Microsoft 365's Tech Debt Leads to Poor User Experience

Patrick Campbell Oct 28 2019

This episode of Tradeoffs is a big one. Hiten Shah, co-founder of FYI and Product Habits, and I are tearing down the two biggest players in office productivity software: G Suite and Microsoft Office 365. With 36 years of experience and more than 180 million active monthly users, Office 365 dominated the market for more than 20 years. Going up against the only major player in the market must have seemed like a formidable task when G Suite came on the scene in 2006, but its native cloud platform is now Office 365’s major competitor.

Pitting Office 365 and G Suite against one another is a great way to show how tradeoffs and product decisions impact even the most successful and established businesses. Regardless of your company size, growth trajectory, or position in the market, these tradeoffs are a part of running a business. We’ll focus on how these two titans of industry battle it out over user experience and product-market fit as arguably some of the most lucrative businesses on the planet.

1. The Tradeoffs

2. Both platforms have made tradeoffs that define their brand

3. Older companies must think about product-market fit differently

4. Lackluster user experience drives down Office 365’s NPS

5. G Suite needs more power; Office 365 needs a better experience

The Tradeoffs

-

-

G Suite sacrifices power in some of its tools (most notably Sheets) for a better user experience. This keeps it out of some segments of the market, like finance, where Excel is still the #1 tool.

-

Office 365’s tech debt and legacy systems have built up a lot of friction in its product, making it difficult for users to perform certain tasks. This leads to a poor experience and a growing perception of Microsoft as outdated and clunky.

-

With a wider and more established user base, Office 365 has created a significant amount of “mental debt.” Its users are too comfortable with the tool or still use outdated features, which makes it more difficult for Microsoft to pivot with current market needs.

-

Both platforms have made tradeoffs that define their brand

When Google first launched G Suite in 2006, Office 365 was already old enough to drink legally in the United States. To surmount such an authoritative brand presence, and a Brobdingnagian user base, G Suite needed to identify where its product could compete. By focusing on user experience and cloud functionality, instead of going after individual tools like Excel, Google built one of the strongest competitors the market has ever seen.

But being native to the cloud made it impossible for G Suite to build features that were as strong as those in Office 365. It traded power for usability, which paid off in the short-term but makes it much more difficult for G Suite to compete in certain segments of the market.

We asked 600 survey respondents, What is the primary benefit you receive from these products? And the most common answer for both tools was related to ease of use:

This means that users see both G Suite’s and Office 365’s main value proposition as keeping all of their business communication, tasks, and responsibilities in one location. We see similar themes echoed in the rest of the answers.

G Suite

-

-

13% said Gmail was the primary benefit

-

9% said syncing across devices

-

Office 365

-

-

8% said the platform was familiar

-

7% said Microsoft Word makes their work easier

-

Users identify just one tool as the software’s primary benefit. But while anyone can sign up for a free Gmail address, Microsoft Word always comes bundled with the rest of Office 365’s platform, which puts Gmail in a better position for customer acquisition.

G Suite received more feedback related to their product, with 9% of people seeing syncing across devices as the primary benefit, which is a good sign that it's delivering on its value prop. What’s worrying is the 7% of people who said Office 365’s primary benefit was familiarity. While it speaks to Microsoft’s brand recognition, it means that customers don’t see functionality as a benefit. They just use the platform because that’s what they’ve always used.

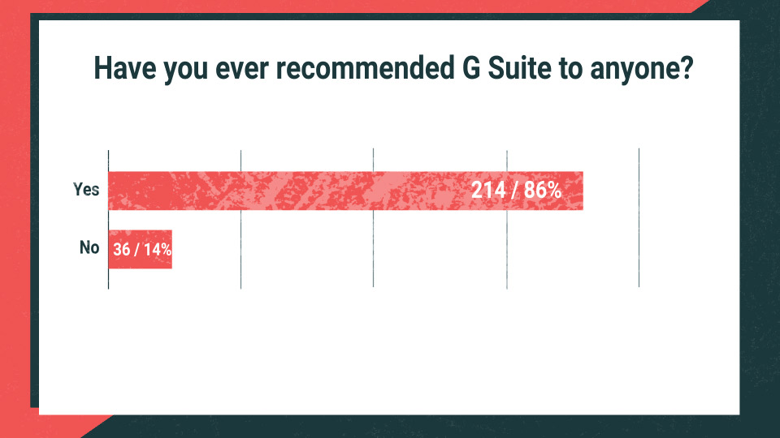

This is most evident in survey takers’ responses when asked if they’ve recommended the product to someone else. While 86% of users recommended G Suite to their friends and colleagues, only 60% of users recommended Office 365.

This goes to show how important usability and core functionality are to a daily-use product. Familiarity with the tool just doesn’t elicit the same kind of trust in the brand as a good experience.

Older companies must think about product-market fit differently

“After a couple of years, the switching costs get so high that, unless a user is willing to be cathartic and just delete everything, moving to another competitor is just too difficult.”

