The complete SaaS guide to calculating and optimizing ARPU

Getting to know your customer is what separates the losers from the winners in the SaaS world. When you break down a successful business you will find 99.9% of the time that they have a strong hold on who their customers are and an even better grasp on where that customer finds value in their product.

This starts with quantifying your customer personas and trickles down deeper into your SaaS metrics as time passes and the business grows. The real secret sauce to understanding your customer is being able to understand your Average Revenue Per User (ARPU). This metric allows you to identify trends and implement change that can shift the trajectory of your business towards that large pool of SaaS profits we all dream of.

So to better understand ARPU, let's take a deep dive into what it is, why it's important, and ways that you can optimize this metric to catapult the success of your SaaS business.

Why you should care about ARPU

To sum up ARPU in one sentence: it's the average amount of monthly revenue that you receive per user.

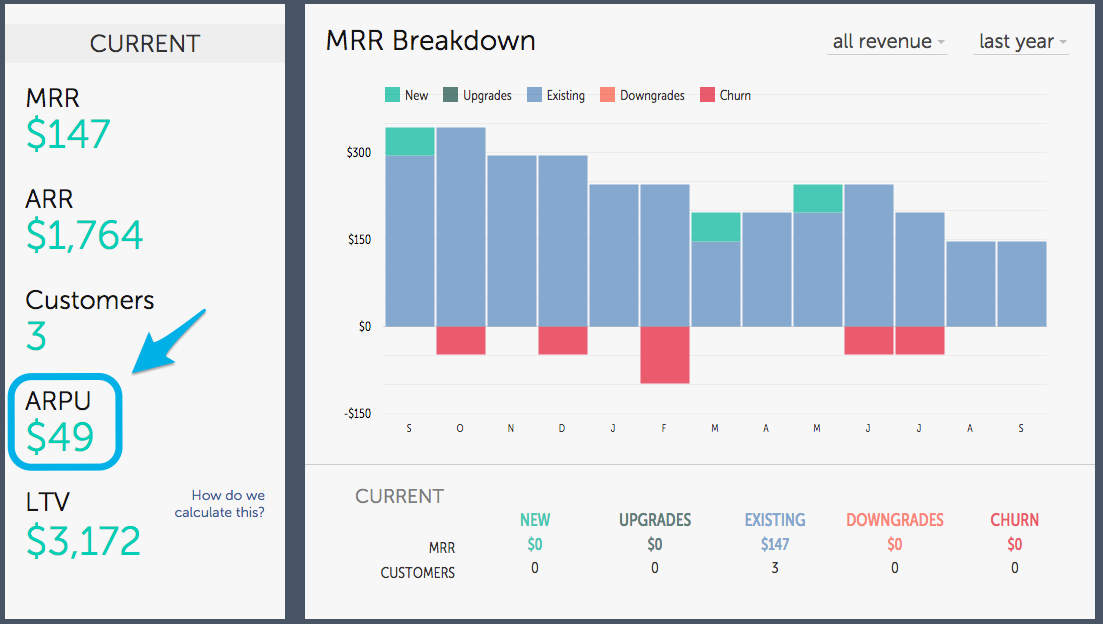

People say ARPU is a "vanity metric" (a metric that isn't actually useful). Those people are using ARPU incorrectly, because while not the deepest metric, when calculated and broken down properly this metric helps you identify trends in a group of customers booked within the month against different cohorts and segments. When graphing this metric you can identify price points that customers are selecting more than others, along with being able to identify upsell/downsell trends - a major factor in the efficacy of your SaaS business model.

Tracking ARPU allows you to plan for the long-term and the short-term. On one end it can be the base for accelerating your Monthly Recurring Revenue (MRR) growth through higher paying customers. ARPU is also a source of fuel for your customer Lifetime Value (LTV) goals, ensuring that your SaaS business is on the trajectory path that it needs to be for optimal success in the long term.

Why Understanding ARPU Is So Important

Understanding ARPU is a bird's-eye view into how well your SaaS company is actually doing, especially when breaking down the information by segment and cohort. The higher the ARPU for a company, the better the chance that the company is able to extract more cash in the future. Additionally, if you're able to have a high ARPU relative to the value you're providing or the revenue of the company, you know you have a product that's driving a better value ratio. In summary though, here's why APRU is important:

Indicates the health of your business financially: If your ARPU is sub-$100, then you know you need to get a metric ton of customers to grow a sustainable company. In this manner, ARPU allows you to see what kind of business you need to be from a pricing and value perspective. Most oftentimes ARPU is the "canary in the mind" indicating that your product may be too cheap in a market that isn't big enough. Alternatively, a high ARPU in a large market indicates you're off to the races in terms of growth and prosperity.

