Data, Launches, Noods, and More

Grace Gagnon May 18 2020

Someone from the ProfitWell crew sent the entire team a link to purchase luxury cucumbers. The internet never disappoints.

Someone from the ProfitWell crew sent the entire team a link to purchase luxury cucumbers. The internet never disappoints.

On that note... In this week's edition of DTC Download, we're breaking down the latest numbers from our index, the hidden benefits of launching during turbulent times, introducing you to PaaS (Pasta as a Service), and so much more.

First up—the index.

1. To launch or not to launch

2. Click and mortar

3. Luxury without labels

4. Send noods

5. Here's what else I'm reading:

How is DTC growth trending over time?

📈7 day +1.43% | 📈30 day +6.22% | 📉90 day -0.84%

d266.jpg?width=600&name=DTC%20Index%2090%20day-20.05.15%20(1).jpg)

Some good news—overall, DTC growth is continuing to trend upward. In April, we saw growth decline, taking its biggest hit toward the middle of the month. However, by the end of April and especially now in May, growth is more promising.

In the past 30 days, we've seen a positive 6.22% change in growth. In the last seven days, change has also been at a positive 1.43%.

How are churn and new revenue trending over time?

MRR Gain -5.53%

8573.jpg?width=600&name=DTC-MRR%20Gain-20.05.18%20(1).jpg)

MRR Loss +2.93%

We see a slight decline with MRR gain. Over the last seven days, MRR gain has been down a negative 5.53%. MRR loss, on the other hand, seems to be improving. MRR loss took a severe hit at the end of March, but by April, it started to recover. And over the last seven days, we've seen a positive 2.93% change in MRR loss.

Be sure to check your subscriber newsletter every Monday morning so that you can kickstart the week with some fresh data on DTC growth.

Know anyone who might also benefit from this data? Send me their email address to grace@profitwell.com and I'll hook them up. Or, they can subscribe directly at index.profitwell.com.

BUSINESS

To launch or not to launch

That is the question. So you've been building a product for quite some time, then a global pandemic strikes—making you question everything. It might feel like tough luck but successful founders argue now might actually be a good time to launch. Take it from Katia Beauchamp, CEO and co-founder of Birchbox.

The beauty subscription box startup Birchbox launched in September 2010 as the unemployment rate peaked at 10 percent. In an article by Inc., Katia said her company experienced the highs and lows, but in the end benefitted from the unfavorable launch timing.

Photo credit/ Birchbox Instagram

Photo credit/ Birchbox Instagram

Beauchamp said the economic downturn facilitated the hiring of, typically expensive, engineering talent. Hiring without money in the bank presented a challenge, but she said offering part-time hours or equity in the business was a good solution.

Twilio, cloud communications platform, also found success after launching in the midst of a financial crisis. It launched November 2008 with only $30,000 in the bank. Inc. reports that after a year of business, co-founder and CEO Jeff Lawson said Twilio booked about $100,000 in revenue. Later the company went on to attract $263.8 million in funding from venture capital firms and now has a market cap of $17.1 billion.

So yes, you can launch a business right now. Some additional advice? Jeff suggests finding a North Star. Identify your core mission and prospective customers. Then determine if you'll be able to serve them. If your product can serve a need right now, then nothing should stop you from launching.

SHOP

Click and mortar

The new shopping experience. Now that brick-and-mortar stores are shuttered, subscription services are filling the void. And our friend Chathri Ali, COO of ReCharge, was featured in this Forbes article confirming that:

"Several high volume brands powered by ReCharge are seeing figures that are double-digit gains and exceeding their Black Friday/Cyber Monday activity."

The TLDR:

-

- Subscription boxes are doing well because they provide an experience customers crave.

- Customer support lines are ringing off the hook with most customers calling simply to say "thanks."

- More subscription companies are adapting to the shift in consumer behavior and need.

- Forbes reports one setback: the subscription learning curve. The one hurdle is educating consumers not yet using subscriptions on the benefits of subscription boxes.

Overall, coronavirus is encouraging consumers to get smart about their buying needs, naturally leading them to subscription. What does this mean for retailers not on the subscription bandwagon? They're gonna have to hop on eventually because according to Forbes, there's never been an easier time to sell subscription.

RETAIL

Luxury without labels

From small businesses to conglomerates like Pepsi, we've seen many brands transition to the direct to consumer model due to COVID-19. While some brands are just hopping on the DTC bandwagon, there's one company setting the bar even higher: Italic.

