Total contract value is a critical SaaS metric that impacts more than your profits. Learn how to calculate it and why it matters to your SaaS business.

SaaS companies need a consistent data stream to improve efficiency and revenue growth. To achieve this level of insight, companies need to work with a variety of SaaS metrics. TCV is perhaps the most suitable SaaS metric to work with, but it’s often underrated and underutilized.

Total contract value, sometimes called contract value, refers to the lifetime value of a contract. If calculated correctly, TCV enables businesses to determine the annual value of a contract per every customer (your company's annual contract value) and the cost of your customer acquisition efforts. Knowing the value of your contract enables you to design a profitable strategy that will benefit your company in the long run. In this post, we take you through the concept of TCV, how to calculate it, and other useful tips and tricks regarding its use.

What is total contract value (TCV)?

The total contract value is a business metric that measures the full amount of revenue a customer contract brings in by taking into account recurring revenue and any one-time fees like onboarding, professional services, etc. This metric is ideal for SaaS companies as it helps them understand and compare how much revenue their business is generating from each contract and estimate how much each new contract will bring in to predict growth.

How to calculate total contract value

As one of the most useful SaaS metrics, TCV can help you keep track of your sales and marketing expenses and predict the average ROI you'll generate. However, many SaaS companies are not conversant with TCV and don’t know how to calculate it. To figure out your company’s TCV, you'll need to use a specific formula.

The TCV formula itself is fairly straightforward:

Total contract value = (monthly recurring revenue x contract term length) + one-time fees

The TCV amount will adjust based on any changes made to the contract length or the MRR. Changing the monthly recurring revenue or offering longer or shorter contract terms can have a dramatic effect on TCV. Remember to account for any variations when comparing TCV bookings if you happen to update your pricing strategy or contract length.

Also, TCV differs from customer lifetime value (LTV) in that it's based on actual contract commitments instead of projections. This means you can't calculate TCV for month-to-month or evergreen subscriptions since there's no way of knowing the contract term length in advance. And the TCV for one-time payments is simply the total amount paid by the customer since there's no recurring component.

An example of TCV calculation

Marketing platform HubSpot offers a range of different prices and plans for their Marketing Hub, depending on what their customers need. Let's look at the TCV of two different hypothetical HubSpot customers:

Customer A: Signs up for the Starter plan at the base price of $50/mo for a one-year contract.

Customer A Total contract value = $50 x 12 + $0 = $600

Customer B: Signs up for the Enterprise plan at the base price of $3,200/mo for a two-year contract, plus a one-time onboarding fee of $6,000.

Customer B Total contract value = $3,200 x 24 + $6,00 = $82,000

TCV is an important but often overlooked SaaS metric

Knowing the total value of a contract a customer signs with your SaaS or subscription company is vital for steering your business in a winning direction. However, TCV is often overlooked. Most companies prefer to use other metrics, such as customer lifetime value (LTV), which investors find more impressive. However, although such metrics can validate growth, they’re often unrealistic indicators of your company’s financial health.

TCV differs from these other metrics because it reflects actual bookings instead of relying on predictions. It also demonstrates a company's growth and gives more accurate revenue estimates, which ultimately helps you tailor sales and marketing efforts accordingly. Here are four factors that make TCV a better gauge of growth than other metrics.

1. Accurately predict revenue and growth

Using TCV instead of LTV to make your calculations helps you create realistic and accurate estimates for revenue growth. This level of accuracy can help you avoid making costly mistakes like onboarding new staff, budgeting for unnecessary resources, and investing too little in your marketing campaign. Investors can also be motivated and impressed by accurate predictions.

2. Focus on your most profitable leads

Your SaaS company can still be successful regardless of how small or large its TCV is; HubSpot recently demonstrated this truth. Regardless of the length of the contract or the LTV, you can break down TCV bookings by dividing customers into different segments to help your sales teams understand them better. Your TCV enables you to determine which customer segments are high spenders so you can channel your sales resources towards the most viable leads and lower your costs while increasing revenue.

3. Optimize your sales for longer contracts

Different contract lengths also tend to work better or worse across different customer segments. You might find, for example, that a certain demographic only buys subscriptions one month at a time, while others are more likely to pay upfront for a year or longer. By knowing which package lengths work best for which cohorts, you can optimize your sales for longer-term contracts, thereby improving your average TCV.

4. Improve your sales and marketing efforts

Marketing requires efficiency. The money you invest in growing the business should bring more returns. Dividing TCV bookings by your customer acquisition cost measures the efficiency of your marketing efforts, helping you determine which marketing channels to double down on and which channels are hindering your growth.

