I joined Paddle several years into the company’s mission to help product-led SaaS businesses grow faster without the distraction of having to build a payments infrastructure. We support nearly three thousand SaaS startups and scale-ups and the team here has spoken to thousands more. Over the years, we’ve seen how high-ambition product-led companies can’t get to where they want to go without hiring sales reps. Many of them are being pulled upmarket, even without an expressed strategy to do so. This happens when your customers grow and their requirements evolve as a result — as was the case for Intercom. It can also happen when you acquire enough discrete customers from different corners of an organization to create momentum for bottom-up expansion. Slack is a prime example of the latter.

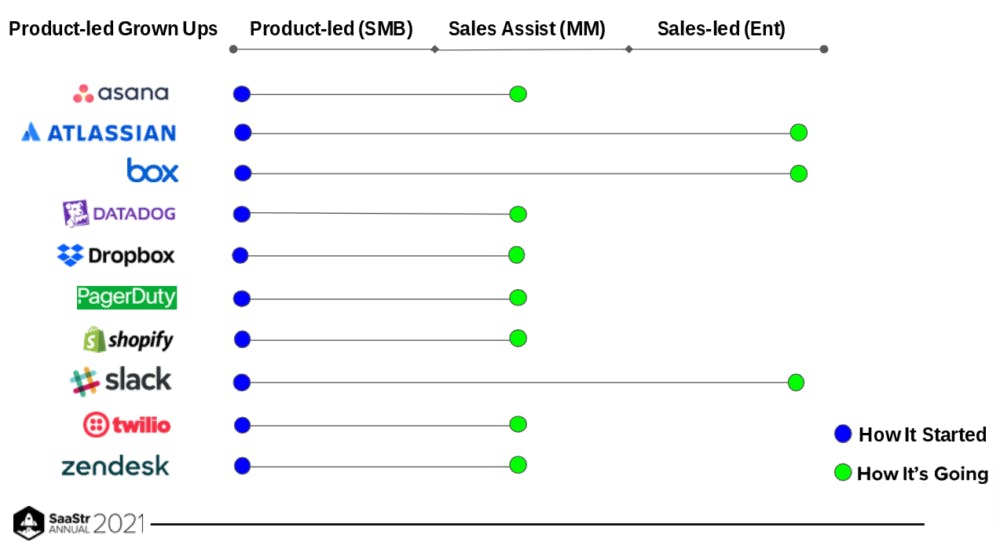

In fact, the software industry is full of success stories about small SaaS companies graduating from an exclusively product-led growth strategy (PLG) to a sales-assisted or sales-led growth motion (SLG). Their customer base shifts from individual users and small teams to larger businesses.

Image credits: SaaStr Annual, 2021

The move upmarket brings dazzlingly large contract values and a lesser likelihood of churn. But from speaking to our SaaS clients and the wider industry, we’ve found that introducing a sales assisted or sales-led strategy brings complexity that can block growth. My job for the last year has been to understand those challenges and work out how Paddle might help our current and future clients overcome them. Here’s what I’ve found.

