The SaaS landscape has evolved dramatically over the past 15 years, with it being easier than ever to get into the market. Increased competition within every segment means agility, flexibility, and a low responsiveness gap is crucial to get ahead.

SaaS companies have now turned to their pricing and billing as a key area to offer flexibility for their customers. Usage-based billing, also known as metered billing, is one way to ensure you never leave money on the table.

What is usage-based billing?

Usage billing is a pricing model where the customer is charged based on their actual usage of a product or service.

This is typically added on top of a standard subscription plan where a customer has a set usage limit. If they exceed that during the contract period, an overage price per unit is applied and billed on top of their plan at the end of the cycle. It can also be used as a pure pay-as-go model with no subscription attached. This option can be done in two ways: requiring prepayment (credits) or billed at the end of the cycle based on the customer’s usage.

It's a very common model in IaaS when there is an associated cost to their customers racking up usage costs. But it’s also becoming very popular in SaaS when there is an obvious quantitative output of value for a product (e.g tracking keywords in SEO or messages in communications platforms).

Here are three SaaS companies seeing success from usage billing.

1. Storrito: Usage plans

Storrito is a brilliant SaaS within the social media management space for managing stories via the web, specializing in Instagram and Facebook.

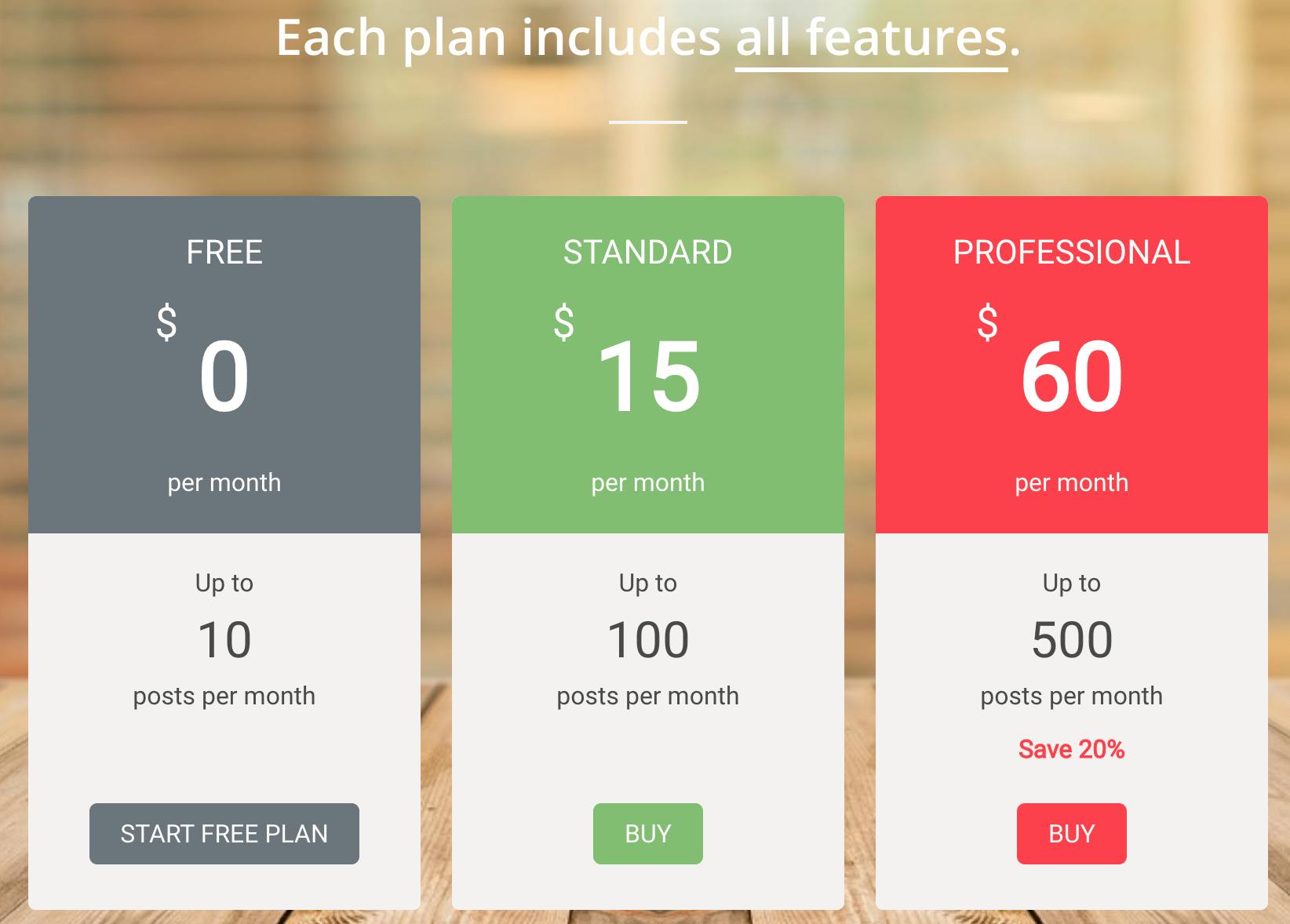

They're an ideal tool for influencers, brands, and digital agencies. Currently, they have complete feature parity between paid plans. The price a customer pays is determined by the number of social media posts they make through the platform each month/year.

They also have a freemium offering of up to 10 posts a month – a great acquisition strategy that delivers instant value for customers of all sizes looking to try out the product before committing.

The higher plan you subscribe for, the greater discount per post you get.

