Tearing Down Pornhub Premium Pricing: Pornhub Subscriptions = Profit

Patrick Campbell Feb 15 2019

Despite the controversy and often negative connotations to porn, it's one of the Internet's biggest industries for some obvious and not so obvious reasons. Considering its impact on the Internet, though, we thought it'd be prudent to explore how one of the largest companies in the space monetizes its users.

Check out this episode of Pricing Page Teardown to learn how Pornhub's subscription model encapsulates users. (This episode is completely safe for work.)

Quick Disclaimer: While there are plenty of good people who work in adult entertainment with upstanding businesses, there are tangents of this industry that are exploitative and unhealthy. If you get some value out of this episode, we'd encourage you to donate to the Rebecca Bender Initiative or Thorn, as we have done.

Tapping into the AMEX effect and VHS

“The adult entertainment industry has been at the forefront of how companies monetized and they've latched on to the subscription model in addition to the advertisement model.”

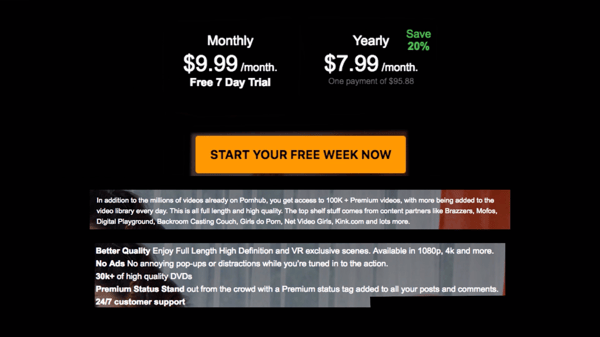

If you were just thrust onto the pricing page with no idea of what site you were on, the Pornhub pricing model looks very similar to Spotify and other consumer content companies. Starting with a free seven-day trial, the base price is $9.99 a month on a monthly basis and $7.99 a month if you prepay for the year. Free trial: check. Annual discount: check.

This makes the yearly subscription price essentially $100, which lowers the friction for potential customers to actually swipe out their credit card.

They call it the AMEX effect. Customers land on this page, see they'll save approximately 20% by going with the yearly package, and get access to a bunch of interesting features that they would otherwise not have access to.

By purchasing the Pornhub Premium Subscription, customers gain access to premium-only content, no ads, better quality and full-length videos, as well as virtual reality (VR). What's super interesting about that is how technology-focused and forward thinking the adult industry is. There's a huge subculture of VR that's dedicated to the industry.

We saw this in the VHS vs. Betamax battle of the 1980s—where the adult industry's adoption of VHS led to its ultimate popularity over Betamax. This just goes to show how much influence the industry has over other markets. There have been stops and starts in the adoption of VR to date, but maybe this will push it into widespread use.

Consumption frequency and age have the biggest impact on WTP

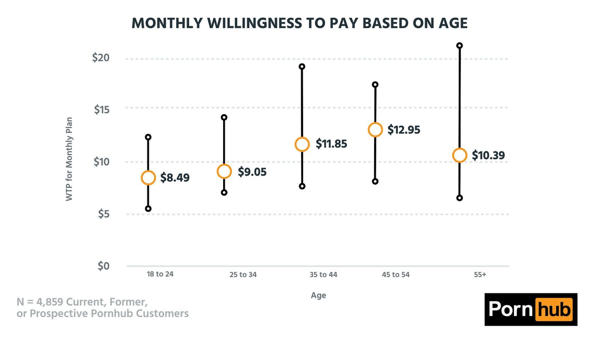

Pornhub is a pretty straightforward example of how willingness to pay changes based on age and frequency. For a consumer product like Pornhub, the younger people are going to have a lower overall willingness to pay even with their objectively higher disposable income.

That said, there's a fair amount of overlap between the different segments, especially when you get to the 35 and above range.

We surveyed 4,859 current, former, or prospective Pornhub customers and found that the 18 to 24 and 25 to 34 age segments come in under the $10.00 mark for monthly willingness to pay at $8.49 and $9.05 respectively. This jumps to just above $10.00 for the 35 to 44 and 45 to 54 segments, showing a higher perceived value in premium services with the willingness to pay ranging between around $7.00 and up to around $20.00.

The average drops off for the 55+ segment, but we're still seeing a big swing—even up to over $20.00 for some respondents. This is definitely in line with what you'd expect when breaking down the data based on age. The younger segments don't really place the same value on premium services as those in the 35+ range. They're more concerned with keeping costs lower.

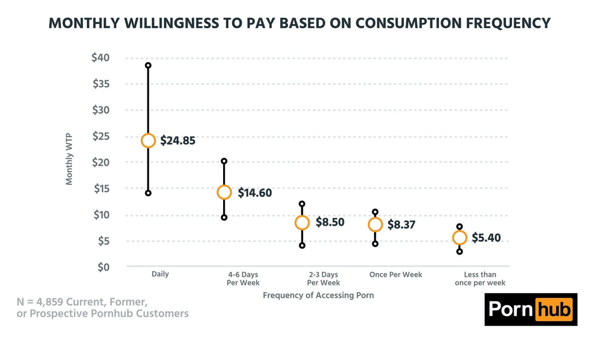

There's a similar story when we take a look at monthly willingness to pay based on consumption frequency. Those customers who are using the product on a more frequent basis are more willing to pay for premium features.

