A recession is looming. And with that comes a lot of advice and commentary about how to manage your business in this new climate.

In a recent thread, Chief Strategy Officer Patrick Campbell analyzed the performance data of 23,200 subscription and SaaS companies to find out what’s happening in the market right now – and what that might mean going forward.

The TL:DR? Things will mostly be fine, but two data points are looking quite scary in both consumer and business markets.

Consumable products are slowing

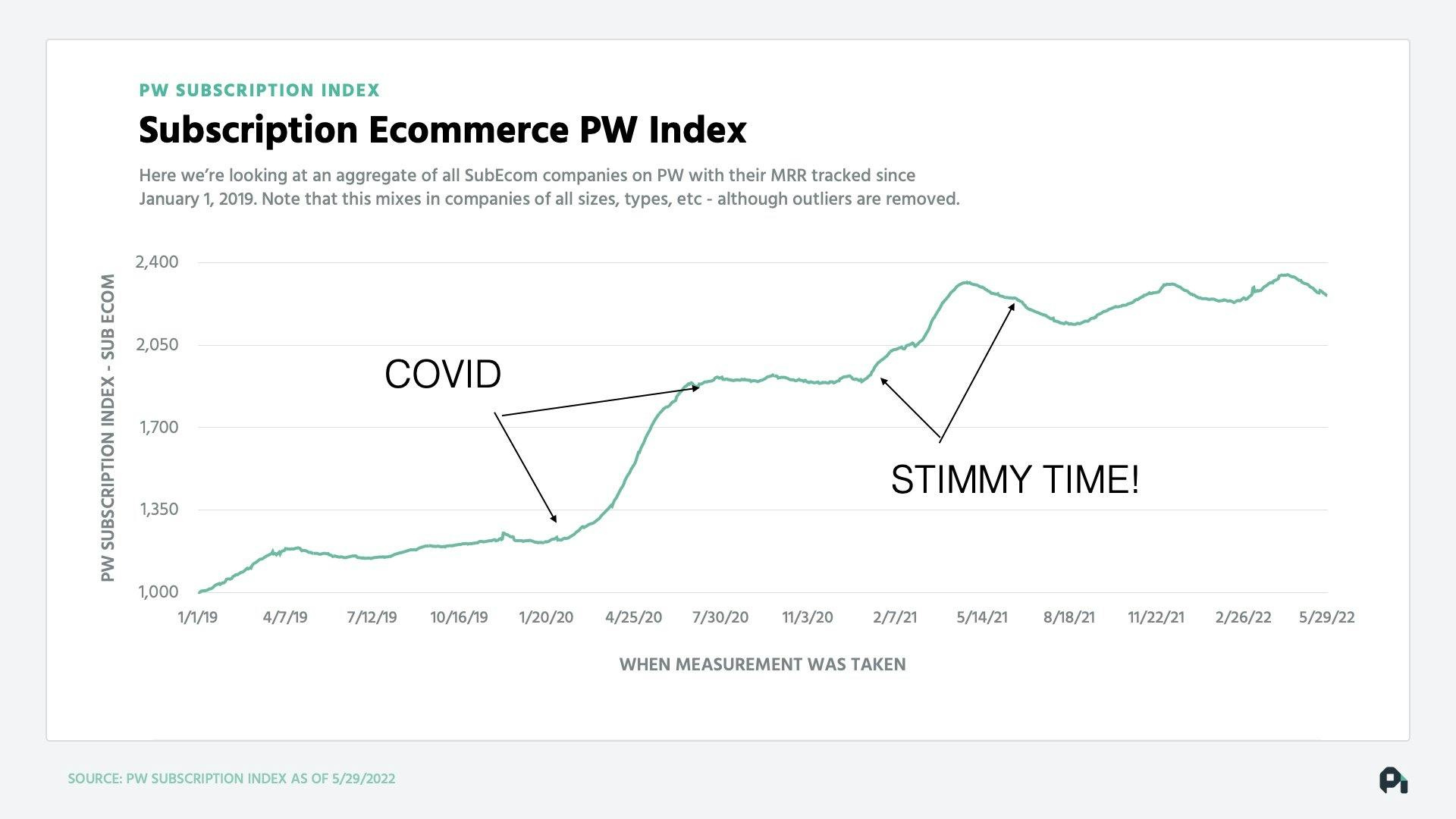

Subscription ecommerce accelerated ten years through COVID and then helped along by stimulus payments (or stimmies) made by the US government during the pandemic. Just take a look:

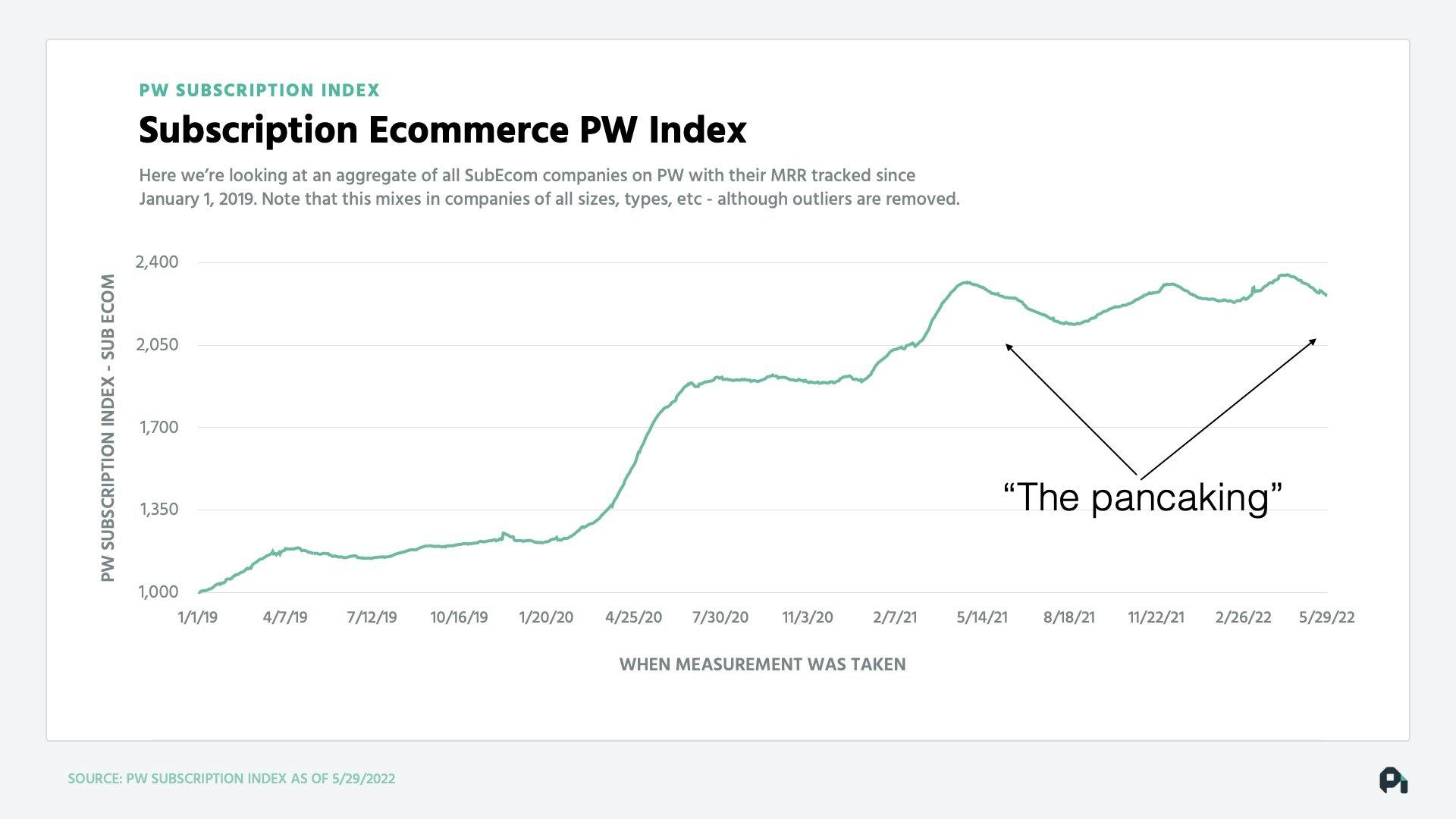

But there’s a problem. As covid subsides and consumer debt looms – consumable products are slowing. Without stimmies those nice-to-have products are going away — “the pancaking” is happening.

