Buyer personas with alliterative names and vague attributes don't cut it anymore. Quantifying your personas is the key to understanding and cloning your best customers.

"Know thy customer" might just be the first commandment of enlightened startups worldwide.

The words have been featured on bumper stickers and t-shirts, motivated thousands of blog posts, and become something of a mantra for founders. Yet, for all of our purported devotion to customer-knowledge, the majority of subscription businesses have little more than a surface-level idea of who their customers really are. Even worse, they're not putting real effort into finding out.

Why Quantify Your Qualitative Buyer Personas

About ninety-nine out of one hundred companies we've talked to are unable to describe their buyer personas beyond a few generalities.

Without data-driven buyer personas, companies cannot succeed in the subscription market. The 1% of companies that have drilled down their buyer personas using data are what we call “LTV Beasts.” They're crazy efficient and crazy profitable. Quantified buyer personas allow you to take real action in your pricing strategy, making the constant improvements necessary to your pricing to massively increase your revenue.

Too many companies develop buyer personas like these and leave it there:

These graphics make companies think they have succeeded in building well-rounded, three-dimensional buyer personas. But if your buyer personas consist only of some vague adjectives and nice photos, they're only good for decoration.

Buyer personas such as these don’t have any actionable data associated with them. It’s not clear what features of a product each would find most valuable, or least valuable, or what they would be willing to pay for them. There is no way to calculate the unit economics of these supposed ideal customers. Nor can you work out where they sit in the company, whether they are key decision makers, or who they report to.

All this key information is missing. Without it, you're reduced to “guess and check” marketing and development.

The Parts of a Quantified Buyer Persona

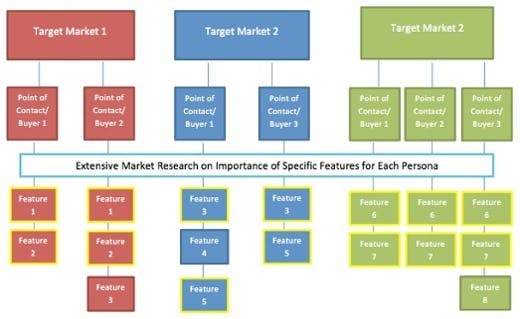

Qualitative buyer personas take your target market and break it down by point of contact. Then, they describe the point of contact with different features, like what their needs are, what their budget is and more.

The problem is that these conclusions are drawn from anecdotes and gut impressions instead of extensive market research and internal data collected from existing customers. By taking a data-heavy approach, you'll create buyer personas grounded in actionable information that fully describes who they are, what they want, and how much they’ll pay. Each of those pieces of information is key to constructing a valuable quantified buyer persona. You can see an example below.

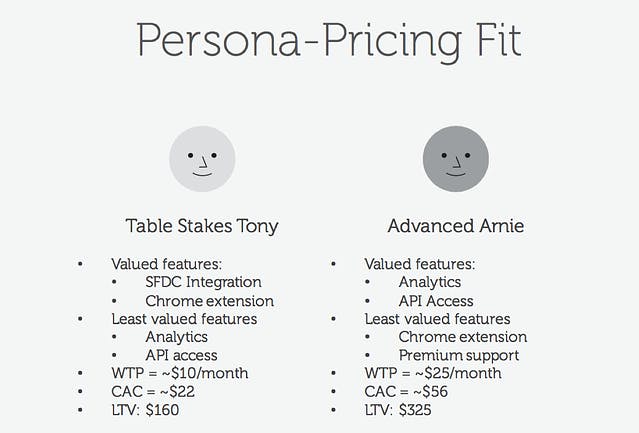

Gone are the adjectives (and unfortunately the sharp photos). They've been replaced by actionable data: valued features, willingness to pay, and unit economics.

This is what your buyer personas should really look like. Sure, you can enhance them with photos, and it is important to add demographic info to make them into more lifelike people. But the real characteristics that matter are the ones that are based on data.

