Let's review HubSpot’s pricing strategy before getting into the nitty gritty of what they’re doing right and what more than likely needs some help.

Pricing is the center of your business. Everything you do, from copywriting to creating a local SEO strategy to providing customer support works to drive people to your pricing page and justify the number you’re charging. Unfortunately though, we’re really bad at pricing. Most of us end up arguing in a boardroom before succumbing to our “gut feelings” and just shipping a pricing page to “see how it does.”

While long time readers of this blog know pricing isn’t hard, it’s a process, we want to take a walk through the SaaS pricing pages of some of the biggest, baddest SaaS companies out there to help you see how pricing has been influential to their success and to give you a few takeaways to implement on your own.

First up, we have the marketing automation behemoth that’s rumored to be the second fastest growing SaaS company in the world right now: HubSpot (full disclosure - we're happy customers). For those of you who don’t know, this orange machine practically invented the concept of “Inbound marketing” and sells a software platform that helps you do everything from manage and track your SEO traffic to create workflows and drip campaigns for your leads. Also most importantly for this post, they have some of the best SaaS pricing out there for their price level.

Let’s first review HubSpot’s pricing strategy before getting into the nitty gritty of what they’re doing right and what more than likely needs some help (all with clear takeaways for you and your business).

The pricing challenges HubSpot faces (you probably do, too)

To understand HubSpot’s pricing, you need to understand a bit more about the product. As mentioned above, HubSpot’s software is a platform that allows you to do a multitude of things, from manage your content (blog posts, marketing sites, ebooks, etc.) to track and manage your marketing funnel. Out of the box it essentially pieces together everything you need to manage your non-paid marketing.

The very nature of this type of product presents an interesting set of problems when formulating a pricing strategy.

- Takes a long time to get value: For one, the product’s time to value ratio is exceptionally large, meaning you can’t just buy an instance, install, and immediately start seeing results – someone or a group of people need to be using HubSpot pretty aggressively to start seeing dividends (leads rolling in, publishing content, etc.).

Pricing Implication: Having a sales person free sale in this instance is hard, because you have to sell the vision, not just the features. That makes pricing complicated, because for a sales person laden sale you need a high value MRR – a tough chicken or the egg problem – hence HubSpot’s heavy fundraising and focus on kick-ass sales. - Not one specific buyer: Additionally, while I know HubSpot defines their buyer personas in exceptional detail, the open ended nature of the product means that practically any company interested in marketing (Pretty sure 100% of businesses) is technically a potential buyer.

Pricing Implication: While not everyone will be a perfect fit, this means that no matter what number they put on their pricing page, there’s a good group willing to pay much more and there’s a good group not willing to pay as much. Additionally, picking the right customer personas is an awful game if done by guess and check. Remember - buyer personas are one of the central tenets to proper pricing. - Marketers can be finicky: Love, love, love marketers, but we’re not the easiest to please (for good and bad reasons), nor are we traditionally the most technical, nor do we receive the most leniency when things aren’t going as well. This means we don’t want to pay as much and we want as close to guaranteed success as possible to get the proper ROI. HubSpot grew through a process of needing to train the market in an era where database marketers were still dominating and few were publishing content.

Pricing implication: “Training” a market costs big bucks to make sure you have a loud mouthpiece. It also makes packaging exceptionally hard, because once someone knows how to use a tool or fill their funnel with a process, they aren’t always ready to move somewhere else.

What HubSpot does right (things you should steal)

Here’s where HubSpot gets things right in their pricing (things you should steal).

- Three very distinct, persona aligned packages: From the price points to the value metric throttles and feature differentiation, each package is very different from one another with clear hooks and balances that will force a prospect into as low dissonance a buying decision as possible. For instance, someone who isn’t interested in A/B testing probably doesn’t need more than 10,000 contacts because the volume of their marketing site isn’t as high. Similarly, someone who wants A/B testing is probably also willing to pay more.\

Pricing takeaway: Aligning your packaging correctly helps sales folks funnel people into the right packages and do what they’re good at – sell. It also helps eliminate uncertainty on a customers end and “plan islands” – plans that have little to no users. Remember, even if there’s a department that needs your product in every company, it doesn’t mean every company needs your product (or that you should target every company). - Variable value metric: We’ve hemmed and hawed about how important a value metric is to a pricing strategy, and you’ll notice with HubSpot the use of number of contacts is the central fulcrum allowing HubSpot to monetize users of all sizes and ensure that as someone is getting more value out of the product they’re being monetized accordingly

Pricing Takeaway: Because of the focus on personas, I highly doubt a lot of their upgrade revenue is contingent upon this expanding value metric (keep in mind a lot of their customers’ databases are probably consistent and not those of startups, marketing machines, etc.). Yet, having the right value metric, makes sure that as you provide more value – more contacts/leads in HubSpot’s case – they’re getting a portion of that value. It also makes the sale less arbitrary, because value is tied to the entire intent of the product. - Cleaner Design: There are a lot of sad SaaS pricing pages, especially in the mid-market and enterprise software spaces. There are even more who just refuse to show their pricing, forcing you to call in and talk to someone for an hour to get a quote. HubSpot cuts through the crap here and remains transparent with their pricing, even letting you calculate the total cost to you.

