The World's Largest Study on SaaS Churn - Part 1

Patrick Campbell Apr 24 2016

While the SaaS community is nothing but supportive, we run rampant with a lot of conjecture and rumor. I don’t think any suggestions or tactics are ill-intention, but rather stem from being an industry in it’s infancy. After all, true SaaS really hasn’t been around for more than a couple of decades.

Take any advice around churn as an example. If you search Quora or Google for, “What’s a good churn rate?”, you get either, “well lower is always better” or numbers that are based off benchmarks of low double digit numbers of companies (these benchmarks vary by industry as well). Again, not the author’s fault, more product of circumstance.

To help give a gift back to the SaaS ecosystem, we’ve compiled the largest SaaS MRR churn dataset in the world, in order to help you answer that ever crucial question: “What should our churn look like?” While churn should always be as low as possible, there comes a point where there’s diminishing returns on fighting churn, but also a point where you need to drop everything to focus on this ever crucial piece of your business. Hopefully this data helps.

Let’s walk through a brief background of the data set, before jumping in and giving you some insight around how the market looks for churn.

1. Some background on the data

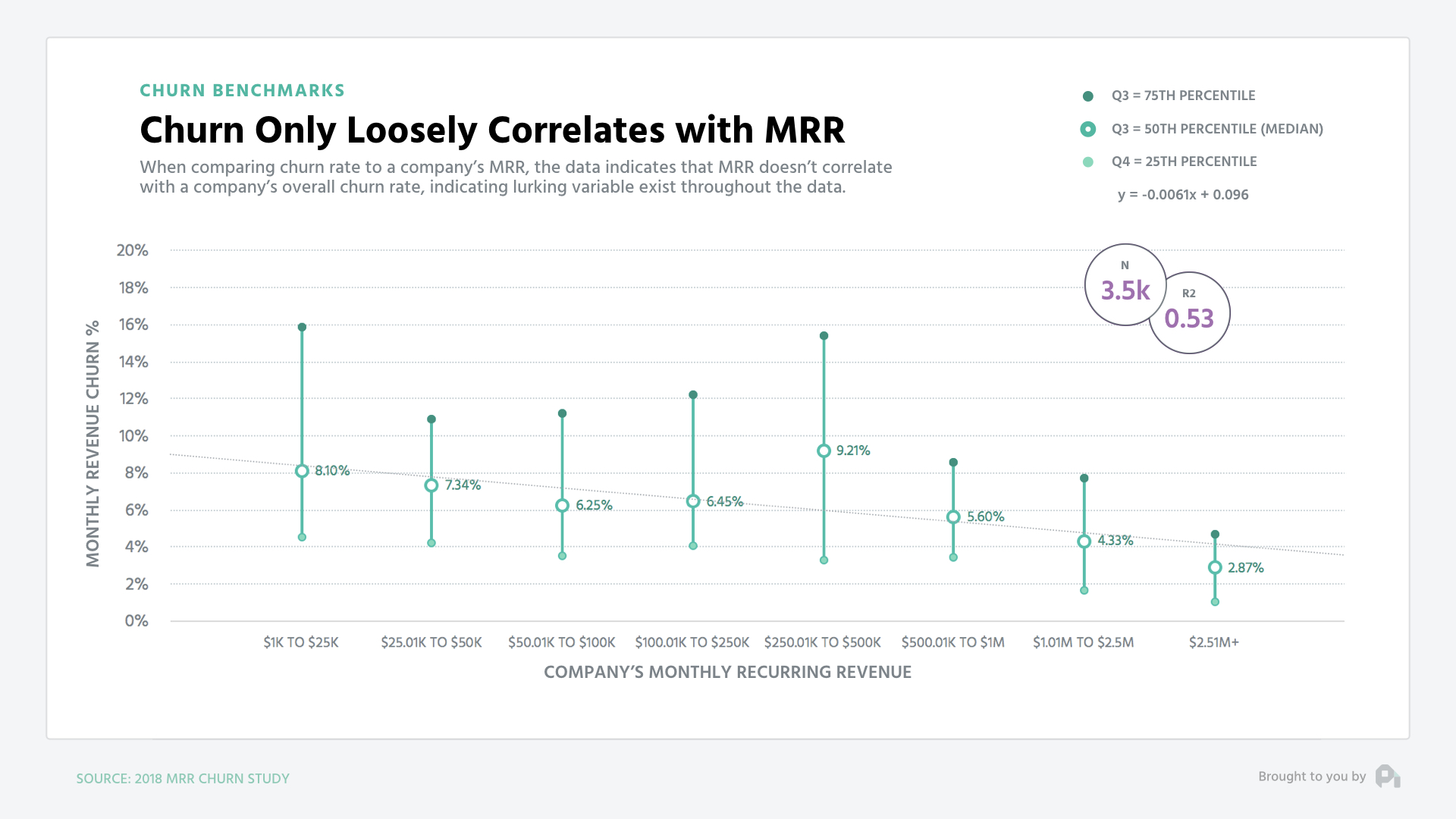

2. Churn vs. MRR: Churn only loosely correlates with MRR

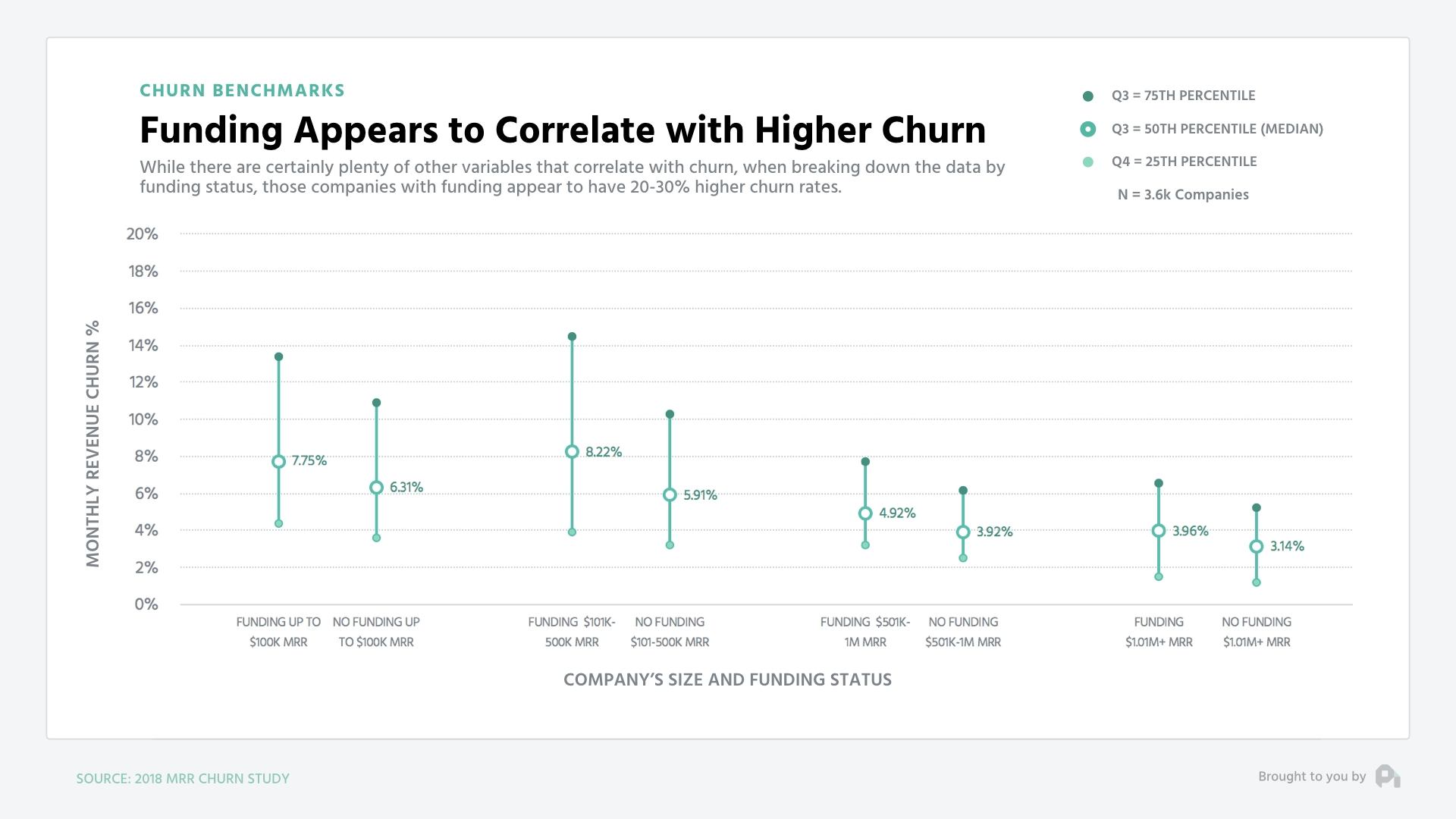

3. Churn vs. VC Funding: Churn 20-30% higher with funding

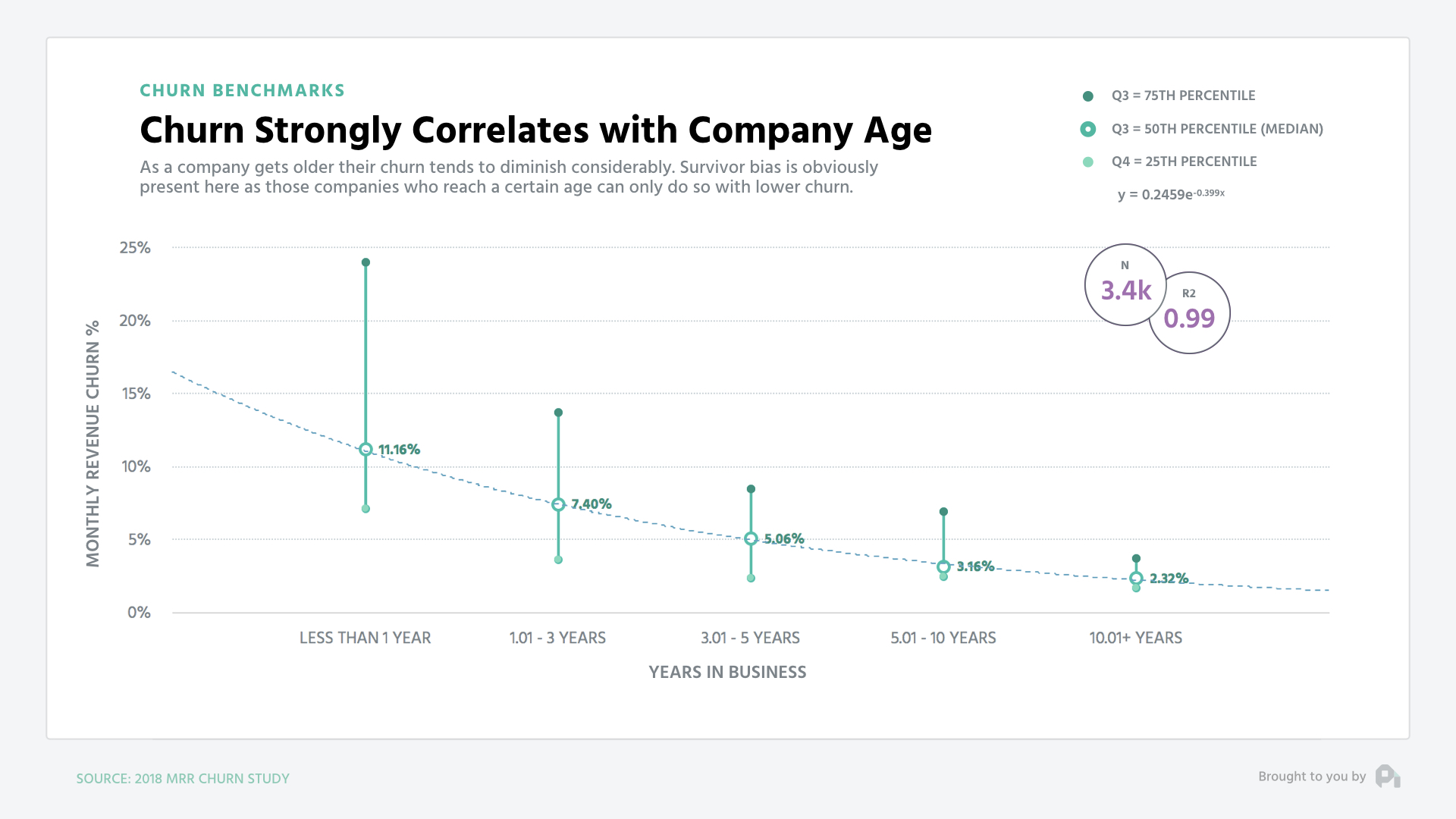

4. Churn vs. Age: Older company correlates to less churn

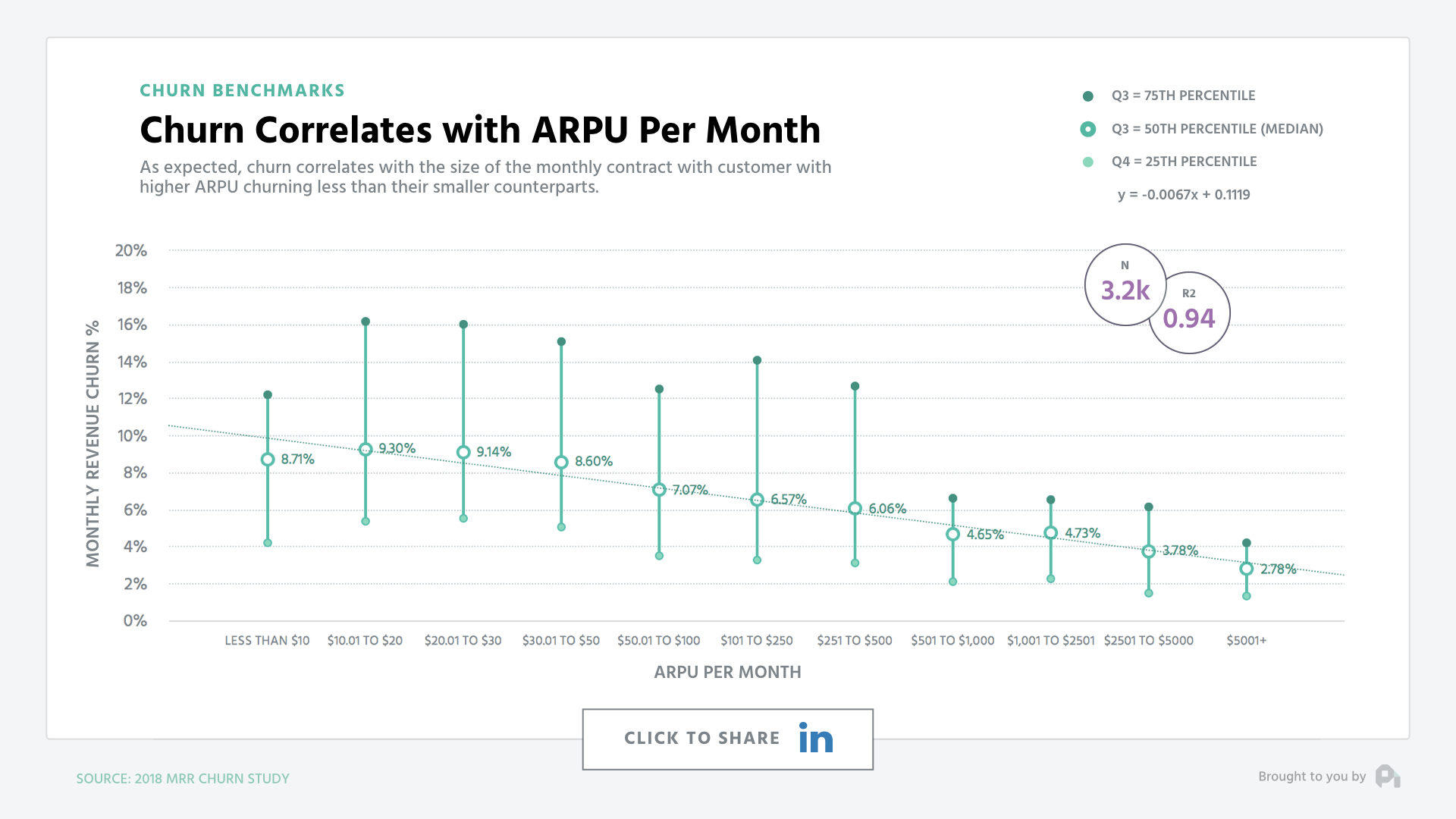

5. Churn vs. ARPU: Higher ARPU correlates to less churn

6. More Data coming - part two is all about pockets of opportunity around churn

Some background on the data

The following data comes from a set of 941 companies (unless noted) across numerous industries (both B2B and B2C). To ensure we had an even split, we ensured that each bin you’re about to see (eg. 1.1-2 years, $10.01-$20 ARPU, etc.) has enough data to support proper variance and to ensure anonymity of the respondents (at least 50 data points).

Further, a couple of key points:

-

Everything you’re about to see is monthly gross MRR churn rate

-

These are benchmarks, so while there are some clear trends here, “good” and “bad” depend on your business