You need to know:

- How to identify your highest-value customers so you can position effectively

- What are the valued features of your packaging that different subsets of customers really want?

- What are these types of customers willing to pay for the right product for them?

- Are the unit economics, such as customer acquisition cost, of these customers profitable for your company?

For each of your buyer personas, you'll need to have this data and keep it updated as you change your product and company.

Here’s are the steps to make this happen.

Break Down Your Customer Down into 3-5 Identifiable People

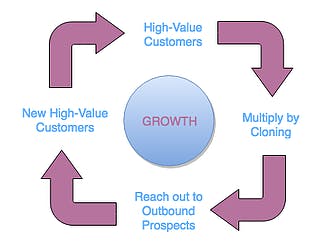

To grow your subscription business, you need to find more of your highest value customers. Cloning these customers acts as a bedrock for the rest of your growth. These are the customers that will drive your company forward and provide the foundation for everything else that you do.

You clone your customers by finding out as much information as possible about them, then reaching out to similar people or organizations through your outbound sales process. Yet, you can’t do this if you have no idea who your customers are in the first place. Collecting as much detail as possible about them is crucial to segmenting and replicating them. Once you have that, you can position your product to appeal to each of these buyer personas.

This helps everyone on your team nail down their audience. Product knows who they're designing for, marketing knows who they're talking to, and sales knows the best leads. Information about your customers from these teams feeds back, letting you can continually optimize your personas to target the highest-value customers.

Getting The Data On Your Best Customers

The first part of building buyer personas is to tease apart the amorphous idea of a “customer” into 3-5 identifiable people. You need to find out who these people are in real life:

- What industries are they in?

- What is the size of their company?

- What is their role within their company?

These are the building blocks that you need to start profiling customers. You probably already have this data about your current customers. By identifying your best customers and working backwards, you can find which buyer personas are currently your customers and which ones you still want to obtain.

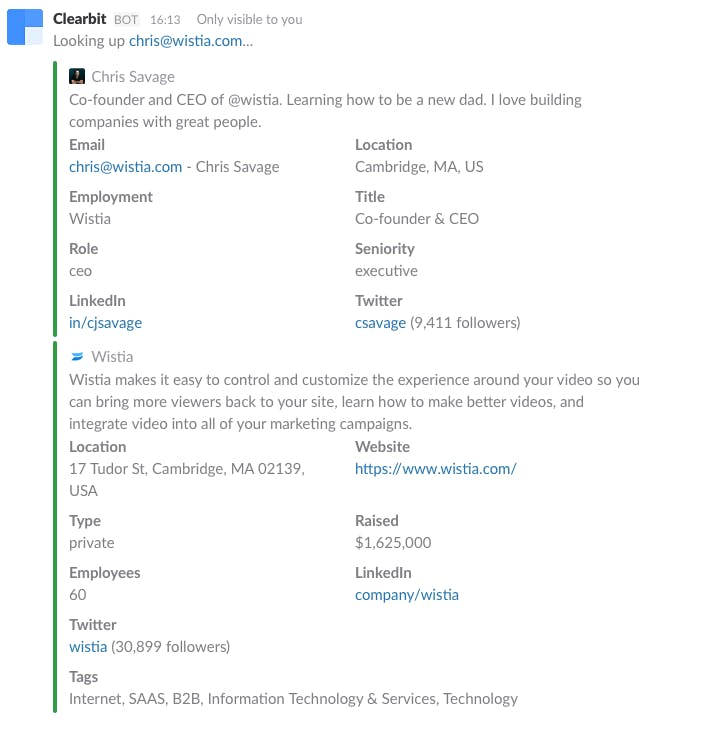

To get this information, you can look at your current customers and build profiles from there. If you’re using a free metrics tool like ProfitWell, you can pull up the payment information for each of your customers and sort by monthly recurring revenue (MRR). If you don’t already have solid demographic information on these customers from conversations or signup questionnaires, you can enrich their data with services such as Clearbit.

