You may not have heard much about the changes to the US sales tax before its recent Supreme Court ruling. Let's recap on what’s changed.

What’s changed?

Prior to 2018, most US sales tax laws were based on ‘physical nexus’. This meant you would only need to charge sales tax if you had a physical presence in a state, like a warehouse or employees.

However, the majority of US states have implemented new tax legislation based on ‘economic nexus’. Sales tax is now collected based on the location of the customer regardless of your physical location.

This means that most businesses selling into the US - from within the US, or other countries - are now legally required to collect and pay sales tax to states on sales to customers located in those states.

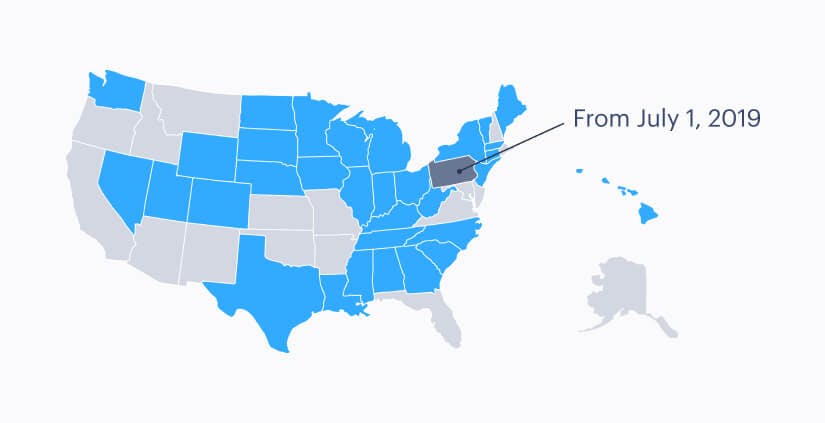

Economic nexus tax laws have now been adopted by 32 states - with more coming soon! - including some of the biggest: New York, Texas, Washington, Illinois, and more. The thresholds - the point at which your business becomes liable to collect sales tax - vary from state to state - some are as low as just $100,000 annual revenue or just 100 transactions.

(Pennsylvania will be added from July 1st, 2019)

What types of transactions and businesses are affected?

Any business selling into the US Any business that has customers located in states that have enacted economic nexus laws are now on the hook to collect sales tax if they meet the eligibility thresholds.

Most B2B and B2C transactions For US sales taxes, both low-value consumer transactions and high-ticket B2B transactions in certain states must include sales tax.

Digital goods and software, and SaaS products Many states have singled out digital software and SaaS products as explicitly included in sales tax laws. There are three officially listed taxable categories: one-off software, subscription software and other digital. Luckily, California - the US’s biggest state for digital goods - has defined digital goods, software, and SaaS as exempt from sales tax.

Businesses of every size Due to the low thresholds - from just $100,000 in revenue or just 100 transactions per year, we expect the majority of software businesses to be liable for sales tax in a minimum of 10 US states.

This is because the ‘transaction’ threshold is described as one receipt or invoice: meaning a single user paying monthly over a year will generate 12 transactions. For example, any software company with more than 10 customers paying monthly in a given state would be generating 120 transactions per year and therefore should be collecting sales tax for all customers in that state.

Why has this happened, and why now?

Until recently, the majority of US sales tax legislation was based on a Supreme Court precedent called Quill , from 1992 - over 27 years ago.

Since then, the world as we know it has changed significantly. Online retail has exploded, while traditional physical retail has suffered. As states saw fewer tax receipts - and encouraged by small retail business owners and associations - they looked to begin taxing eCommerce and online retail to level the playing field.

With a string of online success stories like Amazon (who now generate over $10 billion in annual revenue), it’s easy to see why cash-strapped states couldn’t resist the temptation to bring sales tax rules into the 21st century to help expand their coffers.

What does this mean for software sellers?

If you are selling software to the US - regardless of whether you’re based in the US or not - you must:

- Investigate state rules and determine eligibility - some counties and cities also apply sales tax surcharges, so there are potentially thousands of districts to examine.

- Register with each individual authority to obtain sales tax collection permits.

- Charge sales tax appropriately and provide tax compliant documentation to customers. It’s important to get this right: charging tax without being registered is considered a crime.

- Report and remit the tax collected to each individual state tax authority - this can be a heavy burden, with some states requiring quarterly filing.

- Keep up-to-date with changes at federal, state, county and city levels, monitoring any changes they may or may not make to eligibility rules, thresholds, tax rates, and exemptions.

Choosing to not comply with sales tax rules for each state comes with the danger of backdated tax collection, fines and penalties, audits, and even legal action against a company and its representatives.

In summary, most businesses selling software to the US must now manage a mountain of bureaucracy, unnecessarily spend time on tax compliance and reporting, all while retaining liability.

What does this mean for businesses selling into the US through Paddle?

With Paddle, companies have complete peace of mind. No need to hire extra people, no need to become overnight tax experts. You can continue to run and grow your business without the headaches that tax liabilities compliance world brings.

Unlike other billing or tax solutions, Paddle operates as a Merchant of Record (MoR), becoming legally responsible for sales – including tax – and provides everything you need to sell software: payments, currencies, subscription management, financial and privacy compliance, invoicing,and more.

With Paddle, you can scale software sales with one unified platform, and relax in the knowledge that you no longer have to manage tax compliance. Find out more about what MoR means in our recent blog post.