Every successful software business I’ve come across has a stronghold on two things: who their customers are and where those customers find value in their product. They’re confident in their pricing strategy since they know it’s rooted in real data.

The rest? Well, it turns out most of them are just guessing.

Those two crucial bits of information might seem simple on the surface, but they drive the vast majority of pricing mistakes companies make. Guessing and speculating about their customers’ motivations, needs, values, and willingness to pay means companies are missing out on real opportunities to increase revenue, reduce acquisition costs, and fight churn.

There is one key to solving the problem, though, and that’s data. Getting a handle on your pricing analytics can help you understand how price changes will affect your overall business and optimize your pricing strategy for maximum revenue.

Let’s take a dive into the deep end of pricing analytics: what they are, why they’re important for SaaS founders, and how you can use them to improve profitability.

What are pricing analytics?

Pricing analytics are the metrics and associated tools used to understand how pricing activities affect the overall business, analyze the profitability of specific price points, and optimize a business’s pricing strategy for maximum revenue.

Why pricing analytics is so important for SaaS companies

Companies across just about every business sector and industry vertical—from manufacturing and distribution to retail and ecommerce—can benefit from pricing analytics.

One general rule of thumb, though, is that pricing tends to become a bigger challenge as companies grow. Companies with lots of products sold at different price points, different customer tiers, or complex product bundles tend to see the greatest benefits from analysis.

Subscription billing in particular makes SaaS businesses the perfect candidates for pricing analytics tools like ProfitWell Metrics. Revenue in a SaaS company is built one subscription at a time and paid in small increments; therefore, success in SaaS means understanding the factors that drive subscription and churn rates more than just knowing which factors drive one-time sales. Pricing analytics solutions give you the data to make better pricing decisions, so you can stop guessing and start growing.

How pricing analytics improve profitability

Big data alone won’t solve your pricing problems. Having a strong handle on the reasons behind past performance—in other words, basing your decisions on pricing analytics instead of guessing—can go a long way towards improving your future performance.

Acquire more insights on customers

Going after the wrong customer segment can mean significant lost revenue. For companies dipping their toes into improving their pricing for the first time, even simple tools like customer segmentation can be a huge improvement.

Pricing analytics show which customer segments are the most (and least) profitable and which respond best to specific pricing strategies. Aligning your pricing with those customer segments increases both revenue and profit, keeping customers happy and helping predict and reduce churn.

Optimize your pricing for value

Many businesses rely on the “sounds about right” pricing method. But basing your decision-making on hard data gets you much closer to value-based pricing.

Data lets you quickly learn which customers are most likely to buy and exactly how much they value your solution to their problems. The insights from your pricing analytics drive more effective (and profitable) business and pricing decisions for you, and a fair price for customers that matches the value you provide. Everybody wins.

Identify quick pricing wins

Nearly every company has holes in their pricing strategy just waiting to be patched—pricing leaks, underpriced or overpriced product tiers, or missed upsell opportunities. Pricing analytics tools comb through the data, finding the low-hanging fruit that can be fixed quickly and creating extra revenue in just a few short months.

Discover which channels are most profitable

Pricing analytics can also show, for example, that posting videos on YouTube might bring in fewer qualified leads than written content, but that video helps those leads trust you more, meaning customers who are more willing to pay a premium for your product. Based on that discovery, you might choose to pursue video more aggressively, even though your customer acquisition costs might end up higher.

Recognize which pricing tiers work the best

Tiered pricing models are incredibly common in subscription businesses—most SaaS companies offer some form of pricing tiers to meet the needs of different customer segments. Pricing analytics tools really start to shine when breaking down what those tiers should look like. Having insight into how many tiers you should have, the optimal price for each tier, and who uses which tiers can unlock new levels of profitability for your SaaS product without needing to add new products or features.

Plan promotions

Pricing promotions need to be carefully planned for the most optimal time to acquire the most number of paying customers. Predictive analytics let you keep a close eye on the market, waiting for the perfect time to pounce with your promotional campaign. Most pricing tools will also calculate price elasticity in real time and predict revenue at different price points, making it a piece of cake to set your prices and discount levels for maximum demand.

4 important pricing metrics you need to be tracking

Enough of the why. Let’s dig into some juicy details on how you can get started tracking your pricing analytics. It’s worth noting that while some of these metrics are relevant to all business models, a few are specific to SaaS and other subscription businesses.

Willingness to pay (WTP)

Willingness to pay (WTP), sometimes called price sensitivity, is the maximum amount a customer is prepared to pay for your product or service.

WTP is easily the most important component of your pricing strategy. Without an understanding of the price sensitivity of your product, you have no way of knowing whether or not your product development efforts are yielding an augmented product value (i.e., if customers are really interested in the features you’re creating). In fact, a study at Harvard Business School revealed that a 1% improvement in pricing can improve your revenue by 11%.