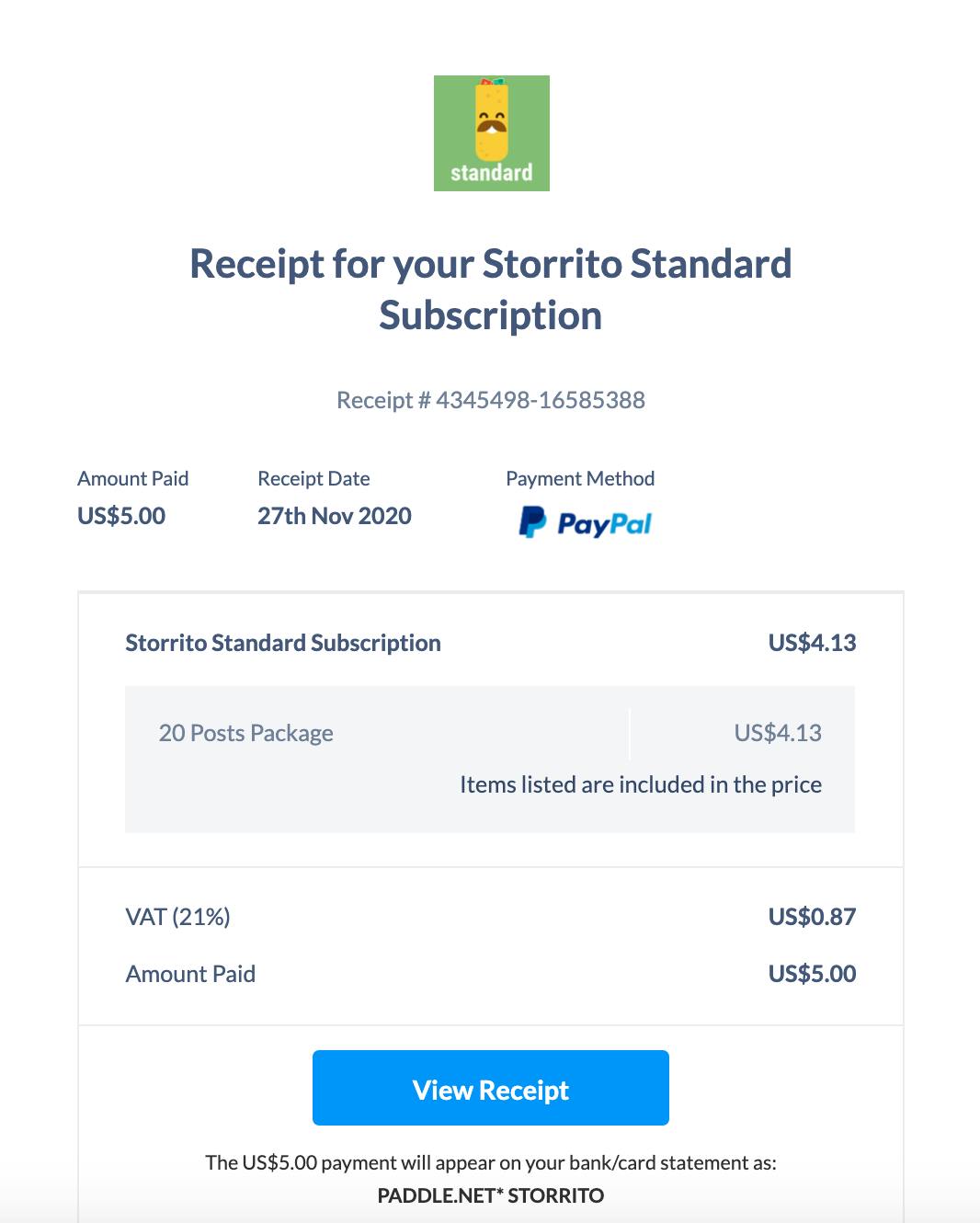

Storrito offers a credit system to bridge the gap between plans and to meet the cyclical usage patterns of some customers. Rather than pushing you to upgrade to a higher plan, you can pay a one-time purchase for additional credits on top of your existing plan.

“Without usage-based billing, we would miss out on revenue just due to the fact that some of our customers do not find the optimal plan for them,” says Max Weber, CEO of Storrito.

“As a developer/founder, usage-based pricing is also attractive for me, since you can save a lot of complexity by not having to differentiate between the features of the plans. It is simple, all plans have all features, even the free plan.”

