Annual contract value (ACV) is an important metric to keep track for all subscription businesses. Learn what it is and how to calculate ACV for your business.

The SaaS four-letter acronym tends to be awash in three-letter initialisms: LTV, CAC, MRR, ROI—the list goes on and on.

Today, we’re digging into one of the most misunderstood but immensely valuable SaaS metrics: annual contract value, or ACV.

Like its closely related cousin annual recurring revenue (ARR), annual contract value can help you understand the health of your SaaS business. Unfortunately, almost no one agrees on how to calculate ACV, leading to a ton of confusing information out there around how to measure ACV.

We want to clear up the confusion. Let’s go through the definition of ACV, a few examples of how to calculate it for your SaaS business, and some tips on how you can use ACV to guide your business decisions.

What is Annual Contract Value (ACV)?

Annual Contract Value (ACV) is the average annual revenue generated from each customer contract, excluding fees. If a customer signs a 5-year contract for $50,000, averaging this value per year will give you an annual contract value of $10,000.

The annual contract value formula

The base formula for calculating ACV is relatively simple:

Total contract value (excluding one-time fees) / total years in contract = annual contract value

How to calculate annual contract value (ACV)

Part of why ACV is confusing for SaaS founders is because it feels very similar to ARR on the surface. But while ARR measures the value of recurring revenue from upsells, renewals, and other momentums at a single point in time, ACV normalizes that total revenue across one or more years.

Let’s go over two different examples to show how you can calculate ACV for your own business, whether your customers prefer long- or short-term contracts.

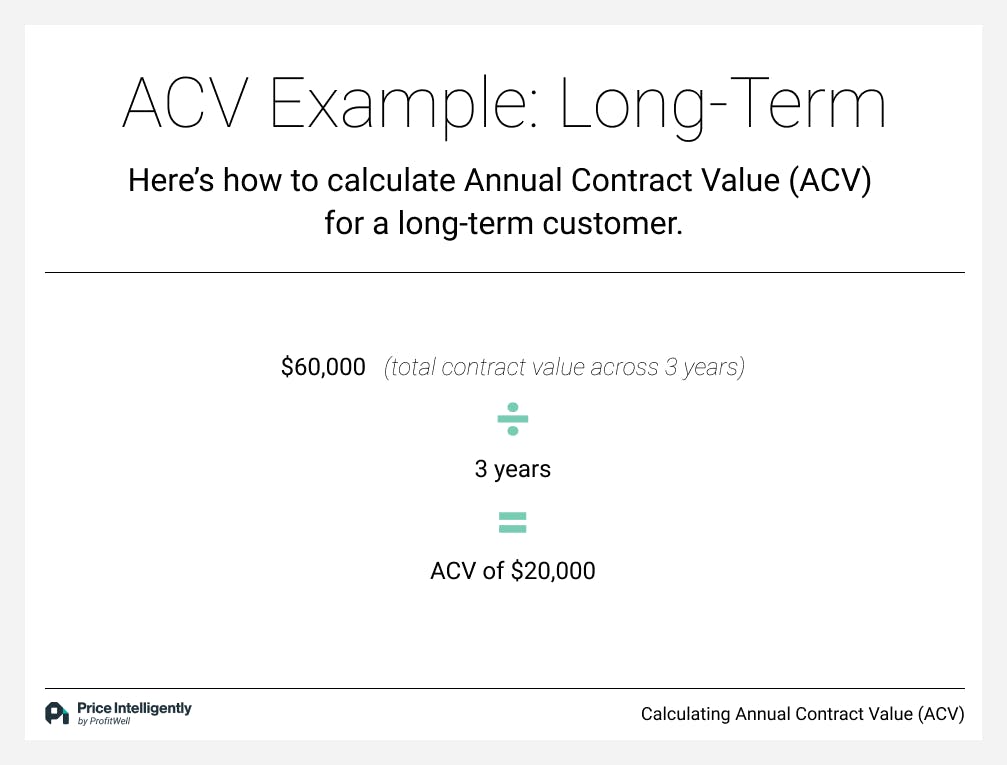

ACV for a long-term customer

Meet Customer A. They recently signed a 3-year contract worth $60,000 with your company (congratulations!), with an initial signup fee of $150. Customer A plans to pay yearly for your software.