It means that at best, growth stays flat.

But worst case scenario is contraction because churn is up:

- 22% in subscription boxes

- 16% in subscribe and save

- 11% in consumer SaaS

In short, while (for the most part) new sales are staying consistent, we’re not replacing lost customers fast enough.

B2B SaaS churn and downgrades are accelerating

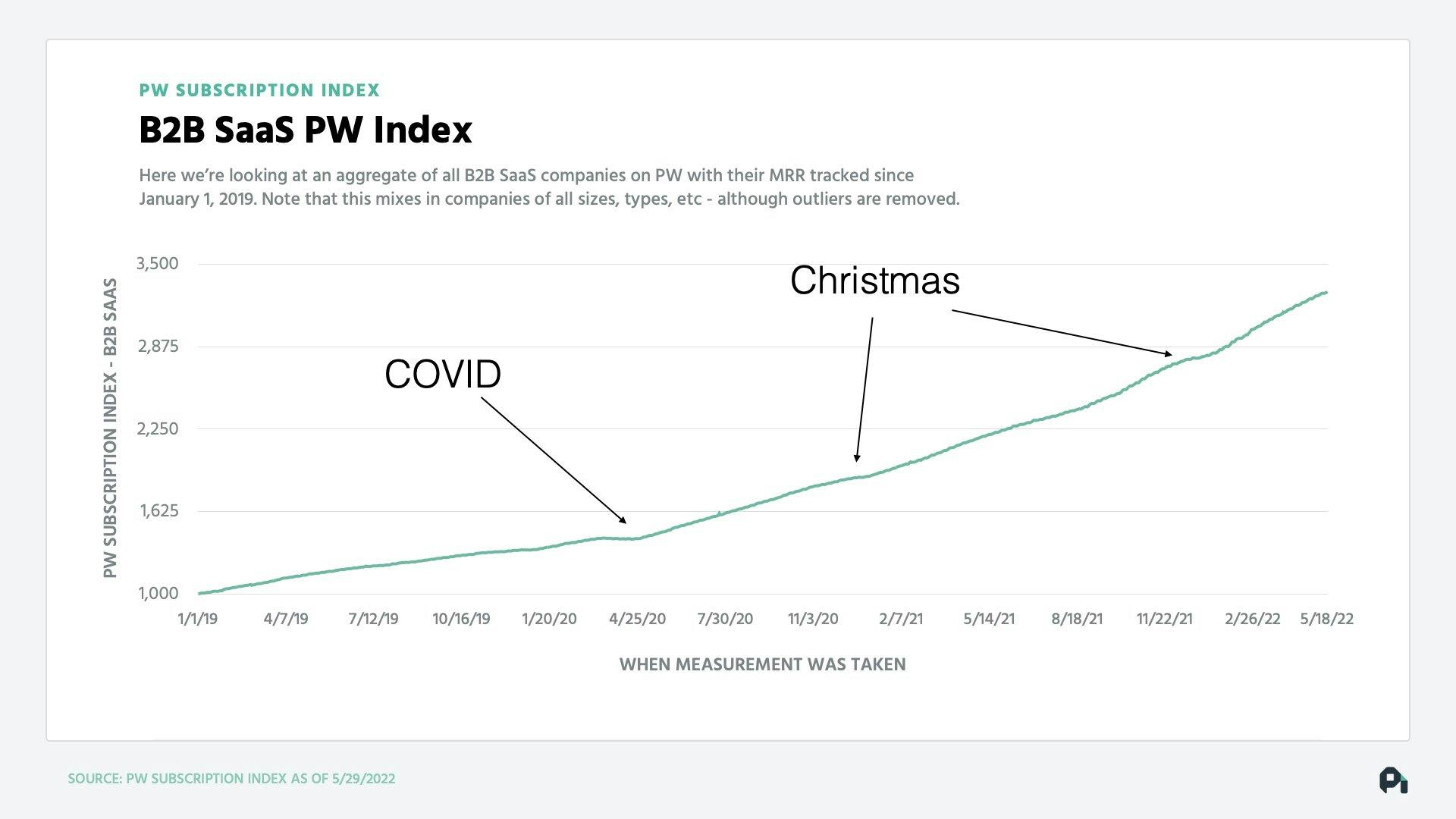

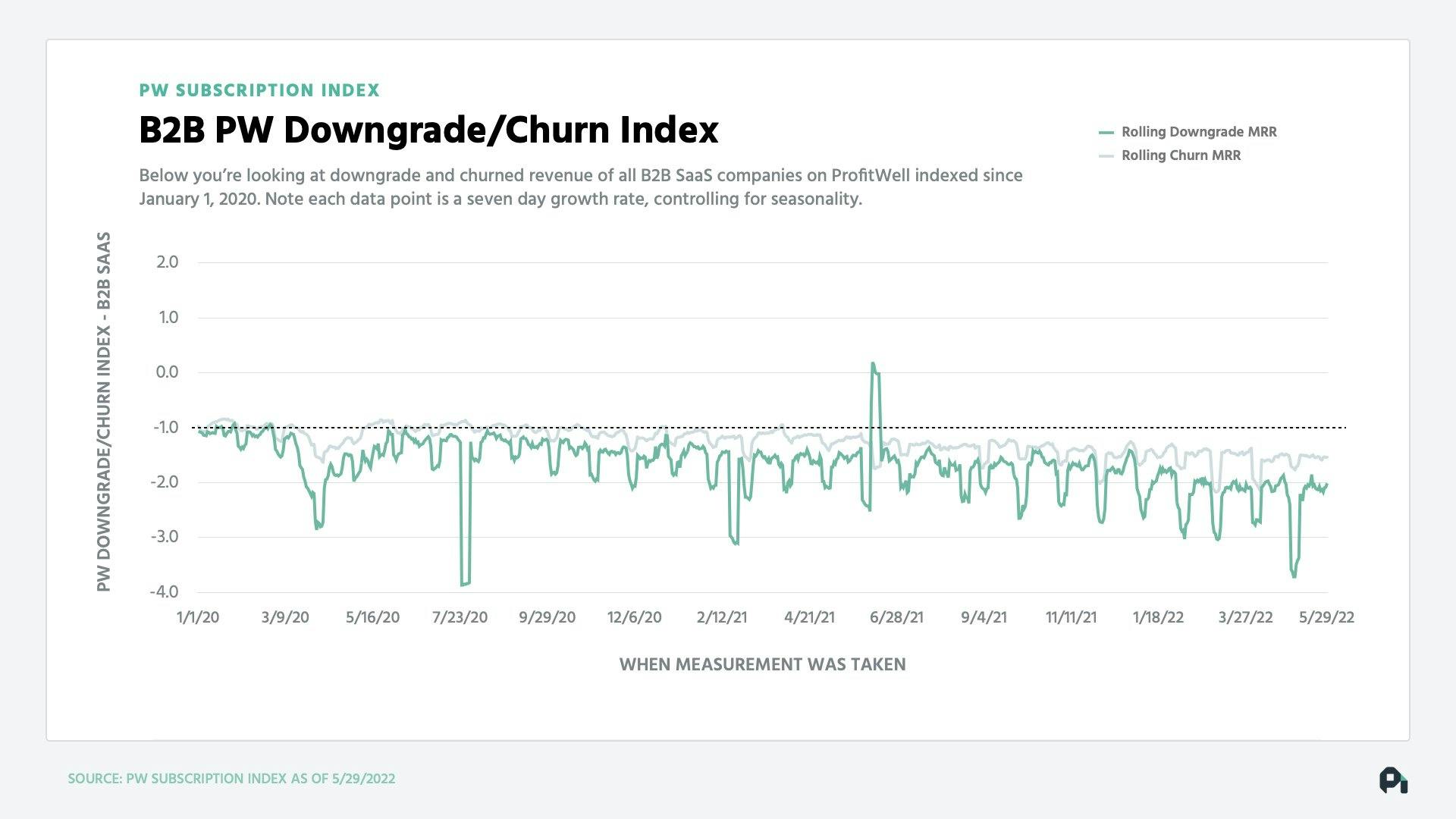

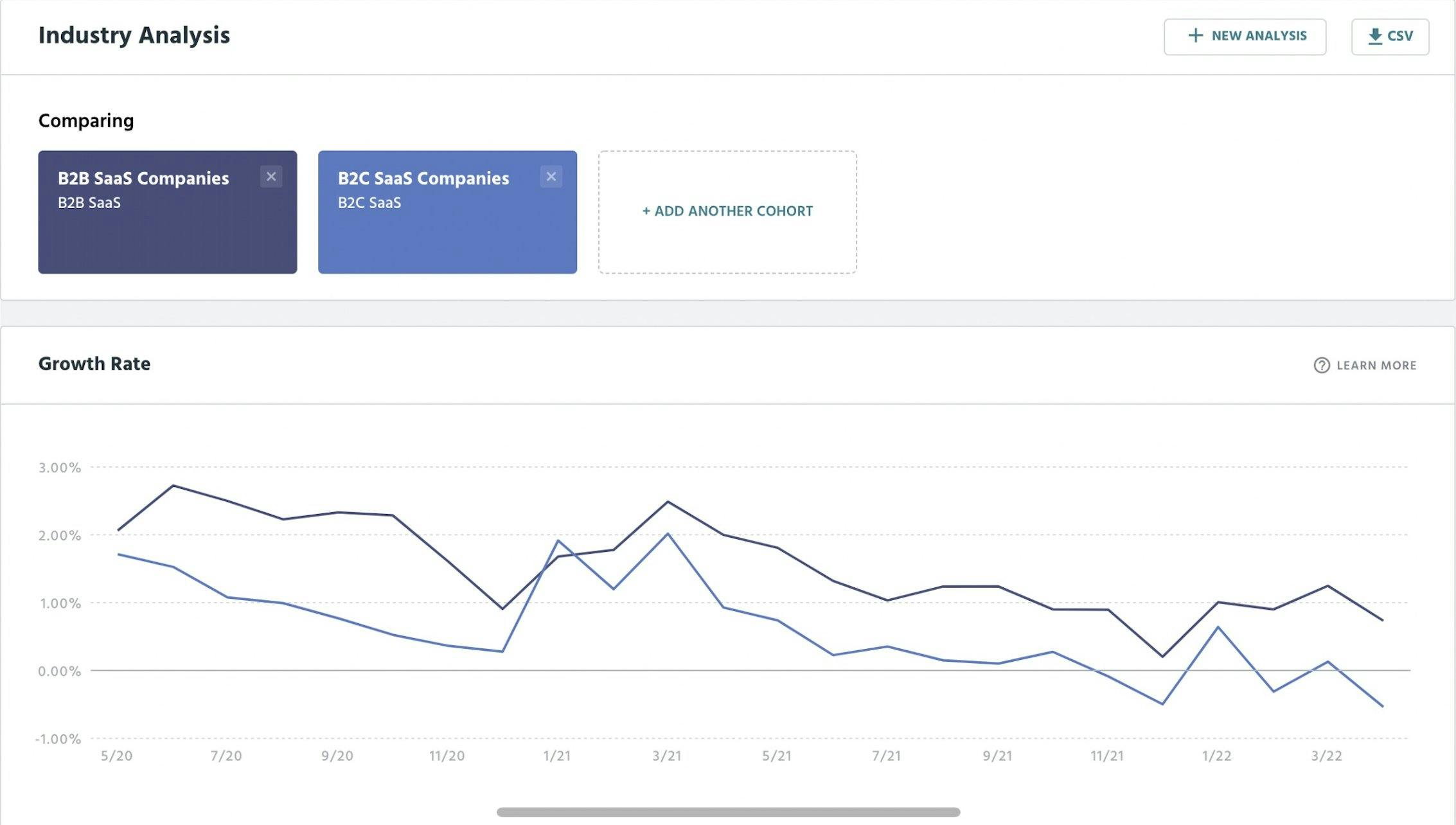

Things get more interesting in the B2B SaaS market. The chart below shows an aggregate view of B2B SaaS companies on ProfitWell with their MRR tracked since 2019. What you see is that COVID was basically a three week stall, similar to a Christmas stall. And though not as apparent, there’s a lurking problem similar to that of subscription ecommerce.

While growth is happening, churn and downgrades are accelerating. Remember, recessions hit the consumer world first and then filter through to B2B.

