See why evaluating your value metric and aligning it with your pricing strategy is the key to optimizing your SaaS business for profits and growth.

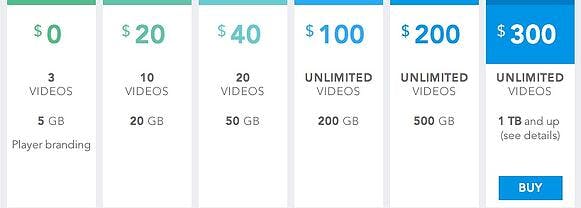

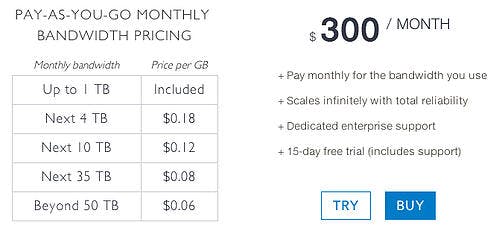

If you’ve read our blog before, you know we dreamboat about this company called Wistia a lot. Like… a lot, a lot. We think their pricing page is one of the best SaaS pricing pages in the world, but not for the reason you might think. Yeah, it’s beautiful (they hired an architect - the building kind - to design it), but we love it mainly because Wistia correctly utilizes one of the most important concepts in pricing: the value metric.

Identifying and pricing along your proper value metric is the difference between surviving and thriving.

There isn’t a billion dollar company out there that hasn’t properly designed its value metric, and although you may not aspire to cross the B threshold, it’s important to get right in any business. You’re probably not too familiar with this concept though, so let’s walk through what a value metric is and why it’s important before digging deeper on ways you can optimize your pricing strategy to properly align with your value metric.

What is a Value Metric?

A value metric is the way a company measures the per unit value of their product for sale. A value metric example is skis, which are sold as pairs. In SaaS, value metrics determine the pricing and subscription terms of a product. If you’re Help Scout help desk software, you’re charging for each seat per month. If you’re selling MacBook Airs, it’s each MacBook Air one time up front. If you’re Wistia, you’re charging for number of videos hosted and the amount of bandwidth those videos take up each month (a dual value metric).

Pretty simple, right? Well, coming up with the right value metric is where things get complicated. Looking back at Wistia, imagine if they had three tiers with different types of features (a bare bones one, an enterprise tier, and then something in the middle), but everyone got unlimited bandwidth and videos. The problem here would be that someone like us (not a lot of videos) and Disney (lots of videos and lots of views) could potentially be paying the same thing. Disney would value the service 100x more than we would and Wistia wouldn’t be able to take advantage of that delta on value. Therefore, charging on bandwidth makes sense, because you can tie value directly to the amount of bandwidth. Theoretically, the more bandwidth I use, the more interaction I’m getting with customers and prospects, and the more I’m willing and able to pay Wistia for that interaction.

Great, so I’ll just charge for each granular value add? Well, not exactly. Performable (now a part of HubSpot) and companies like MixPanel and Amplitude ran/run into this problem. A lot of these analytical platforms were charging “per event”, which intuitively makes sense, because you can tie value directly to what you’re charging for, but they ran/run into problems because there’s no predictability in the costs per month. Their target (product and marketing decision makers) needed that predictability for procurement. A solution a lot of these folks use now is the banded approach, where they’ve figured out the distribution of their customers and essentially make tiers to align to that average usage.

Why Is a Value Metric Important?

Considering a value metric is what you’re charging for, it’s inherently important. Yet, picking the proper value metric has a phenomenal impact on your business. Imagine two SaaS companies that each have 100 customers. The first charges on a per seat per month schema, but there’s little need for more than one seat for each customer. The other sells the exact same product but charges along a metric of particular usage in the app with a bare minimum per month charge. The former has an artificial ceiling on the MRR potentially gained from their customers. The latter’s MRR will grow as their customers grow and/or use the product more. I’d much rather be in company number 2.

If you’re strictly charging per user, per month, or per hour, you’re probably losing out already. About 8 out of 10 companies using per user pricing should be using a different value metric, simply because their products probably don't provide more value with additional users, so charging for them doesn’t make perfect sense.

How To Evaluate a Value Metric?

Evaluating your or other value metrics is pretty simple, although there is some finesse required here. It comes down to fulfilling three basic principles:

1. Does your value metric align with customer’s need?

We’ve belabored this point above, but you need to make sure the way you’re charging aligns with the value someone is actually getting from your product. If you’re a help desk, then charging on a per seat basis makes sense. If you’re application performance monitoring software though, it probably doesn’t make sense. Figure out what your customers value at the center of your product and then back out to a way that you can charge for that value. Wistia determined that the value came from the number of people their customers had viewing their videos. A good proxy for this was bandwidth.

2. Is the value metric easy to understand?

Where Wistia fails a little bit is in the ease of understanding department. The value metric needs to be intuitive to the user. Large video customers Wistia serves would completely understand bandwidth needs, but smaller customers wouldn’t. Even though they did a phenomenal job explaining the concept of bandwidth to their prospects, they fixed this problem even further by not making bandwidth an issue on the lower end of their pricing page and limiting the number of videos per month (something much easier for lower end customers to understand).

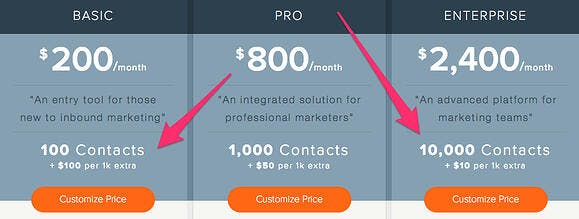

However you decide to charge, it needs to make sense to your prospects, and they should be able to “get it” without talking to someone at your company. HubSpot could have continued to charge for events, landing page submissions, visitors, etc., as those align to their customers’ needs pretty closely. Yet, they backed out from where their customers found value and used “contacts” as a proxy for that value, which is easier to understand and much more predictable (the more contacts I have, the more I’m probably converting them and making money from the product that allowed me to cull those contacts).

3. Does your value metric grow with the customer base?

The first two principles were for your customer. This last one is for you. You need to make sure your value metric grows properly with your customer to ensure you’re increasing your MRR in a predictable manner. Phenomenal SaaS businesses are able to grow even if their acquisition stalls because their value metric is so aligned with their customers, they can simply wait for those customers to grow to ensure they also grow. It’s compound growth too, which is badass. Stripe, HubSpot, and even Salesforce are all examples of companies that have rapidly grown based on this growth, although acquisition definitely helped.

How To Identify The Right Value Metric?

This is worthy of its own post (especially since this beast is getting long), but identifying your value metric doesn’t have to be complicated. First, start by running a list of all the axes you could charge along (not feature differentiation, but actual axes). Next, send a survey or conduct some interviews to determine where your customer ascribes value in your product. From there, make sure the options they’ve chosen align with the three principles above. Finally, test, implement, and iterate.

Your business is constantly evolving with new features, new types of customers, and the like; your pricing strategy should be, too. For more information, download our Pricing Strategy ebook or sign up for a free pricing audit with one of our pricing experts.