Rapid commercial team growth and enablement

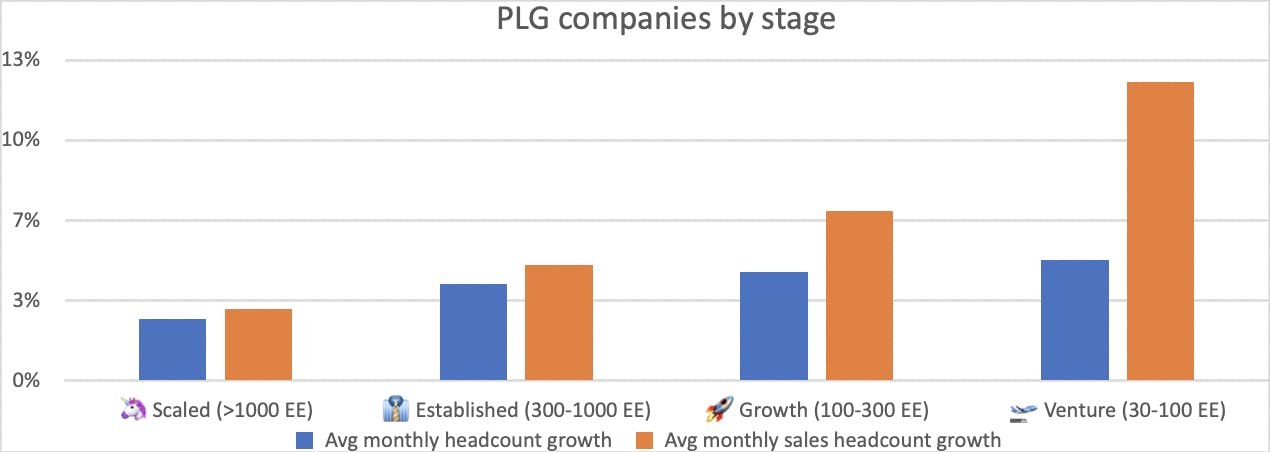

Product-led growth doesn’t mean product-only growth. Most product-led businesses do have some salespeople from early on, with data from peersignal.org showing that PLG startups with fewer than a hundred employees have 8% of their team in sales roles (compared to the B2B average of 14%). But the move upmarket calls for a different level of investment. Those who have achieved enough success to scale beyond 30 people are making clear moves to play catch-up, recruiting 2.5 sales roles for every other increase in headcount.

Image credits: peersignal.org

This catch-up in commercial resourcing creates operational demands. You’ll need to define the optimal compensation structure, hire competent sales leaders, and train reps effectively. The team will need arming with pitch decks, case studies, and other collateral suitable to the segments and accounts they’re going after. You’ll also have new sales ops and tooling requirements, including a CRM, to keep them fed with leads and to track the flurry of outbound activity. Enterprise customers expect dedicated support with implementing and getting value from your product, as well as expanding their contract value over time. Enter the customer success team, with their own operational needs. If you’re selling globally, all of this needs consideration for each of the regions with reps on the ground. If you are successful, all this will happen even faster than in a business that didn’t start with product-led growth.

Back office breaking points

Closing a deal and getting paid looks very different when selling through a sales team compared to a web-based purchase. You’ll increasingly have to negotiate with procurement departments and tackle legal scrutiny before the dotted line is fully signed. Even when that’s not the case, you’ll certainly need to orchestrate the provisioning, management, and reconciliation of payments done through invoicing. That process can swallow huge amounts of time and money, especially if and when it’s reliant on manual interventions, which it often is. Great sales operations are needed from the start so that when you grow things don’t fall apart.

Configure, price, quote

Unlike purchases made online, where the price is set and the payment process automated, selling to large businesses typically requires configuring a bespoke software package, including customizations, integrations and optional features, as well as services like team training. Other factors like discounts and payment terms will need to be reflected in the price and quote. When selling internationally, the currency of the quote and payment will differ based on location. These variables are all determined in conversation, and will need the sales rep to actively document them in your CRM. If deals are being made but data is not being updated or entered properly, there will be a world of trouble downstream, with invoices not being issued correctly and revenue not being recognized accurately.

Invoice delivery, payment, and reconciliation

Issuing a handful of invoices manually is manageable, but as the number increases, the time and resources required can get out of hand. Not only do they need creating and delivering, late payments need chasing to make sure all the money you’re owed actually reaches your bank. Buyers in different countries will want to pay their invoice in different ways, which might require you to set up and manage regional bank accounts. You’ll also be creating invoices and chasing up payments in different languages and currencies. Employing invoice automation can take care of a lot of the legwork here, saving you time and helping you get paid earlier. Every payment, once received, needs to be reconciled with its invoice to confirm accuracy. You’ll want to look into accounting tools, like Quickbooks, to help streamline this process, but also plan for an increase in Finance Ops headcount.

Reporting and compliance

By selling online and through your sales team, you’ll have payments coming in from different channels and from different methods which can easily leave you with siloed financial data. You’ll want to consolidate these revenue streams so you have a clear and reliable view. Sounds simple, but those we have spoken to have detailed how complex this becomes. This is particularly important when selling software globally, as you’ll need to keep on top of your sales tax liabilities in different jurisdictions (unless you sell through a merchant of record). SaaS metrics tools can help give you the visibility you need here.

Simplifying hybrid sales in SaaS

Since discovering the complexity of introducing and scaling a sales-led go-to-market strategy, we’ve been working with our engineering team and a select group of SaaS businesses to create solutions that will remove as many of those pains as we can. Paddle already provides a complete payments infrastructure for PLG SaaS companies, covering checkout and payment routing, subscriptions, and tax compliance. Now we can help our thousands of clients go upmarket fast by automating their invoicing processes and reconciling their revenue streams into a single source of truth.

To learn more about the work I've been doing or to find out how you can avoid unnecessary distraction as you scale upmarket, check out our recent post on the challenges of adding a sales-led motion (and how to overcome them), or browse paddle.com.

This article was originally a sponsored post by Paddle on techcrunch.com, which you can find here.