Italic has been selling DTC luxury goods at cost for a little more than two years. Now, it's introducing Italic Black, an invite-only membership giving members 50% off the already at-cost products. Italic's founder, Jeremy Cai, is calling this "the most ambitious endeavor in modern retail."

The membership is invite-only and capped at a certain number to maintain supply/demand. Existing customers and subscribers can be grandfathered into the membership for $100 a year.

Jeremy said Italic initially intended to be a membership program when it first launched two years ago. "At the last minute, we decided not to because we felt like the product was too sparse, and we didn't want to be known for selling handbags alone. We wanted to be known for selling a lot of quality goods in general," Jeremy said.

Over the past two and a half years, Italic sells way more than handbags alone. Its product offering exceeds 800 items ranging from kitchenware to clothing to accessories. In addition to developing more products, the team also tested out the membership model.

Here's what they found:

-

- On average, member prices are 64% lower than leading brands.

- 93% of new members break even on their first purchase.

- 97% of members recommend the membership to their friends.

- Members save at an average of $746 per year.

How is this possible? Italic can sell products at cost because of its unique business strategy. Italic uses the same manufacturers as high-end labels, Prada, Burberry, and Alexander Wang. The reason why Italic's prices are significantly lower than those brands, though, is because Italic takes the manufacturers on as partners.

"I think because of our unique supply chain we can get a lot more products and categories out than any normal brand would because we're also very asset-light and we don't have to buy our inventory most of the time," Jeremy said.

The ProfitWell crew is big on how pricing can accelerate growth. With that, we usually are not huge fans of discounting. When looking at Italic Black, though, it's a little different. Part of the appeal with Italic Black is that members receive 50% off all items and free shipping. They also have to pay $100 to be minted as a member, which helps Italic level out the associated costs.

Even further than that, Italic Black offers a sense of exclusivity. Jeremy said they cap the number of members. These discounts aren't being thrown at people randomly. It's all calculated beforehand. This membership program will also help in terms of customer lifetime value. If Italic delivers on the value promised, then these members will stay for the long-term, benefitting Italic’s annual recurring revenue.

Since the roll-out of Italic Black, Jeremy said average order values have increased with members, and repeat purchase-rates have skyrocketed. Jeremy said the company is in a weird position with such a large product offering, priced aggressively, but hopes that the product variety will keep customers in it for the long-run.

According to Jeremy, Italic Black is off to a good start, but this cutting-edge strategy is not without risk. Jeremy said,

"The goal for us is not to be losing money on each product sale, but also we're still slightly negative on every product sale."

But, Jeremy said his team offers something that generally no other brand can, which increases the value and minimizes risk. Even though they're slightly negative on product sales at the moment, Jeremy said Italic's customer lifetime value is strengthening.

"I think we're in a unique position because we offer such a large amount of product that the membership alone, 93% of the time, the people who have become members will make the money back in one purchase," Jeremy said.

People commonly refer to Italic as "the Costco model for luxury ecommerce." This comparison isn't wrong, but Jeremy said he's more motivated by Netflix. Blockbuster was Netflix's main competitor in its early days. At first, Netflix seemed like a radical business model. So even though Netflix took less margin per customer to a large degree, Jeremy said Netflix beat out its incumbents with an offer that Blockbuster could not compete with.

The Netflix example applies to Italic (and other business owners) because it proves the power of risk. Testing out a new model, like Italic Black, comes with a certain risk and may not be fruitful at first. Over time though, if the model is robust and it serves a certain value to customers, it will prevail as Netflix did over Blockbuster.

Since the ecommerce space is rapidly growing, leaders need to always be thinking about how they can add a competitive edge to their brand. What offer can we make to customers that will be irresistible? What risks are we willing to take to help us prevail over other brands? These are all questions Jeremy asked himself before rolling out Italic Black because he understands the risk involved, but has confidence that it will positively play out in the end.

While Jeremy calculates the risk-factor and long-term goals for Italic, we are amid a global pandemic. COVID-19 has had its unique impact on Italic, most revolving around the supply chain.

Jeremy said most of Italic's manufacturers' are based in Italy and China, where the virus hit hardest first. Jeremy said,

"In Q1, it was all supply-focused. Our entire supply-chain went offline. And then they recovered very quickly and what hit us harder was actually on the demand side."

Jeremy said Italic has an advantage since people are currently more price and value-sensitive. He said he's not letting the virus stop product development and will continue full steam ahead in terms of marketing.

However, while many companies have pivoted due to the pandemic, Jeremy said introducing Italic Black during COVID-19 was not strategic.

"We're not launching this trying to take advantage of the situation or try to get some cash flow," Jeremy said, "We genuinely believe this is a transformative business model and something that no one's offered before.'

