Postmark and SendGrid are two of the biggest names in transactional email. Helping make sure your emails arrive on time, every time, the companies process billions of purchase receipts, shipping notifications, and password-reset emails every month.

On the surface, these two services are almost identical. But in this week's Pricing Page Teardown, we look deeper into their positioning to see how each is carving out a part of the market for themselves and what they have to do capitalize on add-on potential to offer more value to their customers—and get more value in return.

Delivering it quickly is all that matters in email

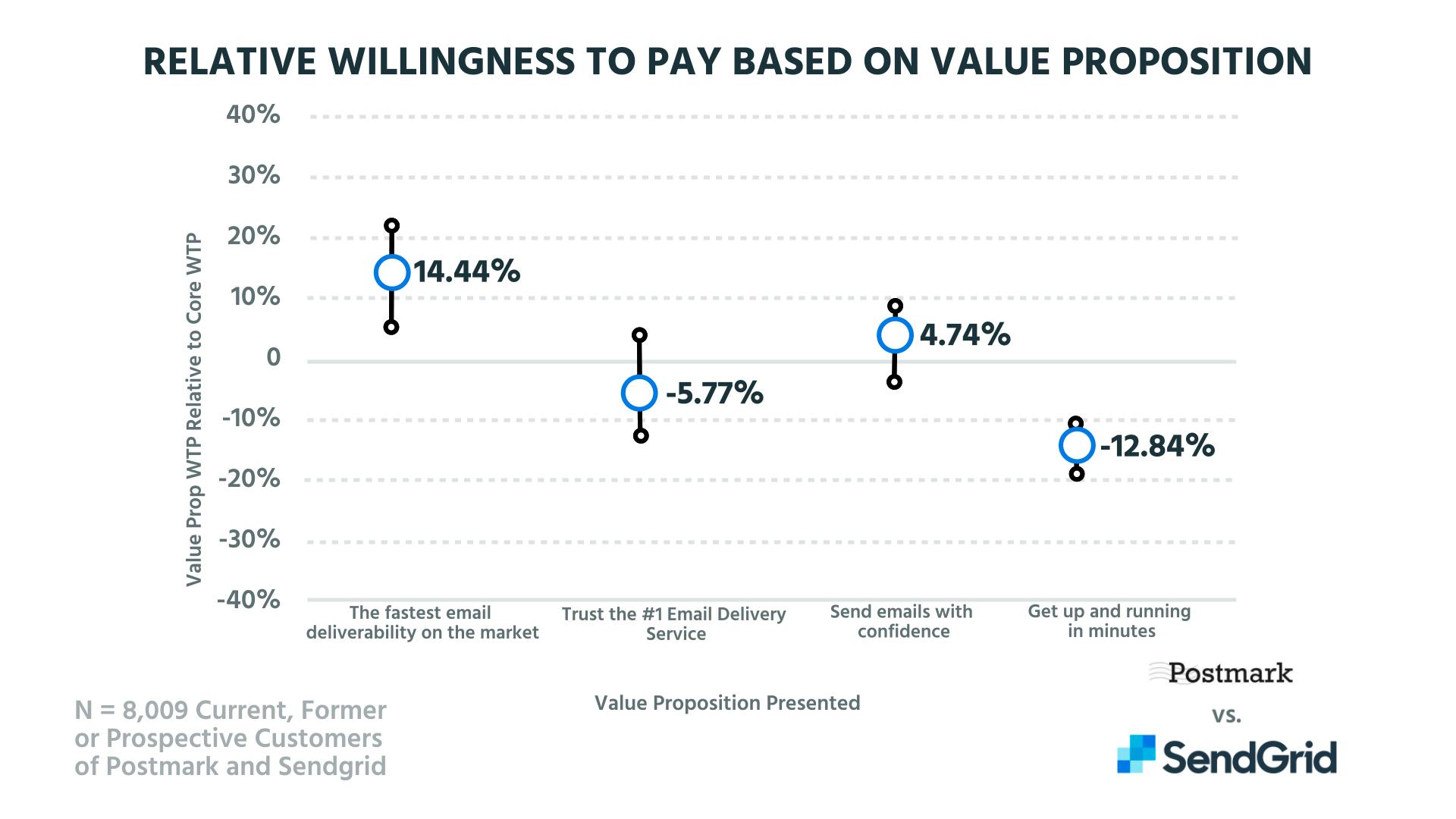

Customers want their transactional email services to be fast. When we asked more than 8,000 Postmark and SendGrid customers what they wanted most, it all came down to deliverability and delivery speed:

Customers had a 14.85% and 19.84% higher willingness to pay for these two features than the median.

Even though other features are important, these two alone are what customers of transactional email services want. The other areas of concern don't even come close to how vital speed is.

