Choosing a product pricing strategy is a momentous decision for any young SaaS company. Not only does it define your early monetization strategy, but it also heavily influences what market segments you’re likely to appeal to directly and how your product will be perceived.

Of course, the better your product is, the more people it’s likely to appeal to. So how do you go about brewing up a product pricing strategy that doesn’t restrict your product’s appeal? How can you chase those affluent, upper-market segments without making yourself off-limits to those lower on the willingness-to-pay chain?

One way to do that is through price skimming. It’s a demanding approach and one that isn’t for every company. But if you learn how price skimming works and execute it right, it can give you an unparalleled competitive advantage, help you increase your customer base and market share, as well as give a huge boost both in revenue and in the esteem in which your product and company are held.

What Is Price Skimming?

Price skimming involves initially charging the highest price your market will accept for your product, then lowering it over time. The logic behind the skimming pricing strategy is that you attempt to “skim” off the top market segment to which you appeal, at the time when your product is freshest, thereby maximizing your profit margins early on. This method targets early adopters and does not target the mass market.

How Does Price Skimming Work?

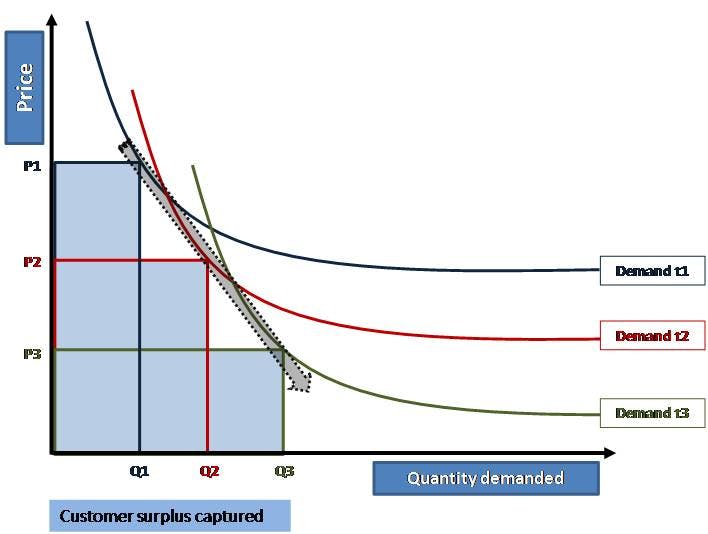

Customers known as early adopters will pay steeper prices for a cutting-edge product if it’s marketed as a “must-have”, whether the price accurately reflects the value or not. Eventually, prices are lowered to follow the product demand curve and attract more price-sensitive customers. Theoretically, as each customer segment is “skimmed” off the top, a company can capture some consumer surplus by charging the maximum price each segment is willing to pay.

Price Skimming Examples

Price skimming examples are mostly seen among tech giants, like Apple, Samsung, Sony, and other companies that develop new technologies that they know are high in demand. But despite the self-evident charms of price skimming as a dynamic pricing model, you’ll need a number of factors in place for it to be truly effective. Let’s take a look at some examples of price skimming that demonstrate what contexts are ideal for this pricing strategy.

The latest iPhone

This might not strictly be SaaS, but Apple’s approach to product pricing epitomizes price skimming in a way that almost anyone will recognize. With each new product offering, Apple’s prices for newly released products seem to be so high that they’re almost dissuasive — and yet, there are always queues outside Apple stores on iPhone release days.

That’s because Apple ticks all the boxes necessary for price skimming to work, including the following:

- It has a huge number of loyal customers who already see the brand as immensely credible and attractive.

- It does not have immediate competition that’s able to undercut them.

- It uses high pricing to signal the higher quality of its new product, a perception reinforced by the rest of its product array ( the components of which are all at various later stages of the skimming cycle).

- Its expected sales volume is so high, as is its speed of developing new products, that lowering prices throughout the skimming cycle will have little to no effect on its overall sales volume.

- Unit costs are not particularly an issue for a company the size of Apple.

As a result, Apple is perfectly placed to exploit the benefits of price skimming to the fullest. The company’s command of so many successful product launches and its corresponding price-skimming strategy is aspirational for any technology company.

Salesforce

Salesforce was one of the key proponents of the price-skimming philosophy in SaaS. The company provoked an entire paradigm shift in the SaaS industry to power its pricing strategy. Salesforce was the first company of its kind to make its CRM available at all times through the cloud. The radical nature of its cloud product made Salesforce a prime example of a company whose tech justified a price-skimming strategy.

The upper tiers of its market—which, in B2B SaaS terms, means enterprise-level deals with large companies—enabled Salesforce to make a tremendous amount of revenue quickly. Later on, it was able to scale down to accommodate smaller businesses that also clamored to use the cutting-edge CRM. Even now that CRMs are more normalized in the market, few companies have employed skimming in the wake of Salesforce’s successful strategy.

Advantages of Price Skimming

1. Higher Return on Investment

Charging the highest initial price during the launch of an innovative product, particularly in high-tech industries, can help your company recoup research and development costs as well as promotional expenses. Companies like Apple benefit from high short-term profits during a product’s introduction, and the initial higher prices are justified by the technological breakthroughs they achieve.

The bottom line is, if you invested all of your cash flow and resources into the development of a gadget or service no competitor can match, then you should be able to charge higher prices during the launch to recover the bulk of your investment and hopefully fund further developments.