The ACV for Customer A, then, can be calculated as follows:

It’s worth noting here that in this case, ACV and ARR are identical—we’ll see why in a minute. Also, ACV is typically calculated only by the value of the contract, and does not include any one-time fees involved with activation, like implementation fees.

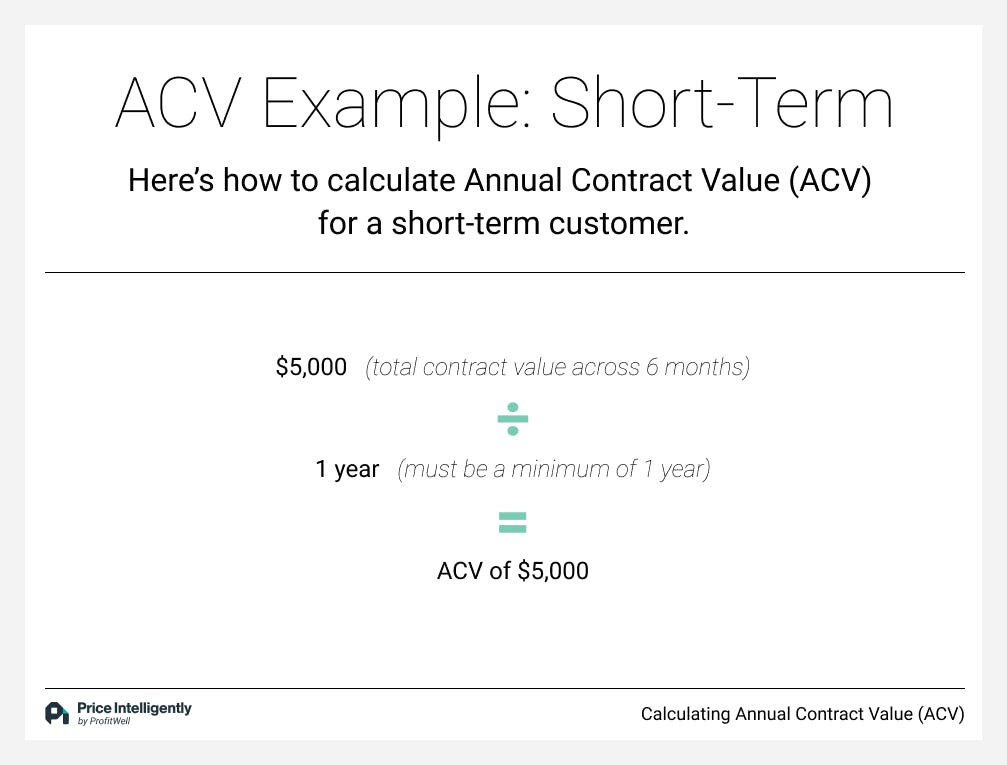

ACV for a short-term customer

Let’s move on to Customer B, who agrees to pay $5,000 for a 6-month contract, paying monthly. Since payments are normalized over one year instead of the length of the contract, the ACV for Customer B is calculated thus:

In this case, assuming Customer B plans to renew at the end of the six-month period, the ARR would be $10,000 over the course of their first year.

