Welcome to Survive or thrive: How operational efficiency can strengthen SaaS in a downturn, a Paddle report with insights from 100 SaaS CEOs, Founders, and Finance leaders.

From rising inflation and interest rates to cost-of-living and energy crises, geopolitical and economic uncertainty has cast a dark cloud over major SaaS markets in 2022.

With the US, UK, and Eurozone heading into recession, what has been the effect on global SaaS and how can companies successfully ride out the storm?

While no SaaS company will completely avoid the scars of recession, there are opportunities for companies to emerge stronger and get ahead of the competition. Those with the ability to overhaul processes and boost their operational efficiency should be feeling particularly bullish.

Christian Owens, CEO, Paddle

The bad news for SaaS

On the one hand, SaaS is not immune to the global downturn.

Valuations are falling

Restricted access to capital Consumers (and businesses) have less purchasing power. The bad news for SaaS On the one hand, SaaS is not immune to the global downturn. In March, Social Capital CEO Chamath Palihapitiya explained that investors would pay 8 x ARR for a SaaS company when interest rates are zero, but for every 1% increase, the valuation decreases between 15 and 20%. With interest rates heading north, valuations for private and public SaaS are tumbling (the average market capitalization is down 57% YoY).

Restricted access to capital

With non-existent rates and easy access to capital, many SaaS companies focused on all out growth over the past few years. Now that capital is more expensive, investors are holding back and SaaS scale-ups are having to reign in their spending to avoid downrounds.

Consumers (and businesses) have less purchasing power

With the increasing cost of living, consumers are monitoring their expenditure and reducing ‘niceto-have’ subscriptions. B2C SaaS will feel the heat first (greater churn and less sales), which will filter through to B2B SaaS as businesses increasingly have less revenue.

The good news for SaaS

On the other hand, SaaS companies are uniquely placed to ride out the storm.

Historical performance

SaaS has only experienced comparable economic conditions once before and passed the test with flying colors. Between 2008 and 2010, over 80% of SaaS companies grew during a recession and many SaaS giants, such as Slack and Asana, were born.

Popularity

SaaS is firmly embedded in the world of work. In 2021, 99% of businesses used at least one SaaS product and global spend on SaaS surpassed $150 billion. Given its integral part to working lives in every industry, especially the move towards remote working, SaaS is verging on ‘must-have’ status.

Efficiency opportunities

With record levels of investment, the SaaS mantra was ‘spend, spend, spend’ without much care for operational efficiency. Now SaaS needs to cut costs, there is a wider scope to improve efficiency than other industries by simply focusing on metrics and unit economics.

"There will always be crises, but when you get through them you have proved your company’s right to exist!"

Survey respondent

An optimistic market?

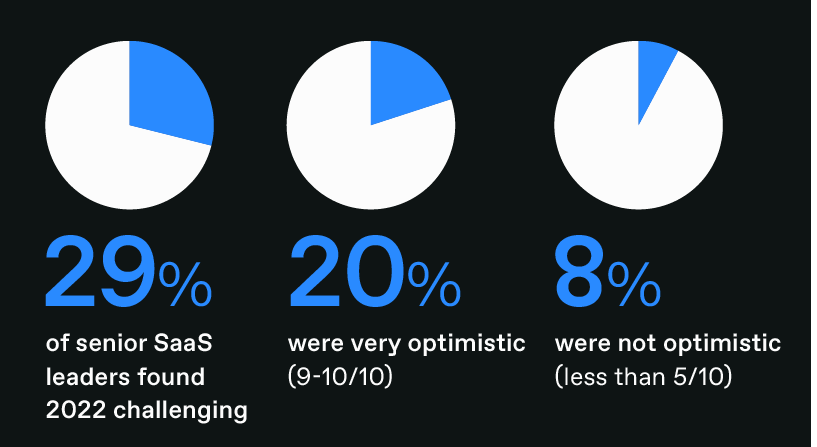

To cut through the noise and get a clear picture of the SaaS landscape, we asked 100 SaaS Founders, CEOs, CFOs, and Finance Leaders what’s been happening in practice. Almost a third (29%) of senior SaaS leaders found 2022 challenging, but the survey also found that average optimism for the year ahead was over 7/10 (7.08). In fact, one fifth of senior leaders were very confident (9-10/10) and only 8% were not confident (less than 5/10).

From increasing demand to healthy margins, SaaS confidence varies according to specific products, business models and markets, but many forward-looking companies share one common trait: a shift in mindset from growth at all costs to lean operations and sustainable growth. Be it extending the cash runway or accelerating towards profitability, managing resource costs or prioritizing retention, having a clear strategy for the next 12-18 months is key to navigating today’s choppy waters and taking advantage of the calmer seas on the horizon.