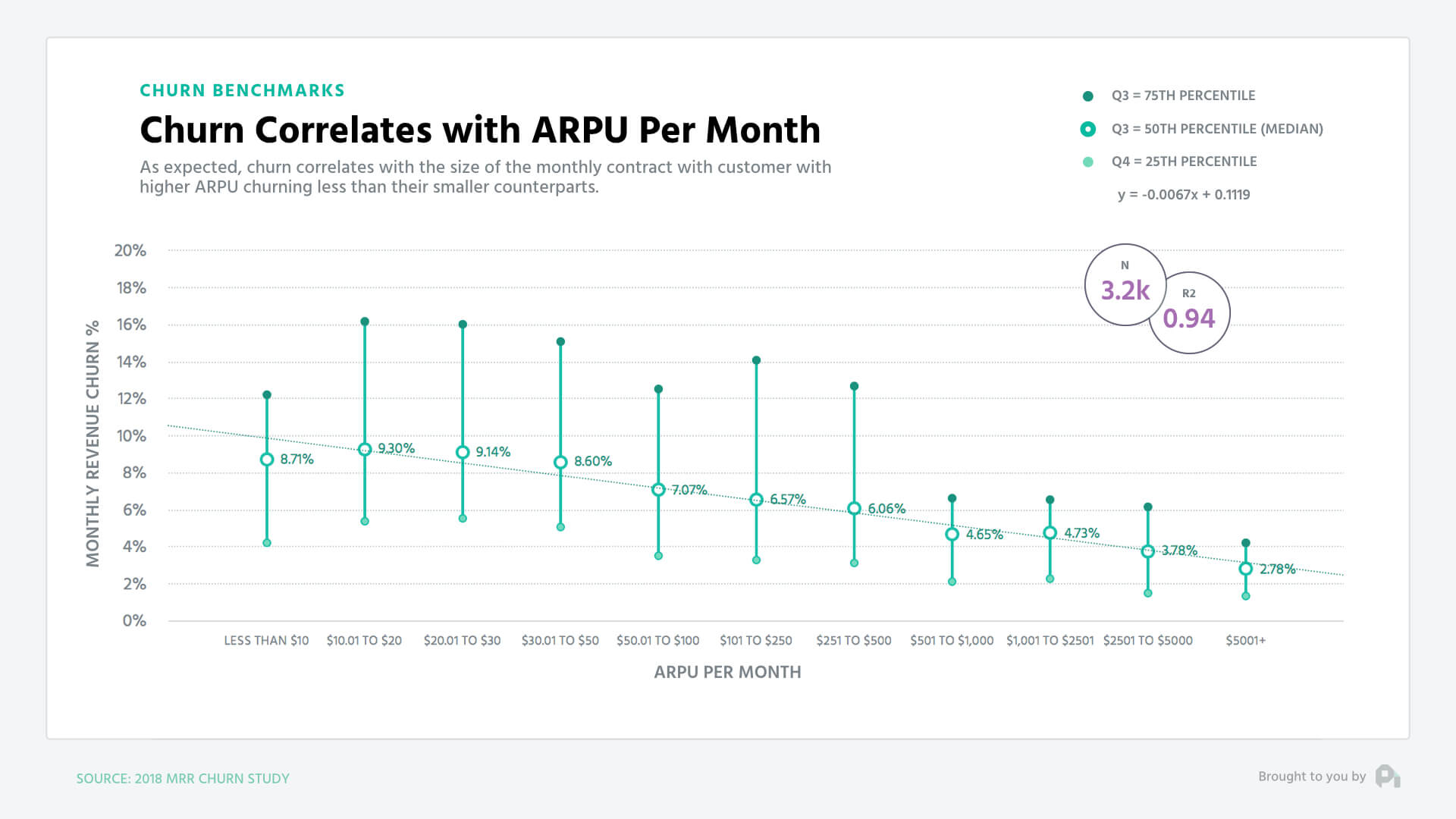

These churn rates tend to feel intuitive though, as consumers tend to be a bit more finicky and fragmented than their business counterparts. More telling though is the relationship between ARPA or the average revenue per account and churn. As you increase the effective price of your product, essentially the churn goes down, because these customers are a bit more serious and presumably think about the purchasing decision a bit more seriously.

Take a look at this blend of B2B and B2C software subscription companies. Single and double digit ARPA correlated with churn between 3% and 15%, whereas four figure ARPA dropped to 1% to 5%.

Customer attrition is just a fact of the subscription life and there’s plenty of tactics and strategies you can use, and that we’ve written about extensively, to lower your churn. Yet, keep in mind there’s likely a floor to these efforts simply because different types of customers and industries lend themselves to different relationships. Put another way – you want to be careful trying to get to 0% churn, because it just might not be possible to get to 0% gross churn depending on your customers.

Well, that's all for now. If you have a question, ship me an email or video to neel@profitwell.com and if you got value here or on any other week of the report, we appreciate you sharing it on Twitter and LinkedIn. That’s how we measure if we should keeping doing this or not. We'll be back next week with more.