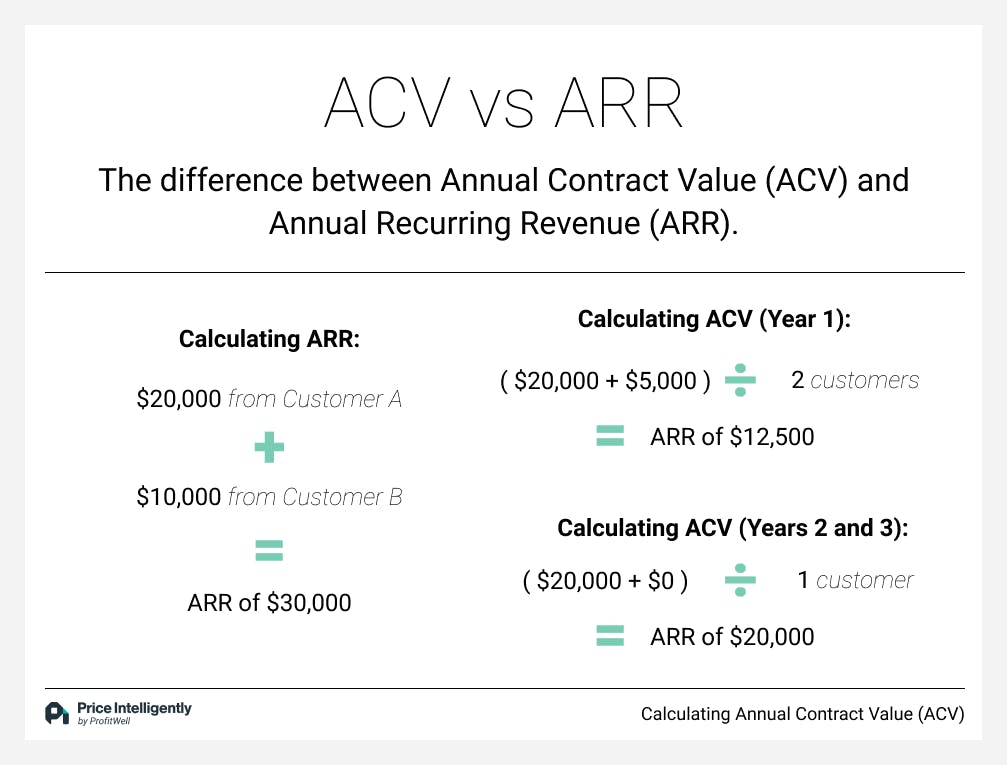

Combining ACV for both customers

This is where things get interesting. Let’s now average our ACV for both Customers A and B.

First, we need to work out the ARR so we can show the difference between how to calculate ARR and ACV. This value gets normalized across the length of each contract, to obtain the ACV for each year:

Now you can see that ACV lets you average out the annual values of contracts across different customers, giving you a great tool to measure the health of your subscription-based business.

How to use annual contract value (ACV) as a metric?

By itself, annual contract value isn’t a super-useful metric. But, by understanding your strategy for ACV, and by comparing it to other SaaS metrics, you can pull out some valuable insights to help guide your business decisions.

ACV helps inform your strategy

Subscription businesses can be successful with either a high or low ACV, and the importance of ACV as a metric is determined by other metrics like churn rate and CAC (customer acquisition cost).

Companies focusing more on consumers, like Spotify or Dropbox, might have a low ACV, but the low cost of acquiring new customers means their user count is high. On the flip side, B2B companies like Salesforce have much larger ACVs, but those users cost more to acquire, meaning not as many users. Both are equally valid strategies, and many founders have built successful SaaS companies with wildly different average ACV values.

It’s crucial to benchmark properly to know where your business is aiming. Measuring and tracking what ACV values make sense for your product, market, and customer base will help inform how you invest in marketing and sales strategy, as well as your marketing and sales teams.

Long story short: if you have small ACVs, that’s not bad—it just means you’ll need more customers.

ACV versus TCV

This is where it can get a little confusing.

While annual contract value normalizes the recurring revenue from each customer contract across a single year, total contract value, or TCV, measures revenue from across the entire contract. Take Customer A from our earlier example—while the ACV was $20,000, the TCV would be $60,000, since it includes all three years of the contract.

So, if you’re wondering which customers are paying you the most on a consistent basis, you’ll want to measure ACV over TCV. ACV also gives you an apples-to-apples comparison of the value of customers with different contract periods, including multi-year contracts.

On the other hand, if you’re wondering who your most valuable customers are across the entire contract term, TCV is the right metric to use. TCV is also more important than ACV when calculating a discount rate for long-term customers.

Measure your ACV for business growth

Now that you're no longer confused about how to calculate ACV or how to use the metric to your advantage, pull up some spreadsheets and get down to business. Understanding your ACV, and what values make sense for your business, can help you identify your most valuable customers, optimize your marketing and price strategy, and track the health of your SaaS company.

It’s more than just another three-letter initialism—it’s another valuable tool in your belt to grow your SaaS.