What’s one thing Apple, Clorox Co., Coca Cola, Dell, Microsoft have in common? They all began as bootstrapped ventures.

Bootstrapping is a common way to get your startup off the ground and running. Although bootstrapping poses some risks, it could pay off in the end.

ProfitWell, the company acquired by Paddle in 2022, grew from founder Patrick Campbell working alone in a room for 12 hours every day to a company with more than 75 employees working out of offices in Boston, Salt Lake City, and Argentina. ProfitWell is proof that startups can succeed being bootstrapped.

What is bootstrapping?

Bootstrapping, or being bootstrapped, commonly refers to a business being built using the personal finances of its founders. That could mean anything from a savings account to a college fund, or retirement account.

Not relying on outside funding sources means businesses do not have to dilute ownership through issuing equity and will not rely on outside banks for debt.

The common methods many founders use to bootstrap

Since you’re not relying on loans or investors, every penny counts when bootstrapping. There’s more you can do than just cracking open your piggy bank and cashing in quarters.

Using up personal savings accounts

If you’ve been saving money, now is the time to cash it in. If you were lucky enough to have relatives who purchased you savings bonds decades back, it’s worth checking to see if they’ve reached full cash value.

Cashing out 401K/IRA accounts

Some company founders choose to cash out retirement funds. It’s not ideal, but it could pay off in the long run.

Selling assets

Selling your car, or maybe some stocks you held, are another way to get quick cash to pay for your venture. Do a purge of things you own. Go through your closet and cabinets. What can you sell that you don’t need anymore?

Living Cheap

Cut corners wherever you can, lifestyle wise. Conduct an audit of your daily expenses to see where you can and should cut back. Are you buying takeout everyday? What streaming services can you say goodbye to? Work from home first, before investing in office space. Use every resource you already have before spending more money.

Asking for help

Family and friends can sometimes be a good source of support. Don’t be afraid to ask. The worst that could happen is they say “no.”

The methodology of bootstrapping a business The methodology of bootstrapping is starting and running your business on existing resources only. AKA, “We have to succeed before the money runs out in X months/years.” That includes having an exit strategy that raises money from friends and family.

Is bootstrapping worth the risks?

Deciding whether your company should be bootstrapped is not an easy decision, but it is a very personal one. Depending on your circumstances the risks will vary, and it’s definitely not for everyone. Let’s unpack some things that may help you decide.

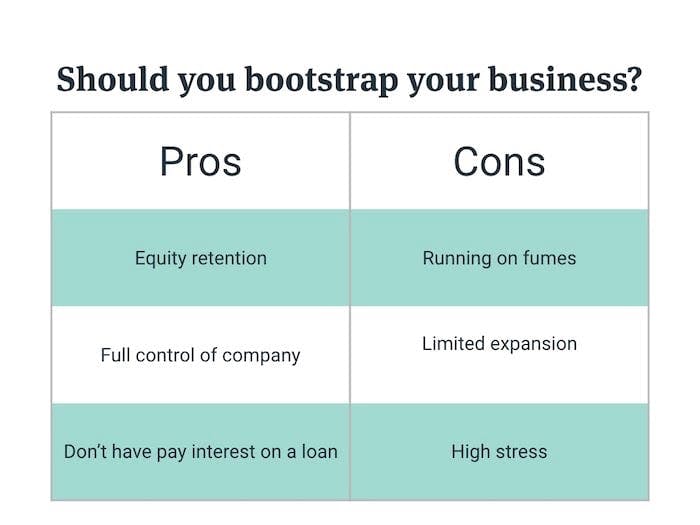

Pros of bootstrapping your business

Equity retention

There’s the option of selling equity, which is the value of the shares issued by a company. So, in simpler terms, selling equity means selling ownership. You can give employees options as to how much salary vs. equity they'd prefer.

