Get a better understanding of burn rate and how to calculate and reduce it with this comprehensive guide for startups and scaling businesses.

If any unfortunate high school kids find this article, hoping it holds the secret to reducing their own personal rate of being burned by friends, these are not the burn rate calculations you're looking for.

If, on the other hand, you're the CFO of a growing business concerned with the speed at which your company is tearing through its funding, these are the exact burn rate calculations you need to get a handle on it.

What is burn rate?

Burn rate is used to describe how quickly a company is spending its cash reserves to cover overhead costs. It is also a measure of negative cash flow, usually expressed as the amount of cash spent per month. For example, if a company has $250,000 in cash reserves and a burn rate of $50,000 per month, it will run out of cash in five months.

Why burn rate is so important

The fact that 82% of startups fail because of cash flow problems tells a story of just how often cash flow is taken for granted by young businesses. Understanding burn rate is key to both recognizing areas for improvement within your company and planning for the future. Especially if you're a funded startup, ignoring your burn rate is not an option.

Burn rate identifies necessary budget cuts

A company's burn rate can hint at overspending. And if you're running a startup, you're almost certainly overspending somewhere. The following three areas are likely contenders.

- Branding: With so many branches and a varied ROI, branding can often be a point of overspend for new companies.

- Vendor Relationships: Many young companies let inertia set in early with vendor relationships, even when rates need to be renegotiated or new partnerships sought out.

- Office Space: Your lust for brand new office space may prevent you from enjoying it for long. Lengthy leases and slower-than-expected staff growth can turn a luxurious workspace into a burn-rate albatross.

Presuming you spot it fast enough, a high burn rate due to factors like these can be a blessing in disguise, pointing you toward more effective replacements for needless expenses. If your burn rate's up because of overspend on branding, consider organic means of building your brand profile instead of paid advertisements. If it's because you're getting a bad rate from a vendor, use it as an opportunity to shake things up.

And if the burn is coming from that corner office, it might be time to move back to the basement for a while.

Burn rate informs how much revenue is needed

Put simply, you can’t go bankrupt if you make more money than you spend. Beyond that, responsible growth and planning (and so the success of your business) are not possible without knowing how much money is left after expenses to reinvest in your company.

For funded startups, the relationship of burn rate to revenue is especially important. You'll have used funding cash to build the company in the early stages, with the aim to reach positive cash flow before the money runs out. Sometimes called “cash runway,” this metric tells you how long the money will last at your current burn rate.

You should ideally target having 12 months or more of runway at any given time, particularly in early seed rounds. That way, you can take the hit of an unexpected expense, a market downturn, or a complication with your product without feeling the heat of a sudden burn rate increase. Pilot has an excellent line of runway calculators.