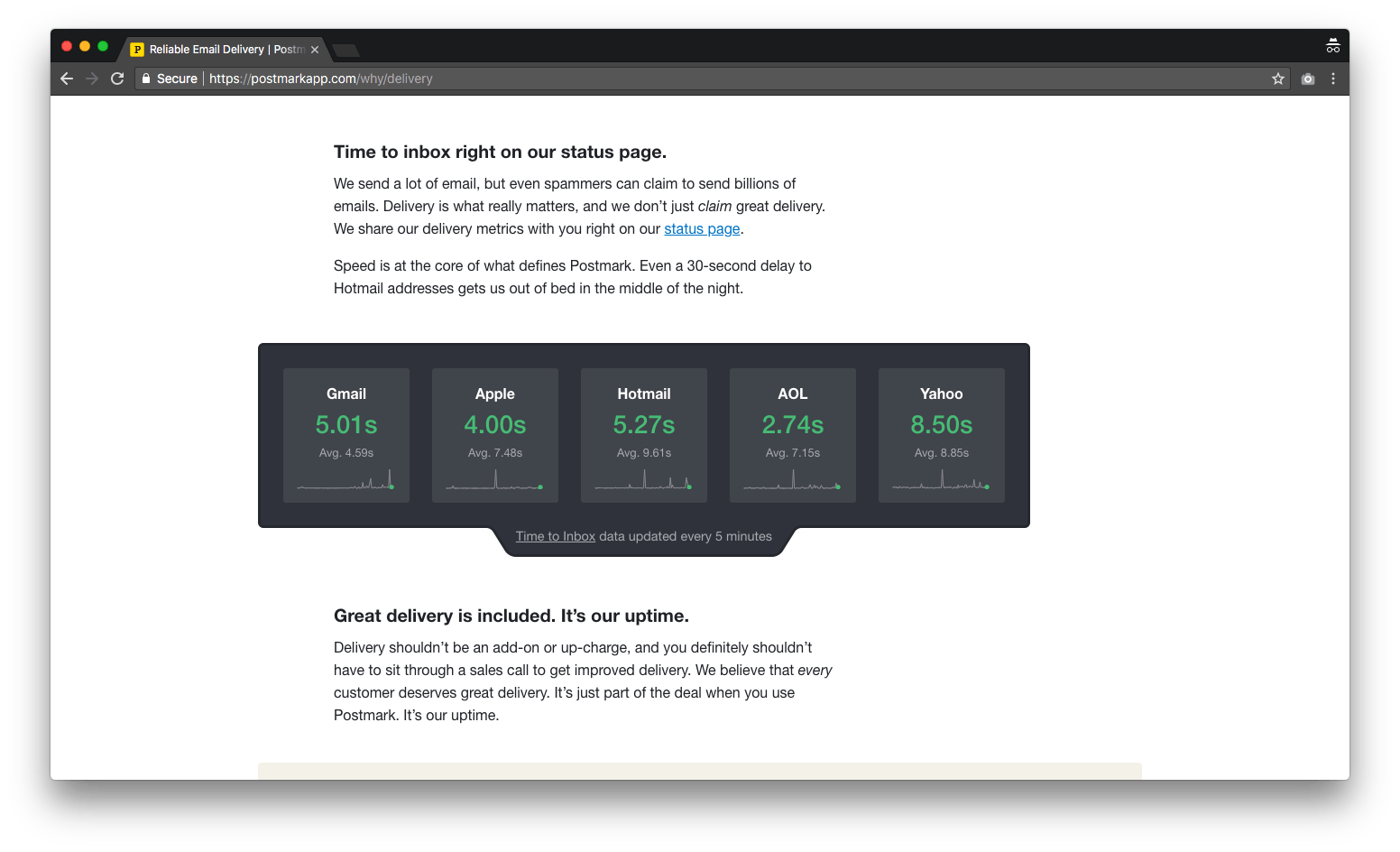

Since that's what people really care about, making those features pop is important. Postmark has really tapped into this. The focus on delivery speed is all over their site, with a free, public, ongoing speed tracker for delivery time to various email services:

They also make clear that they treat any email delivery time of longer than one minute as if their servers were down. They communicate that speed matters to them because they know it matters to their audience.