Full control of company

Having full control (majority control at 51%). This depends, initially, on the number of co-founders, but having control of your vision at a smaller scale is one of the pros of being bootstrapped. You don’t have investors trying to input their opinions. It’s your vision, your money, and your company.

Not paying interest on a loan

Not acquiring debt is also an obvious benefit of being bootstrapped. Many people take out a loan when they first start a business or during the business formation stage, and while this may help get their feet off the ground, the interest on that loan can become quite expensive.

Cons of bootstrapping your business

Running on fumes

Being your own boss is great, but with it, come long days and nights. Not only is it challenging to do a lot with a little, but you also begin to spread yourself thin. You and your company will then both be running on fumes, and that can lead to a negative impact on your business.

Very limited expansion

A limited budget means limited staff, resources, and limited amount of risks you’re able to take. This can result in slower growth and expansion.

High stress

Any mistake you make feels significant because of the limited resources. Every decision seems crucial and that pressure can create high-level stress, resulting in possibly making poor decisions.

Can you afford to bootstrap?

Not everyone can afford to bootstrap their business, and that’s okay. Here are some questions you can ask yourself to help you determine if you have the funds to be bootstrapped.

Do you have enough money to pay for your living expenses + business expenses?

You don’t want to sacrifice your well-being. You should be able to cover both your living and business expenses, during the ramp-up period of your business. Be sure your calculations include enough funds for an extended amount of time, if not indefinite.

Do you have enough money to pay for prototyping, equipment, etc?

Starting a business requires equipment, services, and people. All of these costs quickly add up, so be sure you’re factoring in as many known (and potential) components, as possible.

Do you have customers that are ready to order?

Do you have customers that know about your business idea and are willing to actually send in a check or credit card number? If not, you may want to lock in some customers beforehand.

Do you have backup plans?

What’s your backup plan? Do you have a job, residual income, or something lined up in case your plans fall through?

Limit your risk when bootstrapping

Bootstrapping is risky and scary as hell. You’re taking a shot in the dark essentially, and hoping that your product takes off. There are steps you can take to reduce that level of risk (and ease your stress).

Come in with a plan

Having a financial plan can help your business grow faster than trying to figure it out on the fly. Every purchase and every sale needs to be documented and purposeful.

Lower expenses as much as possible

Little changes can have a big impact. Making your coffee at home versus buying it daily, will quickly make a noticeable difference.

Optimize your pricing

Pricing optimization is an overlooked way to make more money with the same product. A common mistake to avoid is guessing on how to price your product. Don’t guess. ProfitWell has a number of tools that can help you maximize pricing.

Focus on retention

Treat retention as your lifeblood, because it more or less is. Those initial customers will carve the path to financial stability for your business. The more you retain, the less you churn.

Alternatives to bootstrapping

So maybe after reading this, you decided bootstrapping is not the best fit for you. That’s okay—let’s explore other options.

Angel investors

An angel investor is someone who provides capital for a business startup, usually in exchange for convertible debt or ownership equity. Unlike banks, angel investors are not afraid of risk. They also have access to a network of other successful individuals, who may also be interested in investing in your business. Additionally, angel investors bring experience and they have private equity to spare, so they don’t hold the same concerns as banks.

Nevertheless, Angel investors may come with expectations of high returns. They’re putting money into your business so they expect to see a payoff. Having an investor also means you’re not in total control.

Personal loans

You can take out a personal loan—money borrowed from the bank, a credit union, or online lender that you pay back in fixed monthly payments. Having a payment plan can become expensive when you add in interest rates. And most personal loans are not secured or backed by collateral, either.

Business loans

Business loans give business owners access to capital to invest in their business. The business owner must pay back the loan with interest over time. They fall under the category of debt financing.

Are you ready for this journey?

Bootstrapping your business is not an easy journey and requires thoughtful and detailed planning. If you’re considering bootstrapping your business, understanding the risks and preparing for them, as well as being aware of the options you have available, will get you off on the right track.