2. It Helps Create and Maintain Your Brand Image

Price skimming can also create the perception that a product is a high-quality “must-have” for those early adopters who can’t live without the latest tech products. Higher prices at the beginning of a product’s life cycle enable you to build a prestigious brand image that actually attracts status-conscious consumers. In addition, you’ll have the breathing room you need to lower prices as competitors enter the market. In some cases, a lower starting price, in the beginning, can also increase customer price sensitivity, making it impossible to raise rates in the future without losing sales.

3. It Segments the Market

As discussed before, price skimming is an effective way to segment your customer base, potentially allowing you to earn the greatest possible profits from different types of customers as you reduce the price. Starting with a higher price won’t deter your early adopters, and as you lower the price over time, you’ll attract more price-sensitive consumers. If you alter product pricing based on the product demand curve and the maximum price the customers are willing to pay, you can capture some of that consumer surplus and rake in more revenue.

4. Early Adopters Help Test New Products

One benefit of early adopter customers is they act as guinea pigs for new products. Those status-conscious consumers that purchase your innovative product first can provide valuable feedback and help you work out the kinks before the next update and foreseeably a wider user base. In addition to being valuable testers, early adopters who love your product can act as brand evangelists that create a perception of quality via word of mouth. This free promotion will persuade new customers to buy the product when the price drops.

photo credit: x-ray delta one

Disadvantages of Price Skimming

1. It Only Works if Your Demand Curve is Inelastic

Price skimming might be a viable tactic for Apple, but that’s because the quantity demanded doesn’t rise and fall dramatically when the prices change. If the demand curve for your product is generally elastic, meaning price changes have a greater effect on product demand, then initial high prices could really hurt your sales volume. The goal of any company is to make a product as inelastic as possible, but not everyone is selling tech products or services that are ingenious enough to appear indispensable to consumers.

2. It’s Not a Great Strategy in a Crowded Market

In any industry, it is crucial to assess customer valuations and analyze the competition (and their market share) before setting your prices. If you already have a lot of competitors, then chances are your demand curve is fairly elastic, and high prices during your product launch will send customers running in the other direction. Price skimming is not a viable strategy in an already busy market. Unless your product includes amazing new features no one can match, it might be a good idea to avoid skimming if you want to maintain a competitive advantage.

photo credit: pangalactic gargleblaster and the heart of gold

3. Price Skimming Attracts Competitors

Maybe your product is groundbreaking enough that it will create a new market, but as shown by the introductions of the iPhone and the iPad, competitors like Samsung and Microsoft are lurking just around the corner. The success of high prices at the beginning of a new product’s life cycle will intrigue competitors to enter the market, and the inelasticity of a demand curve is almost always reduced over time due to the introduction of viable substitutes. Skimming pricing can also slow the rate of adoption by your potential customers, giving the competition more time to imitate and improve upon your product before you’ve capitalized on the demand for the innovation.

4. It Can Infuriate Your Early Adopters

Remember those brand evangelists that bought your product first? They can just as easily trigger your worst PR nightmare. If prices drop too much or too soon after the initial product launch, your early adopters will feel like they got the short end of the stick. Apple experienced this type of backlash in 2007 when the company reduced the price of the iPhone by $200 just two months after its introduction. The quick 33% price drop from $599 to $399 may have helped increase demand, but some of the phone’s early adopters were understandably upset.

To ensure the customers at the top of your demand curve don’t feel cheated, it’s important to use price skimming consistently and avoid hurried or blatantly obvious reductions in price. Price skimming can also be considered price discrimination, which is the strategy of selling the same product at different prices to different groups of consumers. In some cases, this strategy is against the law, but the actual conditions that define illegal price discrimination are shady, to say the least. For more on the ethical issues of price discrimination, check out our post on pricing strategy ethics.

When Should You Use A Price-Skimming Strategy?

As established above, price skimming is most effective when your company can rely on the context around product launches being in your favor. While some of the most illustrious examples of successful price skimming are hardware as opposed to SaaS, the technology adoption life cycle still makes it a more than viable pricing strategy for SaaS companies. This is particularly true for those SaaS companies whose primary market targets are in the high-end, and who tend to cut enterprise-grade deals.

Having the latest technology holds powerful social currency. If your product can generate strong word of mouth, these early adopters can not only bring in plenty of revenue for you but also become a key source of recurring revenue.

When You Shouldn’t Use A Price Skimming

If your product boasts immediate competition, or if you have a product that isn’t appealing to the higher echelons of the market, then price skimming can prove to be an expensive waste. Likewise, if your product is not sufficiently unique to power a word-of-mouth reaction, then you may not feel all the benefits of a skimming strategy. Finally, resorting to price changes will not yield any results if we are talking about an inelastic demand curve.

Without high quality and brand image, price skimming can impede your progress more than it can help. Incorporate skimming into your pricing strategy only when you have enough repeat buyers to generate dependable word of mouth and assurance that you can’t be easily undercut.

Price Skimming FAQs

What are the most common examples of price skimming?

Some of the most widely known price skimming examples include electronic brands that rely on this strategy during the product launch phase. Their marketing strategies are often directed towards advertising new product functionalities and count on consumers willing to pay a higher price for a sense of exclusivity.

What brands use a price skimming strategy?

Price skimming is a common strategy among tech giants like Apple, Sony Playstation, Samsung, etc. It is also utilized by apparel brands like Nike, Adidas, and others who want to leverage high consumer demand for new products they release.

What is the difference between price skimming vs. penetration pricing?

Both price skimming and penetration pricing are dynamic pricing strategies. However, while price skimming sets high initial prices to target consumers willing to spend more on the latest product, penetration pricing initially relies on low prices to grow their customer base.