2. Remove.bg: credit subscriptions + pay-as-you-go

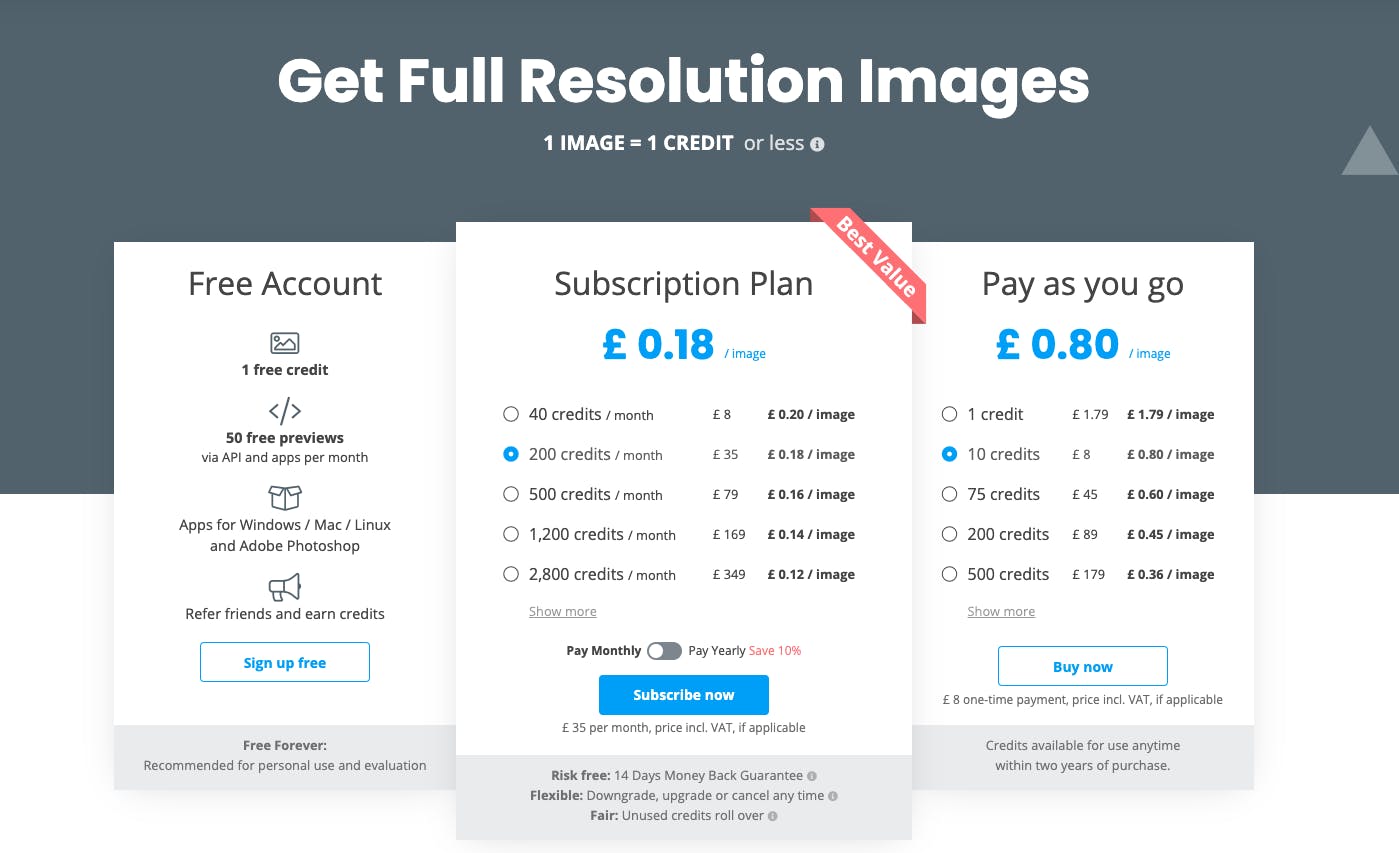

Another high-growth SaaS,Remove.bg(Kaleido) has incorporated usage-based pricing to their plans.