Check out this example data from a recent case study of YouTube’s Premium pricing page. The chart shows the monthly willingness to pay of over 6,000 current, former, and prospective YouTube Premium customers based on age group. Two things quickly become clear: 1) Older audiences are less likely to pay for YouTube, and 2) YouTube Premium’s current pricing of $11.99 per month is exactly what their target demographic—millennials—is willing to pay.

%2byoutubecc5a.jpg?auto=format%2Ccompress&fit=max&w=1920)

This chart shows the monthly WTP of 6303 current, former, and prospective YouTube Premium customers based on age group.

Tracking willingness to pay—especially when you segment customers by age group, as with YouTube above, or other factors like product features or job title—can ensure your products are priced competitively for maximum profit and that your prices stay in line with current market conditions.

Feature value

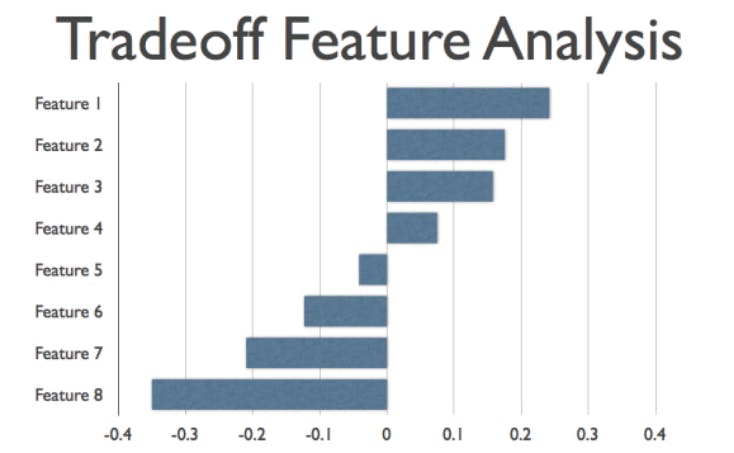

Feature value analysis, also called relative preference analysis, measures which features are more or less important to customers relative to other features. The same idea also applies to value propositions (high-level benefits that prompt purchasing decisions).

Asking customers to choose their favorite and least favorite features can quickly show which features customers care about.

You can't just guess which features customers value— you have to ask them directly. Here at Paddle, we like to take the simple approach of asking customers to choose their favorite and least favorite features. This eliminates the “more is better” mindset that makes most customers check more boxes and masks which features are truly valuable.

If you’re a SaaS company, your pricing page is likely tiered based on a sliding scale running from basic attributes to premium components. Analyzing which features motivate your customers to buy helps you establish how you package and bundle each pricing tier accordingly, helping you capture the most value for that section of the market.

Average revenue per user

Average revenue per user (ARPU) is a measure of the revenue generated each month from each user.

1e3b.jpg?auto=format%2Ccompress&fit=max&w=1200)

Average revenue per user (ARPU) is calculated by dividing the total MRR by the total number of customers.

ARPU gives you a bird’s-eye view into how well your SaaS company is actually doing. The higher your ARPU, the better the chance that the company is able to extract more cash in the future. ARPU also reveals the relative value of your product—if you have a high ARPU relative to the revenue of the company, you know you have a product that's driving a better value ratio.

Customer acquisition cost (CAC) and lifetime value (LTV)

(Yes, I’m cheating a bit by listing these two together, but they’re impossible to separate, so let’s run with it.)

Customer lifetime value (LTV) and customer acquisition costs (CAC) go hand-in-hand when it comes to pricing analytics. You want to spend the right amount to drive new customers to your service without jeopardizing the revenue from that customer. This is known as the LTV/CAC ratio, and it's the "god metric" of many successful SaaS companies.

a293.jpg?auto=format%2Ccompress&fit=max&w=3840)

Lifetime value needs to remain higher than acquisition costs for a SaaS company to be sustainable.

Calculating CAC and LTV for each customer persona will help you understand your buyers even more, letting you make more informed decisions about your pricing strategy.

Get to know your pricing

Collecting and analyzing data on your product’s pricing does take work, but it’s necessary labor if you hope to craft an effective pricing strategy for your business. You can use your pricing analytics to find and fix the holes in your pricing strategy, driving revenue higher and reducing churn.

The key is to start tracking your pricing analytics today. You can collect all the data in the world, but it only becomes valuable once you start using it to drive meaningful pricing decisions.

Of course, you could spend hours pulling data from dozens of programs and tweaking spreadsheets—but we’ve already done all the heavy lifting for you. Grab your free ProfitWell Metrics account today.