How does contract length impact ARPU and churn?

Neel Desai Jun 19 2019

Today Vinish Garg from vhite asks a classic question in the subscription world: How does a customer's contract length affect average revenue per user (ARPU) and churn?

To answer these questions, we looked at the data from over three thousand subscription companies. Here’s what we found.

Relationships are where the beauty of the subscription economy truly shines. For the first time in the history of business, we have a revenue model where the relationship with the customer is baked right into how you make money. Interestingly enough though, we don’t have to test that relationship on a month to month basis – we can (and should) lock in a longer term. What’s the best term though? 1 year? 2 years?

As to not bury the lede - increasing the guaranteed subscription term absolutely lowers churn.

Regardless of ARPU, those companies with a higher percentage of annual contracts see significantly lower churn. This is because these customers have only one purchasing decision per year (albeit a larger one) whereas their monthly counterparts have 12 purchasing decisions per year. Note that the correlation is pretty strong here with those companies that have 100% annual contracts seeing 80% lower churn than those who only do monthly.

2a95.png?width=2035&name=GRAPH_1%20(1).png)

We don’t have enough data on multi-year contracts, but qualitatively we’ve seen the effects to be similar with one important exception. As you increase the term beyond 1 year, the reduction in customer attrition is minimal, meaning there isn’t much to be gained in terms of retention for 2+ year contracts.

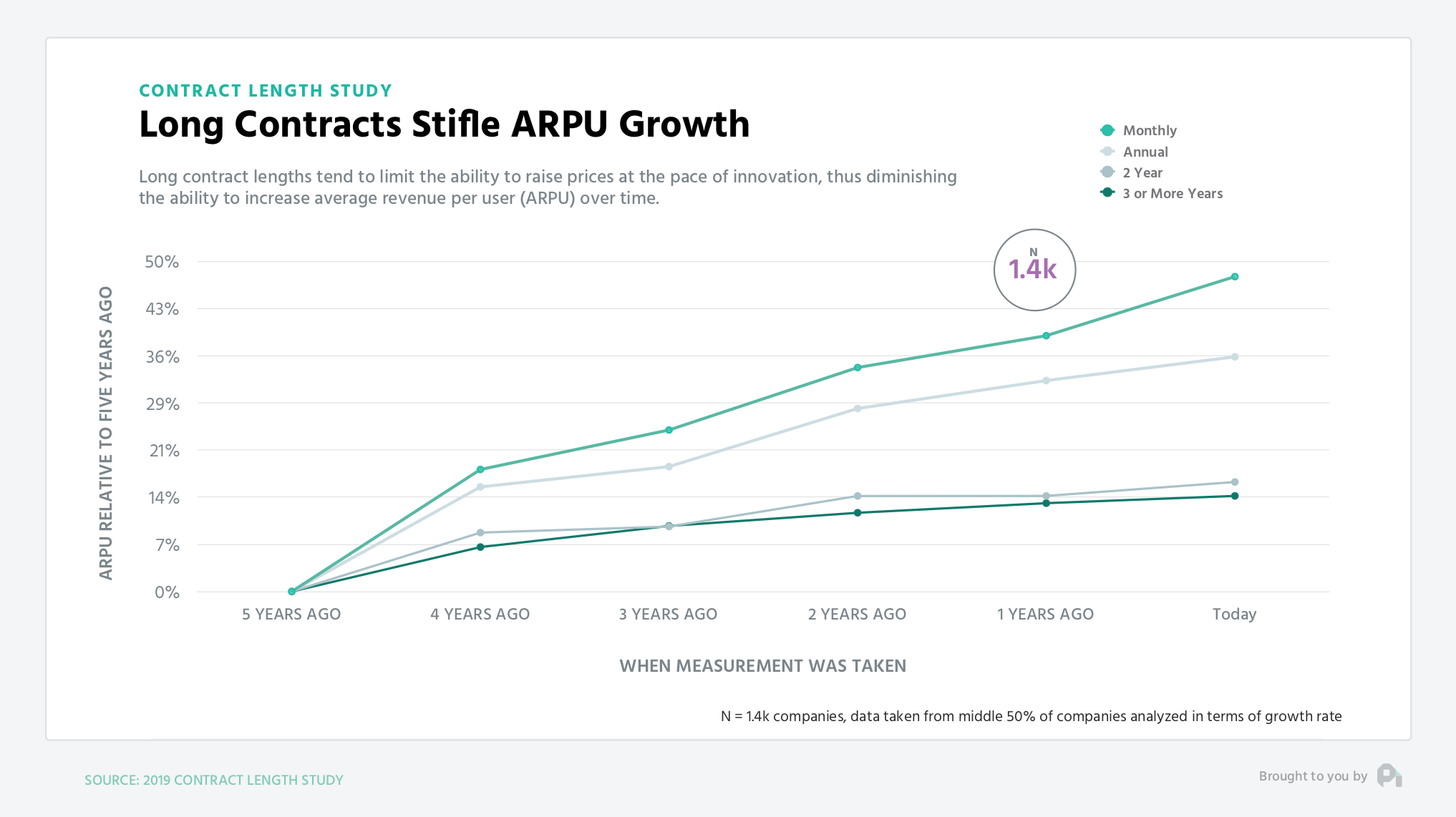

There is much to be lost though with longer term contracts. While many people use two or more year contracts to guarantee they recover acquisition costs, the impact is you lose out on the ability to increase prices or your overall average revenue per user.

Note how those companies using monthly or annual contracts tend to have some fairly decent increases in ARPU over the years. The flexibility of these contracts ensures that as the product improves, the price can also improve. Remember, your price is the exchange rate on the value you’re providing. Those with longer term contracts tend to have fairly flat ARPU, mainly because so much focus is being put on the longer contract that these terms don’t provide a lot of flexibility.

Of course, a big lurking variable here is longer term contracts tend to be used for much larger deals, so what should you do?

Well, in most situations you should definitely optimize for a healthy dose of annual contracts. Axiomatically I would say that most companies out there should avoid contracts longer than a year, strictly because you want to be able to raise prices over time. Some industries won’t be able to avoid the long term contracts due to constraints from the cost of acquisition, but these folks should then make sure contract terms are flexible enough to warrant price increases, especially as the product improves.

Well, that's all I have for today. If you have a question, ship me an email or video to neel@profitwell.com and if you got value here or on any other week of the report, we appreciate any and all shares on Twitter and LinkedIn. That’s how we measure if we should keeping doing this or not.