B2B and B2C SaaS and Subscription COVID-19 Impact Report—Updated Weekly

Patrick Campbell Apr 23 2020

We are living in unprecedented times. Advice is coming from every direction and it's difficult to know who and what to believe.

Here at ProfitWell, we believe in data because data doesn't lie. We look at the numbers to help guide our decisions, turning advice into tangible action items. We've been working around the clock to develop an index displaying MRR and growth trends across SaaS companies. And we'll be sharing with you an overall subscription index, from companies on Profitwell, that will be updated weekly. We've also compiled some crucial and useful information to help guide you during these uncertain times. .

Click below to get the complete ProfitWell Index for B2B or DTC.

Table of Contents:

1. Overall SaaS and subscription index—updated weekly

2. How have SaaS and subscription companies been impacted by COVID-19?

3. How can B2B and B2C companies insulate themselves?

4. Why you need to focus on retention

5. How to calculate customer retention rate

6. 3 ways you can boost retention

7. Metrics you need to stay on top of

Overall SaaS and subscription index—updated weekly

The following graphs were updated on June 16, 2020. At the time of this data collection data, subscription companies on ProfitWell were trending upward.

.004afec.jpg?width=600&name=PW%20Index%206_16.2%20(4).004.jpeg)

The graph above displays data collected since January 1, 2020.

.0036c75.jpg?width=660&name=PW%20Index%206_16.2%20(4).003.jpeg)

The graph above displays data collected since January 1, 2019.

How have SaaS and subscription companies been impacted by COVID-19?

Everyone has been impacted by COVID-19. For SaaS specifically, because most companies follow a recurring revenue model with long-term relationships, it's extremely difficult to acquire new customers. Right now, retention is more important than ever. You may not acquire new customers and see an increase in revenue, but maintaining what you have is more important than ever.

Value propositions changing

Your product's value proposition attracts potential customers to your brand and drives them to convert. Right now—with the economy taking a hit—value propositions are changing. We're seeing major changes when it comes to buyer affinity and behavior. Even if you knew your customers and what they valued really well a few months ago, it's different now. With affinity and buying behavior changing, you need to readjust your value propositions to attract customers and retain the ones you have.

How to adjust your value proposition

With these changes, you need to readjust your value proposition. Here are some tips to help you create better value propositions:

#1 Highlight your true strength and differentiators: Take the time to identify what makes your product truly unique. Don't just blindly throw features and benefits on a page. What's critically important is how you determine which features get listed. We like to look at value propositions from a value-based pricing perspective, so, we insist that companies first look to their own customers rather than making educated assumptions.

#2 Motivate prospective customers to learn more: Strive to communicate your value propositions in a manner that is effective yet brief. Then, you can subtly weave your value props into your feature descriptions. Remember, there is a fine line between capturing a prospect's interested and overwhelming him or her with too many product features. You can avoid information overload by combining a concise summary with the opportunity to learn more via a "request more info" tab or live chat.

#3 Quantify value for your customers when possible: Sometimes, straight up numbers give you meaning that marketing phrases simply cannot. There should be a concept mapping from the value metric to the pricing metric.

#4 Repeat and reiterate: Keep in mind that people, in general, have short attention spans. Your value props displayed on your site should demonstrate why your product offers tremendous value. You must continually reinforce those drivers. You don't want to sound repetitive, though, so you must get creative. One tactic is by leveraging social proof...you can post expert-level recommendations from customers to build that external credibility.

How can B2B and B2C companies insulate themselves?

Focus on longterm increases in cash flow

Secure customers for the long-term and by that, we mean try to get as many people to sign annual contracts as possible. Signing an annual contract will guarantee a year's worth of revenue, increasing cash flow and expected runway. How can this be done? Incentives.

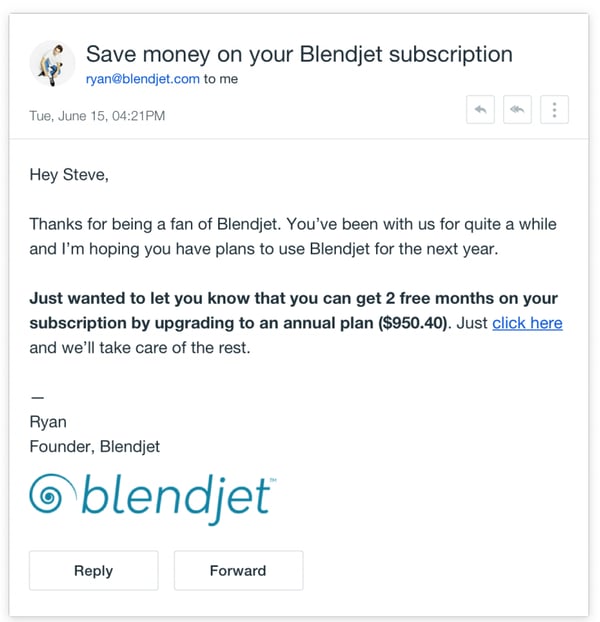

Check out this email:

Blendjet incentivizes customers to upgrade to an annual plan by offering two months free. Yes, they are providing some sort of discount, but at least Blendjet will have that guaranteed source of revenue for the next year.