Daily users have a willingness to pay that's more than double what Pornhub currently charges at $24.85. This drops down to $14.60 for customers consuming content between four and six times per week. Where Pornhub is currently pricing their product is for the customers at two to three days and once per week viewing.

This is a textbook example of a volume play. Pornhub is banking on the idea that those customer segments are going to continue to roll in even if there's a bit of a retention issue.

“It's an interesting product problem from a retention perspective. Pornhub should probably be going after their premium users, because they're the people who actually care about it. But they're also thinking about the volume— thinking 'hey, it's okay if we're getting a $100 subscription from someone who might not come back.'”

Where it might make sense to start catering more to the premium focus customer and daily user, Pornhub could offset a lot of that lost revenue through expansion products. Their ability to upsell and add on to existing memberships could alleviate the need for a higher priced premium tier.

Better segmentation could really enhance their pricing tiers

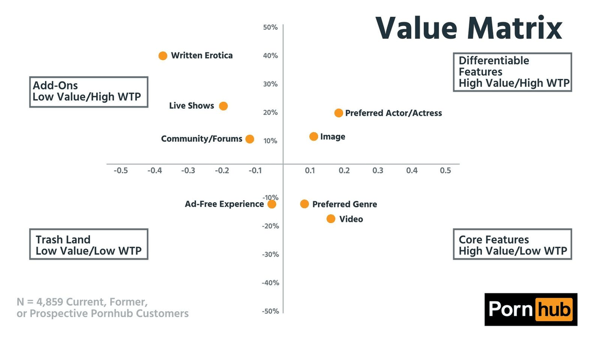

You can see the opportunities for expansion revenue highlighted in the Add-Ons and Differentiable Features section of the following Value Matrix. We took the 4,859 current, former, or prospective Pornhub customers and plotted their willingness to pay against the relative preference for specific features.

We also found some other interesting takeaways in terms of what kind of features are actually valuable for other consumer content companies.

One of Pornhub's premium features is the Ad-Free Experience, which ends up in the Trash Land section of this graph.

“Time and time again, we find this ad-free experience in the lower left-hand quadrant, which is the trash quadrant. It's one of those things where there's not really a premium for it. Pornhub is not necessarily looking at where the value should actually be.”

This is something that we've seen for Spotify and YouTube as well. Customers really aren't valuing that feature at all even though it's the main selling point in a lot of company's premium tiers.

A lot of the Core Features Pornhub offers are spot on, but it gets more interesting in the Differentiable Features and Add-Ons quadrants.

-

Differentiable Features: Customers are more willing to pay for access to high-quality images than we expected. This is indicative of more old-school products, where not as many people are willing to pay for it but those who are will pay more.

-

Add-Ons: Pornhub has done a good job of putting Live Shows into another product, but the Community/Forums are still available for everyone—premium users really only get access to a different kind of badge or avatar.

The most interesting feature we see is Written Erotica, which is boosted way up to a 40% increase in willingness to pay. We attribute some of this to the slant of our data towards men, which make up a vast majority of the respondents to our survey, but it's symptomatic of a larger issue Pornhub is facing in terms of segmentation.

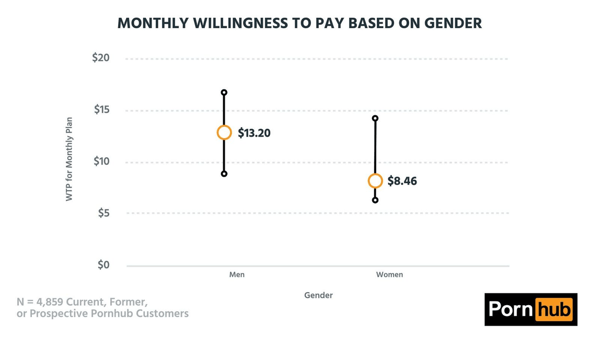

They're not really going after the women's market well at all. When we take a look at the monthly willingness to pay data, women are 50% or so less likely to pay.

There's significant overlap in the ranges we found, but men are averaging $13.20 to women's $8.46. This is likely due to the availability of porn websites that cater directly to women. Pornhub, in addition to making a volume play, doesn't really do much in terms of segmentation and niche content.

We're still seeing ranges that speak to Pornhub's ability to increase their pricing based on willingness to pay. Both men and women are comfortable moving up towards the $15.00 a month mark, with men slightly higher at around $17.00.

There's room to grow but Pornhub definitely knows their target customer

This was a risqué topic for us to tackle, but in most cases Pornhub is doing an excellent job of pricing for the target customer personas. The biggest opportunity comes in terms of segmentation and the women's market.

Peter gives Pornhub a 7.5, stating that the only suggestions he really has are areas of opportunity as opposed to places where the company is making mistakes. I score them a bit lower at 6.3 because I think that they could do a lot more in terms of segmentation.

Pornhub is a pretty big company and by not going after the women's market at all they're missing out on a lot of potential revenue. They could easily niche off and set up a property that addresses these issues directly.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.