Tearing down the Pricing of Squarespace and Wix

Patrick Campbell Apr 30 2018

If you want to build a SaaS product, you've got to build a SaaS website.

If you've got the skills, you can roll your own. If not, there is a growing market of website design companies that are itching to help. They can get your website or online store up and running in minutes, offering templates, hosting, domains, and analytics, all ready to go.

Today on Pricing Page Teardown, Patrick and Peter dive into the two leaders in this space—Squarespace and Wix—to look at their different strategies, where each is winning, and what each could be improving in their pricing strategy to win this market.

Squarespace hit 2 million subscribers in 2017. The New York-based company is now valued at $1.7 billion and is pulling in revenues of $300 million per year. Wix, the younger of the two, went public only seven years after founding. Revenue from the Tel Aviv company pretty much matches Squarespace, with 2016 revenues hitting $290 million.

Let's look at how these two are each carving out a part of this market and who might spring ahead in the coming years.

Different pricing pages, different markets, and differen//www.profitwell.com/pricing-page-teardown-episode-directoryt willingness to pay

On the face of it, Squarespace and Wix offer the same product. You sign up, you choose a design for your website, then they will host it for you at the domain you choose.

But these are two very different companies. From the design on their own sites, and particularly the design of their pricing pages, you can see that they are trying to address to different segments of this market.

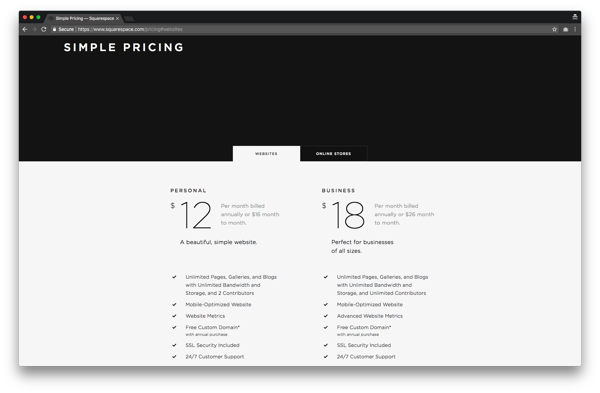

Squarespace is a company that bases itself on design. The pricing page is pristine, monochromatic, modern. It appeals to the B2C customer—the fashion designers, chocolatiers, and yoga studios of the world:

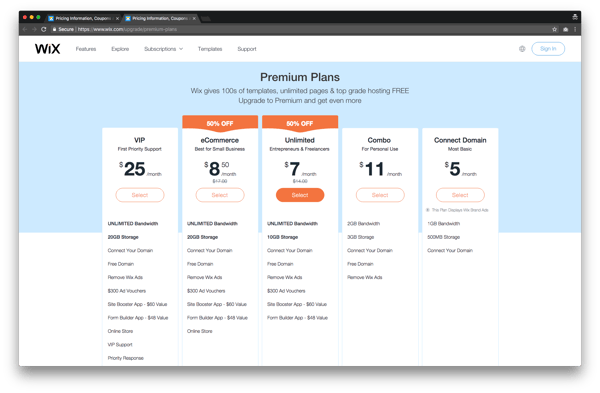

Contrast that with Wix. Any B2B SaaS or traditional business looking for web design would feel at home with this pricing page:

The difference in the two brands is mirrored in the willingness to pay of their respective customers.

4019.jpg?width=600&name=WTP%20Overall%20(0%3B00%3B09%3B26).png)

The median willingness to pay for Squarespace customers is 25% greater than for Wix customers. The low points on the range are about the same, but at the higher end, Squarespace customers have a vastly higher willingness to pay—they will fork out about $10 more per month that Wix customers will.

Considering they are effectively the same product, this is a huge difference. As you can see from the pricing pages, Squarespace isn't offering anything more than Wix. The difference comes down to brand. Squarespace has positioned itself as the premium product, focused on high-end design, and customers are willing to pay more for that design.

This looks like Wix is losing this battle. But their lower willingness to pay means they have the option to capture the lower end of the market, draw customers in, then upsell to increase ARPU and expansion revenue. If they can make their customers successful, willingness to pay increases dramatically:

c202.jpg?width=600&name=Sales%20(0%3B00%3B07%3B18).png)

When a customer isn't generating sales through their website, they don't want to pay for it. Willingness to pay is over 15% lower when the person sees no online sales. But once they do see sales, either online or offline but associated with the site, willingness to pay goes way up. A customer that gets just one offline sale because of their site will pay 10% more, while a customer that gets just one online say through their website will pay almost 15% more.