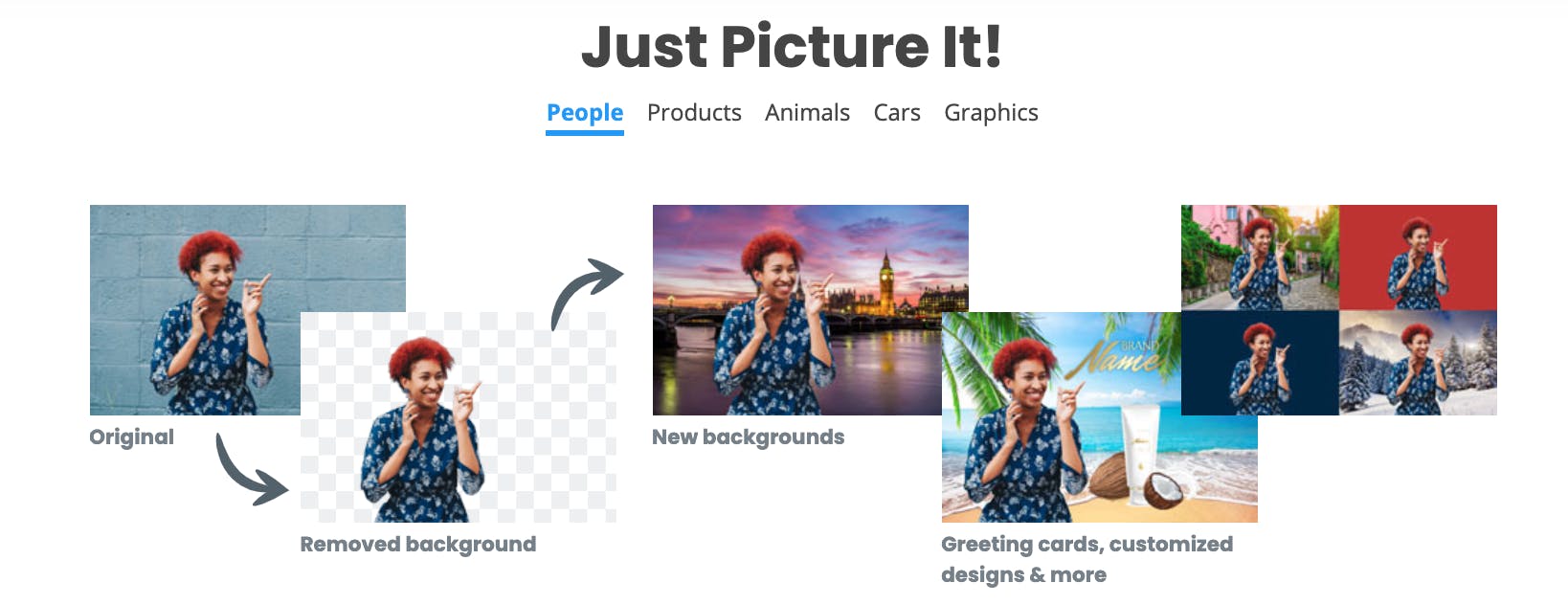

They offer a brilliant suite of features for editing images and videos and don't want to limit access to them in any of their plans based. Instead, customers purchase credits in line with how many images they expect to r be converting a month/year.

Launching subscriptions nowadays seems the norm, but this alienates potential customers who don’t want that level of commitment by offering two pricing models, remove.bg caters to all.

This more flexible pricing strategy has enabled Kaleido to reach 43,000 customers across 181 countries in the space of just 18 months with Paddle. Their credit-based pricing also paves a clear path to moving upmarket and selling to enterprise clients.

3. Matomo: traffic + overages

Matomo is an all-in-one web analytics platform that lets its customers effectively measure success while keeping 100% ownership of their data – a strong ethical alternative to Google Analytics who take privacy seriously.