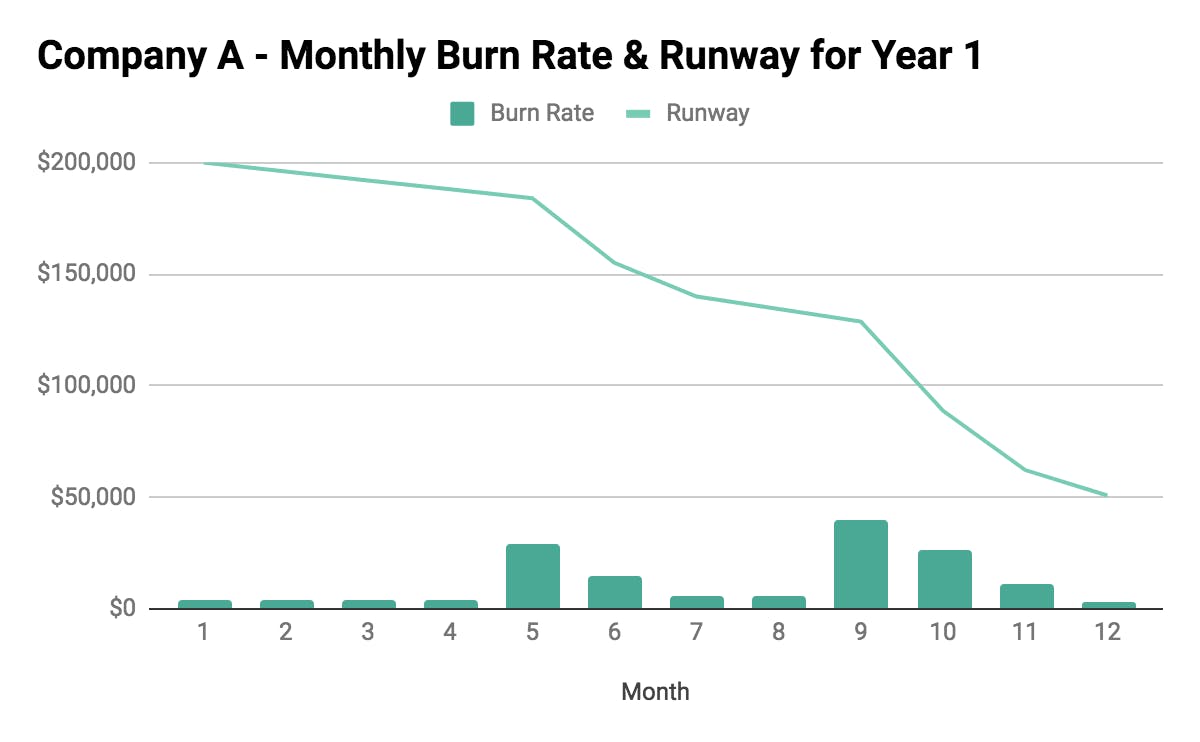

Company A has prepared their cash runway fairly well, and was able to cope with a few unforeseen spikes in their burn rate during their first year. Their runway will not last much longer, though.

High burn rates ARE bad for business

Burn rate is exceedingly important for startups that are using venture capital finance to cover their overhead. And for all of the reasons above, the higher the metric, the worse shape a startup is in.