Pricing takeaway: Even if you get your pricing and packaging right, you need to make sure things are clear to your prospects. Spend some UX cycles ensuring the design helps. Also, really consider making your pricing as transparent as possible. It saves your sales teams so much time. - No touchless sign up: If you’ve never heard of HubSpot and you’ve read this far, you’re probably still confused as to what the heck HubSpot actually does. Although it may be my imprecision in explaining their business, it’s probably also because HubSpot isn’t the easiest product to understand. “Marketing Automation” is an ambiguous concept, so HubSpot forces any prospect to talk to a human being who can break things down in a call or webinar to purchase the product – helping solve for the ambiguity potentially in the product

Pricing Takeaway: A touchless sale isn’t something to always ascribe to, because it’s exceptionally difficult to steamroll revenue to HubSpot’s level without a little help from a sales team.

Where HubSpot can improve (things you should avoid)

Although HubSpot gets most things right, and who are we to argue with a company growing so quickly, there’s some definite things to improve upon (or at least some things to consider):

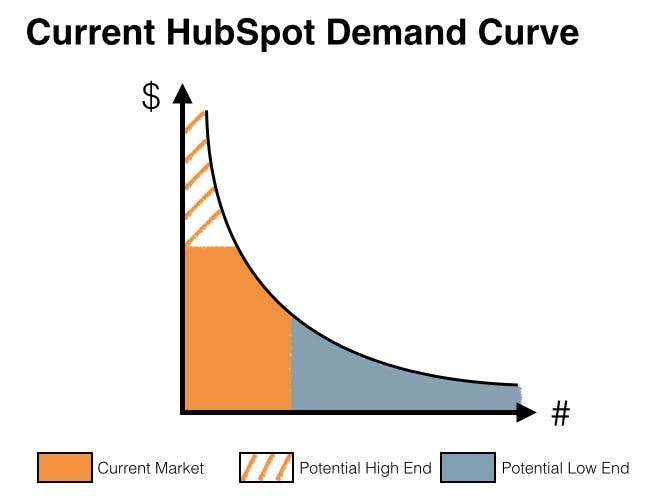

1. Suffering the curse of the mid-market: Not enough entry points on the demand curve

This isn’t necessarily a bad thing, but HubSpot is selling to one of the hardest sectors to serve – the mid-market. This sector is so difficult, because there’s such a balance between affordability and feature set that HubSpot’s dev and product teams need to constantly keep in mind. In other companies, building a product with hundreds of features and selling it for a lot of money or building a bare bones product and focusing on acquisition is typically much easier.

To illustrate this a bit more, HubSpot’s basement bottom price is $200/month, but you’ll probably have more than 100 contacts, so the real price is $300/month (and more realistically a small business owner will have between 2-4k contacts, so it would be a bit more). Not even considering the fact that HubSpot forces you to pay all upfront for a year and spend at least $500 on training (making the get started cost around $4k), you have a recipe for a premium, overpriced product in a persona that looks at this very much as an operational expense, not a capital expense.

How we’d make changes: HubSpot needs more entry level or “gateway” products to warm leads to spending money with the orange sprocket. This “unbundling” can be killer to a mid-market business and they’re already on the right track with Sidekick, a $10/u/month sales intelligence product. Unfortunately though it’s out of their immediate core customer persona (sales person/team vs. a marketer). Granted, for these smaller customers, the individual making the marketing budget decisions is probably the same making the sales budget decisions. Yet, other standalone products would be a fascinating play, especially since they pretty much own a lot of the thought leadership in the space.

2. Suffering the curse of the mid-market: Not enough monetization on the high end

On the high end, HubSpot isn’t as feature intensive as it could be and this loses them sales and causes churn for folks that “graduate” from HubSpot. This problem is compounded by the fact that they’re relatively inexpensive for someone who has 500,000+ contacts with a price of around $7,500 and up. That’s a lot of money, yes, but not much for someone who theoretically is making at least more than $1/lead.

It’s not that HubSpot has to serve these individuals at the low or the high end – hell HubSpot is where they are on the back of the “mid-market” - but as they continue to battle a high customer acquisition cost, ensuring they can fill out their revenue numbers at the high end and their volume cost effectively at the low end is imperative to longer terms success.