Product validation that you're extracting enough value from your personas: One of the biggest mistakes we see from companies is that they're targeting small or enormous customers and the ARPU isn't high enough for the value that's being provided. For instance, if you're selling a product to Disney and they're getting $1M worth of value in time, cost, etc. efficiencies, then you should be charging at least $100k for that product. ARPU helps your product team see if they're aligning the value of the product to the right customer.

Validation that your marketing and sales teams are driving the right deals: ARPU should be increasing consistently over time, especially if you're just starting out in the SaaS game. The reason for this constant need for improvement is because it indicates that your sales and marketing value propositions and targeting are constantly getting better quarter over quarter. Essentially, you're becoming more efficient.

What to include in ARPU

Average Revenue Per User (ARPU) is a tabulation of all revenue coming in from your users divided by the total number of customers that revenue came from. Here are the items that you should include in your ARPU calculations:

Monthly Recurring Revenue: The total amount of recurring revenue that your business brought in for the month.

Account Upgrades: A subsection of MRR that represents the upgrade dollars from the current customer base that you have

Account Downgrades: This includes the total dollar amount of customers that have downgraded their service. This is important because downgrades represent money lost from current customers that have not churned.

Lost MRR from churned customers: This subsection of MRR is a tallying of the MRR that you lost from customers who actually churned, not those who’ve canceled.

Total Paying Customers: Include all of the customers that have paid for your service within the month and have active accounts. If you have “free users” they shouldn't go into the ARPU calculation because they are not providing revenue for your business.

What You Should Not Include In ARPU

The key to getting accurate ARPU metrics is to realize that it is a tabulation of your current customer base and the money that they have spent with you for the month. Additionally, it should be noted that ARPU is a “momentum metric” just like MRR/ARR that thrives on purity.

One of the quickest ways to mess this up is by including items such as “free” or “inactive” customers that you are not generating any revenue from. Conversion is truth, so if someone's not paying you, then they shouldn't be included in your ARPU. If you do include them, you will end up watering down your revenue average for the month and providing investors/stakeholders with a distorted image of how the company is performing.

How To Calculate ARPU

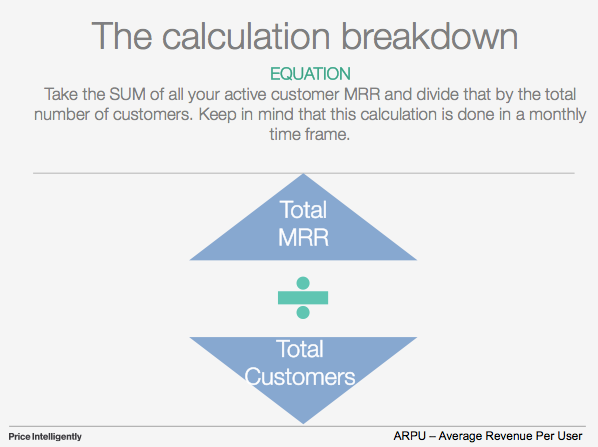

To calculate ARPU you need to account for the total MRR and the total number of customers.

ARPU: Here you take the SUM of all your active customer MRR and divide that by the total number of customers. Keep in mind that this calculation is done in a monthly time frame.

Three Ways to Optimize ARPU

ARPU is the trend identifier metric that allows you to really get to know your customers. The more ARPU you can generate, then the better your SaaS business is doing. Don’t forget that ARPU is what gives you the insight to catapult your business forward by increasing MRR/ARR and extending your customer LTV.

Here are four actionable ways you can optimize ARPU for your SaaS business.

Add-Ons, Value Metrics, and Upgrades: Any way you can absolutely increase the amount of revenue from your customers month over month should be considered. The easiest way to do this is to make sure that a value metric is central to your pricing strategy to bake in expansionary revenue. An alternative to this strategy is to make sure you have a clear add-on and upgrade strategy.

Ensure your retention is on point, especially for larger customers: MRR churn is directly connected to your ARPU, as leaking customers (especially large ones) will reduce your customers and your revenue. Make sure you're running a proper retention process.

Make sure you're targeting the right customer personas: You may be absolutely deflating your ARPU by targeting too many small, distracting (and expensive) low revenue customers. If you're not in the consumer space or a space with hundreds of thousands (if not millions) of potential customers, then you shouldn't be chasing sub-$100/month customers. Make sure you quantify your buyer personas properly and target the right ones for growth.