Something that doesn’t get discussed enough is how product-market fit can change over time. This is especially important for companies with an established user base. Understanding how your customers use the product differently as they become more comfortable is the key to fostering an engaged user base for the long-term. Users who see the product-market fit of your platform increase over time are also less likely to switch over to another competitor that’s offering something flashy or new.

We calculated product-market fit by asking, How disappointed would you be if you could no longer use these products? The results:

-

-

G Suite has a product-market fit score of 65%

-

Office 365 has a product-market fit score of 53%

-

We’re looking for a threshold of 40%, so G Suite and Office 365 are in good standing, especially considering the size of their respective user bases.

We also wanted to show how product-market fit can evolve as users become more ingrained in the service, so we asked users to qualify their answers based on how long they’d been using each platform.

-

-

G Suite increased to 79%

-

Office 365 increased to 67%

-

If we were product managers for either platform, we’d definitely be interested in what causes these increases. Not looking at it would mean we’re losing out on a ton of really valuable insights. The users who switch from somewhat disappointed to very disappointed see the product as more valuable the longer they use it, so you can use that information to figure out how to make more people see things that way.

When we asked, Why would you be disappointed if you could no longer use these products? Some interesting trends appeared.

G Suite

-

-

Used daily (27%)

-

Holds a lot of my information (11%)

-

Collaboration and sharing (10%)

-

Work/personal (8%)

-

Office 365

-

-

Very familiar (20%)

-

Used at work (19%)

-

Used daily (18%)

-

My work depends on it (14%)

-

The top answer for both G Suite and Office 365 was related to how users interact with the product on a daily basis, with 27% saying they use G Suite every day and 18% saying they use Office 365.

The top four answers for each platform show apparent issues with Office 365 because none of the survey respondents supplied answers that were value-driven. The majority of the feedback was related to how Office could be cheaper or how it could provide a better overall user experience.

The feedback for G Suite is much more value-driven and relates directly to its core value proposition of encouraging and facilitating collaboration. This means that, while both platforms saw an increase in product-market fit as users became more tenured, users of Office 365 see more issues with the usability of the product the longer they use it.

Lackluster user experience drives down Office 365’s NPS

When your customers continue to nitpick your product even though they see your product as established in the market, that means you’re not meeting their expectations. For Office 365, it shows why user experience is so important for companies in such a competitive space. A bad product experience, sometimes referred to as death by a thousand cuts, will erode the customer relationship over time.

We calculated the NPS score to track how users felt about both of these companies. Right now, G Suite is in a pretty good place with a score of 43, but Office 365 clocks in at just 14. To see what G Suite and Office 365 could do to increase these scores, we asked, How could the platform be improved to meet your needs?

G Suite

-

-

6% said more storage.

-

5% said build more products.

-

4% said better privacy.

-

Office 365

-

-

15% said it was too expensive

-

10% said make it easier to use.

-

6% said make it free.

-

This is where you really start to see the user sentiment diverge for each platform. Where G Suite received very functional feedback about making the product more useful, feedback for Office 365 focused on price and experience. While you might think that asking for new products or services from G Suite means users are disappointed with what the platform currently has to offer, it actually shows how invested these users are in making the product better for themselves.

For Office 365, the overall sentiment is that they just want to be able to do what they want for cheaper and without so much of a hassle. If 10% of your user base says the product needs to be easier to use, that likely means there’s another 10% to 20% who feel the same but didn’t answer.

That said, both platforms are still not going to have any major issues right away. When we asked, What would you use as an alternative to X if it no longer existed? The answers were overwhelmingly similar.

-

-

72% of Office 365 users said they would use G Suite.

-

51% of G Suite users said they would use Office 365.

-

The second most popular answer for this question was Not Sure, with 20% for Office 365 and 27% for G Suite. This basically means that both companies have so much brand recognition that people wouldn’t know what to use as an alternative if they didn’t exist. This isn’t all that surprising considering we’re talking about Google and Microsoft here. Instead, it confirms that both of these platforms will continue to battle it out for a while.

G Suite needs more power; Office 365 needs a better experience

“You care about your customers, that’s why you should care about your competitors.” Hiten Shah

Both platforms need to understand why people use their competitor. Understanding what’s drawing customers to another service can help you figure out what to do in your own. But right now, Office 365 should be a little bit more worried than G Suite because of its poor user experience. As consumers continue to value the experience of a product as much as its utility, Microsoft is putting itself in harm’s way by not addressing their issues.

G Suite, if they wanted to, could make a few pretty strong plays to boost its position. Even if it’s narrowing the focus for certain tools, like making Sheets a viable (more powerful) competitor to Excel, it could easily unseat Office 365 in some segments of the market. Hiten even postulated about a niche service like Google Finance, which would go after the segment of the market where Microsoft still has the most power.

When it comes down to it, both G Suite and Office 365 are definitely still top dogs in the office productivity market, but with such high status, they’ll have to continue improving at the same pace to stay there.

This wraps up episode five of Tradeoffs. We’d love to hear your feedback, so let us know what you think about the new show on social media. And share it with your friends!

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.