It's a question that hits close to home for us, going from a singular product with Price Intelligently to a multi-product company with ProfitWell.

On this episode of the ProfitWell Report, Chris Hexton, Co-Founder at Vero, asks us to look at the impact on growth of companies having either a singular product focus or a multi-product offering. To answer Chris's question, we looked at just over twelve hundred companies. Here's what we found.

To get right to the point, it's extremely difficult to get to $100M and beyond very quickly without multiple products, but it's harder to get to $10M with multiple products than with a singular products.

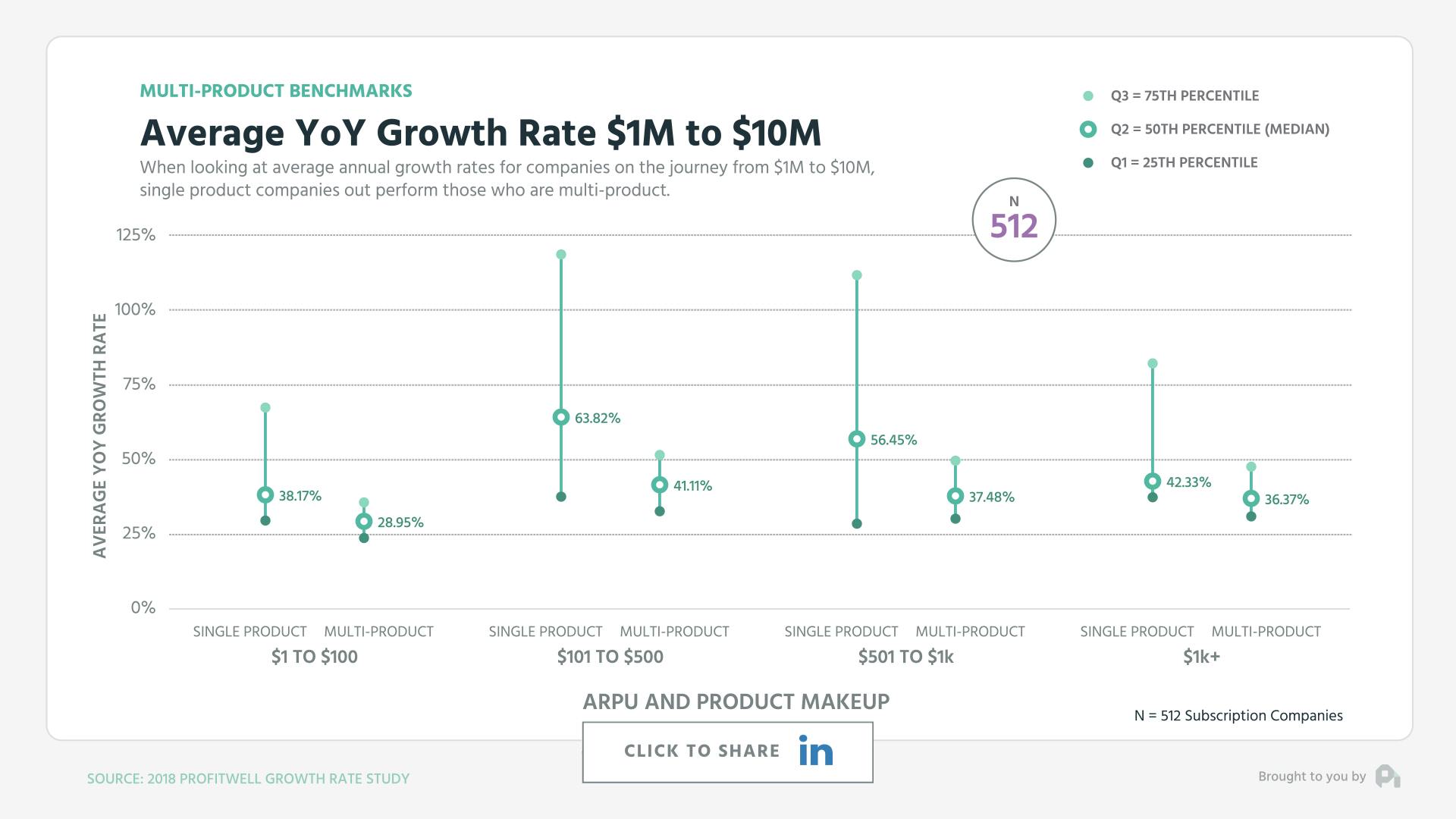

In the $1M to $10M period of growth, companies with singular products, no matter their target ARPU, had a much easier time growing than their multi-product counterparts.

The base cause here is likely because when you're going from $1M to $10M in ARR you're figuring out your growth vectors, while by the time you get to $10M those are fairly figured out.