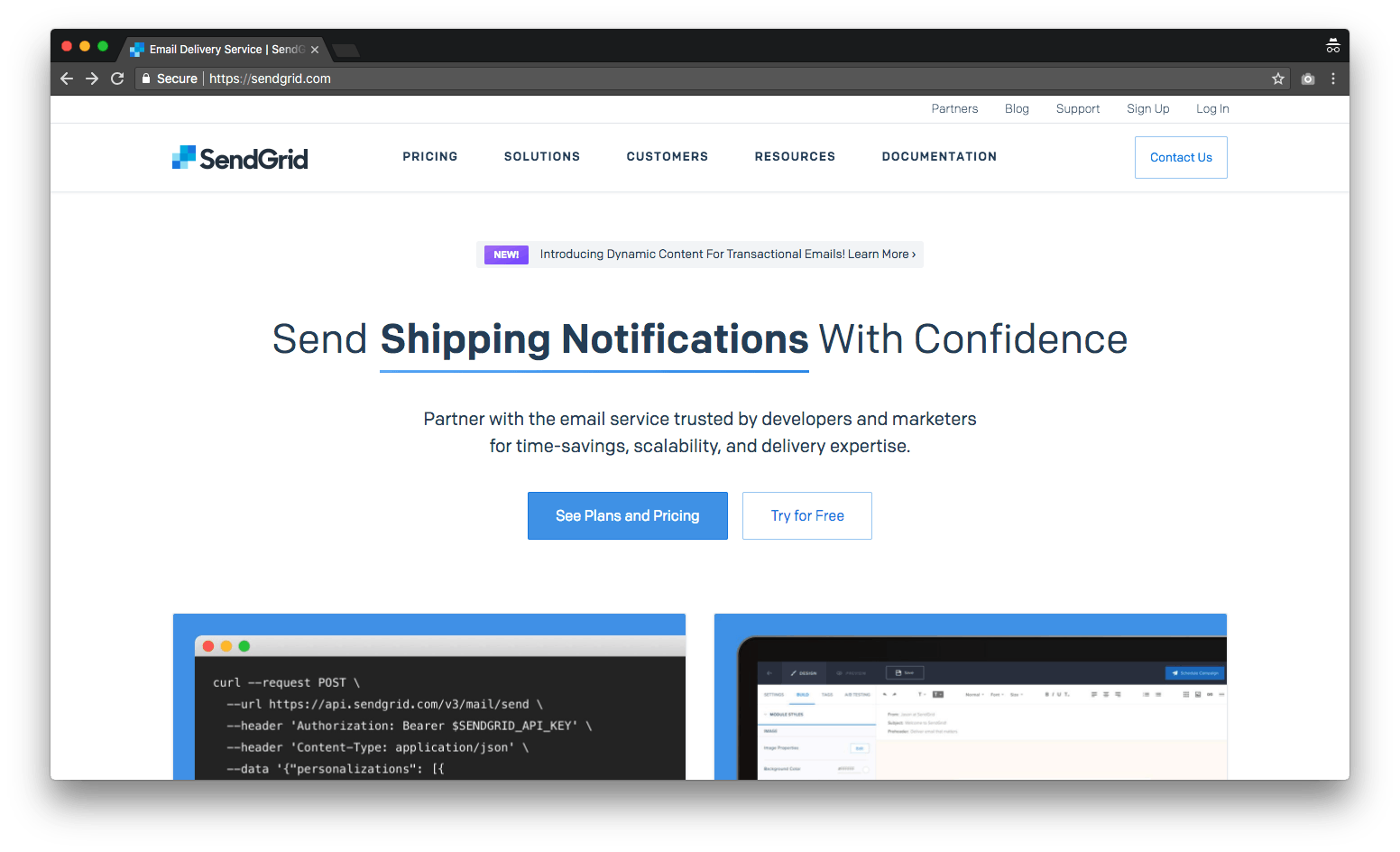

SendGrid is going for the other core feature customers are after: deliverability. But features don't sell—value does. So they have to translate the feature (deliverability) into a value proposition: confidence. Their website language focuses on their being the number one transactional email service and on how reliable they are:

When we slice the willingness-to-pay data by value proposition, we can see that “Send emails with confidence” also has a positive willingness to pay. It also beats out a value prop based on trust:

But it isn't up there with the fast email value proposition. So much of the willingness to pay is based directly on email speed, and that's the cornerstone of Postmark's marketing. It's all over their site, it's all over their advertising pushes, and it's a focus of their research. They know how valuable speed is to their customers, so they lean into it hard.

And Postmark's speed lean includes cultivating a feeling of trustworthiness and reliability based on speed. If you can show that you care about always delivering and always delivering faster than anyone else, that feels reliable, even if Postmark doesn't say it in as many words.

SendGrid, on the other hand, is trying to market based on confidence. And while that is important, and it does have a place on the chart, it's not the biggest draw. SendGrid just isn't getting the acquisition traction off of it that Postmark is getting off of their speed. Postmark is coming across as trustworthy without having to say it, and SendGrid isn't capitalizing on their own high speeds. It's a huge miss not to focus on speed and deliverability.

Expansion through add-ons is where both companies are missing out

These companies are differentiating exactly where the data say they should: dedicated delivery and fast delivery. Postmark really focuses on the lightning-fast email delivery, while SendGrid digs more into the dedicated IP address. They've got their bread-and-butter areas pretty well nailed down, and they seem content to camp there:

But both businesses are missing out on, or at least not fully capitalizing on, the potential expansion revenue of add-ons we see in the upper lefthand box. These are features that users are absolutely willing to pay premiums for, and neither site is really pushing those features on its websites when it could be.

Spam filtration alone is a hugely vital “gotta have it” feature that businesses are clearly willing to pay for at a premium. Which makes sense because, even with transactional email, spam can become a serious issue. But you won't find either brand really pushing that aspect of their services. It's such a small additional feature that could have a huge financial impact for both brands.

Enterprise is where you grow in a crowded market

In a commoditized market, value propositioning and positioning are vital. And while both of these companies are in the same space, they have different pricing strategies and different goals.

Postmark is working on a friendly, accessible style of marketing that is attractive to smaller businesses. Because of this, Postmark is a winner on branding and likability. Their website is more fun, it is easier to navigate if you know nothing about this space, and it is a great place for small businesses to break into a transactional email service. It's offering you exactly what you want, in an understandable format, for a good price.

But companies in commoditized markets are going to find the most growth potential in the enterprise space, and SendGrid is pushing for that direction. SendGrid is taking a more enterprise-focused approach, which is evident in their tier-based pricing system. They aren't trying to be the everyman of transactional email brands. SendGrid wants big businesses. SendGrid feels like it will have the best long-term growth; it feels growth ready.