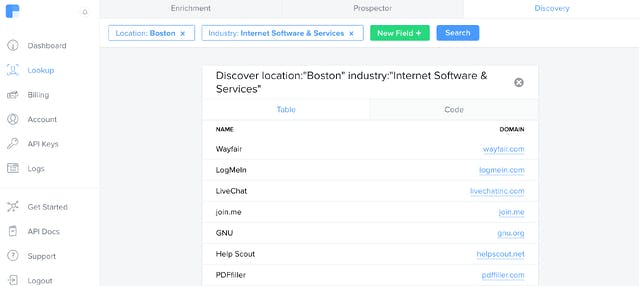

You can run new signups through Clearbit’s Enrichment API to find out more information. For instance, if Chris Savage from Wistia was one of your early sign ups, you could run his email address through the service to find out more about him and Wistia:

(Source: Clearbit Slack integration)

From this you know the answer to the three questions above:

- What industries are they in? Internet generally, B2B video marketing specifically.

- What is the size of their company? 60 employees.

- What is their role within their company? CEO.

If you do this for all current customers, you can segment them along this axis, finding the types of people and companies that are already finding value in your service and bootstrapping off those. From there you can use the Discovery API from Clearbit to find other companies with similar profiles:

In this case, these are other internet companies in the Boston area, but you could look for company size, or more specific tags. Then you can use the Prospector API to find the right contacts to reach out to in each company.

You want this contact information because the real value in buyer personas comes in talking to these customers, either current or potential. Your next step is to reach out and start asking questions about what customers in each persona want and how much they’ll pay.

Understand What Your Customers Value

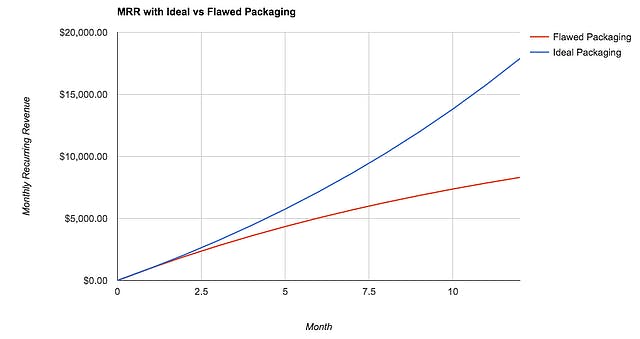

When customers don’t find value, they churn. When they do find value, they grow and upgrade. Therefore, presenting value in the right packaging for the right customers is vital for revenue:

In the graph above, we’ve shown a scenario that demonstrates what can happen with incorrect packaging fit. Ideal packaging represents features optimally aligned with what each buyer persona values most. Flawed packaging occurs when the features in each tier are mixed and don’t correspond to what specific customer profiles want.

A valid assumption is that flawed packaging will lead to high churn (10%) and low upsell to a second $200 tier (3%). Even with 10 new customers joining a $100 plan each month, growth will eventually plateau then start to fall.

Ideal packaging can reverse these numbers, leading to low churn (3%) and high upsell (10%). With the same 10 new customers joining the $100 plan each month the difference quickly becomes obvious. With fewer customers leaving and more upgrading their plans, the growth curve starts to bend the other way, with more and more revenue each month.

Even if it doesn’t entirely reverse the trend, better packaging will always lead to higher upsell and lower churn.

To package your features effectively on your pricing page you need to know what each buyer persona values most. Then you can target these customers' pain points directly within each of your tiers, and display solutions effectively. Finding what features customers really want also ties back into your product development, allowing you to prioritize your roadmap around customer value.