Stop delinquent churn

Now is the time to figure out why customers are churning. Customers may be churning without even realizing it because our research shows that 30-40% of churn originates from failed credit card payments. You can combat churn simply by ensuring that customers' credit card data is up to date.

Treat these customers who have churned due to credit card payment failure, or are about to churn, like a marketing channel. Devise separate messages for them and be calculated about outreach. Shoring up mechanical churn presents a unique opportunity to win back customers and maintain revenue.

Reduce churn through targeted campaigns

Reducing churn should be an obvious solution to saving money during these turbulent times. Deploying targeted campaigns is all about what you say and more importantly, when you say it. Timing is truly everything and ProfitWell Retain can help.

Retain will:

-

- Scan card and transaction metadata and deliver pre-dunning notifications at just the right time to at-risk users.

- Monitor when the best time to ask for an updated credit card from an expiring user is.

- Retry a customer's credit card when there's the highest chance of recovery.

- Constantly adjust timing and content of notifications to optimize recovery.

- Reduce friction immensely by not requiring a user to login to update their payment information.

- Lock out a delinquent user, allowing for a long tail of recovery.

Why you need to focus on retention

Focus on retention because acquisition is extremely difficult right now. With companies furloughing, laying off employees, and freezing hiring...they definitely are not in the market to be spending money on new products. The money you spend on acquiring new customers may not even pan out in the end, damaging your LTV: CAC ratio.

That's why retention is your best friend. Maintaining and improving upon the positive experience your existing users have with your product will help you stay afloat during these rough times. You may not experience growth or it may be slow, but you'll hopefully avoid any loss in revenue.

How to calculate customer retention rate

What does your retention rate look like right now? It’s okay if it’s not as high as it was a few months, or even a few weeks ago. The best way you can help yourself is being honest about your numbers so you can properly strategize.

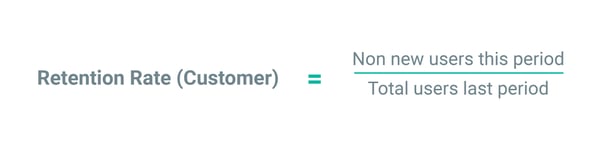

Retention rate calculates how many customers continue to be customers in the subsequent year. Retention rate is typically expressed as a percentage.

In order to maintain retention, you need to know what you’re working with and then set some goals based on your current situation.

3 ways you can boost retention:

1. Pause memberships

This should be done on a case-by-case basis but for customers who are truly in the weeds right now, you should consider allowing them to pause their membership. You’ll take a small hit on MRR for a short period of time, but you’re building trust and loyalty with that customer. At least they won’t churn altogether. It’s just a temporary agreement.

2. Offer bundles or discounts

Typically we aren’t fans of discounting, but considering the situation right now, you need to consider everything. Entice customers that are close to churning due to financial or budgeting issues with a discount. They'll appreciate your understanding and will help you maintain that trust for the long-term.

3. Take advantage of the freemium model

Freemium is an acquisition model, not a revenue model. Freemium offers basic services for free and customers can choose to upgrade for additional features at their own pace. Freemium is great for retention because it nurtures the customer. Now, more than ever, nurturing those relationships is key.

Metrics you need to stay on top of:

1. Churn rate

Churn rate is a business metric that calculates the number of customers who leave a product over a given period of time, divided by the total remaining customers.

Churn rate = number of churned customers/total number of customers

Churn rate is important to measure because it directly impacts other metrics. How so? Well, churn is a direct reflection of the value of the product and features that you’re offering to customers. No matter the situation, when you notice an increase in churn rates, it’s time to assess the value of your product and features in addition to pricing. During these turbulent times, you may notice a little more churn than normal, so you may have to temporarily pivot your product and pricing strategies.

2. MRR churn

MRR churn is the monthly erosion of your SaaS monthly recurring revenue. Tracking MRR churn will give your team the chance to improve your product, pivot your marketing strategies, and gain some new momentum. MRR churn is the sum all of all the revenue that was lost in a monthly time frame—which includes either lost from active cancellations or delinquent cancellations. To find MRR churn rate, simply add the sum of your MRR cancellations and the sum of your MRR delinquent for a given month.

3. Retained revenue

Retained revenue measures the change in revenue and customer count of your beginning-of-month existing customer base. So, for example, if you have $100 in MRR at the end of March, in a different world, you would renew $100 in April. However, given the current state of the economy and other external variables, this value is subject to change due to downgrades (or upgrades), and churn.

If you lose more revenue in churn and downgrades than your existing customers are upgrading, then naturally your retained revenue will go down. On the other hand, though, if you bring in more upgraded revenue than you are seeing churn and downgrades, then the number will go up.

4. MRR gain rate

MRR gain rate measures the amount of change in MRR from your existing customer base due to upgrades in a given month. Again, let’s say if you have $100 at the end of March, $100 can be expected to be brought in. However, that $100 can be higher because MRR gain rate reflects the positive shift in revenue due to upgraded customers. Although this number may be unlikely, it’s a good idea to check.

5. MRR loss rate

MRR loss rate measures the amount of change in MRR from your current customer base due to downgrades and churn in a given month. MRR loss rates reflect the negative shift in revenge due to downgraded and churned customers.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.