-

We’re establishing a baseline here with this data set, and next weeks’s data set is digging deeper to be more prescriptive. Feel free to subscribe here for that data

Churn vs. MRR: Churn only loosely correlates with MRR

While there’s a slight drop in churn as companies get larger in terms of MRR, the correlation is fairly weak, indicating that a higher MRR isn’t necessarily associated with a drop in churn. In fact, there appears to be a big uptick once we reach the $50k-$100k MRR point before some smoothing and bottoming out.

Conventional wisdom would suggest that as a company gets bigger, churn should go down on account of better systems, the ability to specialize, and just more expertise. Yet, there are clearly some lurking variables here as to why this is only slightly the case.

Churn vs. VC Funding: Churn 20-30% higher with funding

When cutting the data further across companies that have been funded vs. those who haven’t the data gets a bit more interesting. As you’ll see in the below, those who’ve been funded at both the early stage and while just entering the gross stage typically have around 20-30% higher churn rates than those who took the bootstrapping route.

There could be a number of reasons for this, but based on qualitative conversations, I’d posit that there’s a bit of a false sense of security with a company with funding. You don’t necessarily need to solve for your churn when you have money in the bank and only worship at the alter of top-line growth. That being said, I don’t have quantitative support on this line of thinking.

Churn vs. Age: Older company correlates to less churn

In a bit of contrast to the above, companies that are older appear to have lower churn, which seems intuitive, because this is the only way to stick around - by making sure you keep your churn in check.

Churn vs. ARPU: Higher ARPU correlates to less churn

Perhaps most telling in terms of the data for benchmarking is when we look at the breakdown of churn across ARPU (average revenue per user). Here there’s a pretty strong correlation between a higher ARPU and lower churn with four figure ARPU correlating with nearly a 50% drop in churn compared to singe lad double digit ARPU.

This data should also feel intuitive, because with high ARPU you have a sales team, typically longer contracts, etc. that then help reduce gross monthly churn globally.

More Data coming - part two is all about pockets of opportunity around churn

There’s a lot to think about with the above data, particularly where you fall on the map. Of course, while there are some clear trends, this isn’t to say your business is doomed if you don’t fall into these categories. Yet, if you’re too far out of these categories, then you may need to re-evaluate your current retention frameworks, especially since customer attrition is crucial to your growth’s success.

Next up we’ll be slicing this data from a few different angles to actually start to be prescriptive for you in reducing churn. If you want some personalized advice around reducing churn, feel free to set up a churn consultation with our team.

By Patrick Campbell

Founder & CEO of ProfitWell, the software for helping subscription companies with their monetization and retention strategies, as well as providing free turnkey subscription financial metrics for over 20,000 companies. Prior to ProfitWell Patrick led Strategic Initiatives for Boston-based Gemvara and was an Economist at Google and the US Intelligence community.