Annual Plans Reduce Churn Dramatically, Data Finds

Neel Desai Jan 29 2019

On this episode of the ProfitWell Report, Brendan Schwartz, Co-Founder and CTO at Wistia, wants to know what proportion of paid plans should be annual versus monthly. To answer Brendan's question, we gathered data from just over two and a half thousand subscription companies.

The beauty of the subscription model is that for the first time in the history of business, relationships are baked directly into how you make money. Every month, year, or however long the term of the subscription is, your customer has a decision to make around if they’re receiving the value for which they’re paying.

If they don’t feel like they’re getting value, then they’ll churn. If they do feel they’re getting value, they’ll renew.

*****We will only be posting a few of these episodes on the blog, which means if you want to make sure you don't miss an episode of this series you must subscribe separately below****

Don't miss out on more insights. Subscribe to get on the ProfitWell Report's list now.

Having a longer term length or an annual subscription can make this easier on you, because the customer is making a deeper commitment that allows you to plead your value case with enough time to show value. Hence why annuals can be instrumental in lowering churn and ramping growth.

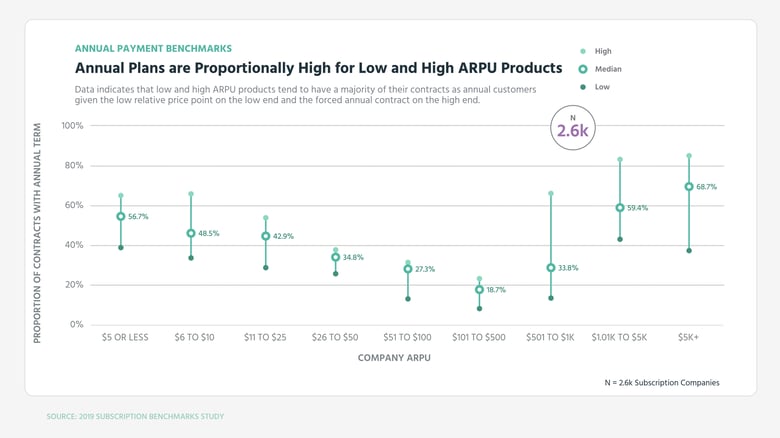

Annual subscriptions as a proportion of overall subscriptions shift wildly depending on your ARPU, with low ARPU companies seeing over 50% of their subscriptions on annual plans, mid-range ARPU companies dropping down to roughly 20-30% of their subscription coming from annuals, and then high ARPU companies swinging back to a high proportion of annuals.

Click to enlarge

This feels pretty intuitive, because low ARPU companies have annual subscriptions that are nice round credit card numbers where a customer is more than willing to swipe for a $100 annual charge. On the high end, you’re likely looking at a mid-market or enterprise type deal, so an annual contract is simply baked into the sales cycle.

That being said, this is descriptive in nature, so what’s the data say around what works and what doesn’t? Well, annuals do reduce churn pretty substantially, because your customers have one purchasing decision per year versus twelve. Keeping track of your annual contract value (ACV) closely and proactively reducing churn before it happens is key to maintaining a healthy business.

As you can see in this data, there’s a strong correlation indicating that as you increase your annuals, you’ll be reducing your churn with folks with the majority of their contracts as annuals seeing almost a fifth of the churn as those who don’t have annuals.

Click to enlarge

Ultimately, more annuals are likely better, especially given the churn implications, so I’d push for optimizing those relationships by understanding where the best point to ask for an annual upgrade is within your customer’s lifecycle.

For most businesses, it’s probably not directly in the initial buying cycle, because your customer doesn’t know about your product quite yet, so some research absolutely needs to be done about your company specifically.

Well, that's all for now. If you have a question, ship me an email or video to neel@profitwell.com and if you got value here or on any other week of the report, we appreciate any and all shares on Twitter and LinkedIn. That’s how we measure if we should keeping doing this or not. We’ll see you next week.