The World's Largest Study on SaaS Churn - Part 2

Patrick Campbell Aug 31 2016

-

Speed1x

-

Quality720p

Hi! We're Wistia. We provide business video hosting to attract, engage, and delight

Thanks for reporting a problem. We'll attach technical data about this session to help us figure out the issue. Which of these best describes the problem?

Any other details or context?

Last week we opened up with the world’s largest set of SaaS MRR churn benchmarks (part 1) to help founders and operators get over guessing when it comes to knowing if they’re on target or not in their businesses. Essentially, we answered the question, "how do you stack up with other companies?" You can see breakdowns of churn across ARPU, MRR, venture backing, and how long the company has been around here.

Here we’re going to dig deeper into churn through data around how churn correlates to a few other key pieces in the churn stack, particularly pieces that are much more prescriptive than simply looking at churn across company demographics. Bluntly, we'll be answering - "what are some fundamental tactics you can use to reduce gross churn?"

Let’s walk through a brief background of the data set, before jumping in and giving you some insight around how you can reduce churn through some key initiatives on your business.

Some background on the data

The following data comes from a set of 941 companies (unless noted) across numerous industries (both B2B and B2C). To ensure we had an even split, we ensured that each bin you’re about to see (eg. 1.1-2 years, $10.01-$20 ARPU, etc.) has enough data to support proper variance and to ensure anonymity of the respondents (at least 50 data points).

Further, a couple of key points:

-

Everything you’re about to see is monthly gross MRR churn rate

-

These are benchmarks, so while there are some clear trends here, “good” and “bad” depend on your business

Churn vs. Annuals: A higher percentage of annual contracts, the better

Perhaps most telling in the data set we explored, was the breakdown of churn around a company’s percentage of MRR that came from annual contracts. Below you’ll see a clear linear correlation between the high percentage of annual contracts and a lower gross churn rate.

This should feel intuitive, because there’s only one opportunity for an annual contract to churn each term, whereas a monthly contract can churn 12 times in a year. Obvious statement I know, but the breakdown is particularly important, because not enough companies are employing annual contracts, let alone for the right reasons. Most companies think it’s a cash flow opportunity when in reality the opportunity is really around churn reduction.

Takeaway: Take annual contracts seriously for reducing churn.

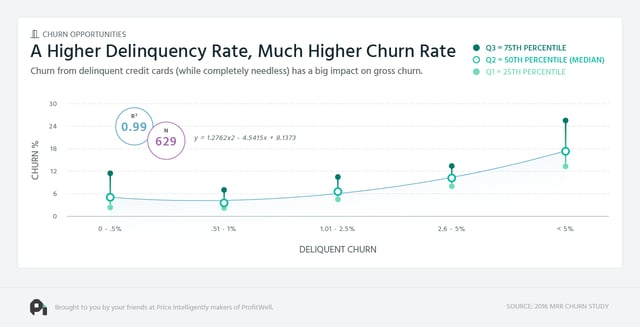

Churn vs. Delinquency Rate: Higher delinquency rate, much higher churn rate

Another intuitive data point, but one that goes often too overlooked, is a company's delinquency rate relative to their churn rate. Delinquency rate is the percentage of MRR that goes delinquent each month due to expirations and other credit card issues (there are 212 different delinquency types).

As you’ll see in the below, the higher the delinquency rate, the much higher the churn. What’s painful about this type of correlation is that this type of churn is absolutely needless, because credit card problems are solvable through numerous means, including using ProfitWell Retain, which does all the work for you to reduce churn (shameful plug).

Takeaway: Make sure you reduce your delinquencies as much as possible through some sort of system - ProfitWell Retain, your own solution, or something - it’s a huge problem.

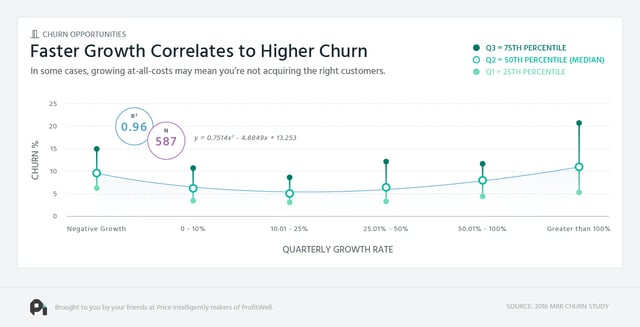

Churn vs. QoQ Growth: Quicker growth correlates to worse churn

While the below is a bit weak in terms of correlation, the relationship is worthy of note, particularly because of the smile graph we’re seeing below. Of course, negative growth correlates to a higher churn rate (that’s where they’re losing the customers).

Yet, extremely high SaaS growth also correlated to a higher churn rate. While I don’t have a ton of data on why this may be, I’d posit that companies growing this quickly are “growing at all costs”, which typically results in shaky, not ideal customers who churn out the other end.

Takeaway: While there’s sometimes a reason for growing quickly at all costs, sometimes it makes sense to slow down at least a bit to make sure you’re acquiring the right customers.

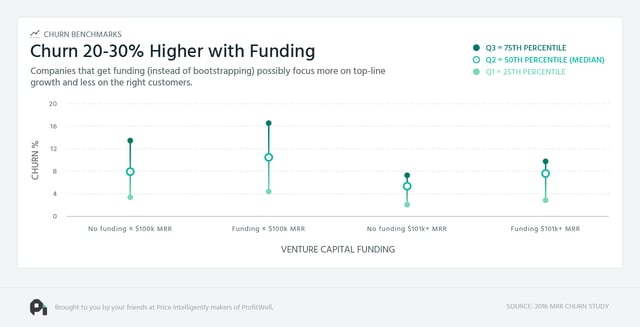

Churn vs. VC Funding: Churn 20-30% higher with funding

When cutting the data further across companies that have been funded vs. those who haven’t the data gets a bit more interesting. As you’ll see in the below, those who’ve been funded at both the early stage and while just entering the gross stage typically have around 20-30% higher churn rates than those who took the bootstrapping route.

There could be a number of reasons for this, but based on qualitative conversations, I’d posit that there’s a bit of a false sense of security with a company with funding. You don’t necessarily need to solve for your churn when you have money in the bank and only worship at the alter of top-line growth. That being said, I don’t have quantitative support on this line of thinking.

Takeaway: If you’re going down the funding route, make sure you don’t put churn reduction on the shelf for later. Churn has a tendency to jump up and bite you at the worst times.

Make sure you focus to reduce churn.

Through our other post on churn benchmarks and this one, hopefully you’ve gleaned a good amount of information around churn to take back into your business to focus enough to reduce churn dramatically. While there are plenty of tactics and hacks to bring down your churn, reducing churn really requires a framework and processes.

To help you in that pursuit, feel free to check out ProfitWell Retain for a quick win to reduce churn. ;)

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.