How we’d change things: On the high end, we need to monetize these folks a hell of a lot more through better metric throttling and more additions. Want more security? Want better analytics? Pay more. New Relic, Optimizely, and Salesforce are brilliant at these moves. HubSpot can be too. Most importantly though, HubSpot’s value to value metric ratio is way off.

As mentioned above, someone with let’s say 500,000 contacts (which is definitely a lot, but probably not even close to the database size of the big dogs out there) is paying $7,500/month. That equates to a cost of about $0.18/lead/year. On the low end a $300/month customer with 3,000 contacts is paying $1.20/lead/year. A very superficial look at things, but as we discussed that 3,000 contact customer is more of a price curmudgeon, whereas the 500,000 contact customer is less price conscious, because there’s a requirement for the product, a budget, and more domain knowledge.

Think about it this way: the difference between $3600 and $4000 is a lot to a pool cleaning business in Ohio, but the difference between $92,000 and $110,000 for an established tech firm in Boston with budget isn’t as much.

HubSpot should raise prices on the big dogs through better throttling and just a higher price in general. The sales process is highly likely to stay very similar and the upside is a dramatic boost in MRR and topline revenue. Of course, features will need to follow, but HubSpot likely already has the features, they just need to put them in front of these prospects.

3. Too many value metrics and throttles on the low end

On the low end, we’ve already discussed issues with quick throttle changes from 100 to 1,000 contacts and every 1,000 contacts after. HubSpot compounds this problem by putting even more throttles on lower end customers with limits on max number of users, email sending, site visits, subdomains, etc. Too many value metric throttles are an issue, especially with a price curmudgeon customer, because there are too many potential friction points for a pricing conversation with someone who already may have had trouble converting.

It’s not to say friction points are bad – you want to spur upgrades when you can, but having 5 different value metrics plus feature differentiation is a lot to swallow, even if only one affects a prospect. Typically we see this setup as a reaction to abuse or certain personas that don’t fit the persona mold perfectly. The problem is that reacting to a bunch of different edge cases, however big, makes a convoluted pricing dynamic that when looked at from a high level has issues, especially when the price point jumps from $300/m to $800/m if you cross one of these thresholds.

How we’d change things: There’s more to analyze here, but for the sake of getting to the point, we’d cut the per user throttle entirely (it’s not effective for getting daily and weekly active users) and more than likely get rid or raise some of the other throttles. Also, we’d probably just include something like 500+ contacts from the get go. HubSpot’s probably has the 100 contact entry point for completely green accounts, but it’s worth giving up some short term gain to reduce the nickel and diming of a price sensitive customer in an effort to ensure a higher LTV.

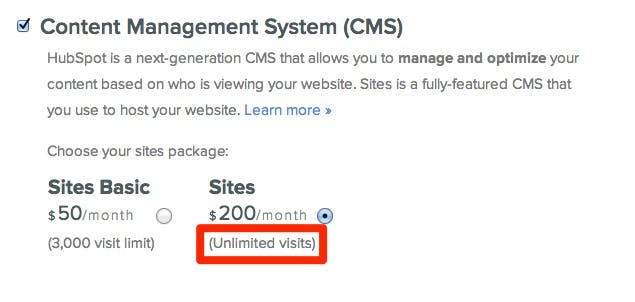

4. Money being left on the table on the high end with HubSpot Sites

On the high end, perhaps the largest problem is the throttle they’ve placed on sites (an add-on that gives you a slick Content Management System to host your website). The Sites Basic limit of 3,000 visits per month seems super reasonable, but giving Unlimited visits for only $200/month is a steal. We want to limit the nickel and diming feeling, but you don’t want to give away the farm.

How we’d change things: HubSpot should run a percentile analysis on the site traffic of those using the CMS. With this data if they want to limit add-on pricing/nickel and diming, we’d put in three tiers – one basic that accounts for maybe 40-50% of accounts, one that accounts for the next 30-40%, and then one that accounts for the last 10-20% (those more than likely willing to pay much more, because the stakes are higher).

This allows them to monetize the top part of their heavy users a hell of a lot more. Of course, these may be a bit different than their big dog contact customers (who probably have a custom CMS or a hardcore enterprise solution), but this is all the more reason to not give away unlimited anything. If they were to do something a bit more sophisticated, then there would be tiers probably every 20-25% of users.

Great pricing strategy with some room for optimization

All in all, HubSpot does a hell of a lot right and all the tweaks we’re suggesting are more optimizations than fixes – all of which are a product of being in the middle of a market. Of course, also keep in mind that we don’t have perfect information here, and even though neither does a prospect, I’m sure there’s plenty here we’re missing. That being said, if there’s one thing to constantly keep in mind, it’s this: pricing is a process. HubSpot’s pricing has evolved a lot in the decade they’ve been around and it’s not the ultimate secret to their success, but it’s definitely been one arrow in their quiver to the long, hard road that is SaaS success.