Cost-plus pricing is a common pricing method, but it's incredibly inefficient for SaaS products.

The cost-plus pricing model is a dependable strategy for many industries, primarily due to how easy it is to implement. But when you’re running a SaaS or subscription business, the model breaks down quickly.

The subscription pricing model is based on monetizing your relationship with your customer; it's built on the value your service provides. The cost-plus model bases your pricing strategy on operational costs without considering how much value you provide to your customers.

In this article, we’ll look at cost-plus pricing to understand how it is used for specific business types. We will also discuss why we don't think this is the right pricing method for SaaS.

What is cost-plus pricing?

Cost-plus pricing is a strategy that adds a markup to a product's unit cost to find the final selling price. It's one of the oldest pricing strategies in the book and is calculated based on just two things:

- Cost of production

- Desired profit margin

The definition of cost plus pricing is to take the cost of building your product and add a percentage on top. Every unit sold then provides the same revenue to cover your costs, plus a profit margin.

Cost plus pricing is a straightforward way of setting the price for a product. It's based on the idea that the seller should be able to make a profit from providing a good or service. This pricing method involves adding a margin to the cost of making a product to create a final sale price. Many businesses use this as their main pricing strategy for new products, as cost plus pricing is the definition of simplicity.

How to use the cost-plus pricing formula

The name says it all. Calculate your total costs, including direct labor costs, manufacturing, and shipping.

Add the desired profit percentage to the total cost.

This will give you the single unit price using the cost-plus pricing method.

A cost-plus pricing example would be, imagine you run an e-commerce store that sells candles. It costs you $10 to make every candle, including materials and labor. To sustain your business, you need to make a 50% profit on each candle to account for the time taken to:

- Produce the ingredients

- Create the candle

- List it on your website

- Ship it out

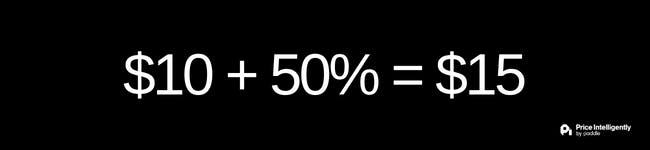

This makes your example of cost-plus pricing into a calculation that looks like this:

Simple, right? By selling each candle for $15, you can cover the cost to make it and your desired profit. That’s what makes this pricing model so appealing; it’s such an easy way to determine a per-unit price.

Advantages of cost-plus pricing

There are a number of benefits to the cost-plus pricing model if you’re working in the right market:

1. Cost-plus pricing strategy takes few resources.

Cost plus pricing doesn't require a lot of additional market research. Business owners are familiar with production costs by adding up different invoices, labor costs and overheads.

Taking the summed costs is simple; then, they can add a margin on top of these costs. This margin should reflect what the market will accept.

Once the costs are calculated, a margin can be added to make the price attractive to the market. It’s pretty simple, so it's a popular strategy among small and new businesses.

2. Cost plus pricing model provides full cost coverage and a consistent rate of return.

Cost plus pricing ensures the full cost of creating a product or fulfilling a service is covered. This is achieved so long as the business is correctly adding up the costs per user or item. This allows the markup to ensure a positive rate of return.

Yet, many additional costs often can’t be accounted for, which results in reduced margins. Fortunately, businesses can create a buffer against surprise costs and fluctuations in demand by increasing the arbitrary margin. Another advantage is that because your prices remain inert, you can easily estimate revenue for a given month. You can do this based on conversion history, marketing spend, etc.

3. Cost plus pricing hedges against incomplete knowledge.

Cost plus pricing can be beneficial when there is limited knowledge of a customer's budget and no competitors in the market. Essentially, the only data you have to guide your pricing decision is the calculation or estimation of your costs. This allows you to push forward at least a starting price to work from as the market and customer develop. It helps to determine a set price that covers costs and provides a reasonable profit.

Disadvantages of cost-plus pricing

The simplicity of cost-plus pricing leads to a number of issues, especially for SaaS and subscription businesses:

1. Cost-plus pricing strategy can be horribly inefficient.

The guarantee of a target rate of return creates little incentive for cutting costs or increasing profitability. As the market and customers continue to change, stakeholders easily become passive towards pricing, creating laziness and atrophy of profits.