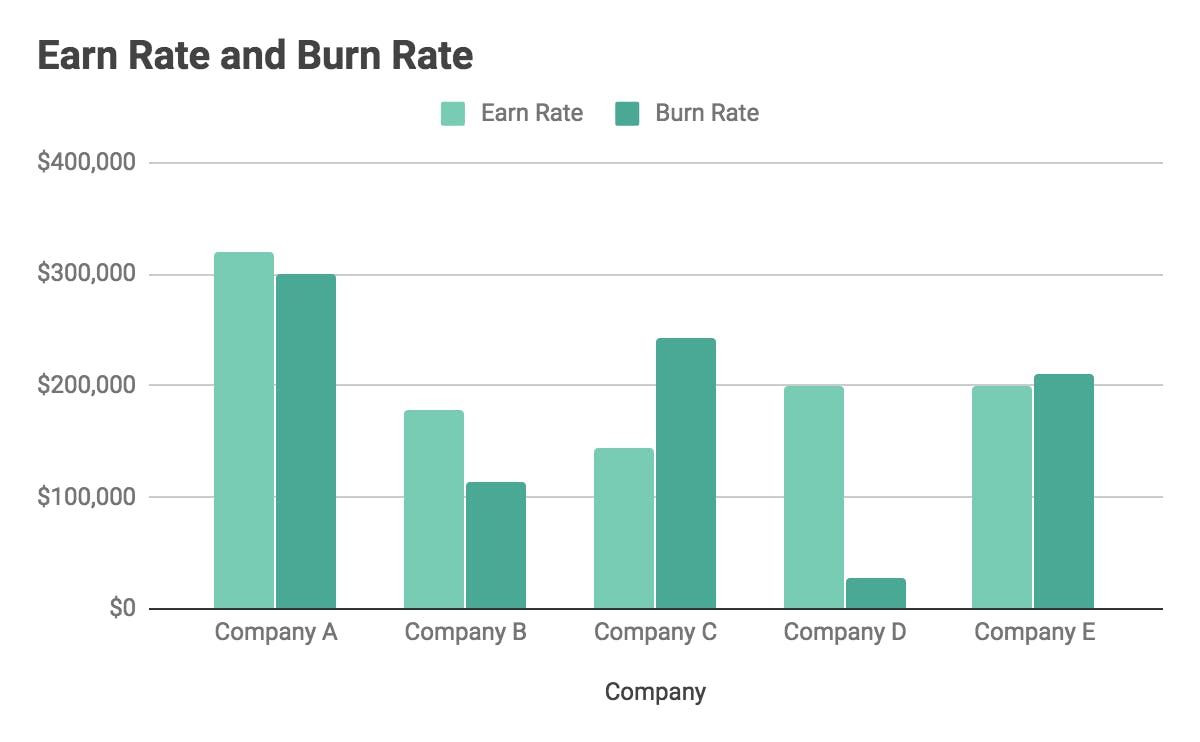

Companies A, B & D have the right idea, but Companies C & E clearly need a change of approach.

And burn rates aren't just for startups either; mature businesses can also find the metric useful as a means of measuring cash reserve, building and targeting later investments. Nevertheless, all this talk is purely academic if we don't have a sure handle on the way we actually calculate burn rate itself.

How to calculate burn rate

Burn rate calculation is not quite as tough as Fermat's Last Theorem, but a robust understanding of both the core burn formula and its variation is critical for business success.

Gross burn calculation

Gross burn paints a picture of how efficient your company is, regardless of revenues streaming in:

Gross burn rate = cash/monthly operating expenses

Having understood this basic formula for gross burn, you then need to incorporate your monthly overhead costs to attain a picture of your net burn. You can do this with the following formula:

Net burn calculation

Net burn shows the rate at which the company is losing money; if your revenues increase, your net burn rate will decrease.

Net burn rate = cash/monthly operating losses

Now that you can compute your burn rate, how do you know what rate is acceptable?

There's no one-size-fits-all answer to this question. All companies should maintain a burn rate that's sustainable relative to their revenues: if you're growing at a rate of knots and there's inbound interest in funding your company, then a slightly higher burn rate can be satisfactory. If growth is stalling, then you need to look at reducing burn.

You should expect a measure of fluctuation as you scale and as you deal with bumps in the road, but it should remain steady and in the shade of your revenue.

How to reduce your burn rate

Your burn rate is intimately tied to almost all commercial activity in your business. This means that, in case the burn needs to die down, strategies to reduce it can come from a number of different angles.

- Reduce churn rate: Even if your monthly overheads haven't been going up, if your company is churning customers like crazy, your revenue will suffer, and your burn rate will go up. An out-of-control churn rate is fatal. Use these tried-and-true strategies to keep it under control.

- Focus on core competencies: For companies young and old, trying to be everything to everyone can be a problem. Pursuing every idea that seems halfway decent will lead to funding that's spread much too thin, sluggish performance, and a high burn rate for low return. Return to your core competencies, pare down the features of your service, and stick to what's essential: efficiency is the fastest way to douse the flames of a high burn rate.

- Defer or reduce expenses: Which expenses aren't directly leading to more revenue? You could make the case that while the $700/month on gourmet coffee for the staff is going the distance and bringing in value, the rock-climbing scholarships probably aren't.

- Cut off products that don’t sell: Many companies offer products for the sake of variety, even if they don’t sell. Not all may be worth keeping, and the company may benefit from (even temporarily) cutting them.

Burn rate can be an anxiety-provoking statistic in the early stages of a funded startup. Maintaining a low burn rate allows all overheads to be accounted for and growth to be steady.

Consistently monitoring your burn rates is not only good for your company's bottom line; it's excellent for focusing your attention on areas in your company that need a rethink (growing churn rates, huge expenses, or ineffective products). If your company isn't feeling the burn, you're heading in the right direction.