The Challenge Of Finding What Your Customers Value

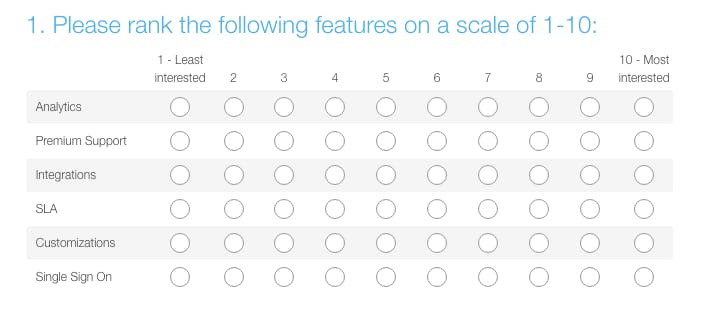

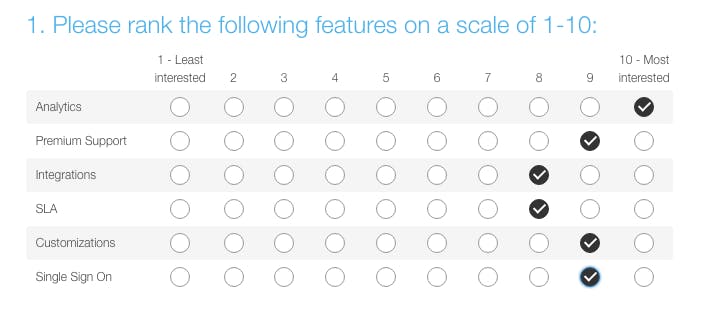

You should never ask people to rank features on a scale. You won’t get any differentiation. Yet, the most commonly used method to determine feature value is to ask people on a 1-10 scale which features they would like to see most in your product:

People will rank features they really want as a 10, the features they are kind of interested in as 9, and the ones they don’t care about as 8:

People say they want everything, and it will be impossible to really separate out what they truly care about and what they really value.

To do that you need to use relative preference analysis. This is a statistical method that you can use to measure value in your product. These questions simply ask people what they most want and least want out of all the options. It forces people to make a decision:

![Question: In terms of [company] pricing, which of the following when it comes to pricing is most preferred? Least preferred? Answer options: Most preferred, Least preferred.](jpg/ngqyzdk0ywitotzmys00zwfkltk1nzetowqzzgjlmmzhy2jm_a6b8a925-8d76-485e-bdd6-33b25d952154_customersurveyexample3cc5a.jpg?auto=format%2Ccompress&fit=max&w=1920)

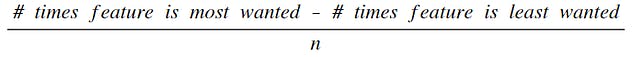

This is like asking “What is the one thing you couldn’t live without and the one thing you could live without?” to your customers. Once you’ve asked enough people, you can calculate a score for each feature using:

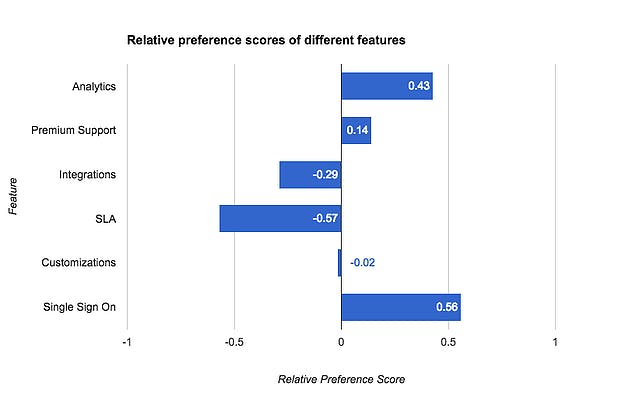

Plotting these scores shows you exactly what features your customers are after, and which they can live without:

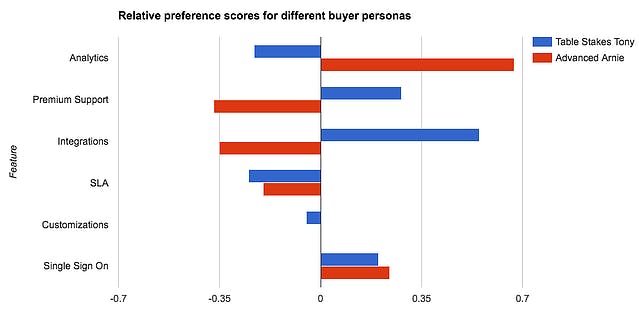

Once you have this information, you can break it down by different personas. Using the examples from above, a relative preference graph for Table Stakes Tony and Advanced Arnie would look like this:

It’s at this point that a picture starts to emerge from your packaging. If one buyer persona cares more about analytics and another about integrations, then you have a natural delineation for your packages. You shouldn’t just stop at the large features; you can break it down into components:

- What type of analytics do the Arnies want?

- What is the best integration for Tony?

You can then go back to these customers and ask more questions, finding out where the value really lies within your product and your company in the minds of your customers. Never be afraid to talk to your customers. They are the ones that know what they value and what they’ll pay for it.

Your Customers' Willingness To Pay

It’s useless to build a product if no one is willing to pay the price you charge for it. Equally useless is setting your pricing too low and losing revenue. Finding the optimal point to set your pricing allows both you and your customers to derive the highest value from the relationship.

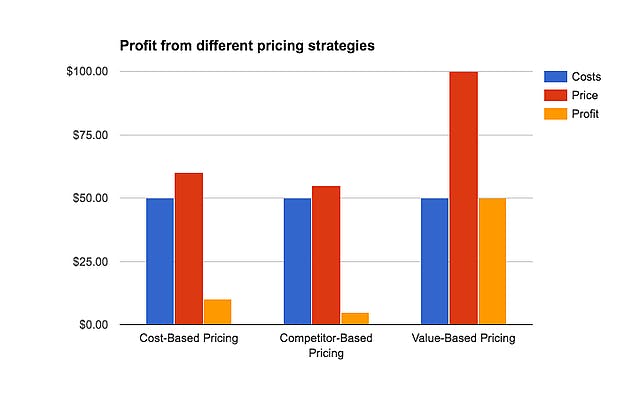

Finding this sweet spot is the foundation of value-based pricing, a far stronger method than either cost-based or competition-based pricing.

With cost-based pricing, you are only taking your own internal costs into account and adding a margin. It’s entirely inwardly focused and doesn’t represent what any of your customers think or feel.

- Here, a 20% profit margin is added on top of costs, leading to a $10 profit per customer.

Competitor-based pricing is equally flawed and through a race-to-the-bottom, can lead to even lower margins. This method makes your prices dependent on other businesses in your industry. It ignores the fact that you should be offering a better product with different value than they are.

- In this scenario pressure from competitor prices only leads to a 10% margin, and a $5 profit per customer.

Value-based pricing takes into account what value you offer and what each of your buyer personas is willing to pay for that value. It's a pricing strategy unique to your company and therefore returns the maximum value for your product and customers.

- With this pricing, the customer sees $100 of value in the product, leading to 100% margin and $50 profit per customer. 5X cost-based pricing, and 10X competitor-based pricing.

You are driving people to your pricing page so you have to know the price they are looking for before they get there.

Discovering What Your Customers Are Willing To Pay

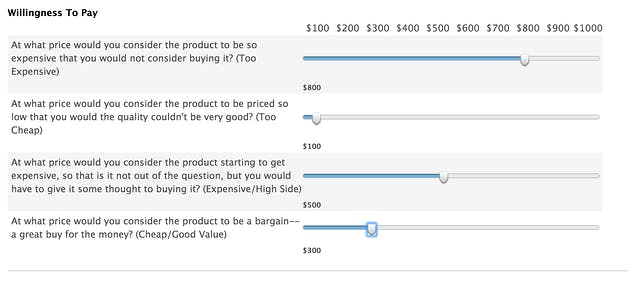

People aren’t very good at thinking about specific price points. They won’t be able to tell you if your product is worth $99/month or $79/month. This is the understanding behind Van Westendorp’s Price Sensitivity Meter developed to determine the pricing landscape for a product. It relies on 4 questions:

- At what price would you consider the product to be so expensive that you would not consider buying it? (Too expensive)

- At what price would you consider the product to be priced so low that you would feel the quality couldn’t be very good? (Too cheap)

- At what price would you consider the product starting to get expensive, so that it is not out of the question, but you would have to give some thought to buying it? (Expensive/High Side)

- At what price would you consider the product to be a bargain—a great buy for the money? (Cheap/Good Value)

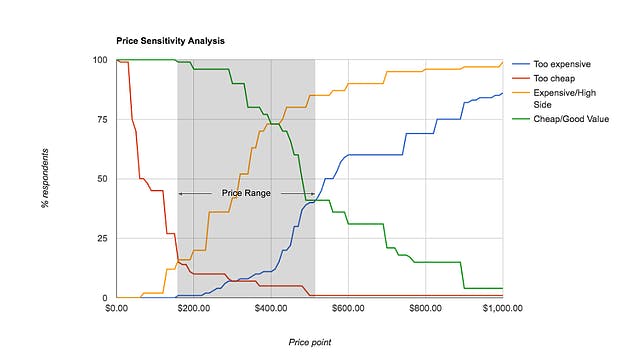

By surveying current and prospective customers with these questions, you can plot the cumulative frequencies for each of these categories:

The optimal price here lays in that middle price range. You want your pricing to be within that center mass where customers find value from your product, don’t consider it too cheap, but still consider it a good deal. Just as with feature analysis, you can then break these numbers down by buyer personas, finding the optimum price point for each potential customer.

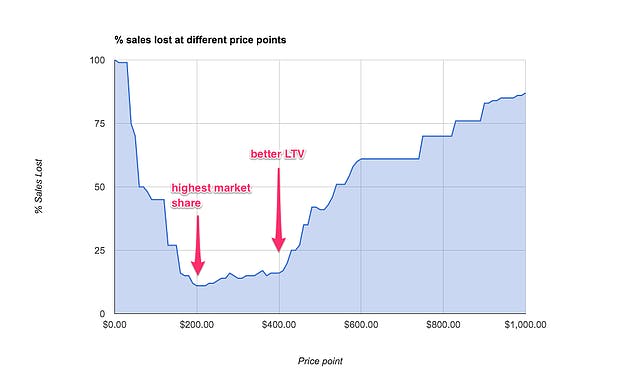

From this data, you can also plot price elasticity to determine where the optimum market share is found:

The highest share of the market is found in the trough at the bottom. This is the price point where the maximum percentage of sales can be found. If you want to capture the bulk of the market, this is where you should set your prices.

However, using this data, you can also see other pricing points that may return higher profits. In this scenario, shifting the price point higher, from $200 to around $400 sacrifices barely any market, but for potentially far better LTV per customer.

This can be seen by plotting out potential MRRs for each price point:

Here, we’re looking at the maximum revenue we could get at each price point from 100 potential customers. If at $200 we have 89% of the market, 89 potential customers, then MRR is $17,800. However, at a price point of $400 we still have 84% of the market, so we can get an MRR of $33,600, an increase of 1.8x even with a smaller share of the market.

Using this data, your pricing committee can see that the sweet spot is at $400, where you can capture plenty of the market but with a higher LTV.

How Much Your Customers Cost

It’s obviously great to have high-value customers, but without knowing how much it’s going to cost to acquire them, you can’t know if the underlying unit economics of your pricing strategy are sound.

