Financing for subscription businesses is more complicated and challenging. Here's what to focus on to successfully finance and grow your subscription business.

Subscription businesses face a variety of challenges unique to their specific model. These businesses need to emphasize (and analyze) certain metrics that other, more traditional businesses often do not. Successfully financing a subscription company involves the use of specific metrics and accounting methods. Certain practices make it much easier for a subscription business to properly gauge its health.

Remember: the majority of challenges have a solution. Subscription business owners can take a wealth of steps to finance their brands. Success can be found through a focus on:

- Recurring revenue

- Retention

- Long-term customer relationships

- Strategic pricing

- Churn rate

How the subscription business model is different from the traditional model

The subscription business model differs from other, more traditional business formats. Rather than an emphasis on sales, per se, subscription brands need to channel their efforts into securing recurring revenue. Acquisition and long-term relationships play key roles in a successful subscription business model. While practices like these can benefit any business, those in the subscription sector rely on them to generate profit.

Recurring revenue is king

While it may feel great to see brand-new subscribers trickling in, those people are not the ones that pay a subscription company's bills. Every customer should be seen as a life-long partner, especially because each individual's lifetime value is so important.

What matters most is that each subscription company's customers generates revenue over a period of time. Signing up for a trial or a short subscription to a service does not translate to revenue for that service. In fact, your customers likely won't make you much cash at all until they've spent money on your subscription service several times over.

Retention trumps acquisition

Subscription companies need to prioritize customer retention over customer acquisition. No marketer will deny the value of retained customers, but it can be difficult to recognize retention's power. It's cheaper to retain customers than to acquire new ones. That makes retention a top priority, and yet many businesses refrain from properly analyzing retention.

Financing the marketing and sales efforts that result in retention takes some work. Subscription businesses should focus on retaining the customers that they already have. It's easy enough; marketers looking to advertise subscription services just need to be willing to get thoughtful about their work.

Long-term relationships are the priority

Think of a big-box store that you've visited to make a purchase recently. Do you genuinely believe that whoever manages the corporation that runs the store cares if you come back again? It would be great, for sure, but...

The fact of the matter is that many traditional businesses don't need to rely on anybody's repeat business. Customers who come back to a store over and over are a great source of income, but they aren't always necessary for success.

Subscription brands present an exception to the rule. If a subscription business wants to turn a profit, it's critical to form long-term relationships with customers. Subscription is all about building lasting relationships.

Pricing is more difficult

It can be a challenge to price products or services offered through a subscription service. Traditional businesses only need to determine how much time and money went into a product before pricing it appropriately. Subscription service owners are not so lucky.

Dealing with value over time is tricky. In many cases, subscription brands need to test the waters with pricing structures to see whether success is viable. The process can be frustrating— even if it generally pays off. It's important for subscription businesses to review their pricing strategies regularly to optimize profits. The process isn't "one-and-done," and it's crucial to success.

Enemy #1: churn

The number one enemy of any subscription service? Churn.

Churn is the most important (and, simultaneously, the most anxiety-inducing) metric in the realm of subscription businesses. Statistics indicate that brands only recover about a third of customers lost to churn. When every customer presents an opportunity for long-term revenue, the negative impacts of churn begin to spiral quickly.

The options you have for financing your subscription business

There are several financing options available to subscription businesses. The two most obvious are private capital and traditional loans; neither is particularly glamorous, but both afford brand owners the cash they need to get started.

Private capital

The term "private capital" refers to a handful of funding sources. Perhaps the most obvious involves a business owner funding their brand with cash from their own pockets.

Most of us, however, do not realistically have the ability to whip out enough money to start a successful subscription brand. That's where two other forms of private capital come in: individual investors and VC funds. You may find that individual investors take interest in your venture and want to get in on the business; that's great. Other budding business owners may turn to VC funds, which are actually easy enough to understand:

- "VC" stands for "venture capital"

- Venture capital funds are a form of investment fund

- These funds manage investors' funds while they seek private equity stakes in small, startup, and other unique businesses (with growth potential in mind)

- Most VC investments are classed as high-risk, high-return opportunities

Traditional loans

Traditional loans are also available for small growing subscription businesses. Nobody can tell you exactly which loan is best for you and your business, but you have the freedom to select from a wealth of personal and business loans.

The most important step to take when using traditional loans to fund your subscription business is to apply common sense. Don't chase loans that will cause you more grief than they're worth. Remember that unique aspects of the subscription sector— like how customers are attracted and how they're retained— could influence the loans available to you.