As the DTC model gains traction, Jeremy said it comes as no surprise, arguing that it's the best time possible to shift to ecommerce because companies don't have anything to lose by turning distribution online.

If you're a leader in the DTC space and you have something new in the works—whether it be a new product, new membership program, or an entirely new brand—don't be swayed by this pandemic. Consumers are relying on DTC now more than ever. If you can calculate risk, provide strong product value, and communicate effectively with customers, then there should be nothing holding you back.

If you'd like to participate, email jeremy@italic.com with "Membership" in the subject line.

Product

Send noods

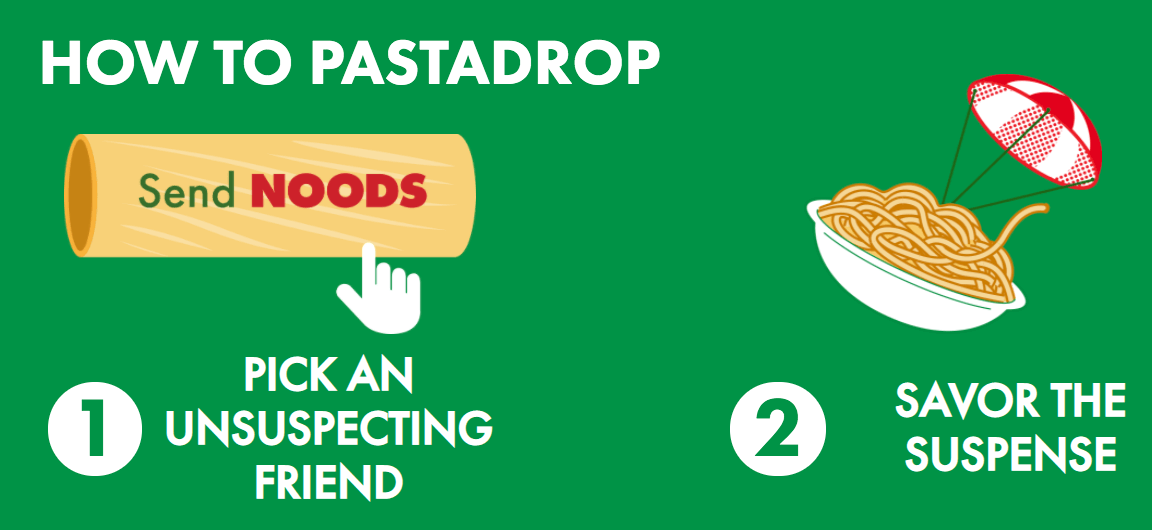

We mean noodles, of course. But seriously, have you heard of PaaS? Here's a new meaning behind the acronym: Pasta as a Service courtesy of PastaDrop, the future of pasta purchasing and sending.

PastaDrop officially launched on Tuesday, May 12. It's an innovative new pasta dispersal method apparently years in the making. PastaDrop makes it easy to gift pasta to your loved ones (or yourself, no judgment).

Noodles by mail? Think of all the pasta-bilities.

LEARN

Here's what else I'm reading:

Adobe's Digital Economy Index

According to this report, U.S. ecommerce jumped 49% in April compared to the baseline period in March. Electronic sales are up 58% and daily online book sales doubled in April. Download the PDF for the findings in full.

Pajama pivot

CNN details a decline in sales for clothing items like pants, but an increased demand for pajamas. To a similar tune, Glossy wrote this piece on how DTC footwear brands are pivoting to slippers.

Just text me

DTC beauty brands are rethinking their communication strategies leading them toward SMS text messaging with customers. Most brands say this strategy shift will be long-term and extend post-coronavirus.

Snacking surge

As Americans crave comfort food, Forbes reports that Frito-Lay launches a DTC site to meet consumer demands. You can avoid the heartbreak of empty shelves at the store and create a Frito-Lay snack pack by visiting snacks.com

Au naturale

The Drum reports P&G and Shopee's "Show Me My Home' aims to make digital transactions more natural for shoppers.The website allows customers to go through their home and shop P&G products specifically by room.

That's all for this week's edition of the DTC Download. For the weekly hook up, straight to your inbox, visit index.profitwell.com to sign up. And, of course, if you have news or ideas you'd like to share, send me a note at grace@profitwell.com

This has been a Recur Studios production—the fastest-growing subscription network out there.

By Grace Gagnon

Content Marketer

7462.jpg?width=1920&name=DTC-MRR%20Loss-20.05.18%20(1).jpg)