A possible strategy for Wix is then to take advantage of the low willingness to pay and offer a bare-bones free plan (which they already do), but tie the upsell to this success. Once revenue is coming through the site, Wix can upsell the customer for a more comprehensive package.

This idea is also supported by data on the willingness to pay based on tech savviness:

9909.jpg?width=600&name=Tech%20Savviness%20(0%3B00%3B06%3B07).png)

Don't miss out on more insights. Subscribe to get on the list for Pricing Page Teardown now.

See the data on pricing strategies across the subscription market every week.

Most upsell packages for SaaS will become more complex as the price rises, adding customization options, analytics, SQL, etc. This is exactly what you don't want to do for web hosting. The people who are most in need of these services are the ones who have no tech ability. They are the restauranteurs and plumbing companies of the world—they just want a site that functions, looks good, and gets them customers.

That is why customers with the lowest level of tech savviness are willing to pay up to 41% more than average for these services. At the other end, people who know how to roll HTML, CSS, and JS together into a neat package aren't willing to pay—their WTP is 37% than average. People with high levels of tech knowledge aren't going to use Wix or Squarespace, and they are definitely not interested in the higher tiers.

Any heavy tech or engineering options should just be excised from these pricing pages.

Do not race to the bottom

“What is the key to winning in this market?”

- Peter Zotto

We are concentrating on Squarespace and Wix, but this is a crowded market. How can either of these companies, or one of their competitors, win?

The answer isn't going straight for the bottom of the market. But low pricing is a good place to start if you can an upsell strategy in place, as Patrick says:

“You can race to the bottom with your entry-level plan, but have some sort of easy entry point into the product. Get that customer, get them setting things up at that really low friction point, then all of a sudden start to upsell.”

The data shows that there are options for both differentiation along pricing tiers and add-ons for Wix and Squarespace customers. We asked over 19,000 current, former, or prospective customers or Wix and Squarespace what they really cared about with this website design services:

016d.jpg?width=600&name=Value%20Matrix%20(0%3B00%3B07%3B28).png)

Let's take each of these corners in turn:

-

Trash Land: These are the features that customers couldn't care less about. Here it is unlimited bandwidth. Again, the customers of Wix and Squarespace aren't tech people. They don't know what unlimited bandwidth means. This type of feature just shouldn't even make it onto the page.

-

Core Features: These are the features that customers have come to expect from such a service. The customers here only identified one such feature—pop-ups. They expect that they'll be able to add timely pop-ups, discounts, or overlays to the site. These small customizations that allow them to run their business better have to be available even at the lowest tiers.

-

Differentiable: These are the features you align your pricing tiers with. They are high value (people want them) and high WTP (people will pay for them). Interestingly here, some of these features are already considered core by more tech-savvy people. SSL security is a great example. This should be a core feature of every site in 2018. But Squarespace or Wix could offer this as only an option on higher plans. Speed Booster is another such differentiator. Wix is using this as exactly the differentiable option it can be. You only get to use this (which they say has a $60 value) when you hit the Unlimited, $14/month plan.

-

Add-Ons: These features are nice-to-have. They have low value—not everyone wants them—but those that do are willing to pay highly for the option. 24/7 support is a classic of this genre. You want to have this as something only offered to the people that truly care about it. These tend to be customers that will have a high volume of issues such as enterprise companies, who you can then charge a premium, or customers that are completely new to the service, such as the non-technical customers that might use Squarespace or Wix.

The latter two here, differentiation and add-ons are how you can create an entry-level, low-friction pricing option, but still have ample headroom for expansion for each customer. This is how pricing can address the acquisition, monetization, and retention triumvirate.

Customer or investor?

“If I was a pizza shop, I would use Wix. How are you going to get me more money?”

- Patrick Campbell

If you were a customer which would you choose? If you were an investor which would you choose? These are the last questions that Patrick and Peter ask. Watch the episode for their full answers. Though Wix is doing well, without the fanfare of Squarespace, it is Squarespace that is playing the long game. Their branding is so strong that they are the dominant contender.

But Wix has that opportunity. They are primed to scoop up that lower end of the market. With the right pricing strategy, they could be building themselves off the success of all those customers they acquired through freemium. And as new entrants come to the market, both Squarespace and Wix are going to have to perfect their pricing to make sure they stay the top two.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.