Deciding when to adjust your pricing is never easy. There is a lot riding on your ability to meet customer expectations—any miscalculation can result in unhappy customers and lost revenue.

Think back to the last time Netflix raised its monthly price—social media was chock-full of negative comments about it. According to a December 2018 survey by The Diffusion Group, 16% of Netflix customers said they would cancel or downgrade if plans increased by only $1.

That’s why understanding how much pricing power you have is so important. This knowledge helps you predict how any price adjustments will impact your customers as well as your business. Instead of worrying about whether or not you’ll lose customers, you’re able to raise your prices with confidence.

What is pricing power?

Pricing power refers to a company's ability to raise prices without reducing demand in their products. The more pricing power you have, the easier it is to raise prices. Pricing power is generally determined by how unique or essential a product is in the eyes of customers, or the unique value it provides to customers relative to competitors.

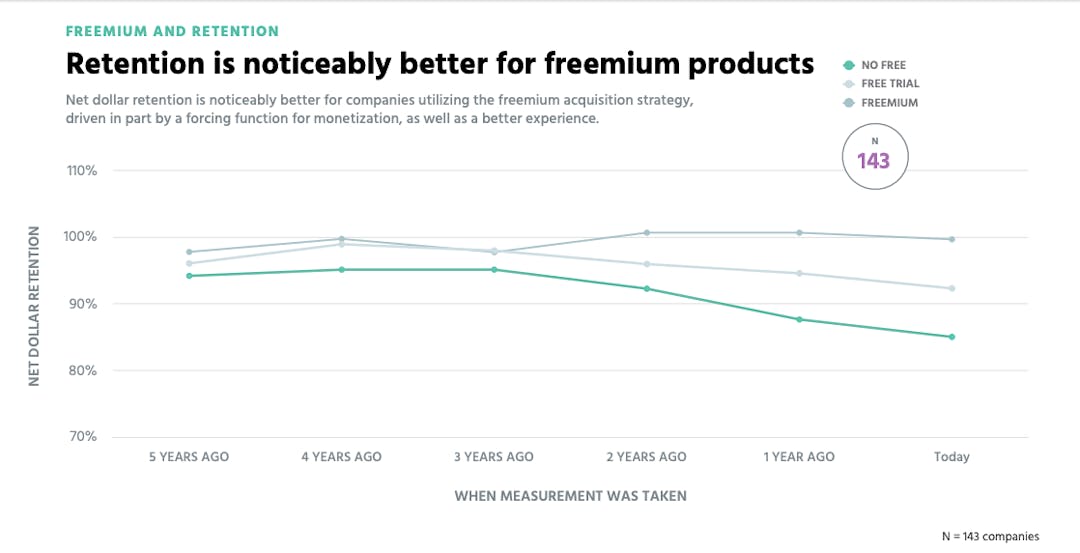

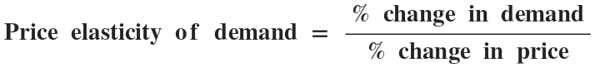

Pricing power is dependent on price elasticity of demand.

a293.png?auto=format%2Ccompress&fit=max&w=3840)

Price elasticity of demand

Price elasticity is a measure of how sensitive your customers are to variations in the price of or demand for your product. In other words, price elasticity quantifies how much the demand for a product changes when the price is either increased or decreased.

To calculate price elasticity of demand, you divide the percentage change in demand by the percentage change in price.

Exclusive products, like luxury cars, are inelastic—meaning higher prices will not impact the demand for the product. They tend to have more pricing power because of their scarcity. Less popular products, like a new sofa, tend to be more elastic. If the price of that sofa increases, you’re less likely to purchase it since there are cheaper alternatives.

When you understand the price elasticity of demand for your products, you understand how much pricing power you have, and this will inform your pricing strategy. This understanding helps you leverage that power to help your business.

How pricing power leads to growth

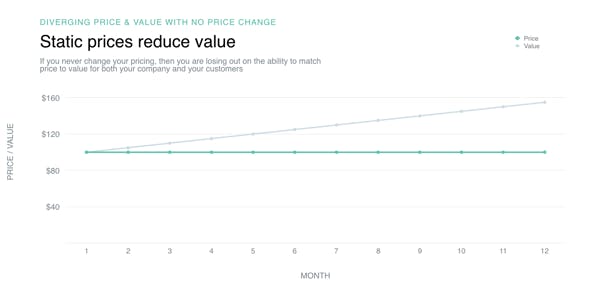

If you don’t change your price throughout the tenure of your company, you’ll never be able to grow. Companies with higher pricing power have more leeway to adjust their prices, so having pricing power is a major competitive disadvantage. Instead of causing a decrease in demand, any increase in price will help stabilize the revenue of your business, maximize your profits, and maintain a predictable growth rate.

You’ll be able to do all this without impacting the customer relationship as well. Without pricing power, the decisions you make regarding price become much more difficult. It’s impossible to keep your price the same forever.

Stabilizes revenues

When you’re able to raise prices without lowering demand for your product, it’s easier to maintain a steady growth rate. This is especially important for SaaS companies, as their revenue is tied to recurring customer relationships.

If your customers are unhappy with raising prices, like what Netflix experienced in its last price adjustment, that has the potential to drive down customer retention rates over time. This makes MRR and ARR less predictable, which makes it more difficult for you to scale your company.

While pricing power isn’t the only thing that will impact your ability to grow, knowing how much latitude you have to increase prices makes it easier to scope out your decisions in the future. This predictability is the basis of stable growth.

Maximizes profit

The ability to securely raise prices also allows companies to maximize their profits. Customers won’t turn to competitors because of the change, so you’re able to bring in more money per customer.