For perspective, the government uses this strategy of guaranteed profit margins on costs to make contracts with private businesses “easier.” The result is an incentive to maximize costs, which wastes billions of dollars and produces shoddy workmanship. A serious cost plus pricing disadvantage.

2. Cost-plus pricing method creates a culture of profit losing isolationism.

This inward-facing approach discourages market research. Although watching competitor prices isn’t the be all and end all, it is a pretty important element of pricing. You should know how much the competing good costs because it can affect your marketing and pricing strategies. With no research, you have little to no data on your customer's perceived product value (more in the last point).

3. Cost-plus pricing doesn’t take consumers into account.

Perhaps the biggest downfall of a cost-plus pricing model is that it completely disregards the customer’s willingness to pay.

To make money, a customer must be involved. Customers are essential to selling anything. Therefore, any pricing strategy that ignores customer value is detrimental to the business's profitability. This creates a vacuum that drains away all of the profit.

In summary, customers don't care about how much something costs you to make. They understand there are costs associated with doing business, but consumers care more about how much value you’re providing.

For example, making a bottle of Rogaine may cost $3, $10, or $50. Consumers only weigh price against the value of a husband with hair on his head. Depending on the customer, could be 2x, 10x, or 100x the cost depending on follicle effectiveness.

Simply barreling ahead with a desired rate of return can result in declining demand that is disregarded until substantial losses occur. Even if consumers buy your product, there could still be a better price for revenue optimization and price differentiation.

Two examples of successful cost-plus pricing strategy

There are a number of different industries that utilize cost-plus pricing effectively. Typically, this model works best when there are defined costs involved in the production or when the product itself is utilitarian in nature. Here are two industries that traditionally rely on the cost-plus pricing model.

Manufacturing

Manufacturing companies thrive on cost-plus pricing. The products they create have relatively predictable fixed costs (such as labor, machine maintenance, raw materials), it’s easy to assign a profit margin percentage using markup pricing on top that sustains the business.

In most of these business arrangements, companies sell manufacturing products in bulk to existing customers with a contract. That makes it even easier to build a predictable revenue stream over time without requiring a price increase or decrease.

Grocery Stores

Consider the last time you went shopping at the supermarket. Regardless of whether you were buying apples, cereal, or beer, you probably had a sense of how much each of these products would cost. That’s because grocery stores rely on the cost-plus pricing model as well. A Honey Crisp apple will be more expensive than a Red Delicious because the Honey Crisp was more expensive to buy.

Grocery stores also buy products in bulk, so it’s likely that they rely on a procurement company that follows the same pricing decision model as our manufacturing example.

Why cost-plus pricing does NOT maximize SaaS profits

The subscription SaaS business model is not compatible with the cost-plus pricing strategy.

When you rely on a predictable profit margin, there’s no incentive to adjust your pricing to match customer expectations or changes in market conditions, which is one of the disadvantages of cost-plus pricing. That can lead to a stagnant price that isn’t aligned with your product’s value or better offers from competitors.

The cost-plus model works better when you’re selling physical products or working in an industry where value isn’t derived from ongoing customer relationships.

At Price Intelligently, we recommend value-based pricing based on value metrics. You can still factor in hard costs associated with running your business, like cloud storage or other infrastructure costs. Choosing this model ensures that your prices will remain aligned with the value you provide to potential customers in a competitive market.

How to find the right price strategy for your business model

When you’re looking for the right model for your business, cost-plus pricing can help you understand how much you need to make to gain a profit. From there, it’s important to understand the value of your product or service to maximize the potential revenue and connect with customers’ willingness to pay.

Our Price Intelligently sprints are tailor-made to help you build a better subscription pricing model. Chat with one of our pricing experts today to learn how we can help you grow your business.

How to calculate cost plus pricing?

The cost plus pricing formula is simply to calculate the cost of a product, plus a profit margin percentage. It is done by multiplying the total costs, such as material costs, direct labor costs, and overhead costs, by 1. The next step is to add profit. For a 25% profit margin, you would multiply your costs by 1.25 to get the sale price.

How does cost plus pricing work?

The cost-plus pricing method requires you to take fixed costs and variable costs, and apply a markup percentage to them to estimate the price of a product.

What is the difference between a cost plus pricing and value based pricing?

To determine the selling price of a product, the cost plus pricing method considers the total costs of making a product. On the other hand, value based pricing relies on the potential customers' perceived product value.