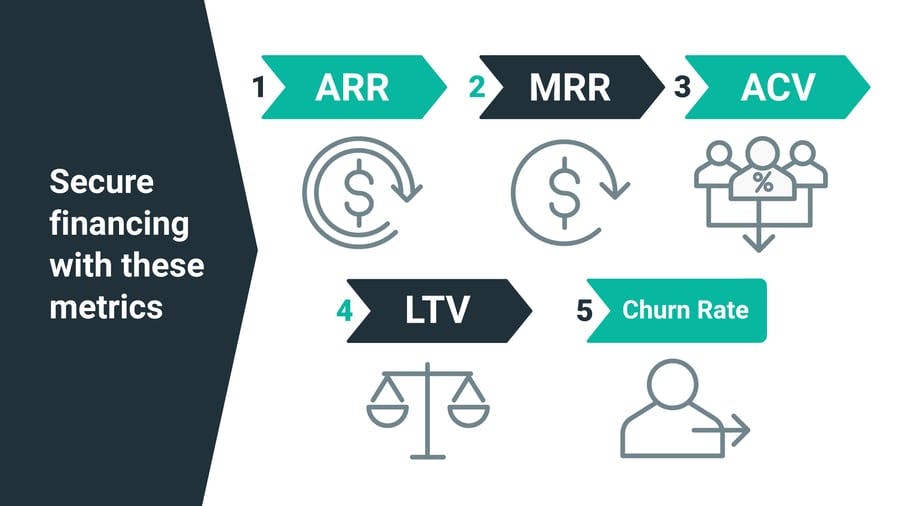

The metrics you'll need to secure financing

For your subscription business to succeed, there are some key metrics you need to track. These metrics can also make or break financing deals; some stand out amongst others as especially important in subscription brands.

ARR

ARR stands for annual recurring revenue. This metric is ideal for annual reporting and macro forecasting— it focuses on the long term. The benefits of tracking APR are plentiful, but two stand out:

- Investors view APR as a reliable indicator of a brand's health (especially because many subscription brands begin operation at a loss)

- APR can help put a good or bad sales month into perspective

MRR

Monthly recurring revenue (or MRR) offers some of the most cut-and-dry insight into a subscription brand's success. Because customer retention is so critical— and difficult— a brand's performance in that area tends to show in its MRR.

MRR is a basic metric. It shows businesses how much revenue from new sales, on average, it can bank on from month to month. It's a small, real-time barometer into any brand's financial performance. Budding subscription brands, in particular, should leverage MRR to ensure that they're meeting sales goals.

ACV & Customer LTV

Subscription businesses need to track ACV (or annual contract value). This metric is simple. It indicates the average annual contract value of your account subscription agreements. It's one of the easiest ways for investors to understand just how much cash customers will drop on your service.

A customer's LTC (or lifetime value) is also an important metric. Some customers are projected to spend much more throughout their lifetimes than others. If you notice those customers in your subscribership, you should try to hold onto them. Customers with high LTVs appeal to investors.

Churn rate

A business' churn rate indicates how many customers cancel or fail to renew their subscriptions within a certain time period. This metric is, of course, imperative to success (and failure too) in the subscription sector.

Your brand's churn rate will help investors understand just how interested customers are in your products or services. If your churn rate is high, you may need to boost customer acquisition through marketing and/or other measures before securing financing.

%2b-%2bbannercc5a.png?auto=format%2Ccompress&fit=max&w=1920)

Five best practices for managing subscription finance

Managing subscription finance can be complicated, but a few best practices simplify the process significantly. It'll require some targeted accounting and a focus on certain metrics, but these steps could help your brand get its cash under control.

1. Create an accounting system centered on recurring revenue

Accounting systems based on traditional business models are not sufficient for the subscription sector. Your accounting system must focus on recurring revenue rather than acquisition or "just" sales. Subscription businesses are essentially hubs for recurring revenue— it dictates finances day-in and day-out.

2. Focus on customer LTV

An emphasis on customer LTV helps most subscription services inch closer to success. The most important thing is how much revenue each customer can generate over time. The higher each customer's LTV, the higher a brand's profits.

3. Spot early indicators of churn

Some behaviors and signs are reviled as early indicators of churn. If you can pinpoint them and reverse course before churn gets out of hand, it could benefit your brand tremendously. Some early indicators of churn include:

- Decreasing usage rates

- Decreasing customer-business interaction levels

- Dramatic industry shifts and changes

- Changes within accounts

4. Build a multifaceted retention strategy

Multifaceted retention strategies allow brands to adapt and develop their approach to sales in real-time. With an understanding of metrics, it's easy to build a strategy that targets customers where they're most likely to churn.

5. Optimize pricing

Optimized pricing is like the silver bullet of subscription businesses. If your pricing is well-researched, it could score a much larger customer base. Rely on multiple pricing methods to make it more likely that your services are competitively valued.

Final thoughts

It's difficult to deny that subscription companies face some unique challenges on the road to financing. The truth is that traditional roadblocks associated with the process can actually be overcome. With the right approach and information, subscription service owners can secure financing and see success within the industry