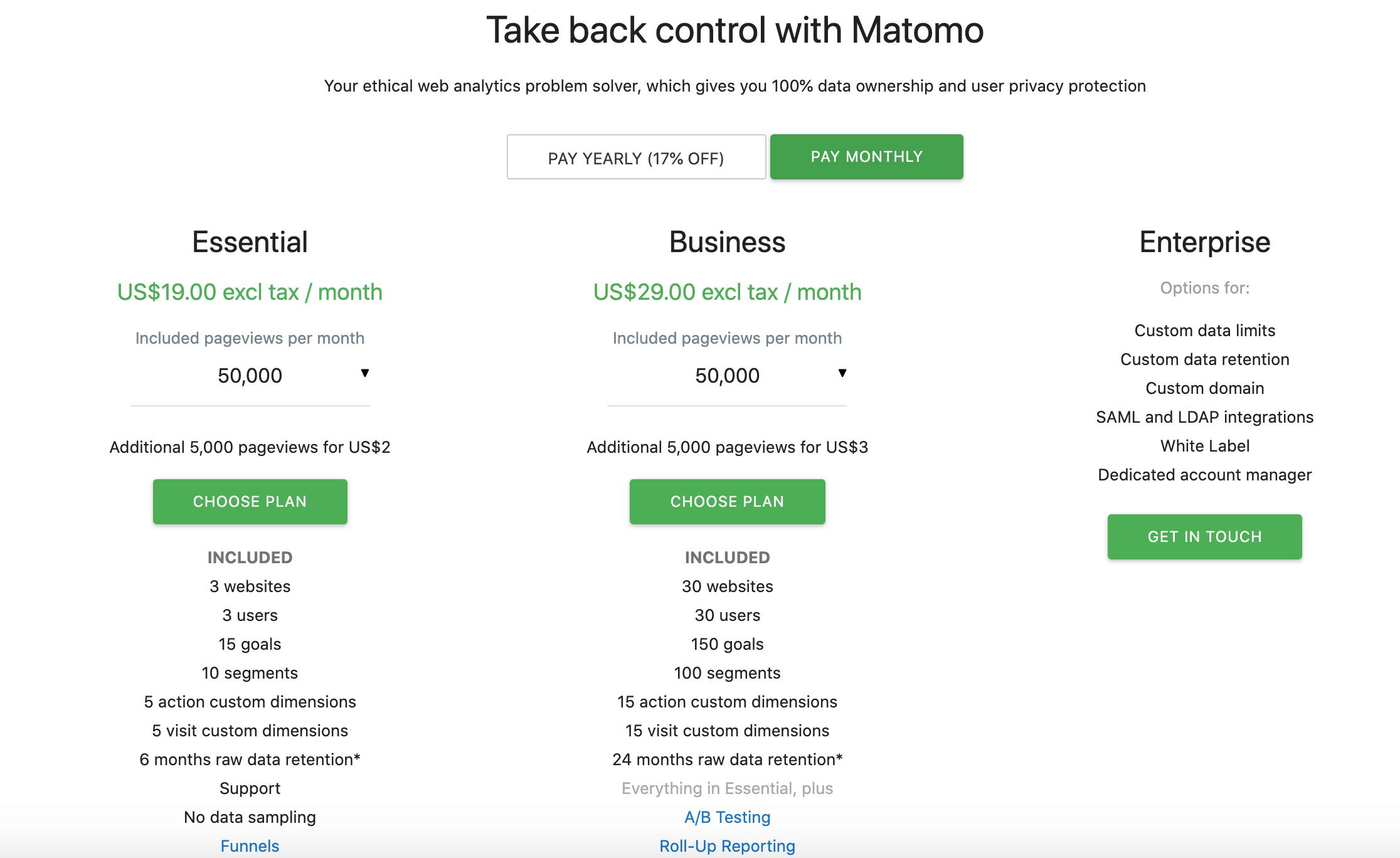

Being an analytics platform, they have set their plans based on pageviews. Customers can preselect their expected pageviews for the month/year and their desired suite of features: Essential or Business. As opposed to the two previous examples, Matomo is billing additional usage as overages when a customer exceeds their quota (e.g. $3 per additional 5,000 pageviews).

The benefit of this is they can simply track the customer’s usage and add this to their bill retroactively. As each customer has a saved account and payment details, this can all be done seamlessly via API without the manual intervention of the customer. It just needs to be made clear to the customer that they've signed up for this sort of agreement.

Their pricing shows a key argument against SaaS having "unlimited plans" for customers: They immediately limit your expansion revenue. Having usage pricing based around pageviews also helps Matomo optimize the way customers can move between Business and Enterprise plans.

Getting usage billing right for your SaaS

There's an ongoing debate on whether usage billing will replace seat-based pricing in SaaS. The argument against going down the usage route is that it might deter customers from actually using more of your product/service. How do you overcome that? Make sure you set up and model the usage so it matches up with the value your customers are expecting.

Most leaders in SaaS will agree that giving customers more payment flexibility is fruitful. Why not offer both options and if you would prefer them to be on standard subscriptions then price the usage option higher to still encourage that?

Another important takeaway is that all of these SaaS businesses didn't just land with this mix of usage pricing; it has been tried, tested, and adjusted on a regular basis. Pulling this off requires a flexible billing infrastructure and revenue delivery strategy. Testing is the only way to figure out if adding usage billing will have a positive effect on your customer lifetime value and net revenue retention.