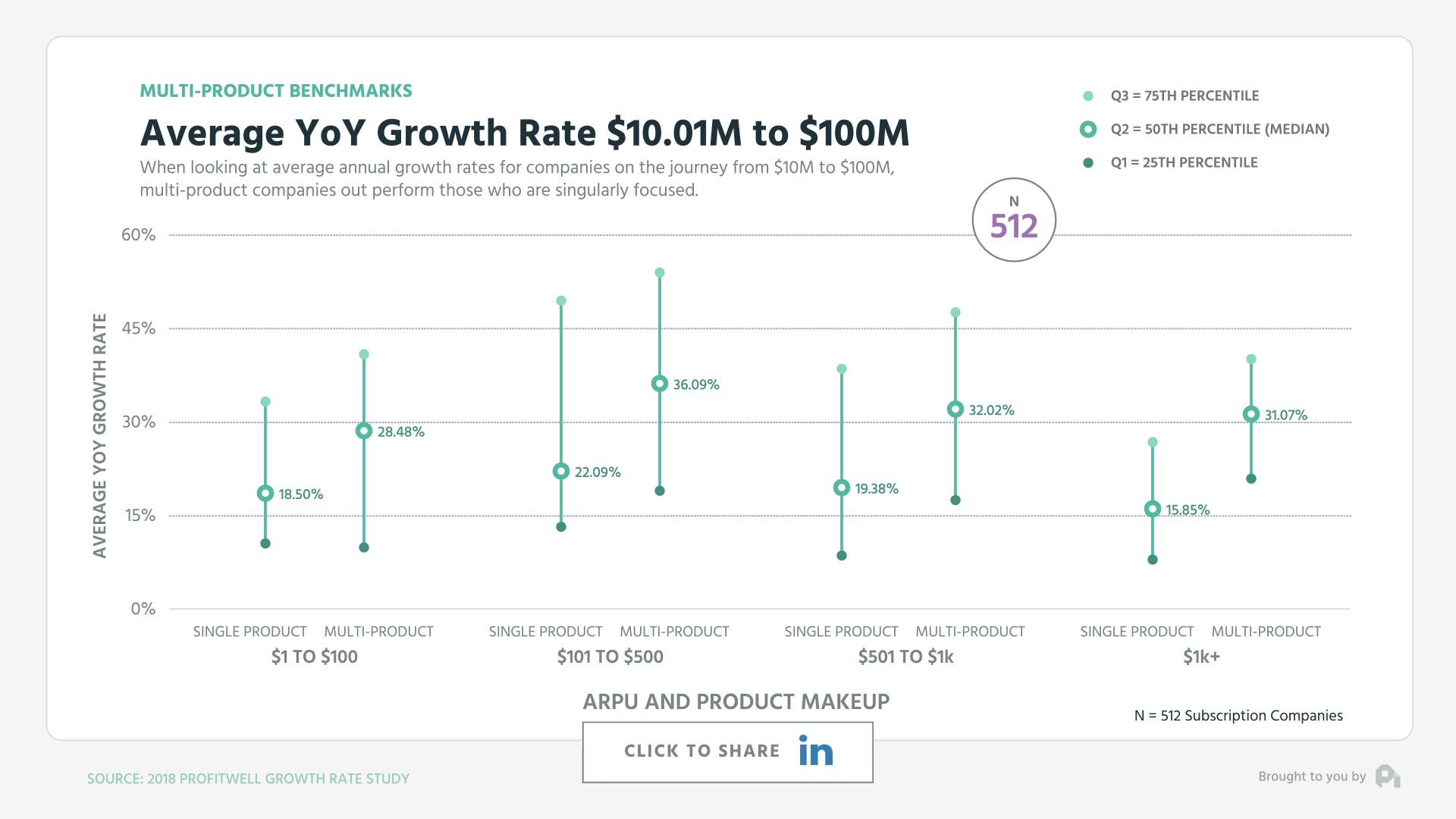

Looking beyond $10M is where things start to get interesting. All of a sudden we essentially see the inverse growth rates happening with multi-product companies growing at a higher clip than their single product cousins and by a fairly wide margin.

Traditional sentiment is that there's survivor bias when you come out with your second or third product, but if you do it after the $10M mark, you likely have figured out your growth vectors, your product approach, and your operational efficiency, leading you to have enough institutional memory to make a multi-product approach successful.

Ultimately, the single and multi-product choice really comes down to the DNA of your company, the market you're in, and the type of company you want. If you're going to scale beyond the startup stage though, the easiest thing you can do if you're in a smaller market is go multi-product. After all, if your customers love you, why wouldn't you try to take more of their pain away through more offerings?