So, even though new sales have been relatively consistent, churn is starting to flood the market resulting in slowing month-over-month growth rates in both B2B and B2C markets. And, unfortunately, it’s only going to get worse in B2B. When B2B churn catches up with growth you’ll likely see new sales lowering too (neither consumers or businesses can afford stuff anymore).

What should you do?

This data is useful as an early warning system – the problem doesn’t necessarily exist yet, but it will.

For now, your focus should be on two things:

- Survival

- Customer lifetime value (CLV)

Survival

Business survival, right now, is about cost savings and reducing your burn rate. Here’s three things you can do:

- Audit your expenses – we’re all paying for things we shouldn’t.

- Make sure you're default alive with at least a 10% buffer if you’re bootstrapped or an 18-24 month runway if venture-backed.

- Re-evaluate all non-core projects. You need to make long-term bets, but scrutinize everything.

Customer lifetime value (CLV)

Subscription growth is pretty basic:

Acquire a customer that's optimally monetized and sticks around for a long time.

Most SaaS businesses focus on the “acquire” part of that sentence, but the rest is crucial as well.

On monetization you should:

- Sell to your existing customers. Happy customers consistently buy more in recessions. Focus on cross-sells, upsells, and add-ons to bring in additional revenue.

- Raise prices. If your net promoter score (NPS) is more than 20, raise prices starting in September (after the balance sheet audits are done).

- Evaluate segments ASAP. Focus your sales team on the most lucrative prospects, rather than those hit hardest by the recession.

- Localize your offering. Localize your product and sales processes in the strongest economies. Beyond currencies and languages, make sure your pricing is region specific too.

- Re-evaluate your discounting strategy. Most discounts are far too high – cut them by half.

On retention, you should:

- Shore up credit card failures. It’s likely that your recovery rate is half what it should be. Reducing friction in your renewal process, or retrying payments at the right time will improve your payment acceptance rate.

- Implement cancellation flows. Entice people to stay with salvage offers and maintenance plans.

- Push longer-term plans. Do a promotion that encourages monthly customers on to quarterly or annual plans.

- Set up reactivation campaigns. Follow up 60, 120, and 180 days after a customer cancels – use small offers to encourage them to come back.

Whoever ends this with the most users will win

There’s a lot to learn from Hubspot and Salesforce and how they handled COVID. They doubled down on these three things during the pandemic:

- Community: They worked to give a forum for people to share their struggles.

- Giving more value for free: Both invested in more free products.

- Experience: Both introduced design shifts that improved their customer experience.

All of which focus on one thing, users. Why? Because whoever finishes this thing with the most users will win. Attracting the right customers, and keeping them happy is what will ultimately see you through.

A recession will impact the whole SaaS industry — including growth, funding, and valuations. Find out more about the impact the state of the market is having on SaaS growth and the funding landscape, here.