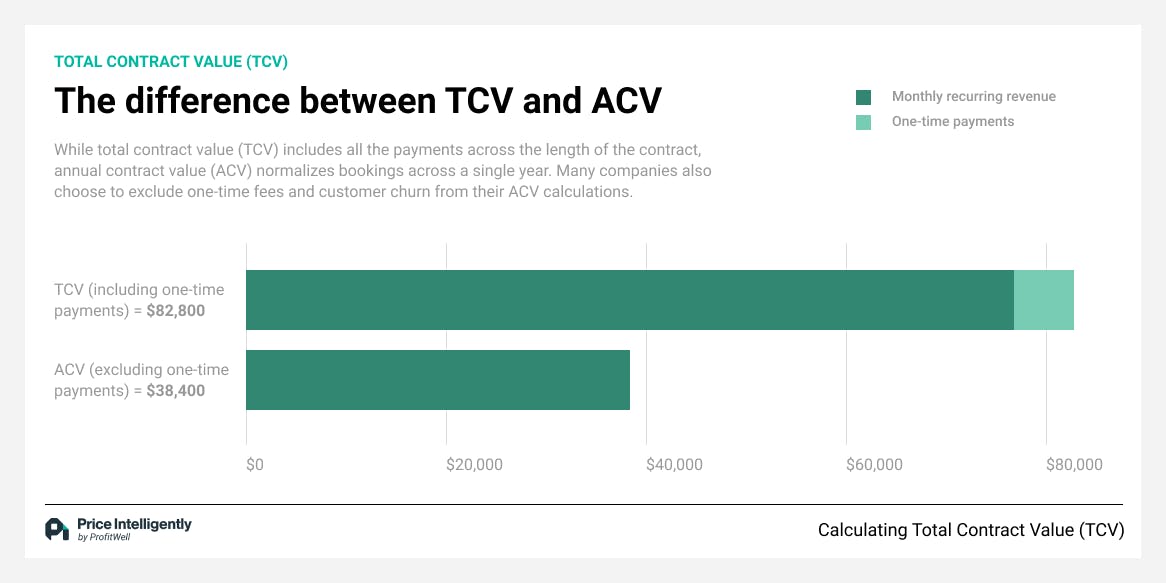

Total contract value (TCV) vs. annual contract value (ACV)

Total contract value (TCV) and annual contract value (ACV) are often used interchangeably. These two metrics serve the same purpose of measuring how much a contract is worth. However, there are a few differences between TVC and AVC.

TCV factors in all revenues and fees paid throughout the contract period, including recurring and one-time payments. AVC, on the other hand, calculates recurring payments made throughout the year. AVC, on the other hand, calculates recurring payments made throughout the year.

So the big difference is that ACV helps you measure the average yearly revenue from a single contract, while TCV enables you to calculate the entire contract’s revenue.

Let's jump back to Customer B in our earlier HubSpot example. While the TCV is $82,800, by excluding the onboarding fee and dividing by the two-year contract length means the ACV is only $38,400.

Just like TCV, there's no correlation between company success and high versus low ACV. ACV comes in handy over TCV for comparing different cohorts and for analyzing growth. Annualizing contract value eliminates the differences arising from varying contract lengths, making it much easier to see whether new bookings are growing over time and whether those bookings are truly more valuable versus just being longer.

No matter how you choose to calculate ACV, though, everyone in your company, along with any investors and stakeholders, must calculate it the same way. Keeping your metrics consistent helps avoid confusion and ensures everyone has a shared direction when making decisions.

Other SaaS metrics to use alongside TCV and ACV include:

- Annual recurring revenue (ARR). Use this metric to calculate how much recurring revenue you expect to generate in a year.

- Customer acquisition cost (CAC). Use this SaaS metric to determine how much your business spends on customer acquisition.

- Churn rate. With this metric, you can measure how many customers your company loses every month and its impact on your revenue.

- Revenue run rate. Use this metric to predict how much revenue your business would generate based on your past earnings.

Total contract value (TCV) vs. customer lifetime value (LTV)

Customer lifetime value refers to the net profit you can potentially generate from a single customer for the duration of your business relationship. LTV helps you determine how much profit each customer brings in against the total amount you invest in acquiring them. LTV should be calculated as the net profit of the customer for the entire contract period and not as the present value of the customer or the overall gross margin.

To calculate LTV, take the monthly revenue per customer and the average order value and multiply it by the total number of orders the customer made. Next, calculate the monthly contribution margin per customer (revenue generated minus other customer-related variable costs). These variable costs include administrative and operational costs required to serve the customer. Monthly churn rates can determine the average monthly customer lifespan. Therefore, LTV is the customer's contribution margin multiplied by their average lifespan. Always ensure the customer's lifespan is 12 or 24 months.

How ProfitWell Metrics helps you track SaaS relevant data and create real-time product reports

Our ProfitWell Metrics tracking tool is designed to help you grow your revenue from subscriptions. It’s both cost and time-effective and focuses on the needs of your business and customers. ProfitWell Metrics is designed to provide profitable outcomes by minimizing churn and optimizing prices for subscriptions. The dashboard allows you to track your most essential metrics and customer activities. It also enables customers to view their actions, photos, and labels. The tool comes with the following features:

- Acquisitions

- Revenue

- Engagement

- Data segmentation

- Integrations

- Pricing tools

- ROI monitoring

- Subscription and analytics

Our software comes with native integrations and Metric APIs to connect with Google, Sheets, Stripe, and ReCharge. Finally, it can be used on mobile, including iOS and Android. It's a fast service that's compliant with GDPR.

Total contract value FAQs

How is total contract value calculated?

To figure out your company’s TCV, you'll need to use a specific formula. To calculate TCV, multiply the monthly recurring revenue (MRR) with the length of the contract terms, then add any other one-time fees included in the contract.

Total Contract Value = Monthly Recurring Revenue (MRR) x Contract Term Length + Any One-time Fees.

What does TCV mean?

TVC stands for total contract value. It's an essential business metric that helps you determine how much revenue a contract will bring. It also takes into account recurring expenses such as hiring expenses, service fees, etc.

What is the difference between TCV and ACV?

TCV factors in all revenues and fees paid throughout the contract period, including recurring and one-time payments. AVC, on the other hand, calculates recurring payments made throughout the year. The main difference being that ACV helps you measure the average yearly revenue from a single contract, while TCV enables you to calculate the entire contract’s revenue.

What is SaaS TCV?

TCV is an essential SaaS metric to determine the lifetime value of contracts. TCV is an ideal metric for SaaS companies as it helps them estimate how much profit their business can generate from a single contract.