With every price increase, you’re bringing in more money per customer with essentially the same amount of effort and investment. Your current customer base therefore becomes more profitable.

New customers will also become more profitable faster, which helps offset customer acquisition costs (CAC)and increases lifetime value (LTV). Assuming operational costs don't increase elsewhere, the jump in price leads to a greater profit per acquired customer.

Keeps you in business

Increasing your prices makes it easier for your company to adapt to changing market conditions and higher internal costs. As your business grows, it naturally becomes more expensive to keep running. When you can safely increase your price, it improves your bottom line and ensures the company remains profitable regardless of these changes.

Pricing power also allows you to increase your price alongside the value you provide to customers. Each new product you build or feature you release adds value for the customer. If there is high demand for these additions, you’re able to scale the price alongside these changes.

As customers are less likely to leave your service when they experience a pricing change, more pricing power helps you retain more customers over time, which is an advantage over your competition.

What pricing power tells you about your price flexibility

Price flexibility has a direct relationship with your pricing power. With more pricing power, you have the flexibility to change your price without negatively impacting your customer relationships. If your pricing power is lower, you don’t have a whole lot of room to increase prices before customers start brandishing their pitchforks.

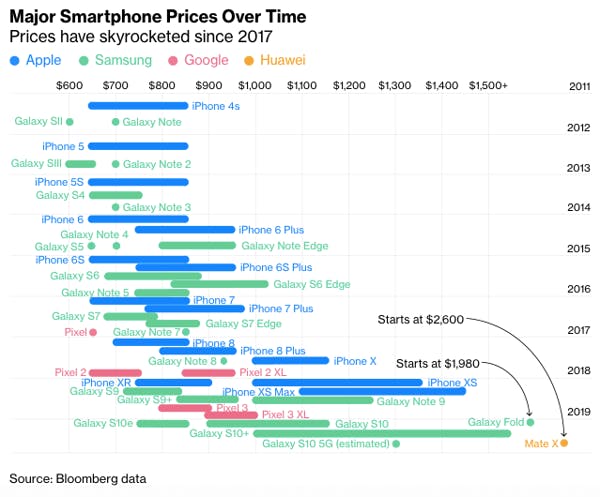

Consider the smartphone market—the major players (Apple, Samsung, Google) have so much pricing power that they can more or less charge whatever they want for a device. In 2019, the cost of smartphones has doubled in only a few years. The most expensive option outside of Huawei’s new entrant to the market was a Samsung phone clocking in at $1,980—three times greater than the phone’s initial price in 2011.

Smartphone price increases since 2011 via Bloomberg.

Each of these companies has the pricing power to back an increase without losing any demand for their product. Sure, some customers might switch between different Android and iOS when they’re upset, but most users stick with one type of phone forever.

Now, let’s go back to our Netflix example. Simply raising their plans by $1 to $2 dollars, respectively, resulted in its first-ever loss of domestic paid customers. While it was able to weather the storm, the increase it made was much less egregious than those in the smartphone market. Still, Netflix received a more negative response to the change because it didn’t have enough pricing power.

These examples illustrate how pricing power has real-world implications for the stability and profitability of your business. It’s not just another metric to report on for your business.

Four more examples of real-world pricing power

Pricing power is dependent on the type of products you sell. Companies that sell exclusive products tend to have significant pricing power, while companies that sell more common products suffer from traditionally low pricing power.

1. Scarce goods

Hotel bookings, flights, Uber rides—all of these products and services have pricing that is subject to change based on the scarcity of the good. For example, if it’s a peak hour for Uber ride requests in an area, the service will increase the price of a ride because there are fewer drivers available.

Scarce products have a lot of pricing power because there are limited resources as well as high demand. When a product becomes less scarce, it will likely lose some of its pricing power and see a decrease in demand.

2. Luxury goods

On the opposite side of the equation are luxury goods. These products have high pricing power because of their exclusive nature. Buying a luxury item lets the customer feel like they’re a part of something unique and special, even if the product is in large supply. Because buyers expect luxury goods to be expensive, they may even interpret increases in price as a sign of greater quality.

That said, companies that sell these products need to work harder to maintain an air of exclusivity. Otherwise, they’ll experience a drop in their pricing power as well. Any dip in perceived status will have a negative impact on their pricing power.

3. Commodity goods

Commodity goods and raw materials suffer from traditionally low pricing power. If the brand dish soap you use increases its price, you’ll likely look to a competitor for a better deal. This is the driving factor behind the success of subscription companies like Dollar Shave Club or Blue Bottle Coffee. They’re subverting the pricing power of commodity goods by doubling down on convenience and community.

Instead of focusing on ways to increase their pricing power, companies in a commoditized market need to build stronger and more sustainable relationships with customers to support business growth. Unlike luxury or scarce products, commodity products can’t lean on market conditions and customer perception.

4. Brand loyal goods

Brand loyalty has a direct and positive impact on pricing power. The more loyal a customer is, the more accepting they’ll be of an increase in price, thus giving these companies higher pricing power. Think back to the smartphone example from earlier. Apple has some of the strongest brand loyalty in the world, so the company has no trouble raising their prices with every new phone release.

With brand loyalty and pricing power so interconnected, if either starts to decrease, the other will as well. That’s why it’s important for companies with a lot of brand loyalty to maintain their customer relationships.

When you look at how these factors impact the pricing power of particular products, it’s easy to see how important it is for building a stable and growing business. If you don’t look at the pricing power of your business, any price adjustments you want to make are significantly more difficult.

How much pricing power do you have?

If you’re unsure of how to calculate your pricing power, sign up today! Price Intelligently offers free pricing audits that can help you determine this data point and so many more!

a293.png?auto=format%2Ccompress&fit=max&w=3840)