Success comes down to:

1. centering around a Compass Metric

2. enabling a data-driven process

3. understanding the axes through which SaaS metrics impact your business

A Compass Metric empowers your team around a single goal

One of the most often found problems in SaaS companies is that there’s so much data that no one knows the primary focus of the business. Product may be working on active usage. Marketing may be working on leads. Sales may be working on net new accounts. While these parts of your business may truly be working in tandem to one another towards a common goal, often times they aren’t aligned and may actually be working against one another.

The best way to align everyone is by utilizing what’s known as a SaaS Compass Metric. Setting one metric that your entire team rallies around ensures that everyone is working on the same goal and contributing to that goal in every way they can to optimize that metric. For smaller businesses that metric may be new accounts. For mid-stage or larger business that metric may be net-new MRR. Regardless of the metric though, everyone should know exactly what they’re supposed to be optimizing and the progress of that metric on at least a weekly basis.

Take MRR, for instance. If you’re optimizing net new MRR, then your product team is working on new add-ons or increasing the consumption of your value metric. Your marketing team is driving leads and your sales team is focused in on increasing ARPU. The shifts seem subtle, but everyone in your organization needs to be empowered to make the changes necessary to drive that one metric home.

Realize how each SaaS metric impacts your business

While we wrote extensively about how to pick and set up your SaaS Compass Metric here, doing so requires a more intimate knowledge of not only your SaaS metrics, but what they’re optimizing. For instance, if you’re an earlier stage business, then your primary goal may simply be active users as you work to find product-market fit. Once you’ve nailed activity you may move on to strictly MRR growth. Later stage companies may care strictly about optimizing their LTV/CAC ratio.

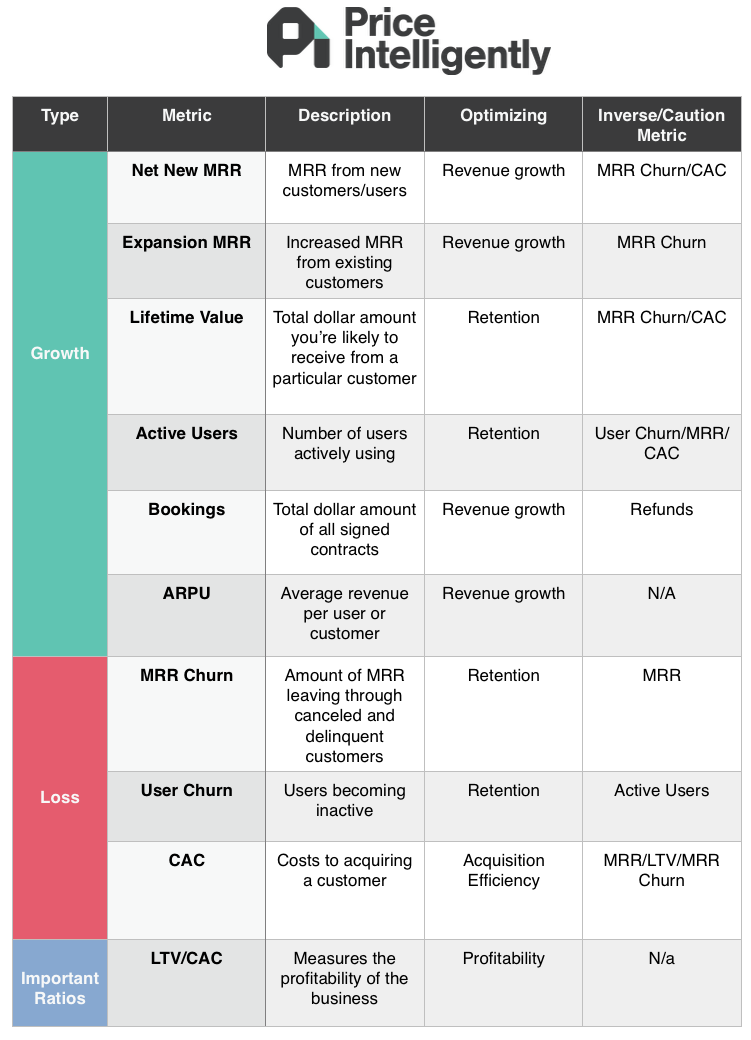

Regardless of which metric you pick, you need to focus on what you’re going to be optimizing. To help, we’ve put together a handy chart below to make sure you understand the fulcrums through which your metrics are optimizing. Remember though that each metric has an inverse or caution metric that can be negatively impacted.

For instance, MRR growth at all costs may take away too much time and effort from retention or CAC, resulting in a higher MRR number, but a lot of churn or loss in profitability. Most businesses will focus their efforts on one area and switch courses over time.

Enable a data-driven, hypothesis testing framework

As you have a handle on your metrics and have chosen where to optimize, you need to make sure you’re evangelizing a truly data-driven process. Not many companies understand what it means to be truly data-driven, and instead are merely invested in data. If you’re simply data invested, you’re likely running into analysis paralysis and arguments where data is a political weapon that doesn’t actually advance the decision-making process. This results in lost opportunities and a lot of wasted time.

While others have written extensively about data-driven processes (we’re partial to Brian Balfour’s growth process), the important concept to keep in mind is that you actually have a process. Set a goal, create a hypothesis, test that hypothesis as quickly as possible, and then reject or accept that hypothesis based on the impact on your goal. We’ll write more on this soon.

Learn your SaaS metrics like the back of your hand

The final part of this process is to make sure you know your SaaS metrics cold. Not “sort of” know them, but know them intimately. We started the education process below by walking through the different fulcrums through which your metrics are impacted, but here’s a breakdown of links that go into calculating and optimizing each of these metrics. You can also sign up for our SaaS metric Bootcamp here that walks through each of them.

Your Main SaaS Metrics

- Monthly Recurring Revenue (MRR): The normalized monthly revenue from all of the recurring items in a subscription.

- MRR Churn: The monthly erosion of your SaaS monthly recurring revenue.

- Lifetime Value (LTV): The total dollar amount, you're likely to receive from an individual customer over the life of their account with your product.

- Customer Acquisition Cost (CAC): The total cost of sales and marketing efforts that are needed to acquire a customer.

Your Secondary SaaS Metrics

- Average Revenue Per Users (ARPU): It's the average amount of monthly revenue that you receive per user.

- SaaS Bookings: The total dollar value of all new signed contracts.

- SaaS User Churn: The occurrence of a customer losing access to your service and or the subscription running out.

Defer to Data; Know Your Metrics

In the age of measure anything, sometimes you need to remember that you shouldn’t measure everything. Curation in your metrics and having a formal data driven SaaS metric process is crucial to SaaS success. We’ll keep bringing you the SaaS noise, but here are some other good articles to check out:

- Rolling SaaS Metrics Deceive You. Here’s Why: You shouldn’t be looking at your SaaS metrics on a rolling basis, because the process hides your actual progress and problems.

- Everyone in SaaS is Using Buyer Personas Incorrectly: Similar to your SaaS metrics, your buyer personas are the fulcrum through which you create a good product and align your company around common customers.

- Data Shows that Discounting Lowers LTV by Over 30%: Discounting strategies may appear to boost MRR quickly, but have disastrous impacts on the backend of your MRR through lower LTV.