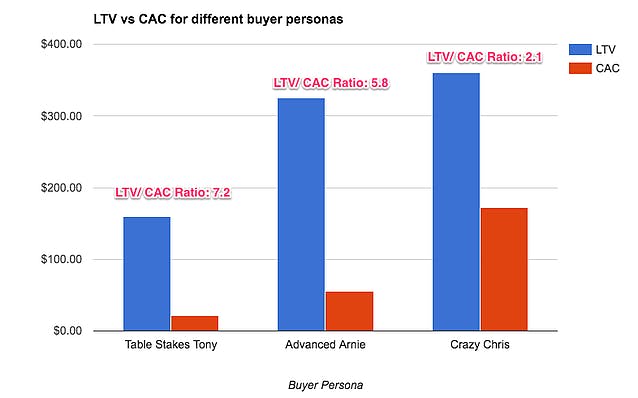

Calculating the customer acquisition cost (CAC) for each of your buyer personas brings together all aspects of your pricing:

- CAC will show whether you have positioned your company towards realistic customers you can afford.

- It shows you whether the packages and personas you have put together are viable.

- Calculating CAC allows you to align your funnel so your marketing department can acquire the right leads through the right channels for each persona.

If we go back to the buyer personas from the initial Pricing-Persona Fit data, we can see why this is so important:

For ideal growth, your lifetime value (LTV): CAC ratio should be over 3:1. Luckily, it is for both Table Stakes Tony and Advanced Arnie. You will get significantly more value from these customers than it cost to acquire them. They add to your growth engine.

But if we imagine another buyer persona, Crazy Chris, we can see this isn’t always true. Crazy Chris could have a higher willingness to pay and therefore higher LTV, but he also has a higher CAC. It costs to acquire Crazy Chris. With an LTV:CAC ratio of just 2.1:1, Chris is going to be slowing down the growth of your company, and therefore you would need to decide whether this was a customer worth pursuing.

This is the final piece on the puzzle of your buyer personas. If you’ve got high-value, low-cost customers, you’ve got outrageous growth.

Calculating Your Buyer Persona CAC

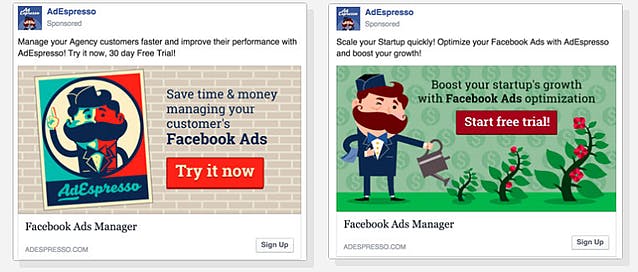

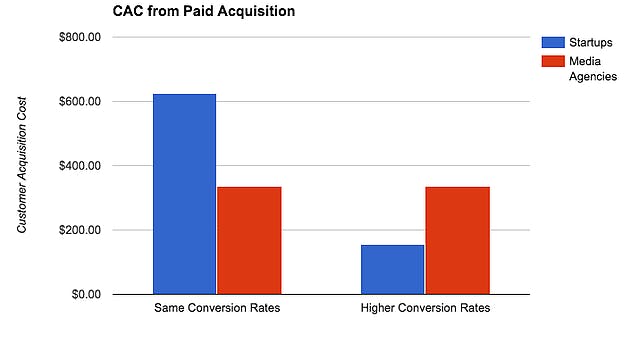

You can calculate your customer acquisition cost (CAC) for each persona using this formula:

When you are initially developing your buyer personas, this is difficult to do. You probably won’t have reliable data of sales and marketing costs, and the number of customers acquired might be too low to produce a stable CAC.

If you don’t have this information, then market research can come to your aid again. Ask your potential customer what products and services they are using at the moment. You can then guesstimate the CAC of these products and companies by looking at where they are advertising, how they are marketing, and how they are selling.

CAC can also be estimated from the type and size of your potential customers. Large, high-value customers are going to have higher CACs compared with the small companies using your product. It’s not important to have these numbers nailed down, but to start adding them to your personas and iterating from there when you get the right data.

If you do already have customers that fit your buyer personas, or that are in your funnel, start looking closely at how much it is costing for each acquisition. These analytics should be readily available through any of your channels.

AdEspresso, a Facebook ad optimization service, segments their customers using buyer personas in their own Facebook ads:

The first ad here is targeted towards media agencies (main value: saving time), whereas the second is targeted towards startups (main value: growing user base).

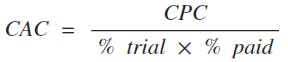

In this channel, the cost per click (CPC) for different ads along with the conversion rate will give you an approximation of the CAC. In this scenario, let’s say the CPC for these is $1.68 and $3.13 respectively, suggesting startups are more costly to acquire. As AdEspresso has a free trial, we can then use Andrew Chen’s formula for converting CPC to CAC for paid acquisition channels:

Where “%trial” and “%paid” are the conversion rates from visit to trial, and from trial to paid plan, respectively. Though form the CPC alone it might seem that startups are a bad bet, that drastically changes when different conversion rates are taken into consideration:

This is why it’s important to understand all the data and metrics behind your customers. Startups could more willing to try SaaS and convert than media agencies. Without quantifying your buyer personas and only thinking about them in abstract, this is data, and revenue, you would be missing.

This information can be added to the buyer persona and linked to the willingness to pay, and through that lifetime value (LTV). You can then determine whether the unit economics for each of these buyer personas, and therefore the whole persona itself, is realistic and sustainable.

Translating All This To Your Pricing Page

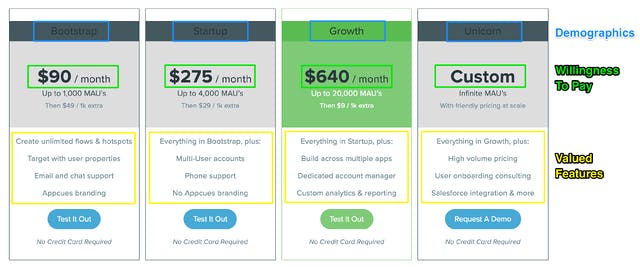

Once you have all this data you have to do the hardest and scariest part, put it into your pricing page. Here, user onboarding service Appcues shows how it’s done:

The four positioning tiers are segmented by the company's different buyer personas. Within each, the distinct parts of each profile are used to attract the ideal customer:

- The demographics are condensed into a single word that best describes that persona: a bootstrapper, a startup, a growing company, or a large unicorn.

- The packaging of the valued features show the relative preferences of each buyer persona. The Bootstrap persona only wants quick and easy access to the product, while Growth wants custom analytics and support.

- The willingness to pay is shown in the actual pricing, which grows with the growing demographics and features. The smaller companies are only willing to pay $90/month, whereas Appcues knows they can get 7x that for Growth buyer personas.

This final hurdle is where a number of companies fail as they suffer from decision paralysis at this final point. Companies worry that once a price is in digital ink, it will scare customers away. If they get it wrong, then customers won’t sign up and they won’t be able to recover.

This entire pricing process is designed to squash that objection in your company and your mind. If you have followed the process correctly, talked to your customers, and obtained all the right data, then the decision will be made for you. Quantifying your buyer personas gives you concrete starting points for your pricing and packaging, showing you exactly what your customers value, and what they are willing to pay. As long as you price within that range and tier out your packages correctly, you will have customers.

What should be obvious from this process is that this isn’t just about that final pricing matrix. The questions and answers you get in this process go way beyond just that one page, into the entire design of your site:

- If you know what feature your customers really value then that should be the first thing they see when they hit your landing page.

- Your sub-landing pages can be designed around each of the main features for each buyer persona.

- You can construct your sales funnel to pass through different features as potential customers travel to your pricing page.

Conclusion

Quantified buyer personas are all about one thing: value.

They allow you to determine, via data and analysis, which customers are most valuable to your company and how you are most valuable to your customers. Through research that allows you to define specific characteristics for your customers, you can gain a deep and invaluable understanding of your customers.

The days of buyer personas being little more than alliterative names and vague attributes are over. Adding data to your customer profiles makes them actionable. It turns them into the foundation for the growth of your entire company, allowing you to clone great customers while getting optimum value from them and offering exceptional value back.